Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 14 Which of the following stock valuation methods would not be appropriate for a company not currently paying a dividend? O a. Constand Dividend

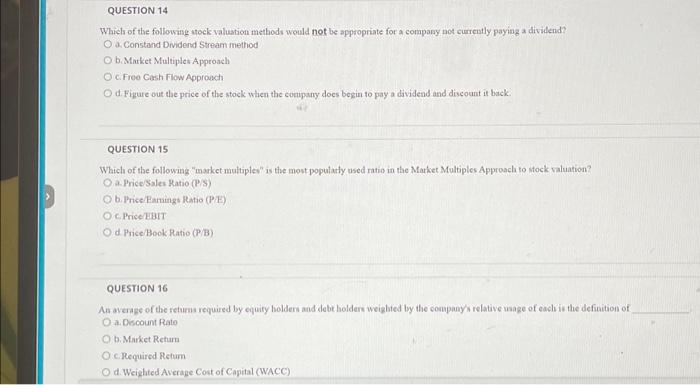

QUESTION 14 Which of the following stock valuation methods would not be appropriate for a company not currently paying a dividend? O a. Constand Dividend Stream method O b. Market Multiples Approach O c. Free Cash Flow Approach O d. Figure out the price of the stock when the company does begin to pay a dividend and discount it back. QUESTION 15 Which of the following "market multiples" is the most popularly used ratio in the Market Multiples Approach to stock valuation? O a. Price/Sales Ratio (P/S) O b. Price/Earnings Ratio (P/E) c. Price/EBIT O d. Price/Book Ratio (P/B) QUESTION 16 An average of the returns required by equity holders and debt holders weighted by the company's relative usage of each is the definition of O a. Discount Rate O b. Market Return c. Required Return O d. Weighted Average Cost of Capital (WACC)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started