Question 1-5

Question 1-5

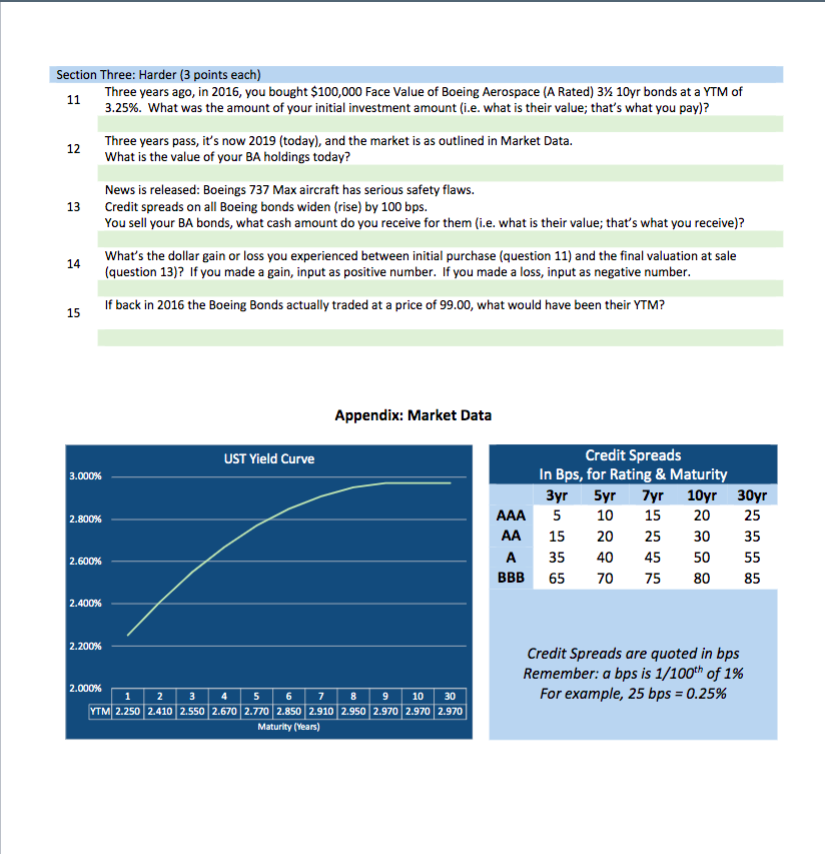

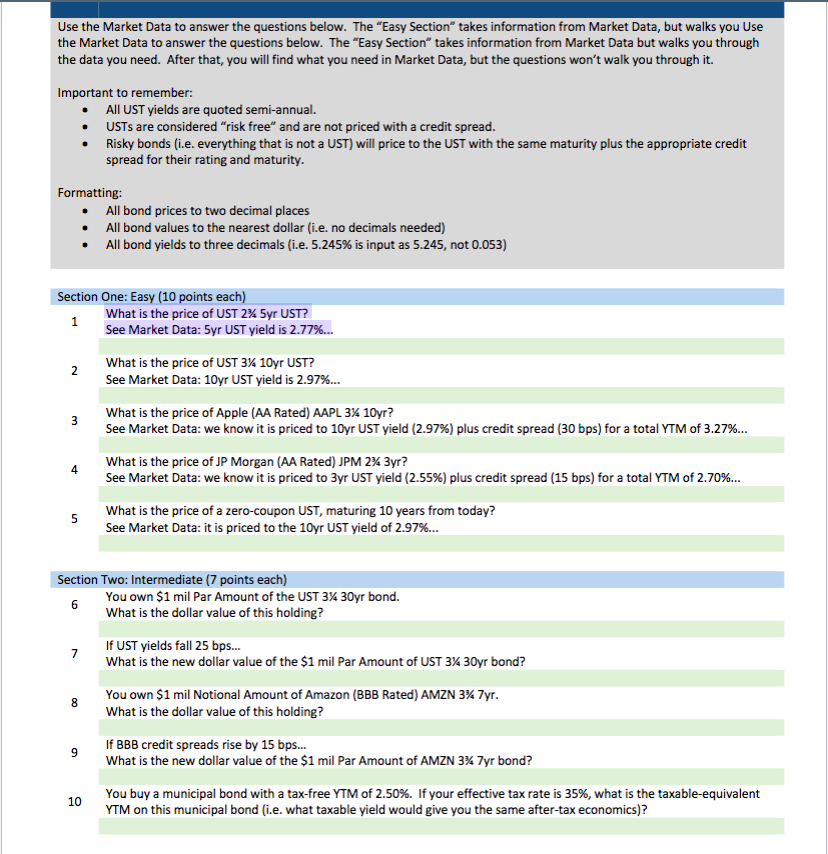

Use the Market Data to answer the questions below. The "Easy Section takes information from Market Data, but walks you Use the Market Data to answer the questions below. The "Easy Section takes information from Market Data but walks you through the data you need. After that, you will find what you need in Market Data, but the questions won't walk you through it. Important to remember: All UST yields are quoted semi-annual. USTs are considered risk free" and are not priced with a credit spread. Risky bonds (i.e. everything that is not a UST) will price to the UST with the same maturity plus the appropriate credit spread for their rating and maturity. Formatting: All bond prices to two decimal places All bond values to the nearest dollar (i.e. no decimals needed) All bond yields to three decimals (i.e. 5.245% is input as 5.245, not 0.053) Section One: Easy (10 points each) 1 What is the price of UST 2% Syr UST? See Market Data: 5yr UST yield is 2.77%... 2 What is the price of UST 3% 10yr UST? See Market Data: 10yr UST yield is 2.97%... 3 What is the price of Apple (AA Rated) AAPL 3/4 10yr? See Market Data: we know it is priced to 10yr UST yield (2.97%) plus credit spread (30 bps) for a total YTM of 3.27%... What is the price of JP Morgan (AA Rated) JPM 2% 3yr? See Market Data: we know it is priced to 3yr UST yield (2.55%) plus credit spread (15 bps) for a total YTM of 2.70%... 4 5 What is the price of a zero-coupon UST, maturing 10 years from today? See Market Data: it is priced to the 10yr UST yield of 2.97%... Section Two: Intermediate (7 points each) 6 You own $1 mil Par Amount of the UST 3% 30yr bond. What is the dollar value of this holding? 7 If UST yields fall 25 bp... What is the new dollar value of the $1 mil Par Amount of UST 34 30yr bond? 8 You own $1 mil Notional Amount of Amazon (BBB Rated) AMZN 3% 7yr. What is the dollar value of this holding? 