Answered step by step

Verified Expert Solution

Question

1 Approved Answer

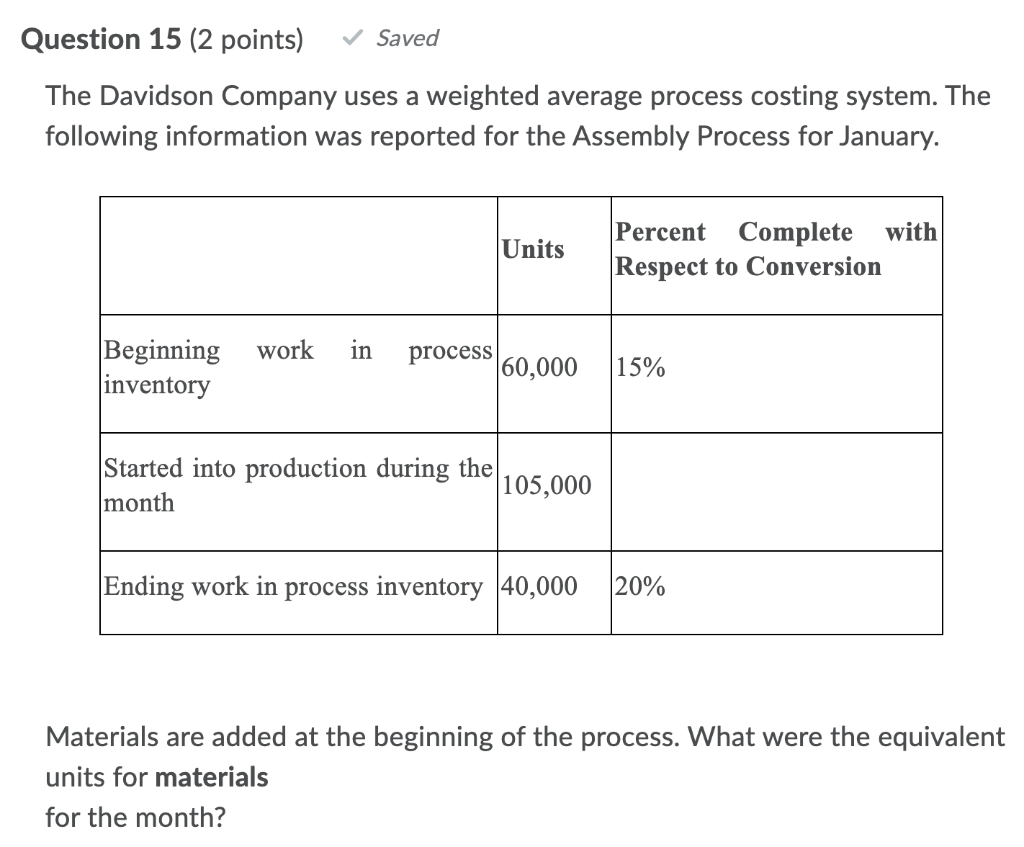

Question 15 (2 points) Saved The Davidson Company uses a weighted average process costing system. The following information was reported for the Assembly Process for

