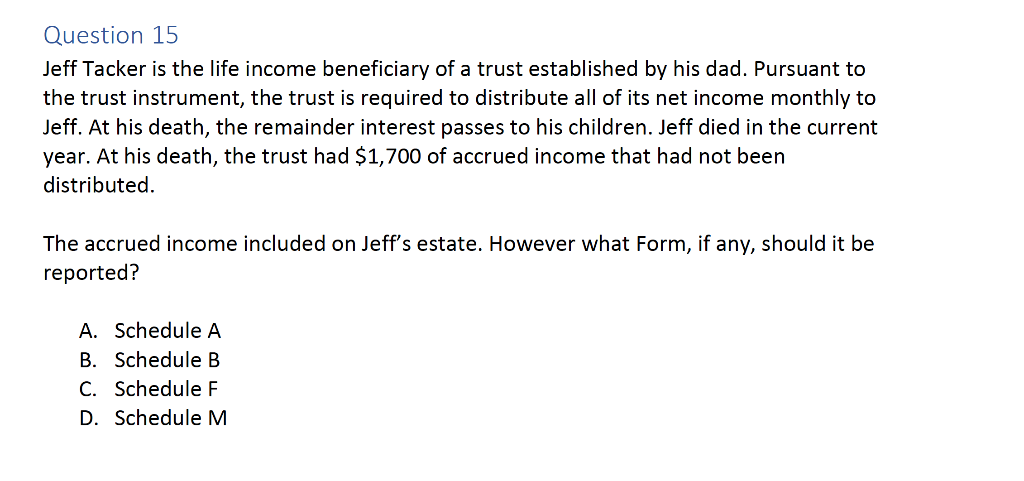

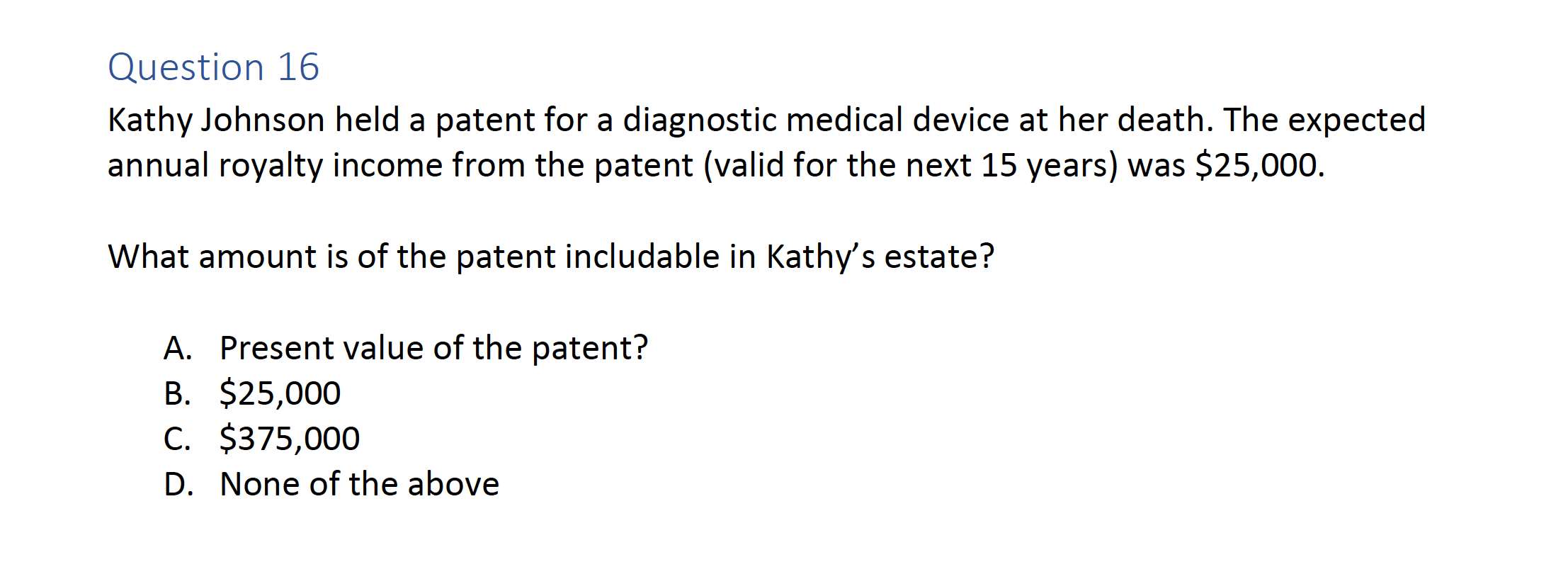

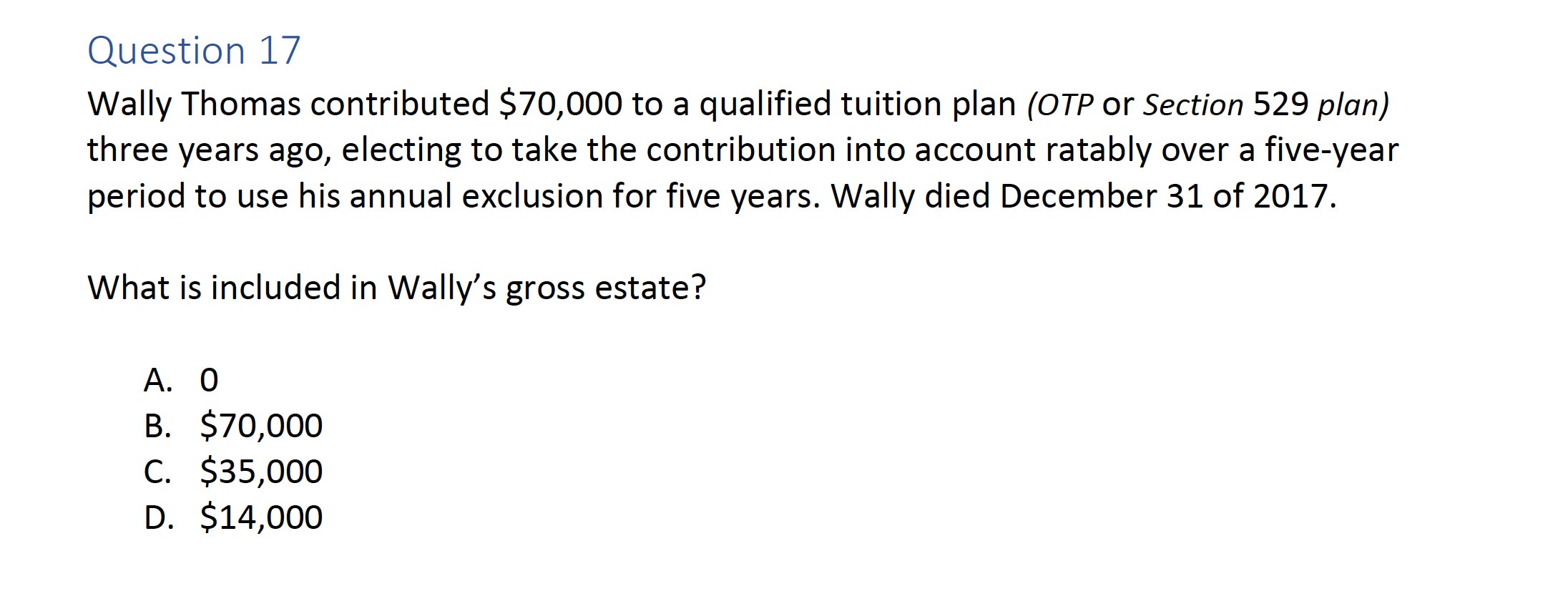

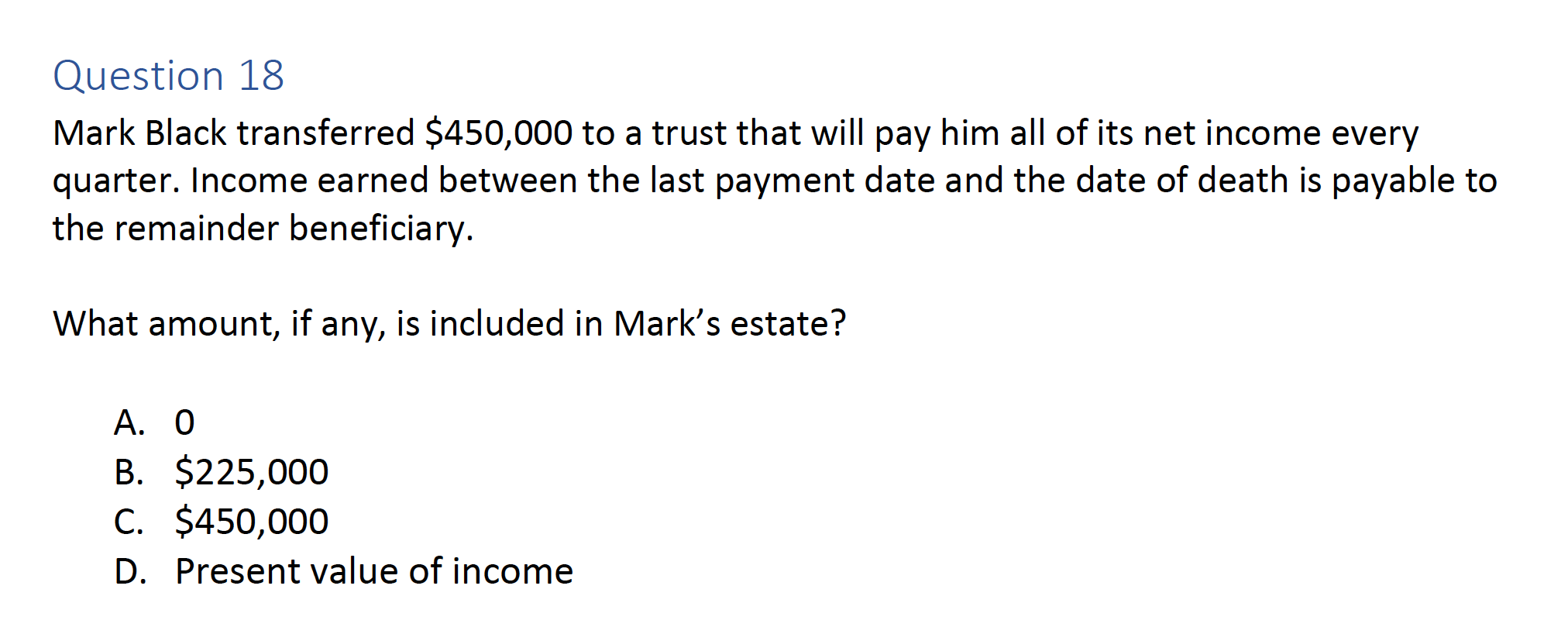

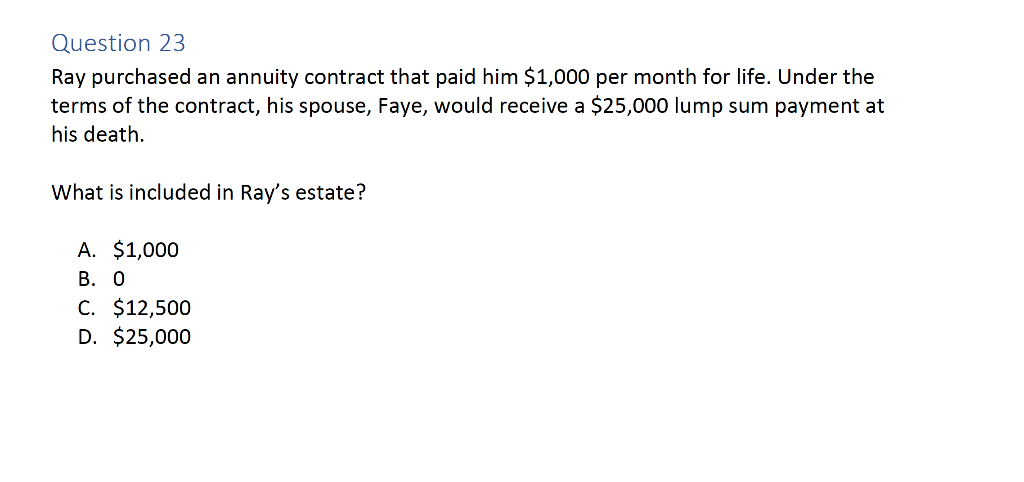

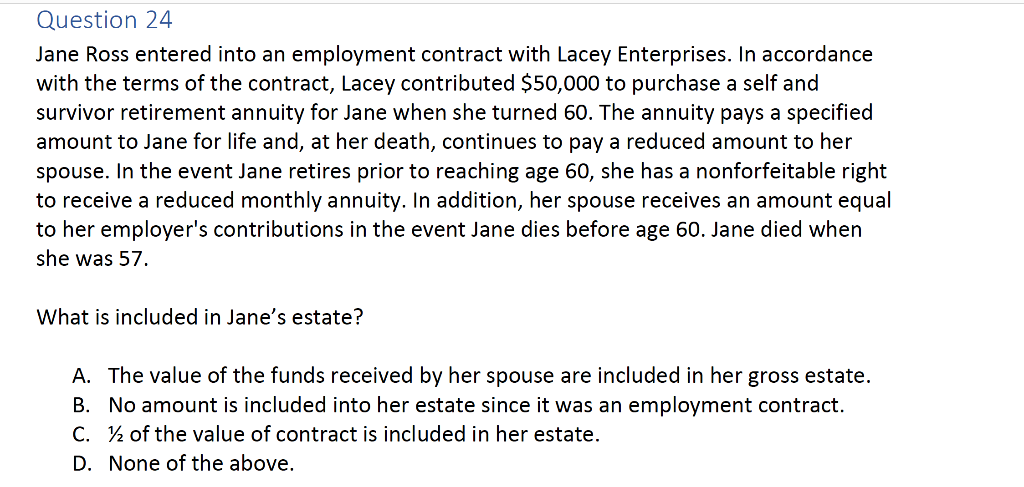

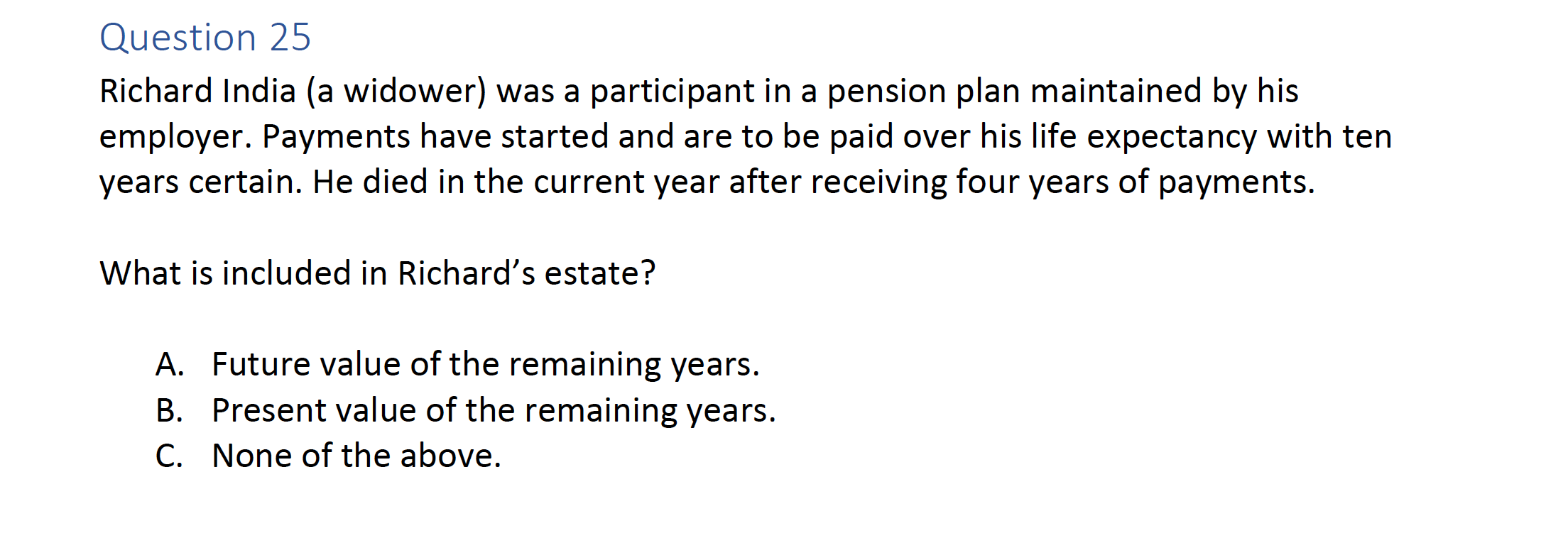

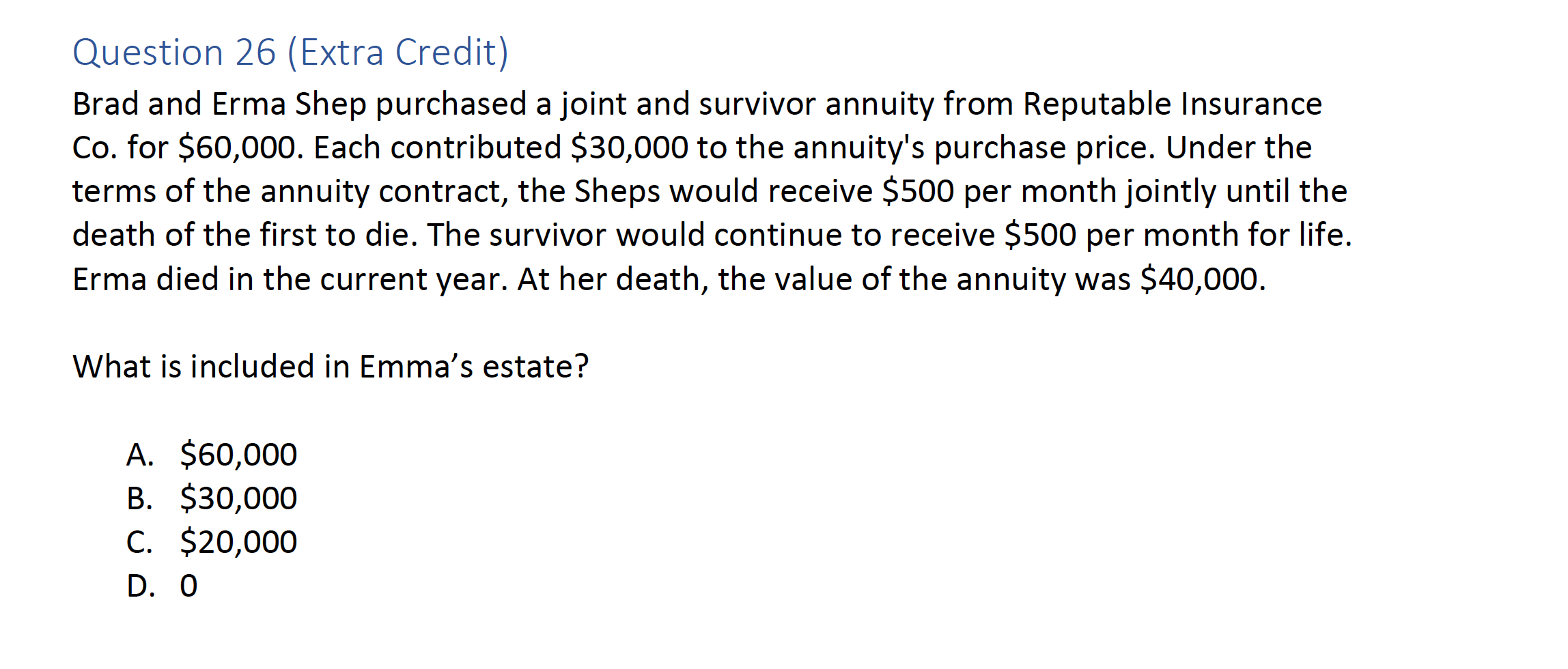

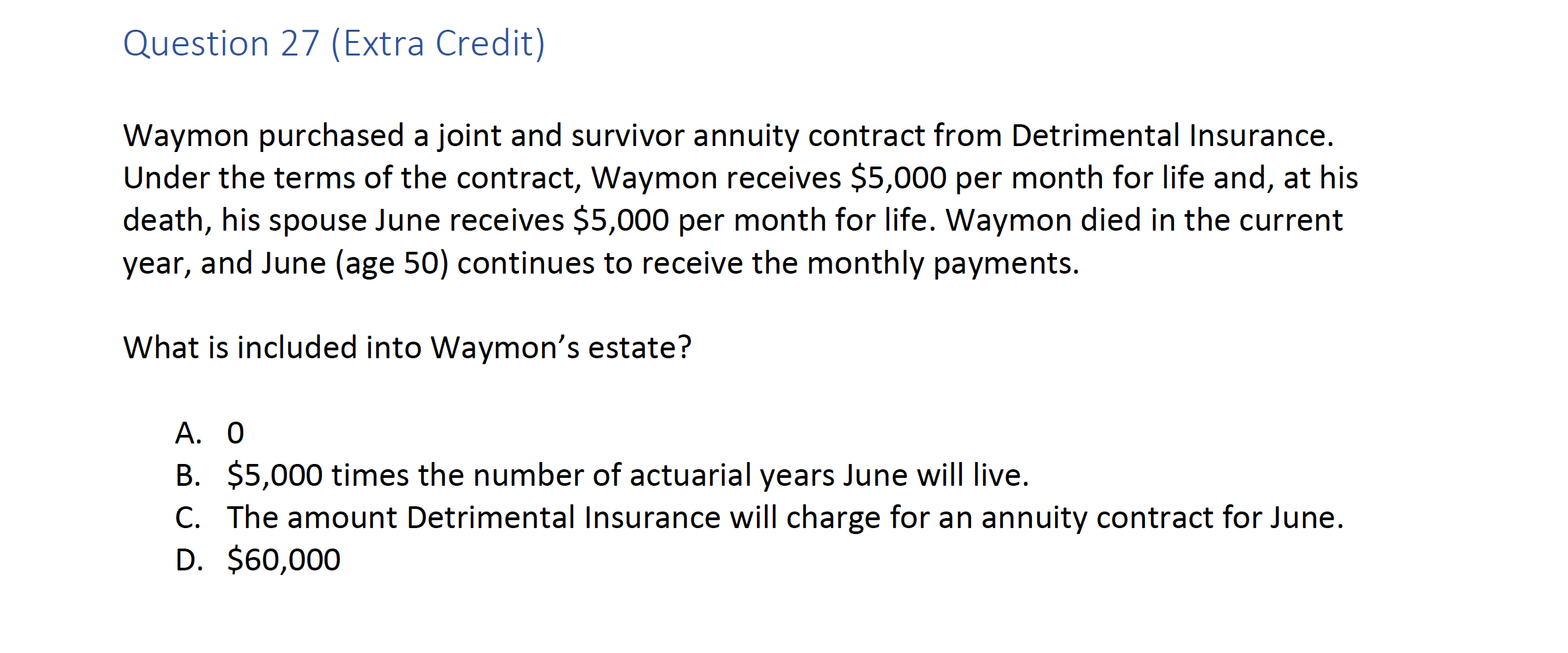

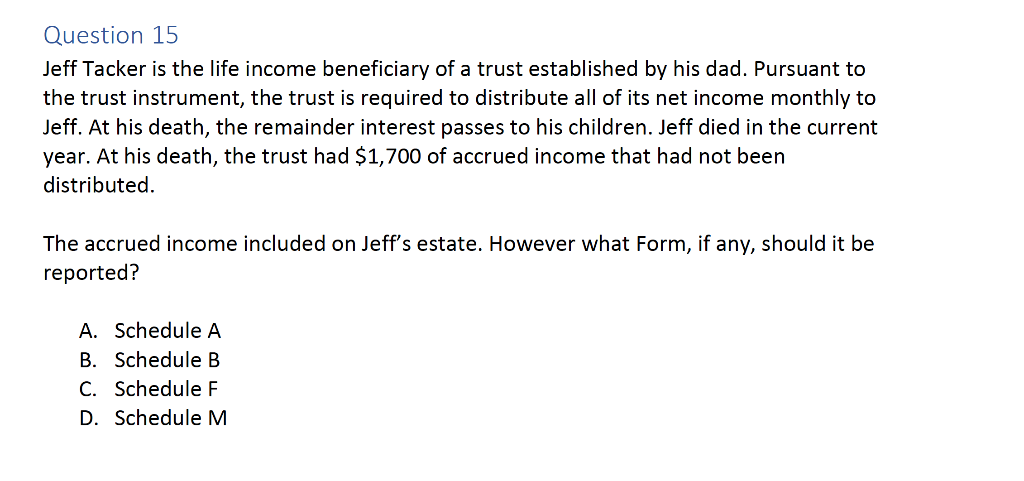

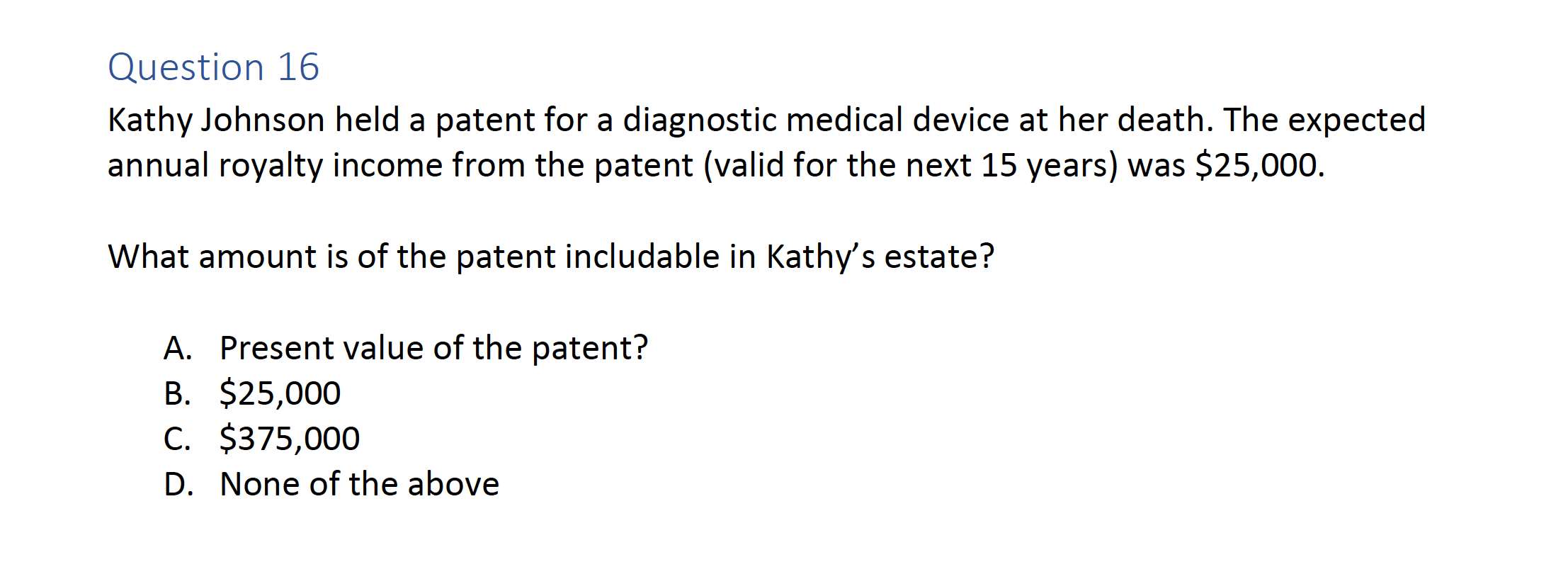

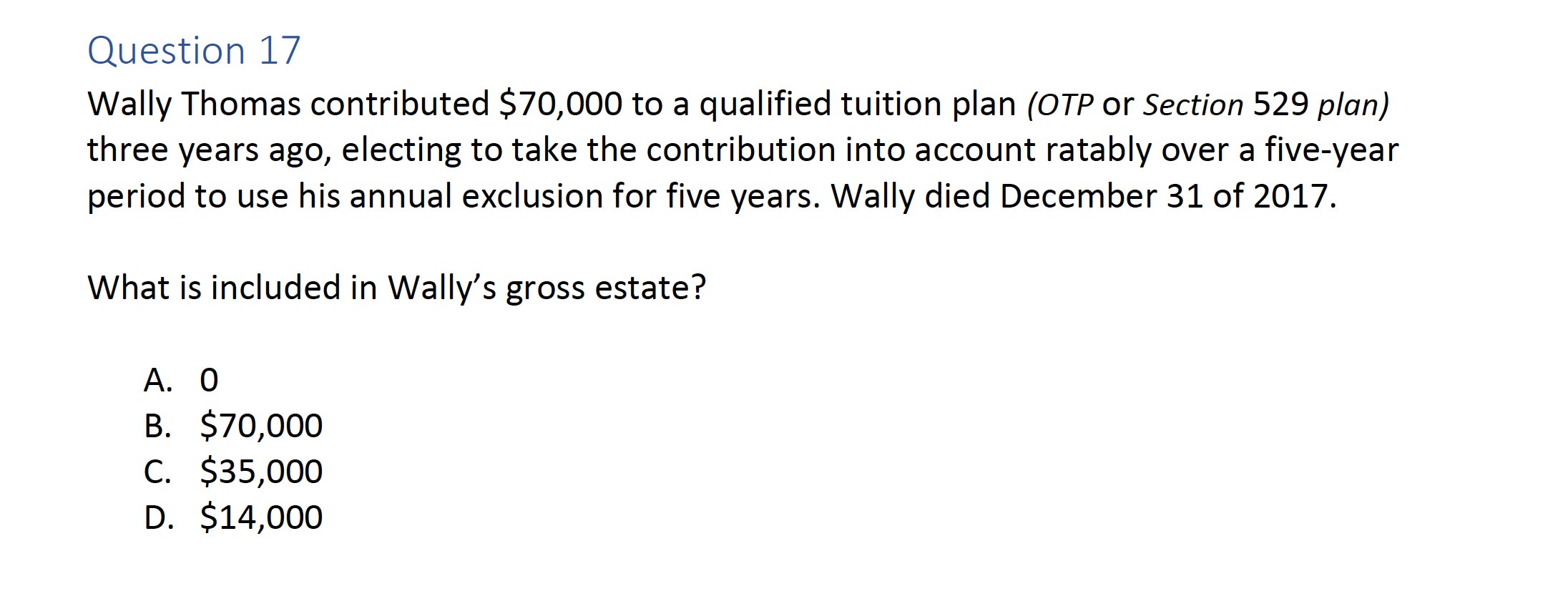

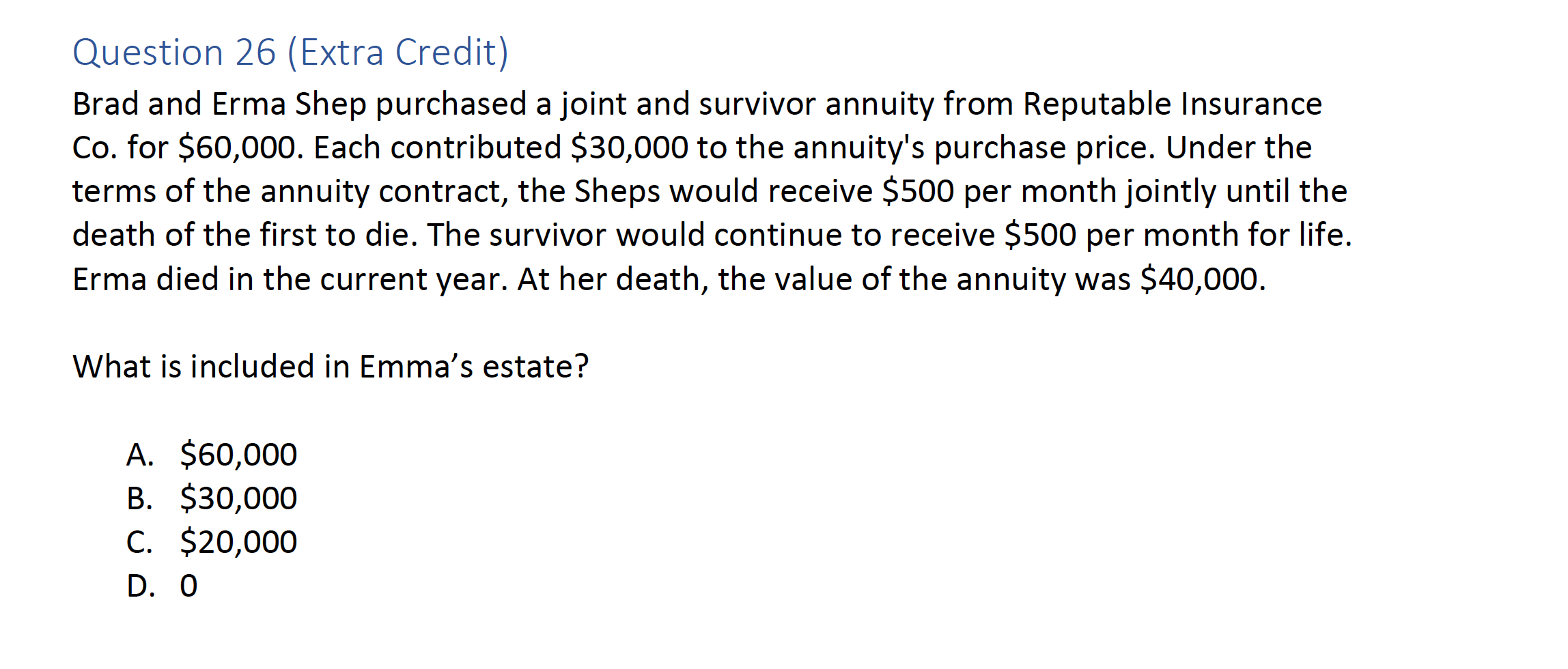

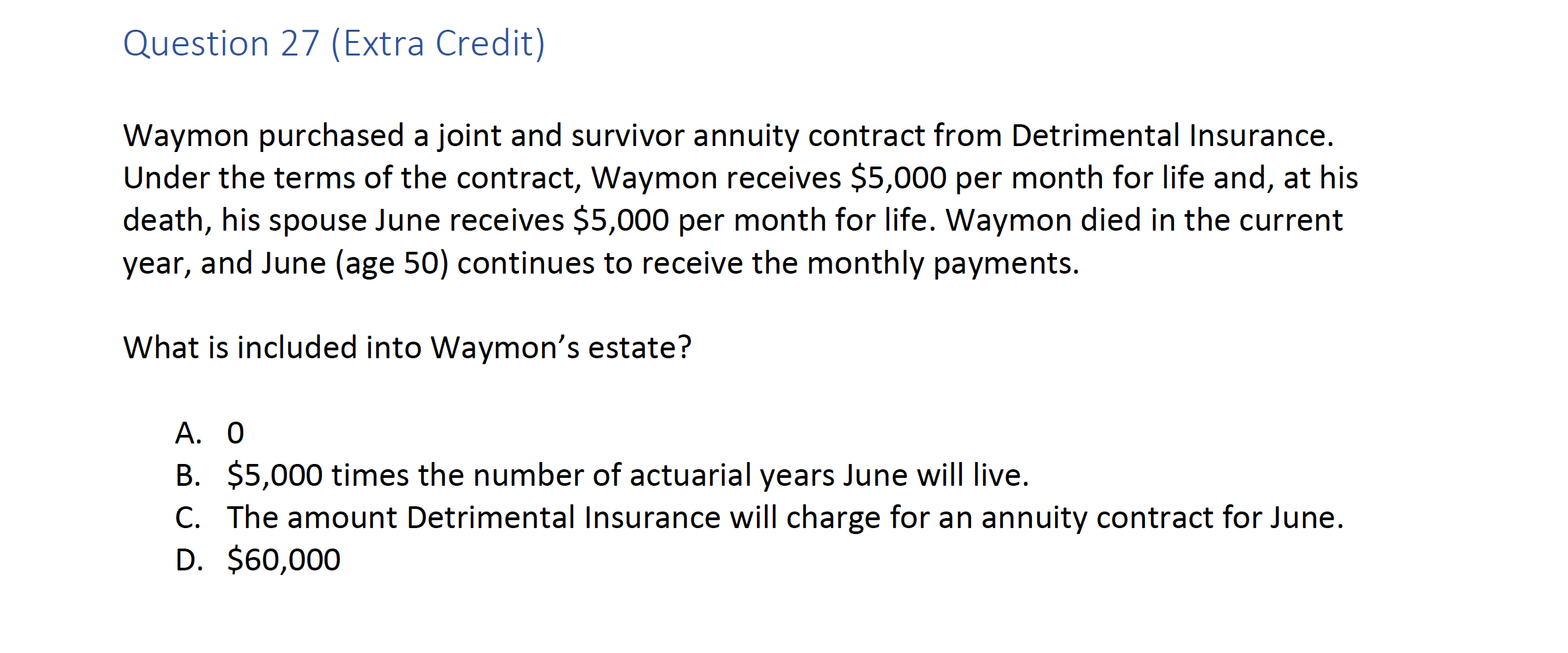

Question 15 Jeff Tacker is the life income beneficiary of a trust established by his dad. Pursuant to the trust instrument, the trust is required to distribute all of its net income monthly to Jeff. At his death, the remainder interest passes to his children. Jeff died in the current year. At his