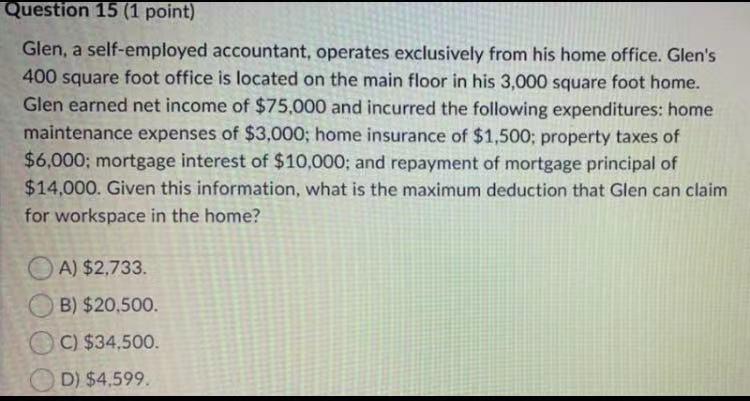

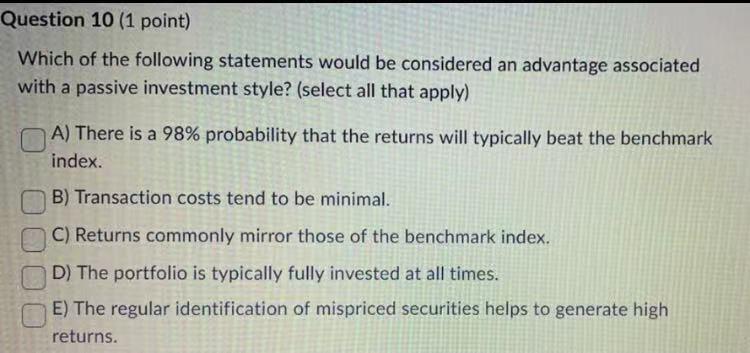

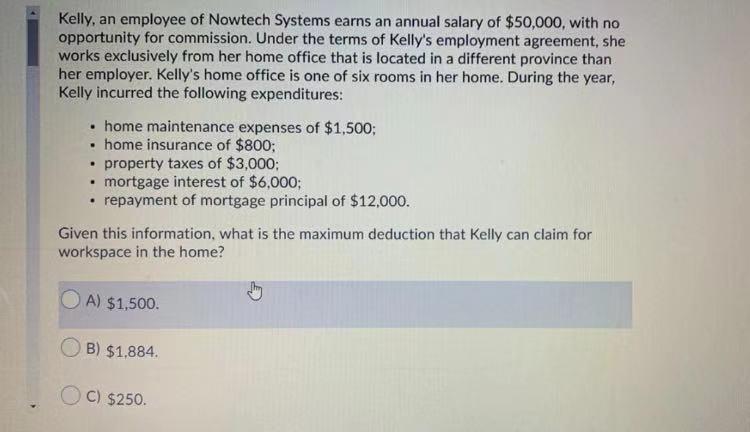

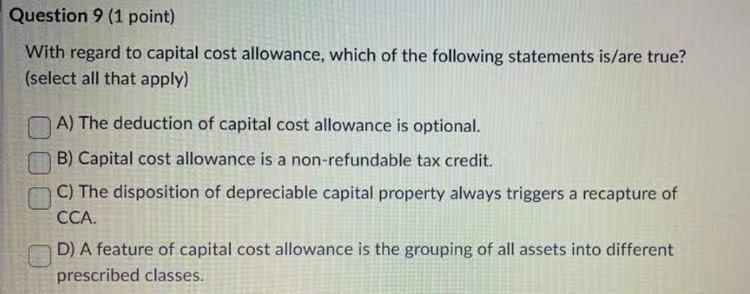

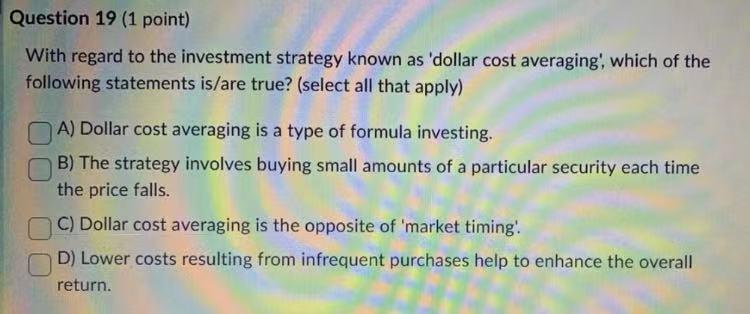

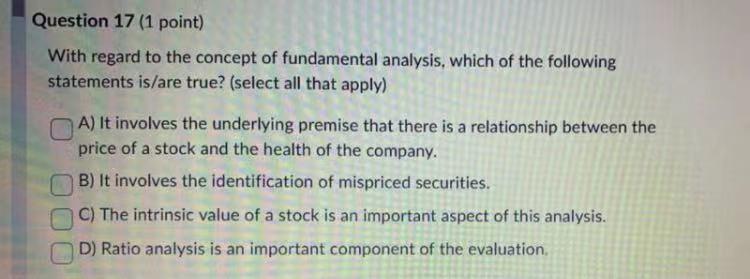

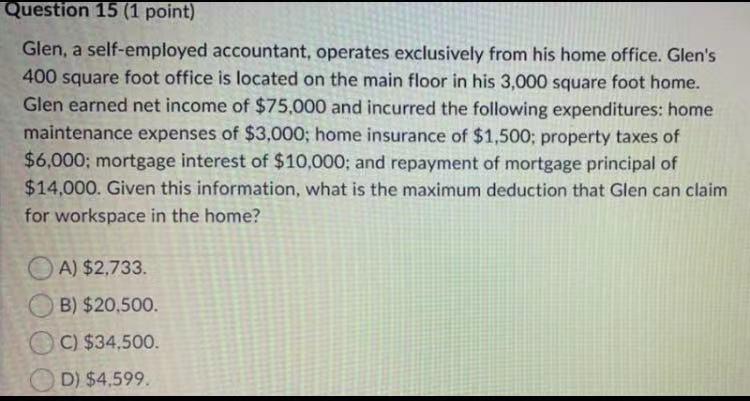

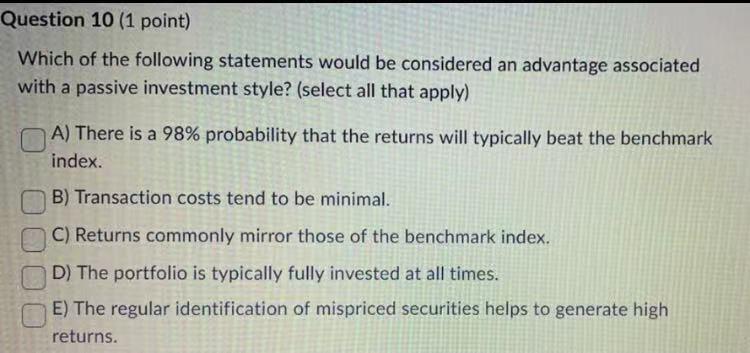

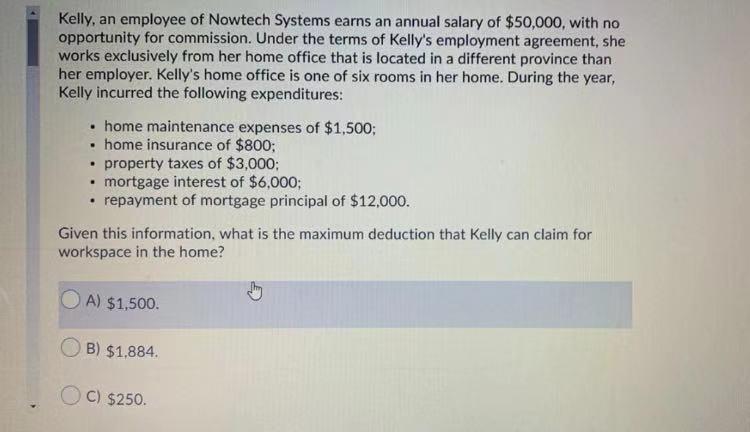

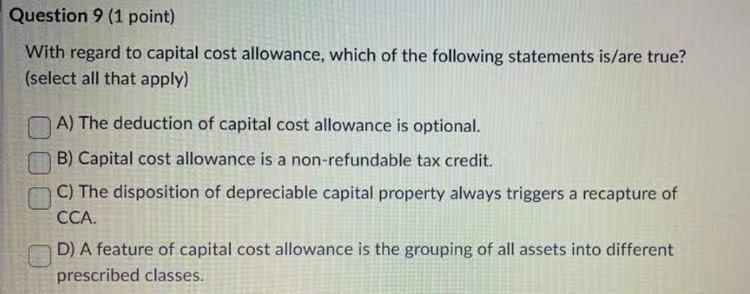

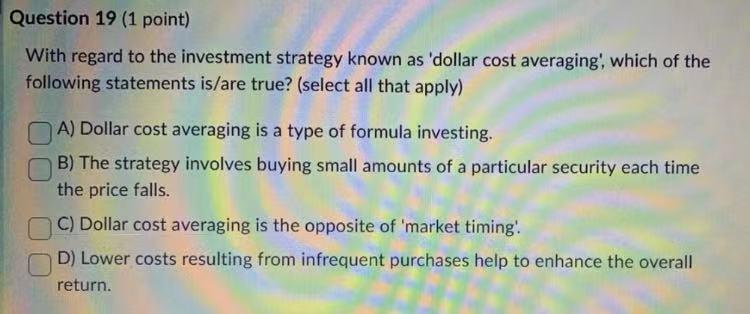

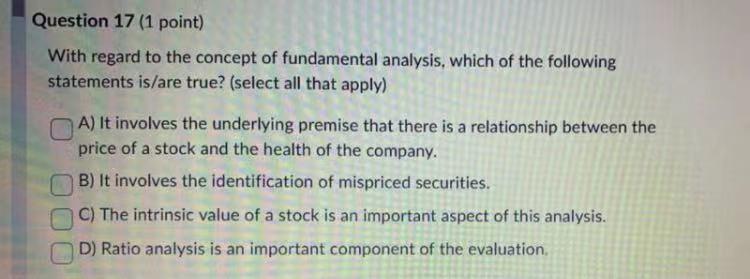

Question 15 (1 point) Glen, a self-employed accountant, operates exclusively from his home office. Glen's 400 square foot office is located on the main floor in his 3,000 square foot home. Glen earned net income of $75,000 and incurred the following expenditures: home maintenance expenses of $3,000; home insurance of $1,500; property taxes of $6,000; mortgage interest of $10,000: and repayment of mortgage principal of $14,000. Given this information, what is the maximum deduction that Glen can claim for workspace in the home? OA) $2,733. B) $20,500. C) $34.500. D) $4,599. Question 10 (1 point) Which of the following statements would be considered an advantage associated with a passive