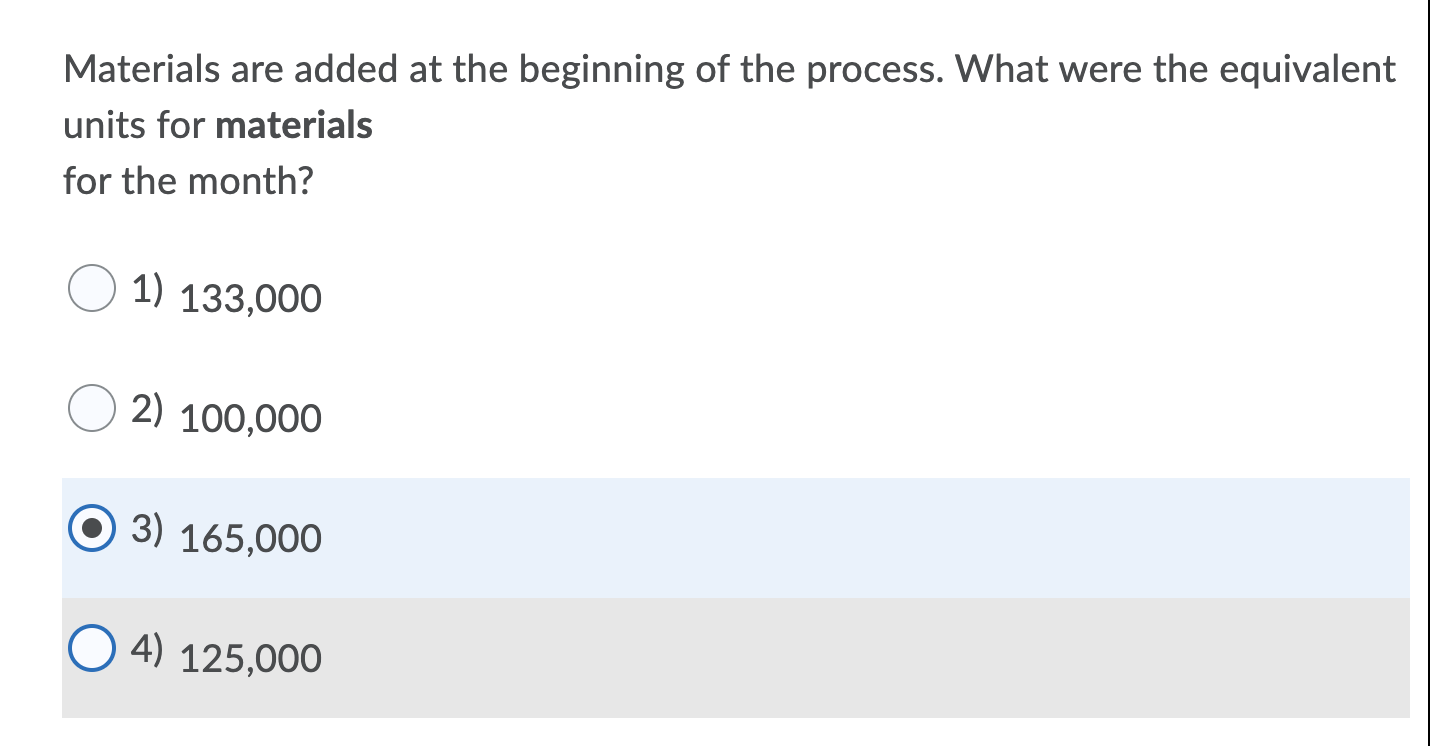

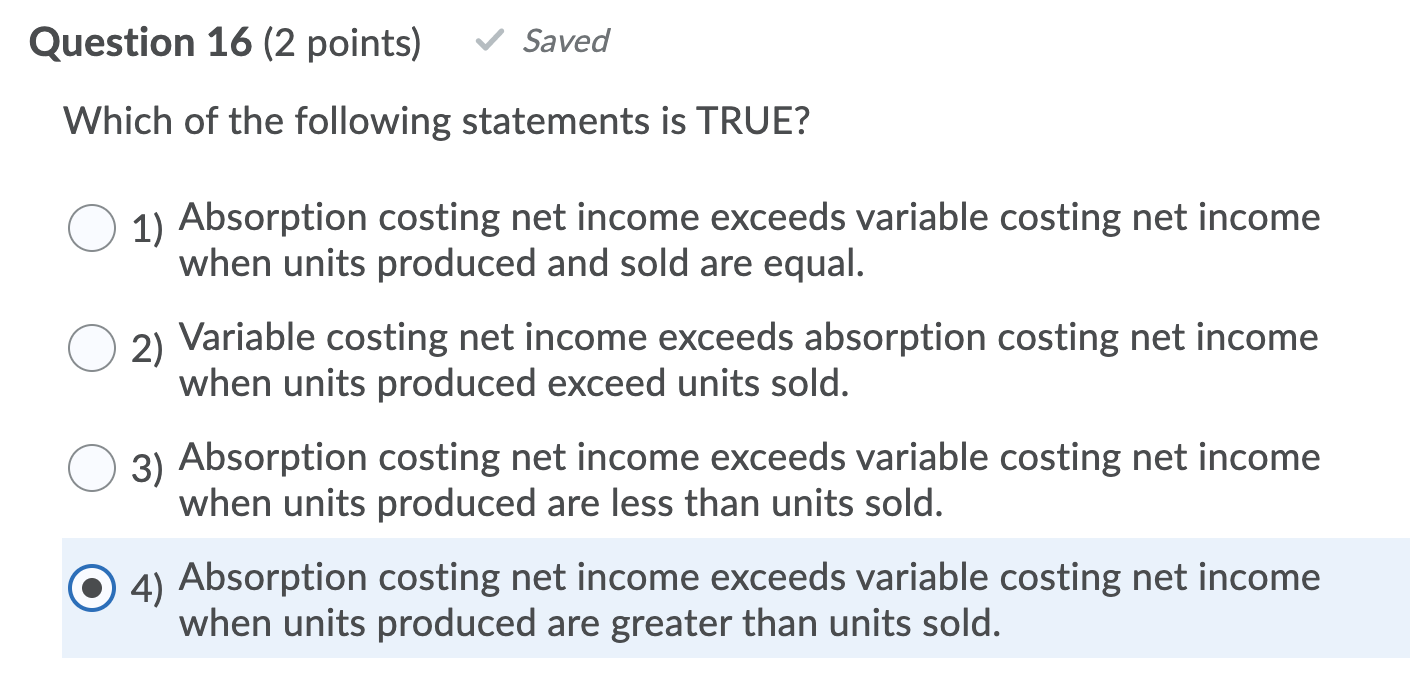

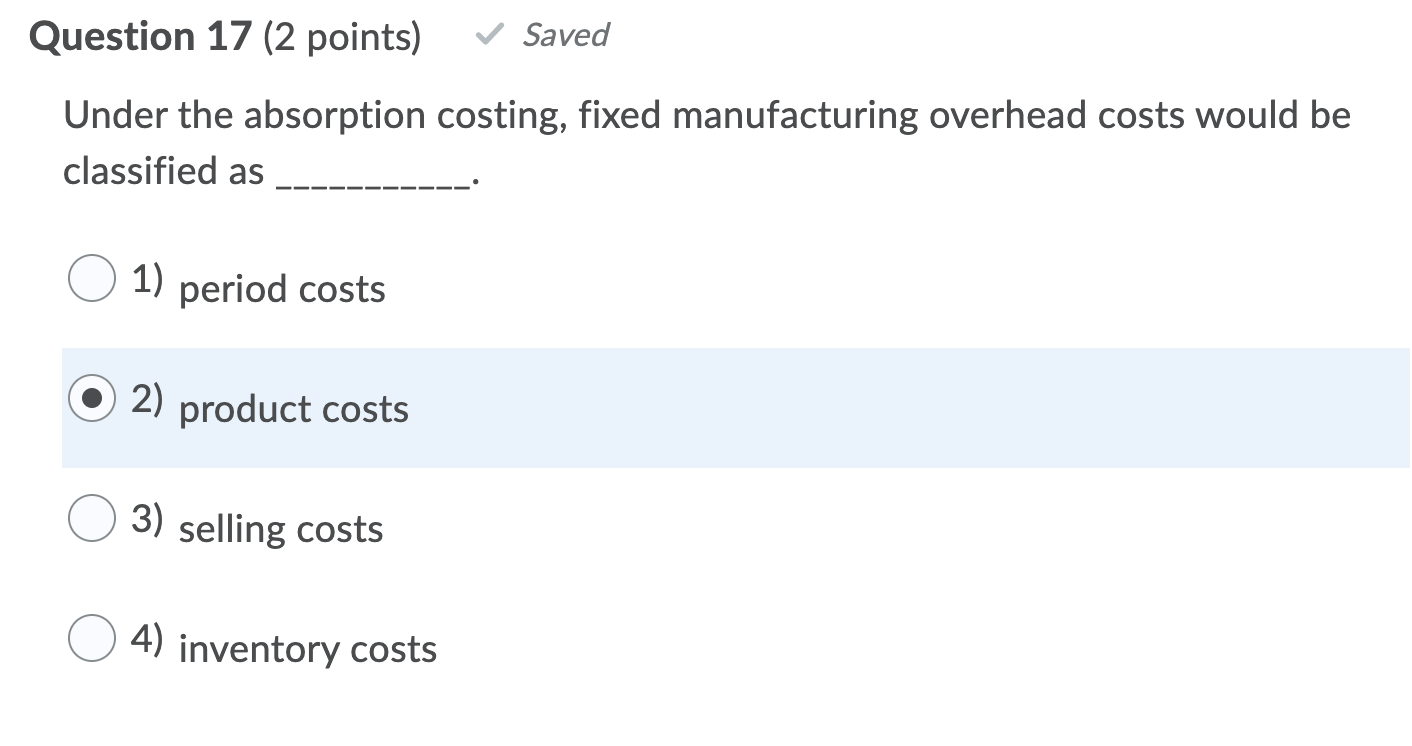

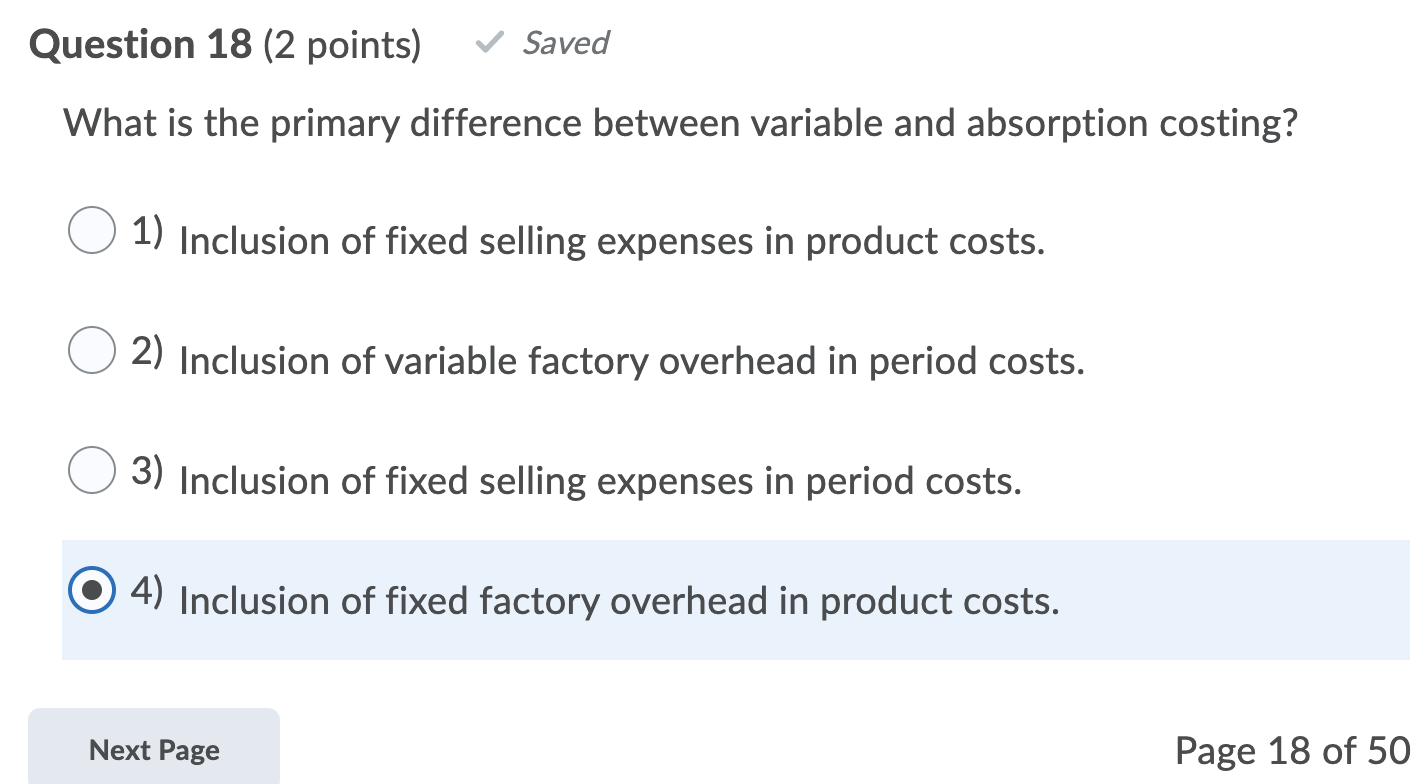

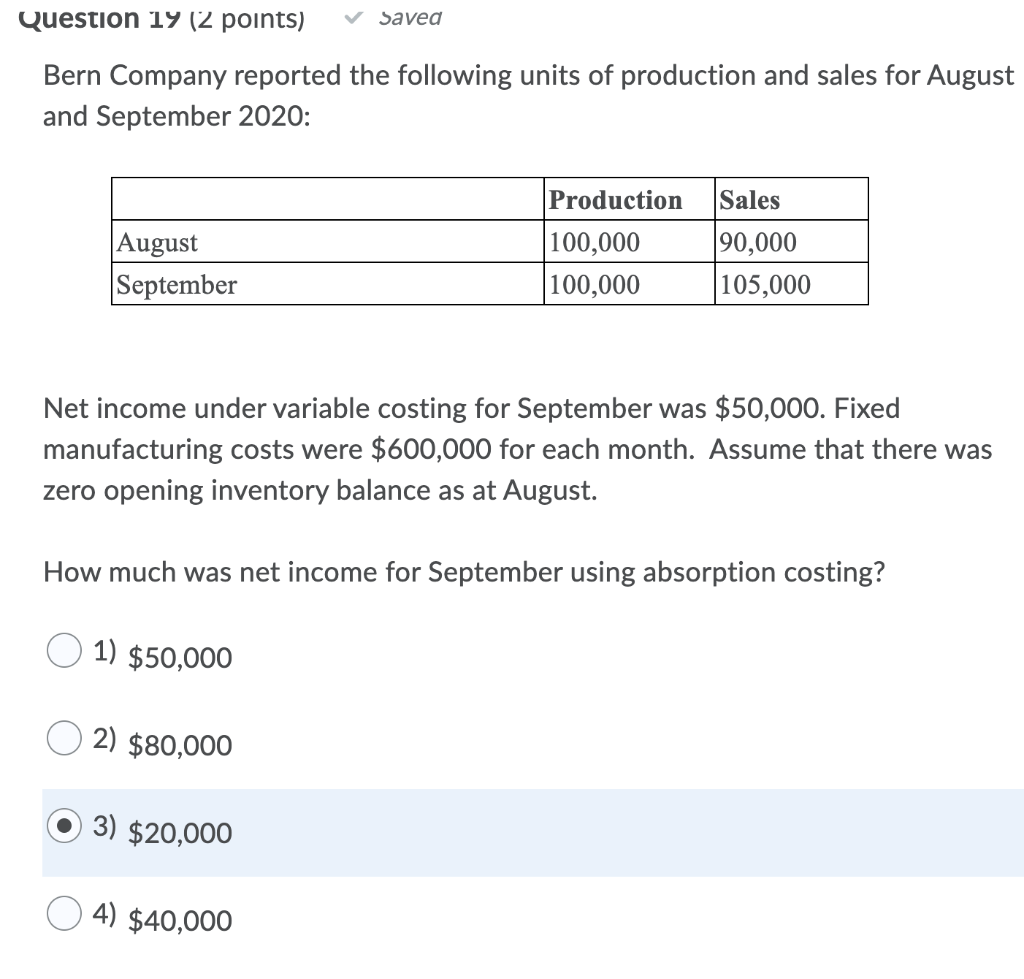

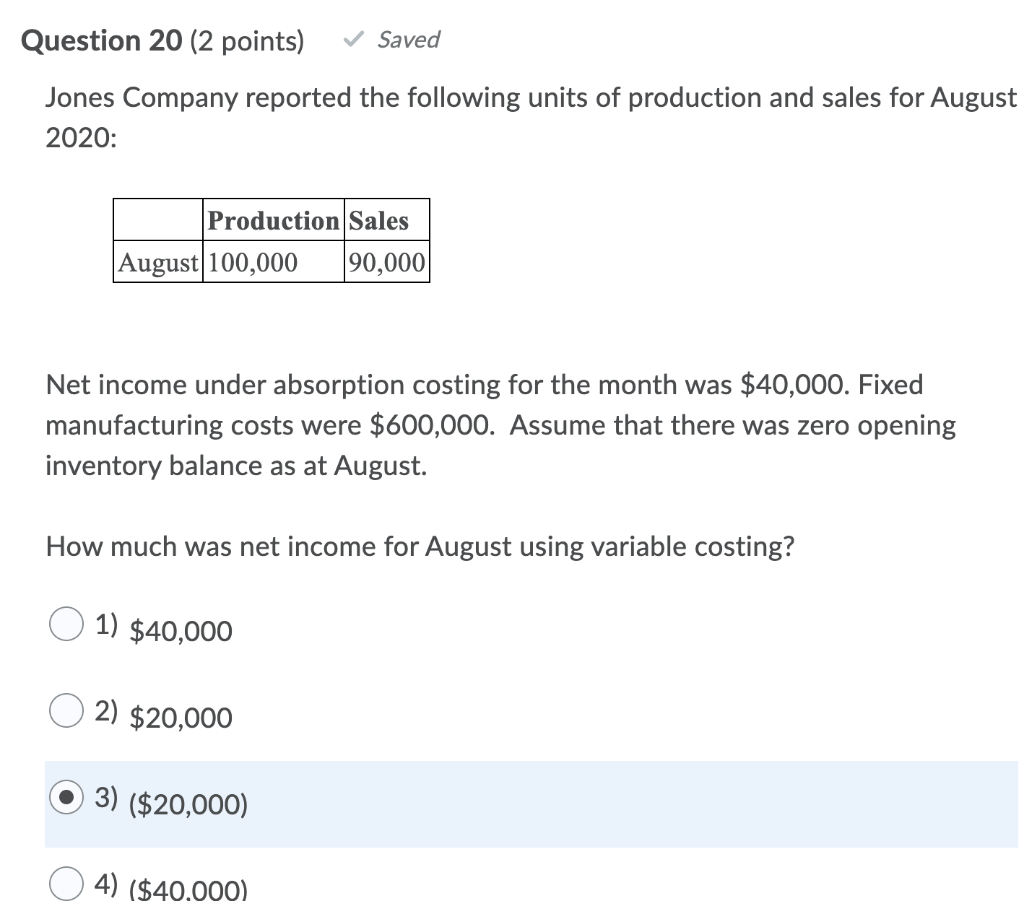

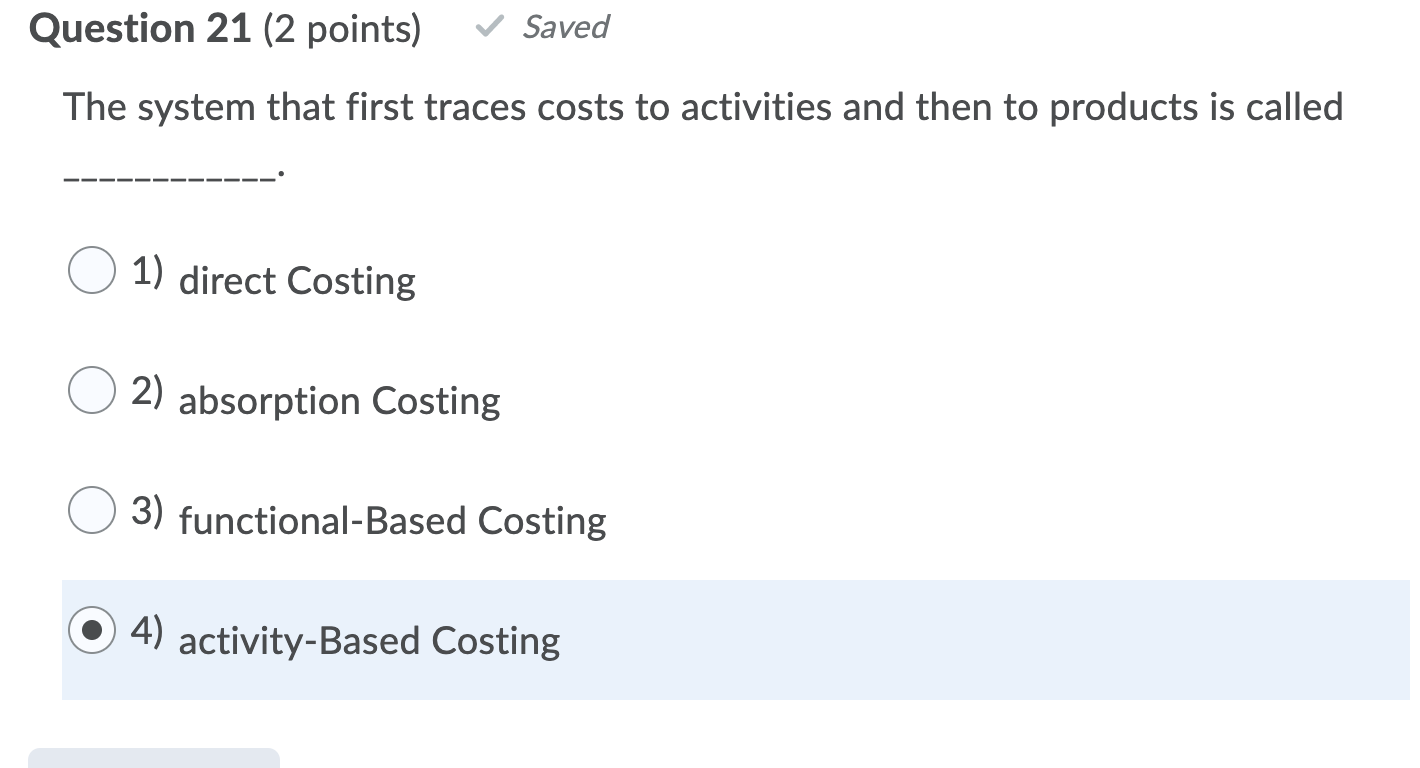

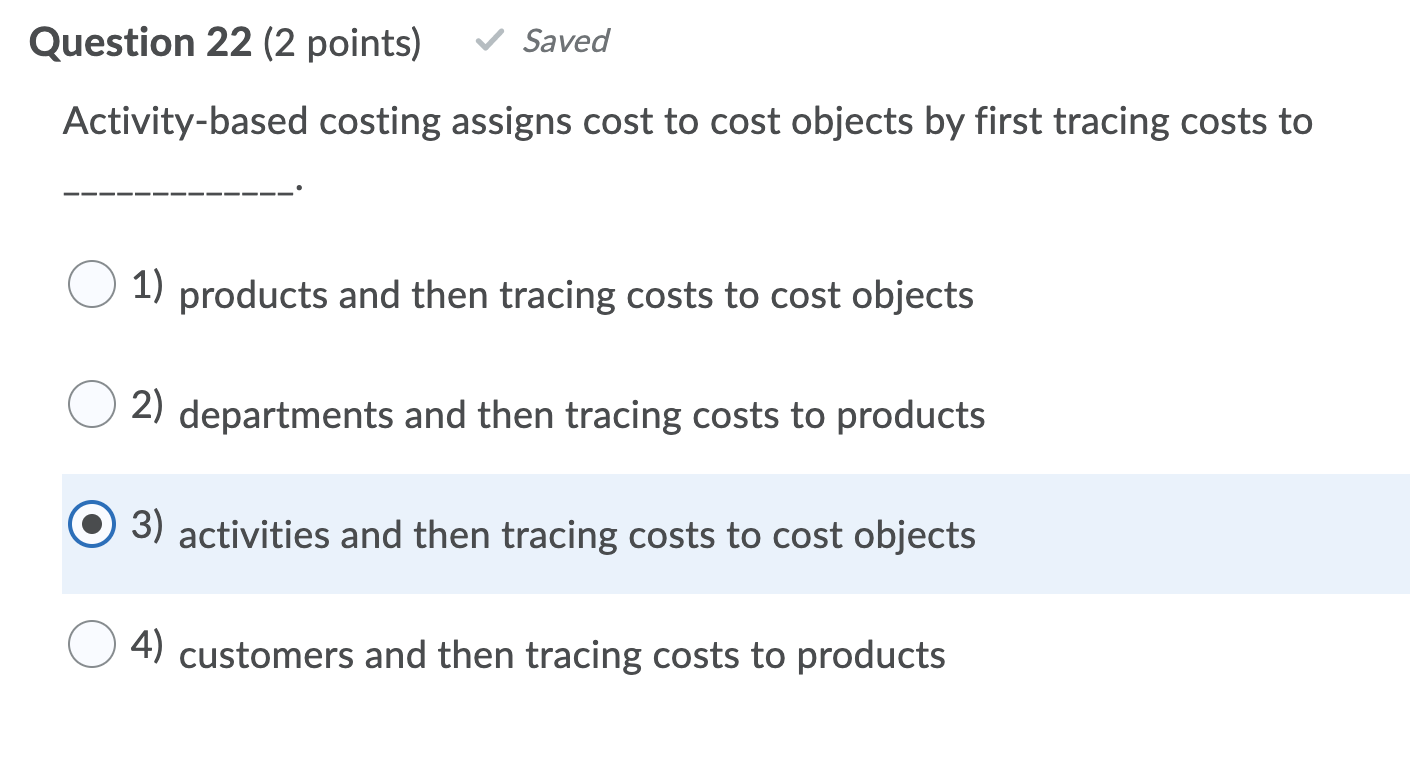

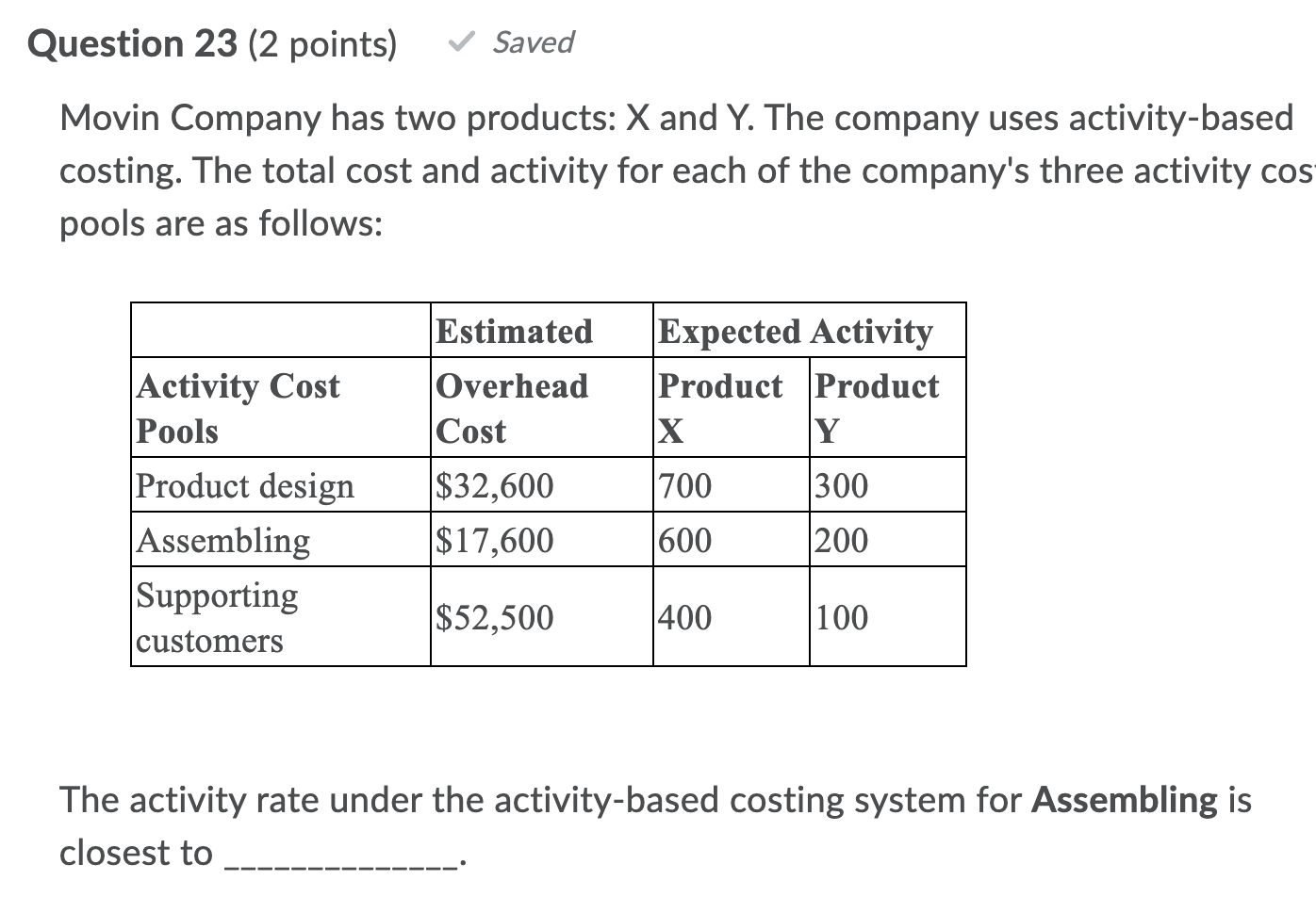

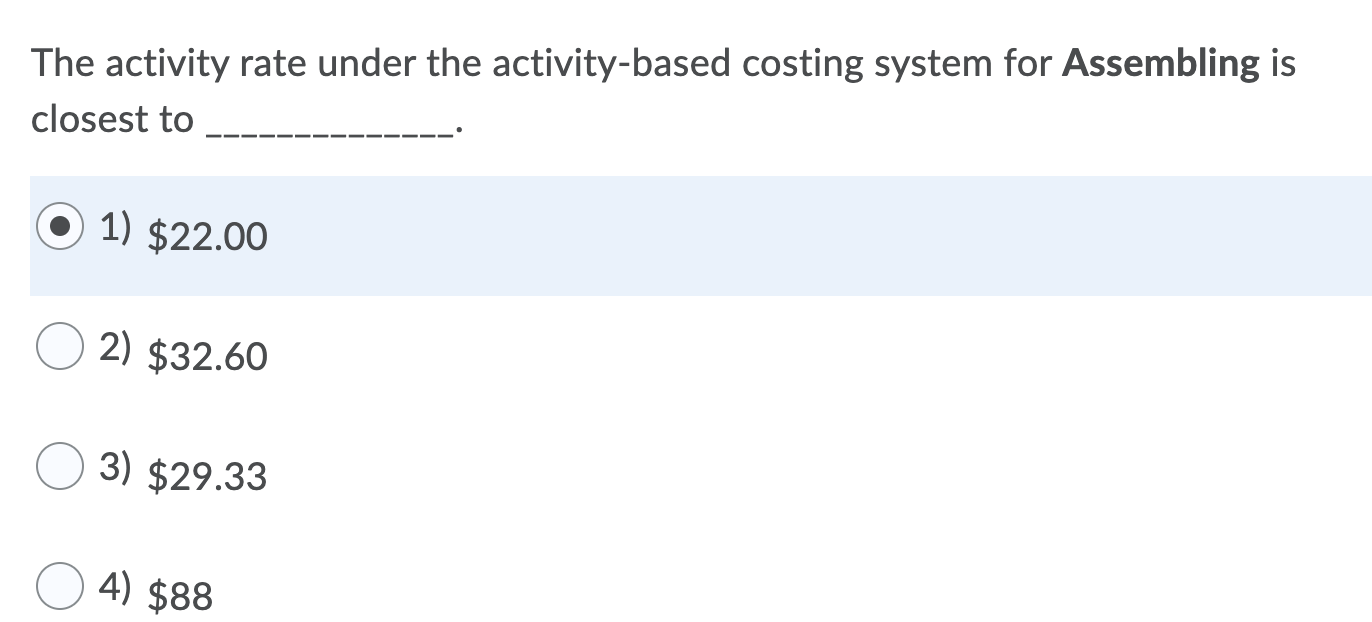

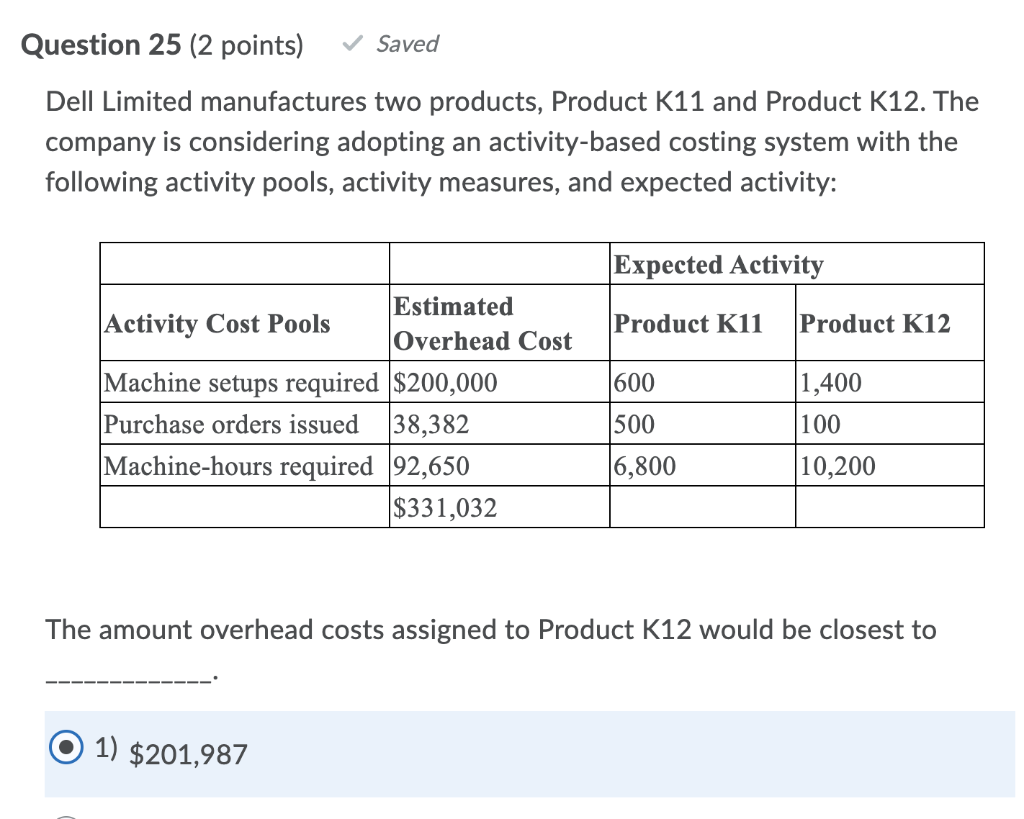

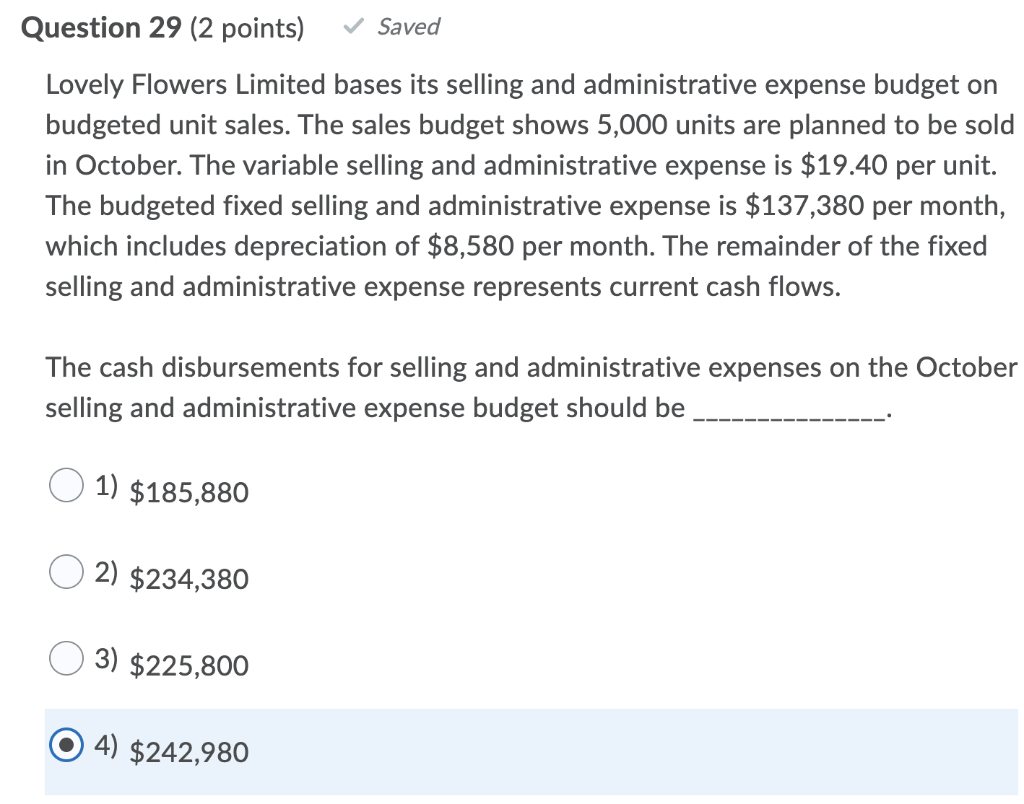

Question 15 (2 points) Saved The Davidson Company uses a weighted average process costing system. The following information was reported for the Assembly Process for January. Units Percent Complete with Respect to Conversion work in Beginning inventory process 60,000 15% Started into production during the 105,000 month Ending work in process inventory 40,000 20% Materials are added at the beginning of the