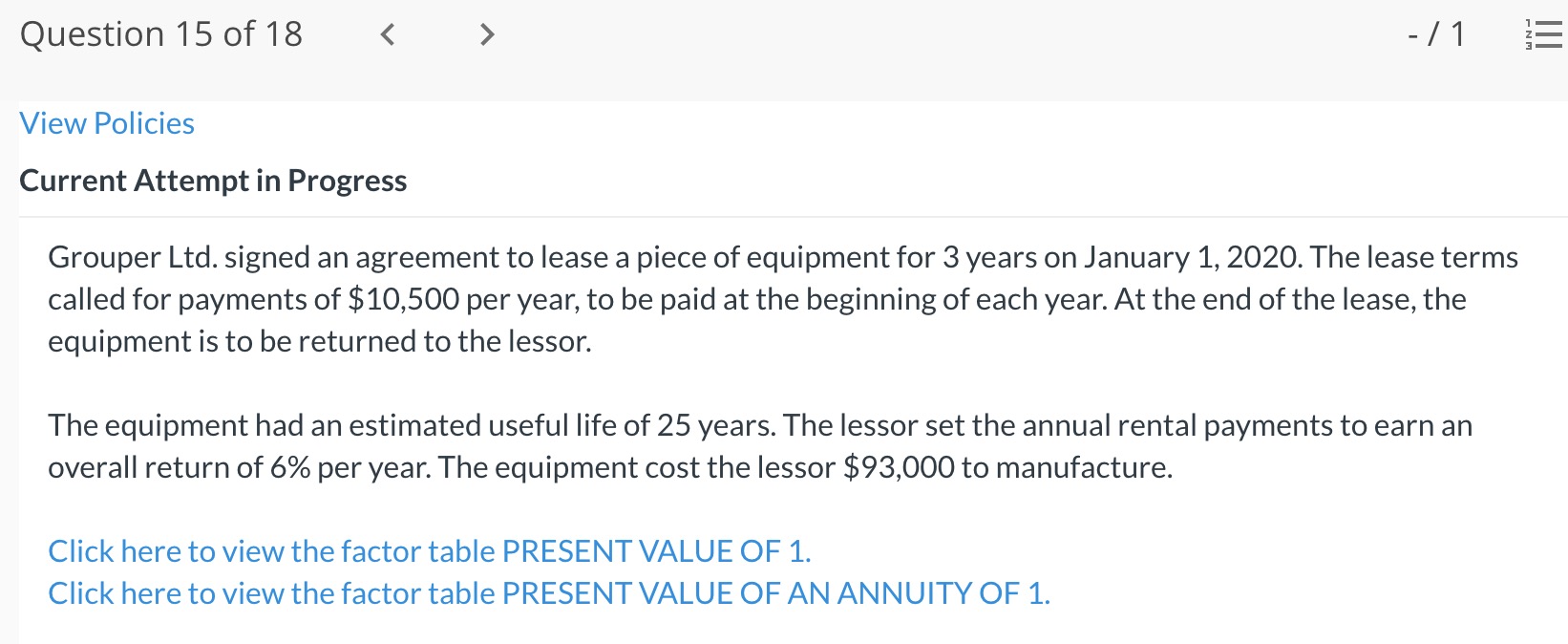

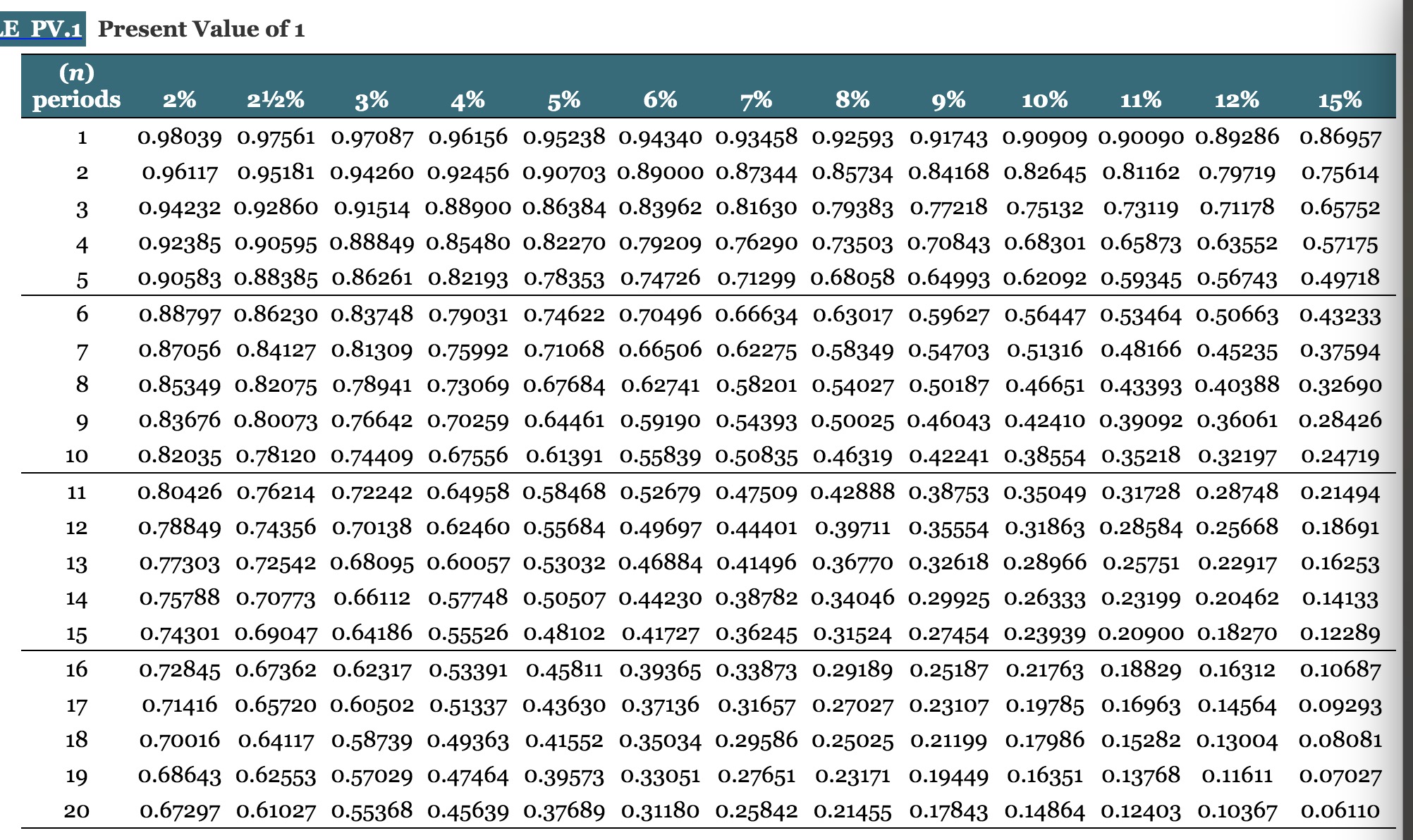

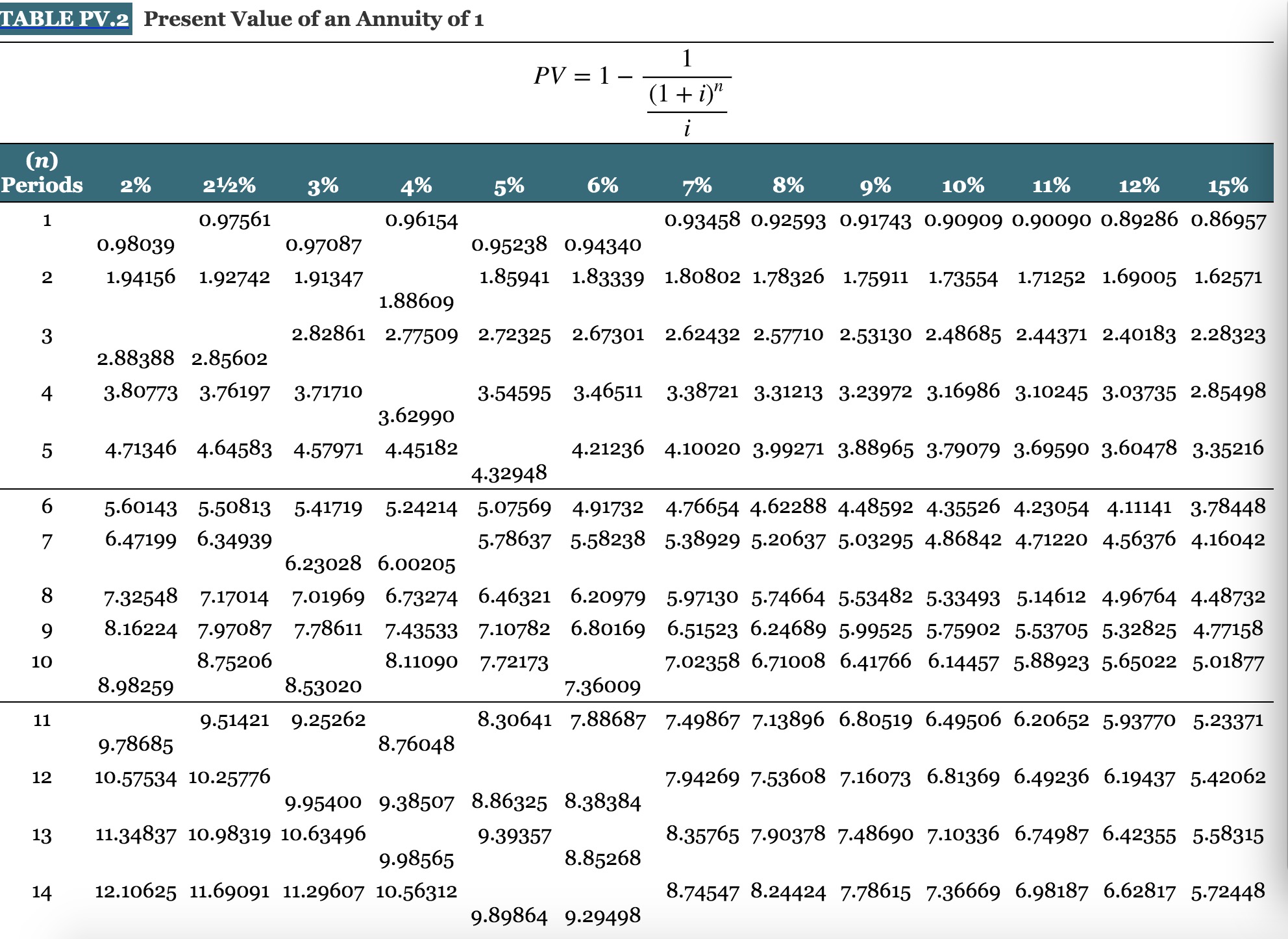

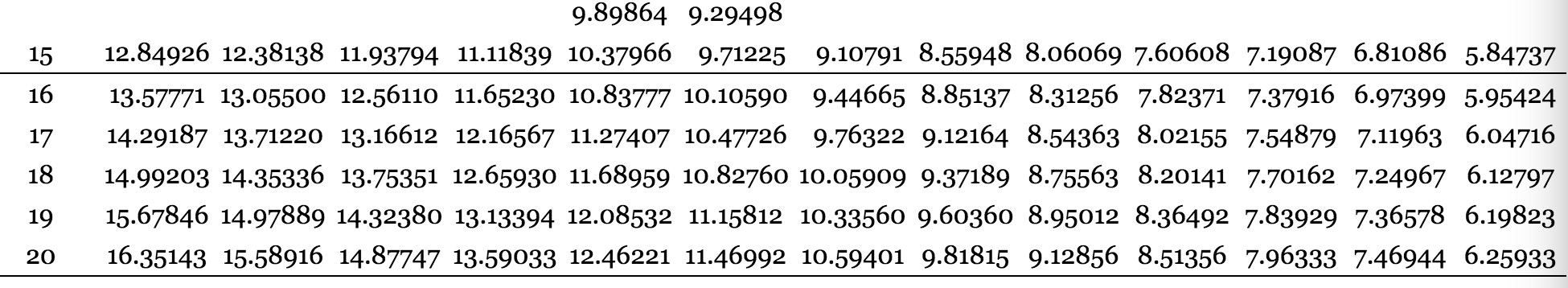

Question 15 of18 - /'| E View Policies Current Attempt in Progress Grouper Ltd. signed an agreement to lease a piece of equipment for 3 years on January 1, 2020. The lease terms called for payments of $10,500 per year, to be paid at the beginning of each year. At the end of the lease, the equipment is to be returned to the lessor. The equipment had an estimated useful life of 25 years. The lessor set the annual rental payments to earn an overall return of 6% per year. The equipment cost the lessor $93,000 to manufacture. Click here to View the factor table PRESENT VALUE OF 1. Click here to View the factor table PRESENT VALUE OF AN ANNUITY OF 1. Prepare thejournal entries on the books of Grouper Ltd. on January 1, 2020 and on December 31, 2020, assuming adjusting journal entries are done annually and that Grouper follows ASPE. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. if no entry is required, select "No entry" for the account titles and enter 0 for the amounts. _ Date Account Titles and Explanation Debit -: Qg E PV.1 Present Value of 1 (n) periods 2% 21/2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 15% 0.98039 0.97561 0.97087 0.96156 0.95238 0.94340 