death, the trust had $1,700 of accrued income that had not been distributed. The accrued income included on Jeff's estate. However what Form, if any, should it be reported? A. Schedule A B. Schedule B C. Schedule F D. Schedule M Question 16 Kathy Johnson held a patent for a diagnostic medical device at her death. The expected annual royalty income from the patent (valid for the next 15 years) was $25,000. What amount is of the patent includable in Kathy's estate? A. Present value of the patent? B. $25,000 C. $375,000 D. None of the above Question 17 Wally Thomas contributed $70,000 to a qualified tuition plan (OTP or Section 529 plan) three years ago, electing to take the contribution into account ratably over a five-year period to use his annual exclusion for five years. Wally died December 31 of 2017. What is included in Wally's gross estate? A. 0 B. $70,000 C. $35,000 D. $14,000 Question 18 Mark Black transferred $450,000 to a trust that will pay him all of its net income every quarter. Income earned between the last payment date and the date of death is payable to the remainder beneficiary. What amount, if any, is included in Mark's estate? A. O B. $225,000 C. $450,000 D. Present value of income Question 19 Wally Piper transferred $250,000 to a grantor retained annuity trust (GRAT) and retained the right to receive an annuity of $15,000 per year for 10 years. At the expiration of the trust term, the remainder interest passes to his son. What if Wally dies during the term of his income interest? A. $250,000 included in his gross estate. B. $15,000 is included in his gross estate. C. A portion of the trust's value will be included in gross. D. None of the above Question 20 Lydia Brasch transferred her personal residence worth $350,000 to a qualified personal