Answered step by step

Verified Expert Solution

Question

1 Approved Answer

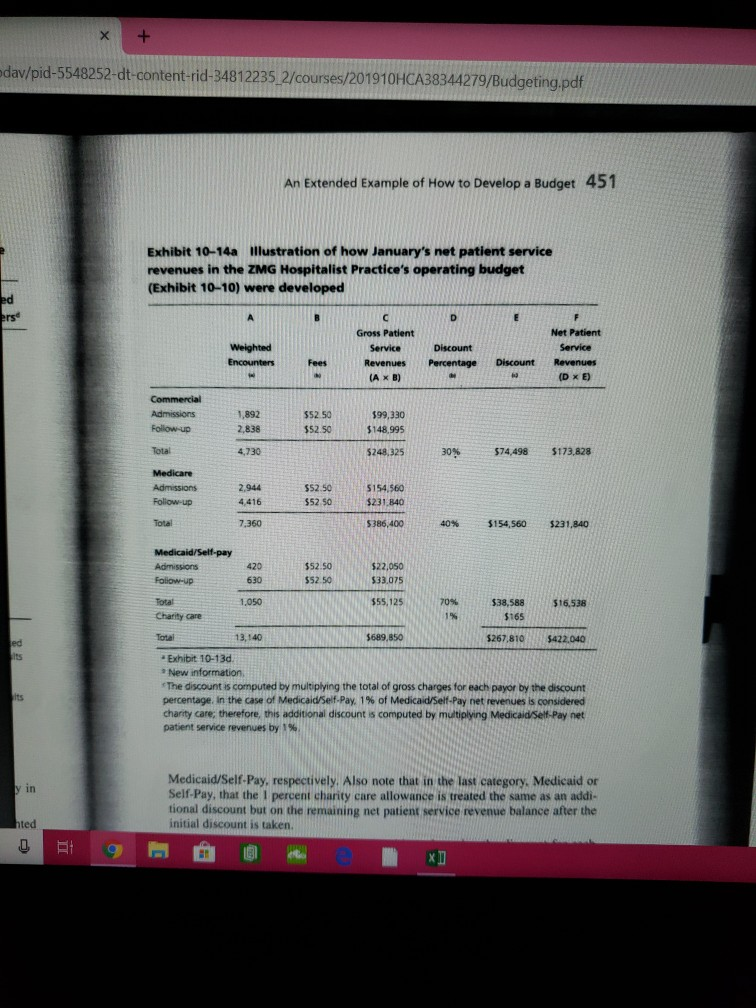

Question 15 and 18 dav/pid-5548252-dt-content-rid-34812235. 2/courses/201910HCA38344279/Budgeting pdf 451 An Extended Example of How to Develop a Budget Exhibit 10-14a Illustration of how January's net patient