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.86957 2 0.96117 0.95181 0.94260 0.92456 0.90703 0.89000 0.87344 0.85734 0.84168 0.82645 0.81162 0.79719 0.75614 3 0.94232 0.92860 0.91514 0.88900 0.86384 0.83962 0.81630 0.79383 0.77218 0.75132 0.73119 0.71178 0.65752 4 0.92385 0.90595 0.88849 0.85480 0.82270 0.79209 0.76290 0.73503 0.70843 0.68301 0.65873 0.63552 0.57175 5 0.90583 0.88385 0.86261 0.82193 0.78353 0.74726 0.71299 0.68058 0.64993 0.62092 0.59345 0.56743 0.49718 6 0.88797 0.86230 0.83748 0.79031 0.74622 0.70496 0.66634 0.63017 0.59627 0.56447 0.53464 0.50663 0.43233 0.87056 0.84127 0.81309 0.75992 0.71068 0.66506 0.62275 0.58349 0.54703 0.51316 0.48166 0.45235 0.37594 8 0.85349 0.82075 0.78941 0.73069 0.67684 0.62741 0.58201 0.54027 0.50187 0.46651 0.43393 0.40388 0.32690 0.83676 0.80073 0.76642 0.70259 0.64461 0.59190 0.54393 0.50025 0.46043 0.42410 0.39092 0.36061 0.28426 10 0.82035 0.78120 0.74409 0.67556 0.61391 0.55839 0.50835 0.46319 0.42241 0.38554 0.35218 0.32197 0.24719 11 0.80426 0.76214 0.72242 0.64958 0.58468 0.52679 0.47509 0.42888 0.38753 0.35049 0.31728 0.28748 0.21494 12 0.78849 0.74356 0.70138 0.62460 0.55684 0.49697 0.44401 0.39711 0.35554 0.31863 0.28584 0.25668 0.18691 13 0.77303 0.72542 0.68095 0.60057 0.53032 0.46884 0.41496 0.36770 0.32618 0.28966 0.25751 0.22917 0.16253 14 0.75788 0.70773 0.66112 0.57748 