Answered step by step

Verified Expert Solution

Question

1 Approved Answer

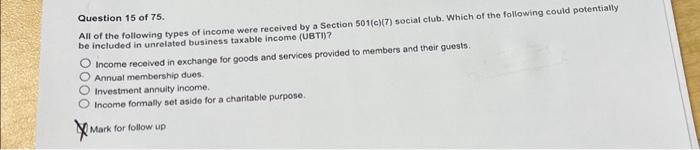

Question 15 of 75. All of the following types of income were received by a Section 501(c)(7) social club. Which of the following could potentially

Question 15 of 75. All of the following types of income were received by a Section 501(c)(7) social club. Which of the following could potentially be included in unrelated business taxable income (UBTI)? 0000 Income received in exchange for goods and services provided to members and their guests. Annual membership dues. Investment annuity income. Income formally set aside for a charitable purpose. X Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started