question 14 please

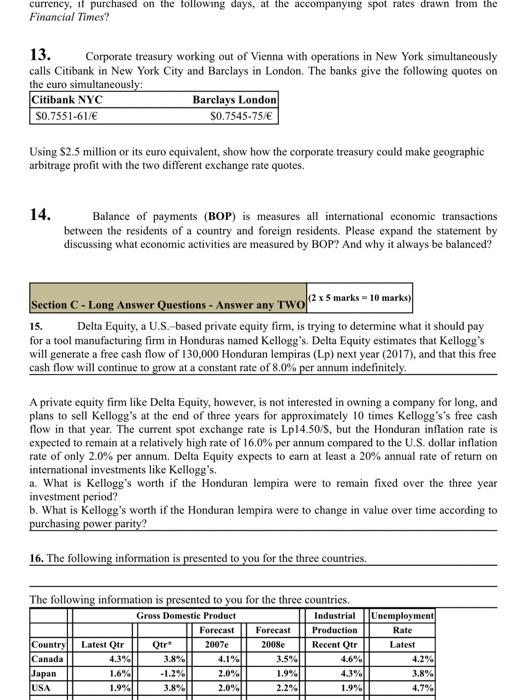

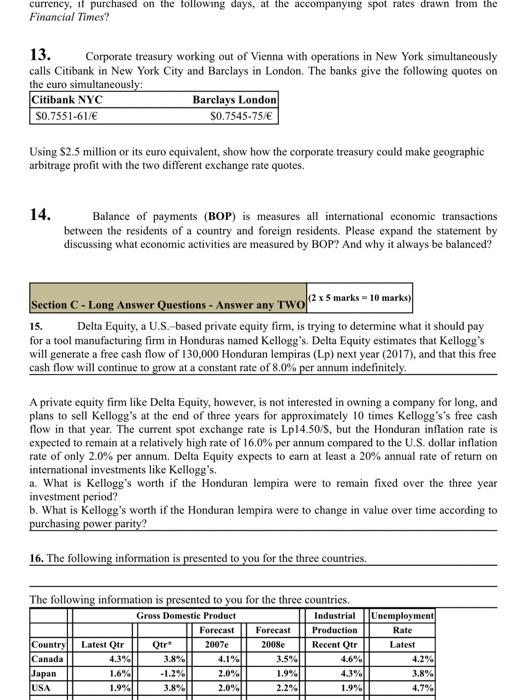

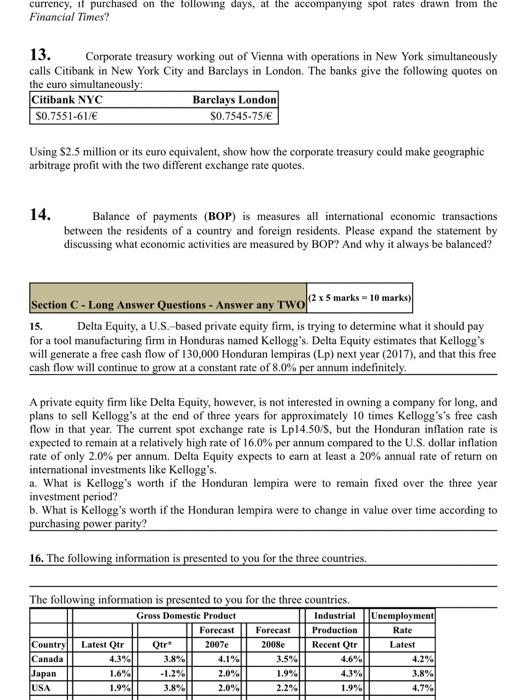

currency, if purchased on the following days, at the accompanying spot rates drawn from the Financial Times? 13. Corporate treasury working out of Vienna with operations in New York simultaneously calls Citibank in New York City and Barclays in London. The banks give the following quotes on the euro simultaneously Citibank NYC Barclays London S0.7551-618 S0.7545-75/ Using $2.5 million or its curo equivalent show how the corporate treasury could make geographic arbitrage profit with the two different exchange rate quotes. 14. Balance of payments (BOP) is measures all international economic transactions between the residents of a country and foreign residents. Please expand the statement by discussing what economic activities are measured by BOP? And why it always be balanced? Section C-Long Answer Questions - Answer any Two (235 marks = 10 marks) 15. Delta Equity, a U.S.-based private equity firm, is trying to determine what it should pay for a tool manufacturing firm in Honduras named Kellogg's. Delta Equity estimates that Kellogg's will generate a free cash flow of 130,000 Honduran lempiras (Lp) next year (2017), and that this free cash flow will continue to grow at a constant rate of 8.0% per annum indefinitely A private equity firm like Delta Equity, however, is not interested in owning a company for long, and plans to sell Kellogg's at the end of three years for approximately 10 times Kellogg's's free cash flow in that year. The current spot exchange rate is Lp14.50/s, but the Honduran inflation rate is expected to remain at a relatively high rate of 16.0% per annum compared to the U.S. dollar inflation rate of only 2.0% per annum. Delta Equity expects to earn at least a 20% annual rate of return on international investments like Kellogg's. a. What is Kellogg's worth if the Honduran Lempira were to remain fixed over the three year investment period? b. What is Kellogg's worth if the Honduran Lempira were to change in value over time according to purchasing power parity? 16. The following information is presented to you for the three countries. The following information is presented to you for the three countries. Gross Domestic Product Country Canada Japan USA Latest Otr 4.3% 1.6% 1.9% Otr 3.8% -1.2% 3.8% Forecast 2007 4.1% 2.0% 2.0% Forecast 2008 3.5% 1.9% 2.2% Industrial Production Recent Our 4.6% 4.3% 1.9% Unemployment Rate Latest 4.2% 3.8% 4.7% currency, if purchased on the following days, at the accompanying spot rates drawn from the Financial Times? 