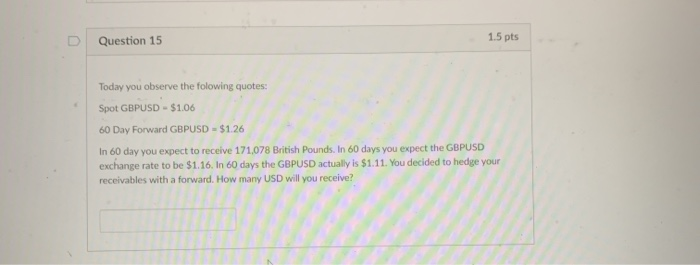

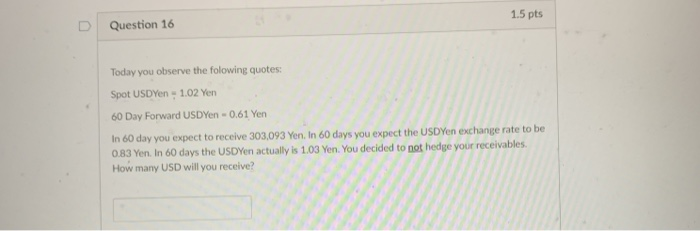

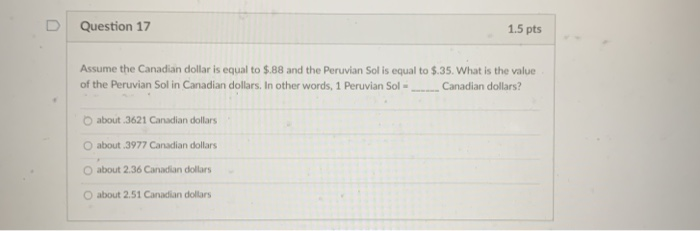

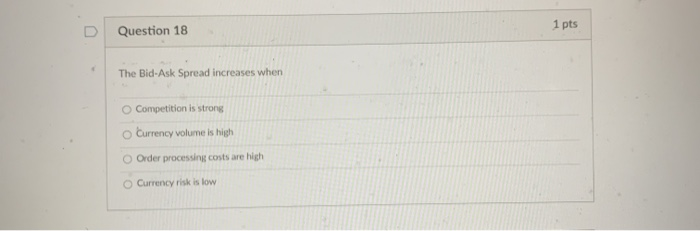

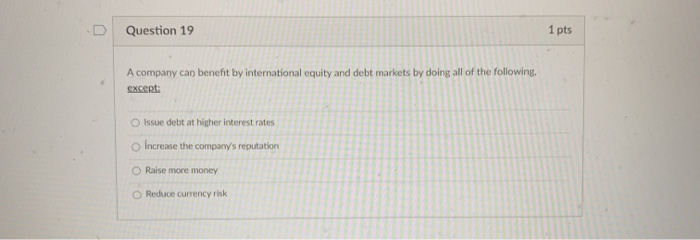

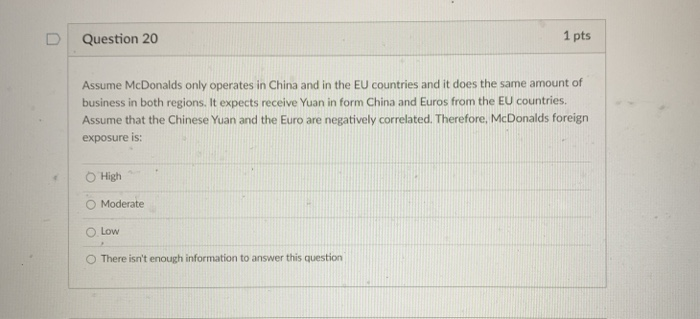

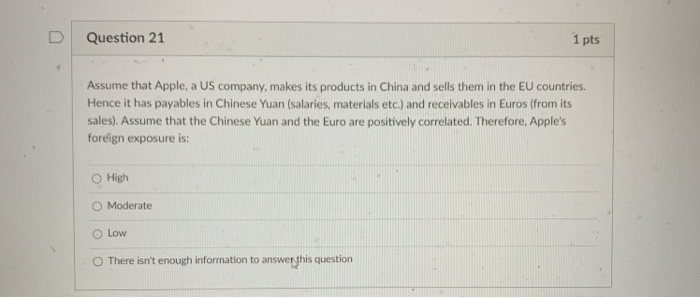

Question 15 1.5 pts Today you observe the folowing quotes: Spot GBPUSD - $1.06 60 Day Forward GBPUSD - $1.26 In 60 day you expect to receive 171,078 British Pounds. In 60 days you expect the GBPUSD exchange rate to be $1.16. In 60 days the GBPUSD actually is $1.11. You decided to hedge your receivables with a forward. How many USD will you receive? 1.5 pts Question 16 Today you observe the folowing quotes: Spot USDYen - 1.02 Yen 60 Day Forward USDYen -0.61 Yen In 60 day you expect to receive 303,093 Yen, in 60 days you expect the USDYen exchange rate to be 0.83 Yen. In 60 days the USDYen actually is 1.03 Yen. You decided to not hedge your receivables. How many USD will you receive? D Question 17 1.5 pts Assume the Canadian dollar is equal to $.88 and the Peruvian Sol is equal to $.35. What is the value of the Peruvian Sol in Canadian dollars. In other words, 1 Peruvian Sol - Canadian dollars? about.3621 Canadian dollars about.3977 Canadian dollars about 2.36 Canadian dollars about 2.51 Canadian dollars Question 18 1 pts The Bid Ask Spread increases when Competition is strong o Currency volume is high Order processing costs are high Currency risk is low Question 19 1 pts A company can benefit by international equity and debt markets by doing all of the following, except: Issue debt at higher interest rates Increase the company's reputation Raise more money Reduce currency risk D Question 20 1 pts Assume McDonalds only operates in China and in the EU countries and it does the same amount of business in both regions. It expects receive Yuan in form China and Euros from the EU countries. Assume that the Chinese Yuan and the Euro are negatively correlated. Therefore, McDonalds foreign exposure is: High Moderate Lov There isn't enough information to answer this question Question 21 1 pts Assume that Apple, a US company, makes its products in China and sells them in the EU countries. Hence it has payables in Chinese Yuan (salaries, materials etc.) and receivables in Euros (from its sales). Assume that the Chinese Yuan and the Euro are positively correlated. Therefore, Apple's foreign exposure is: High Moderate Low There isn't enough information to answer this