process. What were the equivalent units for materials for the month? Materials are added at the beginning of the process. What were the equivalent units for materials for the month? 1) 133,000 2) 100,000 3) 165,000 O 4) 125,000 Question 16 (2 points) Saved Which of the following statements is TRUE? 1) Absorption costing net income exceeds variable costing net income when units produced and sold are equal. 2) Variable costing net income exceeds absorption costing net income when units produced exceed units sold. 3) Absorption costing net income exceeds variable costing net income when units produced are less than units sold. 4) Absorption costing net income exceeds variable costing net income when units produced are greater than units sold. Question 17 (2 points) Saved Under the absorption costing, fixed manufacturing overhead costs would be classified as 1) period costs 2) product costs 3) selling costs 4) inventory costs Question 18 (2 points) Saved What is the primary difference between variable and absorption costing? 1) Inclusion of fixed selling expenses in product costs. 2) Inclusion of variable factory overhead in period costs. 3) Inclusion of fixed selling expenses in period costs. 4) Inclusion of fixed factory overhead in product costs. Next Page Page 18 of 50 Question 19 (2 points) Saved Bern Company reported the following units of production and sales for August and September 2020: Production Sales August September 100,000 100,000 90,000 105,000 Net income under variable costing for September was $50,000. Fixed manufacturing costs were $600,000 for each month. Assume that there was zero opening inventory balance as at August. How much was net income for September using absorption costing? 