13. Corporate treasury working out of Vienna with operations in New York simultaneously calls Citibank in New York City and Barclays in London. The banks give the following quotes on the euro simultaneously Citibank NYC Barclays London S0.7551-618 S0.7545-75/ Using $2.5 million or its curo equivalent show how the corporate treasury could make geographic arbitrage profit with the two different exchange rate quotes. 14. Balance of payments (BOP) is measures all international economic transactions between the residents of a country and foreign residents. Please expand the statement by discussing what economic activities are measured by BOP? And why it always be balanced? Section C-Long Answer Questions - Answer any Two (235 marks = 10 marks) 15. Delta Equity, a U.S.-based private equity firm, is trying to determine what it should pay for a tool manufacturing firm in Honduras named Kellogg's. Delta Equity estimates that Kellogg's will generate a free cash flow of 130,000 Honduran lempiras (Lp) next year (2017), and that this free cash flow will continue to grow at a constant rate of 8.0% per annum indefinitely A private equity firm like Delta Equity, however, is not interested in owning a company for long, and plans to sell Kellogg's at the end of three years for approximately 10 times Kellogg's's free cash flow in that year. The current spot exchange rate is Lp14.50/s, but the Honduran inflation rate is expected to remain at a relatively high rate of 16.0% per annum compared to the U.S. dollar inflation rate of only 2.0% per annum. Delta Equity expects to earn at least a 20% annual rate of return on international investments like Kellogg's. a. What is Kellogg's worth if the Honduran Lempira were to remain fixed over the three year investment period? b. What is Kellogg's worth if the Honduran Lempira were to change in value over time according to purchasing power parity? 16. The following information is presented to you for the three countries. The following information is presented to you for the three countries. Gross Domestic Product Country Canada Japan USA Latest Otr 4.3% 1.6% 1.9% Otr 3.8% -1.2% 3.8% Forecast 2007 4.1% 2.0% 2.0% Forecast 2008 3.5% 1.9% 2.2% Industrial Production Recent Our 4.6% 4.3% 1.9% Unemployment Rate Latest 4.2% 3.8% 4.7%