Question 15

and 18

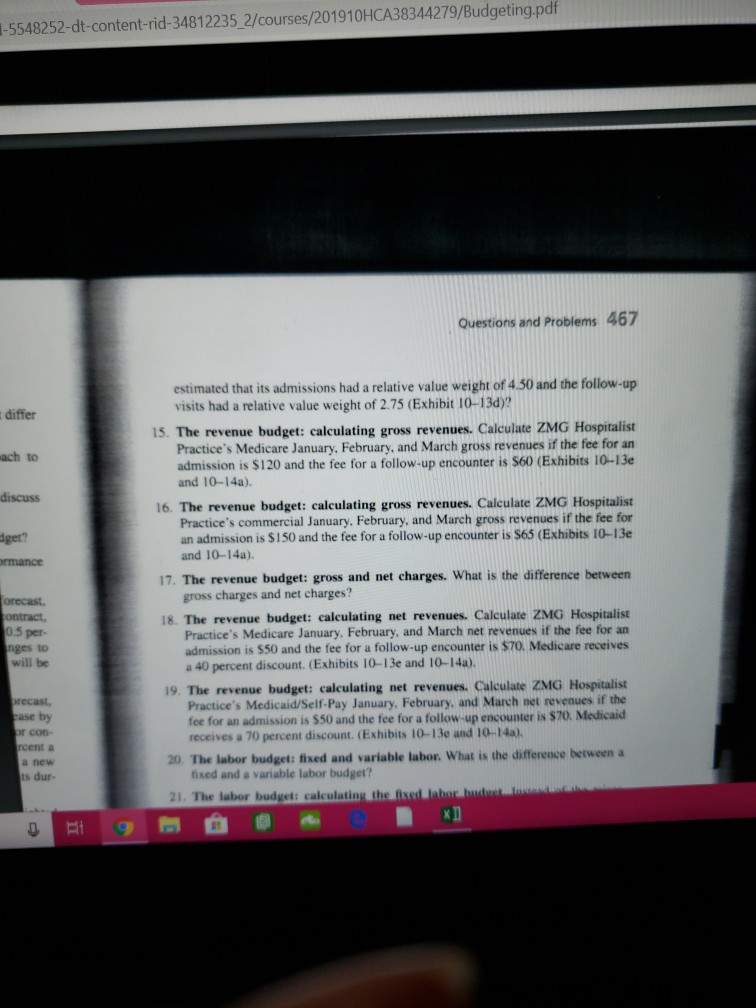

dav/pid-5548252-dt-content-rid-34812235. 2/courses/201910HCA38344279/Budgeting pdf 451 An Extended Example of How to Develop a Budget Exhibit 10-14a Illustration of how January's net patient service revenues in the ZMG Hospitalist Practice's operating budget (Exhibit 10-10) were developed ed Gross Patient Net Patient ServiceDiscount Encounters Fees RevenuesPercentage Discount Revenues A x B) D x E) 1,892 Admissions2,838 $52 50 $99,330 $$2.,50 $148,995 Total 4,730 s248325 30% s74498 $173.828 2,944 Admissions4416 52.505154.560 $231.840 $386,400 Total 7360 s154,seo s23.840 40% Medicaid/Self-pay $52.50 $52.50 $22,050 $33.075 420 630 1,050 $55.125 70% s38,588 $16.538 Charity care 165 1% 13,140 $689,850 $267,810$422,040 Exhibit 10-13d 3 New information The discount is computed by multiplying the total of gross charges for each payor by the discount percentage, in the case of MedicaidSelf-Pay, 1 % of MedicadSelf-Pay net revenues is considered charity care; therefore, this additional discount is computed by mutiplying Medicaid/Self-Pay net patient service revenues by 1%. Medicaid/Self-Pay, respectively, Also note that in the last category. Medicaid or Self-Pay, that the I percent charity care allowance is treated the same as an addi- tional discount but on the remaining net patient service revenue balance after the in hted initial discount is taken 2/courses/201910HCA38344279/Budgeting.pdf -5548252-dt-content-rid-34812235 467 Questions and Problems estimated that its admissions had a relative value weight of 4.50 and the follow-up visits had a relative value weight of 2.75 (Exhibit 10-13d)? differ 15. The revenue budget: calculating gross revenues. Calculate ZMG Hospitalist Practice's Medicare January, February, and March gross revenues if the fee for an admission is S120 and the fee for a follow-up encounter is $60 (Exhibits 10-13e ach to and 10-14a). discuss 16. The revenue budget: calculating gross revenues. Calculate ZMG Hospitalist Practice's commercial January. February, and March gross revenues if the fee for an admission is $ 150 and the fee for a follow-up encounter is $65 (Exhibits 10-13e dger? and 10-14a). rmance 17. The revenue budget: gross and net charges. What is the difference between gross charges and net charges? 18. The revenue budget: calculating net revenues. Calculate ZMG Hospitalist Practice's Medicare January, February, and March net revenues if the fee for an ontract, 5 per- nges to will be admission is $50 and the fee for a follow-up encounter is $70. Medicare receives a 40 percent discount. (Exhibits 10-13e and 10-14a). 19. The revenue budget: calculating net revenues. Calculate ZMG Hospitalist Practice's Medicaid/Self-Pay January, February, and March net revenues if the fee for an admission is $50 and the fee for a follow-up encounter is $70. Medicaid receives a 70 percent discount. (Exhibits 10-13o and 10-14a). recast, e by r con- cent a a new s dur- as 20. The labor budget: fixed and variable labor. What is the difference between a fised and a variable labor budget? 21. The labor budget: calculating ths dav/pid-5548252-dt-content-rid-34812235. 2/courses/201910HCA38344279/Budgeting pdf 451 An Extended Example of How to Develop a Budget Exhibit 10-14a Illustration of how January's net patient service revenues in the ZMG Hospitalist Practice's operating budget (Exhibit 10-10) were developed ed Gross Patient Net Patient ServiceDiscount Encounters Fees RevenuesPercentage Discount Revenues A x B) D x E) 1,892 Admissions2,838 $52 50 $99,330 $$2.,50 $148,995 Total 4,730 s248325 30% s74498 $173.828 2,944 Admissions4416 52.505154.560 $231.840 $386,400 Total 7360 s154,seo s23.840 40% Medicaid/Self-pay $52.50 $52.50 $22,050 $33.075 420 630 1,050 $55.125 70% s38,588 $16.538 Charity care 165 1% 13,140 $689,850 $267,810$422,040 Exhibit 10-13d 3 New information The discount is computed by multiplying the total of gross charges for each payor by the discount percentage, in the case of MedicaidSelf-Pay, 1 % of MedicadSelf-Pay net revenues is considered charity care; therefore, this additional discount is computed by mutiplying Medicaid/Self-Pay net patient service revenues by 1%. Medicaid/Self-Pay, respectively, Also note that in the last category. Medicaid or Self-Pay, that the I percent charity care allowance is treated the same as an addi- tional discount but on the remaining net patient service revenue balance after the in hted initial discount is taken 2/courses/201910HCA38344279/Budgeting.pdf -5548252-dt-content-rid-34812235 467 Questions and Problems estimated that its admissions had a relative value weight of 4.50 and the follow-up visits had a relative value weight of 2.75 (Exhibit 10-13d)? differ 15. The revenue budget: calculating gross revenues. Calculate ZMG Hospitalist Practice's Medicare January, February, and March gross revenues if the fee for an admission is S120 and the fee for a follow-up encounter is $60 (Exhibits 10-13e ach to and 10-14a). discuss 16. The revenue budget: calculating gross revenues. Calculate ZMG Hospitalist Practice's commercial January. February, and March gross revenues if the fee for an admission is $ 150 and the fee for a follow-up encounter is $65 (Exhibits 10-13e dger? and 10-14a). rmance 17. The revenue budget: gross and net charges. What is the difference between gross charges and net charges? 18. The revenue budget: calculating net revenues. Calculate ZMG Hospitalist Practice's Medicare January, February, and March net revenues if the fee for an ontract, 5 per- nges to will be admission is $50 and the fee for a follow-up encounter is $70. Medicare receives a 40 percent discount. (Exhibits 10-13e and 10-14a). 19. The revenue budget: calculating net revenues. Calculate ZMG Hospitalist Practice's Medicaid/Self-Pay January, February, and March net revenues if the fee for an admission is $50 and the fee for a follow-up encounter is $70. Medicaid receives a 70 percent discount. (Exhibits 10-13o and 10-14a). recast, e by r con- cent a a new s dur- as 20. The labor budget: fixed and variable labor. What is the difference between a fised and a variable labor budget? 21. The labor budget: calculating thsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started