Question 1-4 please

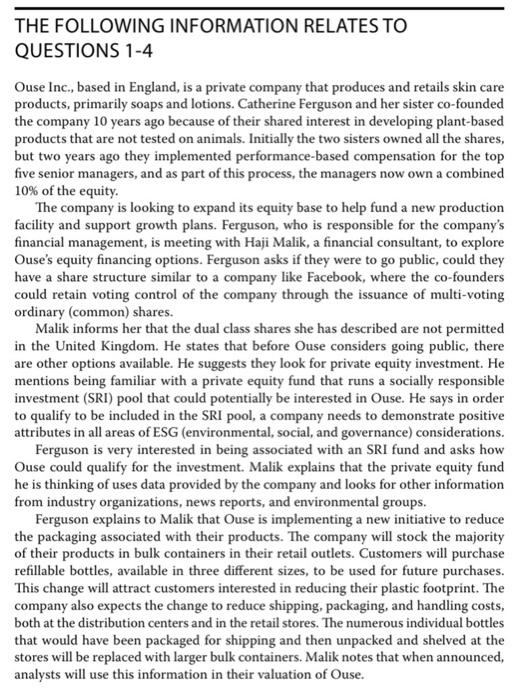

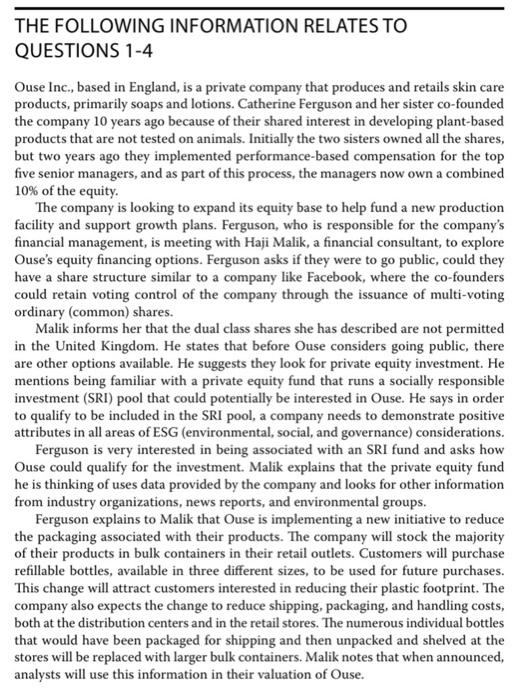

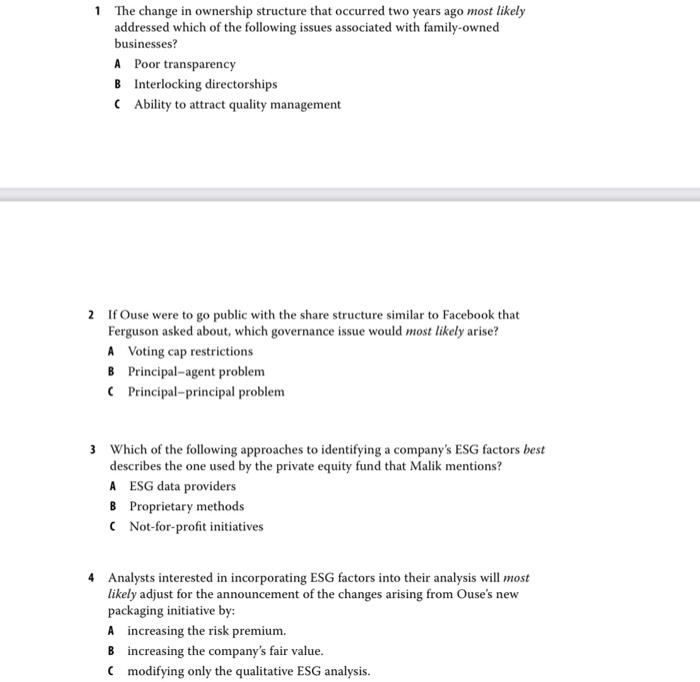

THE FOLLOWING INFORMATION RELATES TO QUESTIONS 1-4 Ouse Inc., based in England, is a private company that produces and retails skin care products, primarily soaps and lotions. Catherine Ferguson and her sister co-founded the company 10 years ago because of their shared interest in developing plant-based products that are not tested on animals. Initially the two sisters owned all the shares, but two years ago they implemented performance-based compensation for the top five senior managers, and as part of this process, the managers now own a combined 10% of the equity. The company is looking to expand its equity base to help fund a new production facility and support growth plans. Ferguson, who is responsible for the company's financial management, is meeting with Haji Malik, a financial consultant, to explore Ouse's equity financing options. Ferguson asks if they were to go public, could they have a share structure similar to a company like Facebook, where the co-founders could retain voting control of the company through the issuance of multi-voting ordinary common) shares. Malik informs her that the dual class shares she has described are not permitted in the United Kingdom. He states that before Ouse considers going public, there are other options available. He suggests they look for private equity investment. He mentions being familiar with a private equity fund that runs a socially responsible investment (SRI) pool that could potentially be interested in Ouse. He says in order to qualify to be included in the SRI pool, a company needs to demonstrate positive attributes in all areas of ESG (environmental, social, and governance) considerations. Ferguson is very interested in being associated with an SRI fund and asks how Ouse could qualify for the investment. Malik explains that the private equity fund he is thinking of uses data provided by the company and looks for other information from industry organizations, news reports, and environmental groups. Ferguson explains to Malik that Ouse is implementing a new initiative to reduce the packaging associated with their products. The company will stock the majority of their products in bulk containers in their retail outlets. Customers will purchase refillable bottles, available in three different sizes, to be used for future purchases. This change will attract customers interested in reducing their plastic footprint. The company also expects the change to reduce shipping, packaging, and handling costs, both at the distribution centers and in the retail stores. The numerous individual bottles that would have been packaged for shipping and then unpacked and shelved at the stores will be replaced with larger bulk containers. Malik notes that when announced, analysts will use this information in their valuation of Ouse. 1 The change in ownership structure that occurred two years ago most likely addressed which of the following issues associated with family-owned businesses? A Poor transparency B Interlocking directorships Ability to attract quality management 2 If Ouse were to go public with the share structure similar to Facebook that Ferguson asked about, which governance issue would most likely arise? A Voting cap restrictions B Principal-agent problem (Principal-principal problem 3. Which of the following approaches to identifying a company's ESG factors best describes the one used by the private equity fund that Malik mentions? A ESG data providers B Proprietary methods (Not-for-profit initiatives 4 Analysts interested in incorporating ESG factors into their analysis will most likely adjust for the announcement of the changes arising from Ouse's new packaging initiative by: A increasing the risk premium. Bincreasing the company's fair value. (modifying only the qualitative ESG analysis