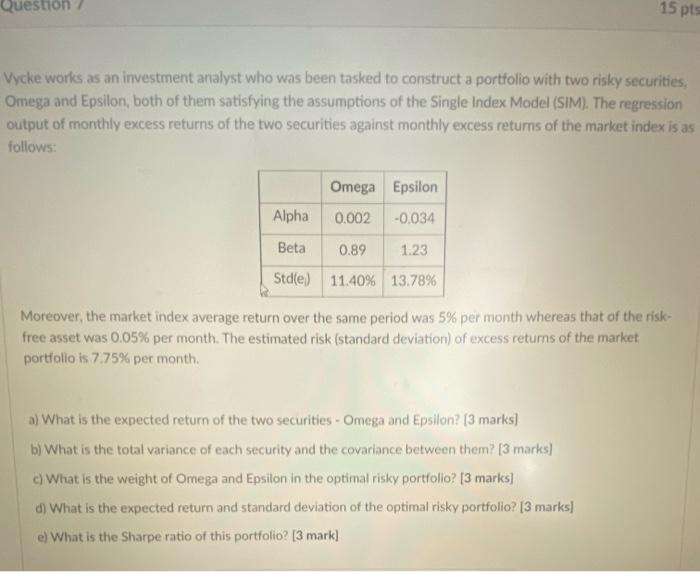

Question 15 pts Vycke works as an investment analyst who was been tasked to construct a portfolio with two risky securities, Omega and Epsilon, both of them satisfying the assumptions of the Single Index Model (SIM). The regression output of monthly excess returns of the two securities against monthly excess returns of the market index is as follows: Omega Epsilon Alpha 0.002 -0.034 Beta 0.89 1.23 Stdle) 11.40% 13.78% Moreover, the market index average return over the same period was 5% per month whereas that of the risk- free asset was 0.05% per month. The estimated risk (standard deviation) of excess retums of the market portfolio is 7.75% per month a) What is the expected return of the two securities - Omega and Epsilon? (3 marks) b) What is the total variance of each security and the covariance between them? [3 marks) c) What is the weight of Omega and Epsilon in the optimal risky portfolio? [3 marks] d) What is the expected return and standard deviation of the optimal risky portfolio? [3 marks] e) What is the Sharpe ratio of this portfolio? [3 mark] Question 15 pts Vycke works as an investment analyst who was been tasked to construct a portfolio with two risky securities, Omega and Epsilon, both of them satisfying the assumptions of the Single Index Model (SIM). The regression output of monthly excess returns of the two securities against monthly excess returns of the market index is as follows: Omega Epsilon Alpha 0.002 -0.034 Beta 0.89 1.23 Stdle) 11.40% 13.78% Moreover, the market index average return over the same period was 5% per month whereas that of the risk- free asset was 0.05% per month. The estimated risk (standard deviation) of excess retums of the market portfolio is 7.75% per month a) What is the expected return of the two securities - Omega and Epsilon? (3 marks) b) What is the total variance of each security and the covariance between them? [3 marks) c) What is the weight of Omega and Epsilon in the optimal risky portfolio? [3 marks] d) What is the expected return and standard deviation of the optimal risky portfolio? [3 marks] e) What is the Sharpe ratio of this portfolio? [3 mark]