Answered step by step

Verified Expert Solution

Question

1 Approved Answer

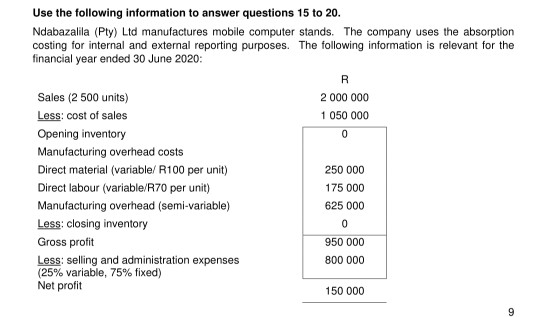

Question 15 to 20 Use the following information to answer questions 15 to 20. Ndabazalila (Pty) Ltd manufactures mobile computer stands. The company uses the

Question 15 to 20

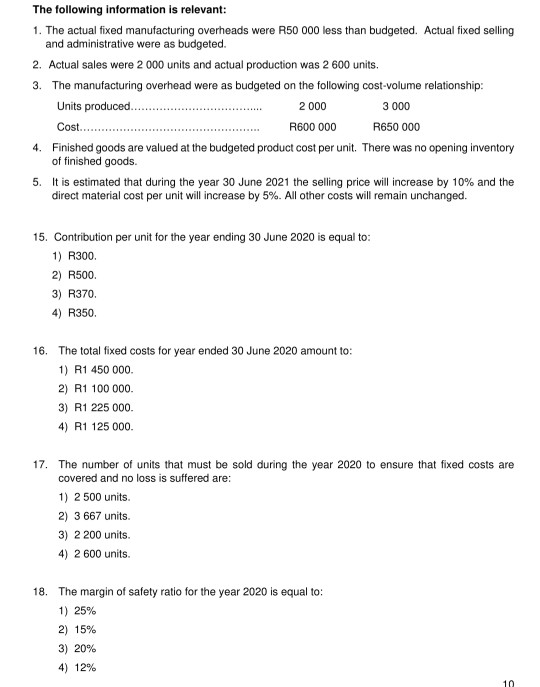

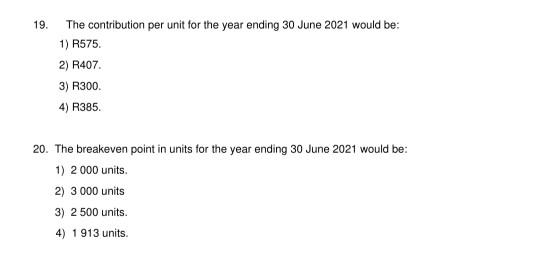

Use the following information to answer questions 15 to 20. Ndabazalila (Pty) Ltd manufactures mobile computer stands. The company uses the absorption costing for internal and external reporting purposes. The following information is relevant for the financial year ended 30 June 2020: R Sales (2 500 units) 2 000 000 Less: cost of sales 1 050 000 Opening inventory 0 Manufacturing overhead costs Direct material (variable/ R100 per unit) 250 000 Direct labour (variable/R70 per unit) 175 000 Manufacturing overhead (semi-variable) 625 000 Less: closing inventory 0 Gross profit 950 000 Less: selling and administration expenses 800 000 (25% variable, 75% fixed) Net profit 150 000 9 The following information is relevant: 1. The actual fixed manufacturing overheads were R50 000 less than budgeted. Actual fixed selling and administrative were as budgeted. 2. Actual sales were 2 000 units and actual production was 2 600 units. 3. The manufacturing overhead were as budgeted on the following cost-volume relationship: Units produced.. 2 000 3 000 Cost. R600 000 R650 000 4. Finished goods are valued at the budgeted product cost per unit. There was no opening inventory of finished goods. 5. It is estimated that during the year 30 June 2021 the selling price will increase by 10% and the direct material cost per unit will increase by 5%. All other costs will remain unchanged. 15. Contribution per unit for the year ending 30 June 2020 is equal to: 1) R300. 2) R500. 3) R370. 4) R350 16. The total fixed costs for year ended 30 June 2020 amount to: 1) R1 450 000 2) R1 100 000 3) R1 225 000 4) R1 125 000 17. The number of units that must be sold during the year 2020 to ensure that fixed costs are covered and no loss is suffered are: 1) 2 500 units 2) 3 667 units. 3) 2 200 units. 4) 2 600 units. 18. The margin of safety ratio for the year 2020 is equal to: 1) 25% 2) 15% 3) 20% 4) 12% 10 19 The contribution per unit for the year ending 30 June 2021 would be: 1) R575. 2) R407 3) R300. 4) R385. 20. The breakeven point in units for the year ending 30 June 2021 would be: 1) 2 000 units. 2) 3 000 units 3) 2 500 units. 4) 1 913 unitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started