residence trust three years ago. Pursuant to the trust instrument, Lydia retains the right to use and occupy the residence for five years. At the expiration of the trust term, the remainder interest in the trust (i.e., the residence) passes to her son, Frank. Lydia died unexpectedly in the current year. What is included in Lydia's estate? A. Nothing since it was transferred in trust during her life. B. The FMV of the trust at that date of her death since she retained a right to the trust. C. Something less than FMV of the trust since she died during the term of the trust. D. None of the above Question 21 Cheryl Hunt transferred property in trust with the income payable to her spouse, Jay, for life. At Jay's death, the balance in the trust reverts to Cheryl, if she survives Jay. If Cheryl predeceases Jay, the remainder interest passes to their son, Mike. Do the reversionary interest rules apply to Cheryl upon Jay's death? A. Yes, since trust property will revert to Cheryl if she survives Jay, she has retained a reversionary interest in the trust. B. No, since the trust property does not revert to Cheryl if she survives Jay, she has not retained a reversionary interest in the trust. Question 22 Rhonda Wright established an irrevocable trust for the benefit of her children seven years ago. Pursuant to the trust agreement, the beneficiaries had the right to withdraw amounts contributed to the trust (i.e., a Crummey power). The trust purchased a $500,000 life insurance policy on Rhonda's life. Rhonda made annual gifts to the trust that were used to pay the policy's premiums each year until her death in the current year. Rhonda did not possess any incidents of ownership in the policy at any time prior to her death. Is the $500,000 insurance policy includable