1) $50,000 2) $80,000 3) $20,000 4) $40,000 Question 20 (2 points) Saved Jones Company reported the following units of production and sales for August 2020: Production Sales August 100,000 90,000 Net income under absorption costing for the month was $40,000. Fixed manufacturing costs were $600,000. Assume that there was zero opening inventory balance as at August. How much was net income for August using variable costing? 1) $40,000 2) $20,000 3) ($20,000) 4) ($40,000) Question 21 (2 points) Saved The system that first traces costs to activities and then to products is called 1) direct Costing 2) absorption Costing 3) functional-Based Costing 4) activity-Based Costing Question 22 (2 points) Saved Activity-based costing assigns cost to cost objects by first tracing costs to 1) products and then tracing costs to cost objects 2) departments and then tracing costs to products 3) activities and then tracing costs to cost objects 4) customers and then tracing costs to products Question 23 (2 points) Saved Movin Company has two products: X and Y. The company uses activity-based costing. The total cost and activity for each of the company's three activity cos pools are as follows: Estimated Expected Activity Product Product x Y Overhead Cost $32,600 |$17,600 700 Activity Cost Pools Product design Assembling Supporting customers 300 600 200 |$52,500 400 100 The activity rate under the activity-based costing system for Assembling is closest to The activity rate under the activity-based costing system for Assembling is closest to 1) $22.00 2) $32.60 3) $29.33 4) $88 Question 25 (2 points) Saved Dell Limited manufactures two products, Product K11 and Product K12. The company is considering adopting an activity-based costing system with the following activity pools, activity measures, and expected activity: Expected Activity Activity Cost Pools Estimated Overhead Cost Product K11 Product K12 600 500 Machine setups required $200,000 