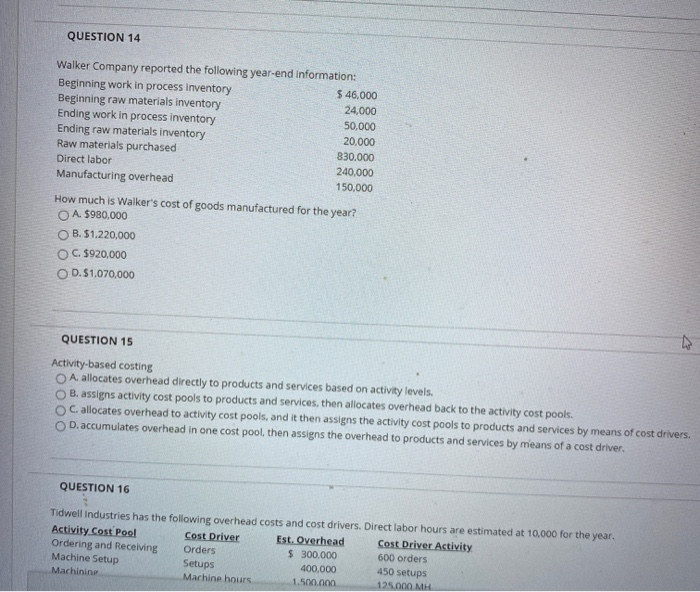

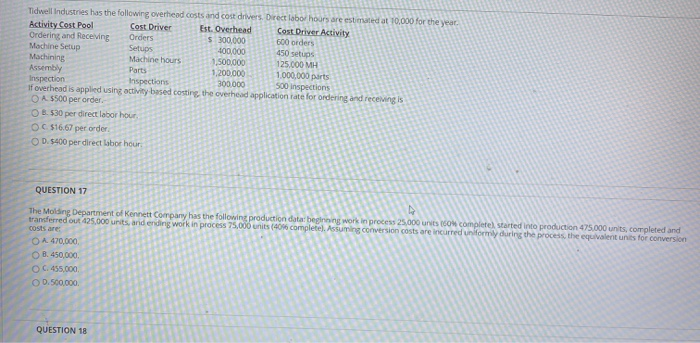

QUESTION 14 Walker Company reported the following year-end information: Beginning work in process inventory $ 46.000 Beginning raw materials inventory 24,000 Ending work in process inventory 50.000 Ending raw materials inventory 20.000 Raw materials purchased 830.000 Direct labor 240.000 Manufacturing overhead 150,000 How much is Walker's cost of goods manufactured for the year? A. $980,000 B. $1.220,000 C. $920,000 OD. $1.070,000 QUESTION 15 Activity-based costing O A allocates overhead directly to products and services based on activity levels. B. assigns activity cost pools to products and services, then allocates overhead back to the activity cost pools. C. allocates overhead to activity cost pools, and it then assigns the activity cost pools to products and services by means of cost drivers. D. accumulates overhead in one cost pool, then assigns the overhead to products and services by means of a cost driver. QUESTION 16 Tidwell Industries has the following overhead costs and cost drivers. Direct labor hours are estimated at 10,000 for the year. Activity Cost Pool Cost Driver Est. Overhead Cost Driver Activity Ordering and Receiving Orders $ 300,000 600 orders Machine Setup Setups 400,000 450 setups Machinine Machine hours 1.500.000 125.000 MH Tidwell Industries has the following overhead costs and cost drivers. Direct labor hours are estimated at 10,000 for the year. Activity Cost Pool Cost Driver Est. Overhead Cost Driver Activity Ordering and Receiving Orders $ 300,000 600 orders Machine Setup Setups 400,000 450 setups Machining Machine hours 1,500,000 125.000 MH Assembly Parts 1,200.000 1.000.000 parts Inspection Inspections 300.000 SOO inspections If overhead is applied using activity based costing the overhead application rate for ordering and receiving is O A $500 per order. OB530 per direct labor hour OC 516.67 per order D. 5400 per direct labor hour QUESTION 17 The Molding Department of Kennett Company has the following production data: beginning work in process 25,000 units 60% completel Started into production 475.000 units, completed and transferred out 425.000 units, and ending work in process 75,000 units (0 complete). Assuming conversion costs are incurred uniformly during the process, the equivalent units for conversion costs are OA. 470,000 OB. 450,000 OC. 455,000 0.500.000 QUESTION 18