Answered step by step

Verified Expert Solution

Question

1 Approved Answer

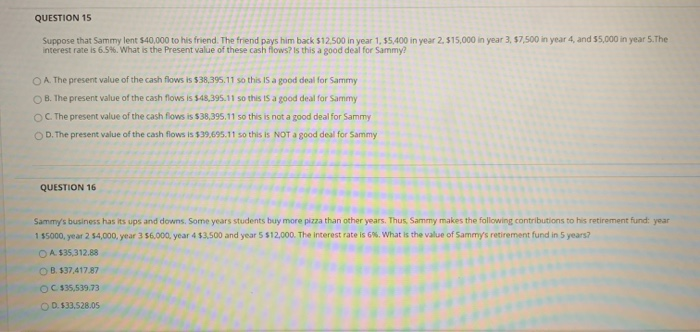

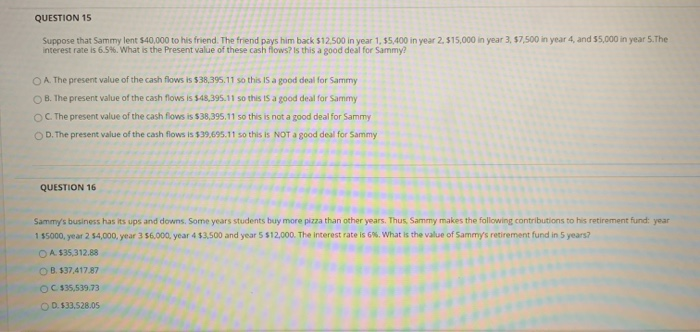

QUESTION 15 Suppose that Sammy lent $40,000 to his friend. The friend pays him back $12.500 in year 1, $5,400 in year 2. $15,000 in

QUESTION 15 Suppose that Sammy lent $40,000 to his friend. The friend pays him back $12.500 in year 1, $5,400 in year 2. $15,000 in year 3.57,500 in year 4 and 55,000 in year 5.The interest rate is 6.54. What is the Present value of these cash flows? Is this a good deal for Sammy? A. The present value of the cash flows is $38,395.11 so this is a good deal for Sammy B. The present value of the cash flows is 548,395.11 so this is a good deal for Sammy OC. The present value of the cash flows is $38,395.11 so this is not a good deal for Sammy D. The present value of the cash flows is $39,695.11 so this is NOT a good deal for Sammy QUESTION 16 Sammy's business has its ups and downs. Some years students buy more pizza than other years. Thus, Sammy makes the following contributions to his retirement fund: year 1 $5000, year 2 54,000 year 3 56,000. year 4 $3.500 and year 5 $12,000. The interest rate is 6%. What is the value of Sammy's retirement fund in 5 years? O A. 135,312.88 OB. 337,417.87 O $35,539.73 OD.533,528.05

QUESTION 15 Suppose that Sammy lent $40,000 to his friend. The friend pays him back $12.500 in year 1, $5,400 in year 2. $15,000 in year 3.57,500 in year 4 and 55,000 in year 5.The interest rate is 6.54. What is the Present value of these cash flows? Is this a good deal for Sammy? A. The present value of the cash flows is $38,395.11 so this is a good deal for Sammy B. The present value of the cash flows is 548,395.11 so this is a good deal for Sammy OC. The present value of the cash flows is $38,395.11 so this is not a good deal for Sammy D. The present value of the cash flows is $39,695.11 so this is NOT a good deal for Sammy QUESTION 16 Sammy's business has its ups and downs. Some years students buy more pizza than other years. Thus, Sammy makes the following contributions to his retirement fund: year 1 $5000, year 2 54,000 year 3 56,000. year 4 $3.500 and year 5 $12,000. The interest rate is 6%. What is the value of Sammy's retirement fund in 5 years? O A. 135,312.88 OB. 337,417.87 O $35,539.73 OD.533,528.05

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started