investment style? (select all that apply) A) There is a 98% probability that the returns will typically beat the benchmark index. B) Transaction costs tend to be minimal. C) Returns commonly mirror those of the benchmark index. D) The portfolio is typically fully invested at all times. E) The regular identification of mispriced securities helps to generate high returns. Kelly, an employee of Nowtech Systems earns an annual salary of $50,000, with no opportunity for commission. Under the terms of Kelly's employment agreement, she works exclusively from her home office that is located in a different province than her employer. Kelly's home office is one of six rooms in her home. During the year, Kelly incurred the following expenditures: home maintenance expenses of $1,500; home insurance of $800; . property taxes of $3,000; . mortgage interest of $6,000; repayment of mortgage principal of $12,000. Given this information, what is the maximum deduction that Kelly can claim for workspace in the home? A) $1,500 OB) $1.884 C) $250. Question 9 (1 point) With regard to capital cost allowance, which of the following statements is/are true? (select all that apply) A) The deduction of capital cost allowance is optional. B) Capital cost allowance is a non-refundable tax credit. C) The disposition of depreciable capital property always triggers a recapture of . . D) A feature of capital cost allowance is the grouping of all assets into different prescribed classes. Question 19 (1 point) With regard to the investment strategy known as 'dollar cost averaging', which of the following statements is/are true? (select all that apply) A) Dollar cost averaging is a type of formula investing. B) The strategy involves buying small amounts of a particular security each time the price falls. C) Dollar cost averaging is the opposite of 'market timing! D) Lower costs resulting from infrequent purchases help to enhance the overall return. Question 17 (1 point) With regard to the concept of fundamental analysis, which of the following statements is/are true? (select all that apply) A) It involves the underlying premise that there is a relationship between the price of a stock and the health of the company. B) It involves the identification of mispriced securities. C) The intrinsic value of a stock is an important aspect of this analysis. D) Ratio analysis is an important component of the evaluation