in her estate? A. Yes B. No Question 23 Ray purchased an annuity contract that paid him $1,000 per month for life. Under the terms of the contract, his spouse, Faye, would receive a $25,000 lump sum payment at his death. What is included in Ray's estate? A. $1,000 B. 0 C. $12,500 D. $25,000 Question 24 Jane Ross entered into an employment contract with Lacey Enterprises. In accordance with the terms of the contract, Lacey contributed $50,000 to purchase a self and survivor retirement annuity for Jane when she turned 60. The annuity pays a specified amount to Jane for life and, at her death, continues to pay a reduced amount to her spouse. In the event Jane retires prior to reaching age 60, she has a nonforfeitable right to receive a reduced monthly annuity. In addition, her spouse receives an amount equal to her employer's contributions in the event Jane dies before age 60. Jane died when she was 57. What is included in Jane's estate? A. The value of the funds received by her spouse are included in her gross estate. B. No amount is included into her estate since it was an employment contract. C. 12 of the value of contract is included in her estate. D. None of the above. Question 25 Richard India (a widower) was a participant in a pension plan maintained by his employer. Payments have started and are to be paid over his life expectancy with ten years certain. He died in the current year after receiving four years of payments. What is included in Richard's estate? A. Future value of the remaining years. B. Present value of the remaining years. C. None of the above. Question 26 (Extra Credit) Brad and Erma Shep purchased a joint and survivor annuity from Reputable Insurance Co. for $60,000. Each contributed $30,000 to the annuity's purchase price. Under the terms of the annuity contract, the Sheps would receive $500 per month jointly until the death of the first to die. The survivor would continue to receive $500 per month for life. Erma died in the current year. At her death, the value of the annuity was $40,000. What is included in Emma's estate? A. $60,000 B. $30,000 C. $20,000 D. 0 Question 27 (Extra Credit) Waymon purchased a joint and survivor annuity contract from Detrimental Insurance. Under the terms of the contract, Waymon receives $5,000 per month for life and, at his death, his spouse June receives $5,000 per month for life. Waymon died in the current year, and June (age 50) continues to receive the monthly payments. What is included into Waymon's estate? A. 0 B. $5,000 times the number of actuarial years June will live. C. The amount Detrimental Insurance will charge for an annuity contract for June. D. $60,000