Purchase orders issued 38,382 Machine-hours required 92,650 $331,032 (1,400 100 10,200 16,800 The amount overhead costs assigned to Product K12 would be closest to 1) $201,987 The amount overhead costs assigned to Product K12 would be closest to 1) $201,987 2) $331,032 3) $165,516 4) $200,274 Question 26 (2 points) Saved Which of the following is NOT an advantage of budgeting? 1) It forces managers to plan. 2) It provides resource information that can be used to improve decision making. 3) It aids in the use of resources and employees by setting a benchmark that can be used for the subsequent evaluation of performance. 4) It provides organizational independence. Question 27 (2 points) Saved Which of the following is the most common starting point in the information gathering process for budgeting? 1) The personnel forecast. 2) The sales forecast. 3) The production forecast. 4) The projected income statement. Question 28 (2 points) Saved Which of the following is NOT a component of the master budget? 1) Sales Budget. 2) Capital Budget. 3) Cost of Goods Sold Budget. 4) Budget to Actual Variance Analysis. Question 29 (2 points) Saved Lovely Flowers Limited bases its selling and administrative expense budget on budgeted unit sales. The sales budget shows 5,000 units are planned to be sold in October. The variable selling and administrative expense is $19.40 per unit. The budgeted fixed selling and administrative expense is $137,380 per month, which includes depreciation of $8,580 per month. The remainder of the fixed selling and administrative expense represents current cash flows. The cash disbursements for selling and administrative expenses on the October selling and administrative expense budget should be 1) $185,880 2) $234,380 3) $225,800 4) $242,980

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started