0.50507 0.44230 0.38782 0.34046 0.29925 0.26333 0.23199 0.20462 0.14133 15 0.74301 0.69047 0.64186 0.55526 0.48102 0.41727 0.36245 0.31524 0.27454 0.23939 0.20900 0.18270 0.12289 16 0.72845 0.67362 0.62317 0.53391 0.45811 0.39365 0.33873 0.29189 0.25187 0.21763 0.18829 0.16312 0.10687 17 0.71416 0.65720 0.60502 0.51337 0.43630 0.37136 0.31657 0.27027 0.23107 0.19785 0.16963 0.14564 0.09293 18 0.70016 0.64117 0.58739 0.49363 0.41552 0.35034 0.29586 0.25025 0.21199 0.17986 0.15282 0.13004 0.08081 19 0.68643 0.62553 0.57029 0.47464 0.39573 0.33051 0.27651 0.23171 0.19449 0.16351 0.13768 0.11611 0.07027 20 0.67297 0.61027 0.55368 0.45639 0.37689 0.31180 0.25842 0.21455 0.17843 0.14864 0.12403 0.10367 0.06110TABLE PV.2 Present Value of an Annuity of 1 1 PV = 1 - - (1 +in i (n) Periods 2% 21/2% 3% 5% 6% 7% 8% 9% 10% 11% 12% 15% 1 0.97561 0.96154 0.93458 0.92593 0.91743 0.90909 0.90090 0.89286 0.86957 0.98039 0.97087 0.95238 0.94340 2 1.94156 1.92742 1.91347 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 1.88609 CO 2.82861 2.77509 2.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 2.88388 2.85602 4 3.80773 3.76197 3.71710 3.54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 3.62990 5 4.71346 4.64583 4.57971 4.45182 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 4.32948 5.60143 5.50813 5.41719 5.24214 5.07569 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.47199 6.34939 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 6.23028 6.00205 8 7.32548 7.17014 7.01969 6.73274 6.46321 6.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 8.16224 7.97087 7.78611 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 10 8.75206 8.11090 7.72173 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 8.98259 8.53020 7.36009 11 9.51421 9.25262 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 9.78685 8.76048 12 10.57534 10.25776 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5-42062 9.95400 9.38507 8.86325 8.38384 13 11.34837 10.98319 10.63496 9.39357 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5-58315 9.98565 8.85268 14 12.10625 11.69091 11.29607 10.56312 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 9.89864 9.294989.89864 9.29498 15 12.84926 12.38138 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 16 13.57771 13.05500 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 17 14.29187 13.71220 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 18 14.99203 14.35336 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 7.24967 6.12797 19 15.67846 14.97889 14.32380 13.13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 20 16.35143 15.58916 14.87747 13.59033 12.46221 11.46992 10.59401 9.81815 9.12856 8.51356 7.96333 7.46944 6.25933