9 If BBB credit spreads rise by 15 bps... What is the new dollar value of the $1 mil Par Amount of AMZN 3% 7yr bond? You buy a municipal bond with a tax-free YTM of 2.50%. If your effective tax rate is 35%, what is the taxable-equivalent YTM on this municipal bond (i.e. what taxable yield would give you the same after-tax economics)? 10 Section Three: Harder (3 points each) 11 Three years ago, in 2016, you bought $100,000 Face Value of Boeing Aerospace (A Rated) 310yr bonds at a YTM of 3.25%. What was the amount of your initial investment amount (i.e. what is their value; that's what you pay)? 12 Three years pass, it's now 2019 (today), and the market is as outlined in Market Data. What is the value of your BA holdings today? 13 News is released: Boeing 737 Max aircraft has serious safety flaws. Credit spreads on all Boeing bonds widen (rise) by 100 bps. You sell your BA bonds, what cash amount do you receive for them (i.e. what is their value; that's what you receive)? What's the dollar gain or loss you experienced between initial purchase (question 11) and the final valuation at sale (question 13)? If you made a gain, input as positive number. If you made a loss, input as negative number. 14 If back in 2016 the Boeing Bonds actually traded at a price of 99.00, what would have been their YTM? 15 Appendix: Market Data UST Yield Curve 3.000% 2.800% Credit Spreads In Bps, for Rating & Maturity 3yr 5yr 7yr 10yr 30yr 5 10 15 20 25 35 55 65 70 75 80 85 15 20 25 AAA AA A BBB 30 2.600% 35 40 45 50 2.400% 2.200% Credit Spreads are quoted in bps Remember: a bps is 1/100th of 1% For example, 25 bps = 0.25% 8 9 10 30 2.000% 2 3 4 5 6 7 YTM 2.250 2.410 2.550 2.670 2.770 2.850 2.910 2.950 2.970 2.970 2.970 Maturity (Years) Use the Market Data to answer the questions below. The "Easy Section takes information from Market Data, but walks you Use the Market Data to answer the questions below. The "Easy Section takes information from Market Data but walks you through the data you need. After that, you will find what you need in Market Data, but the questions won't walk you through it. Important to remember: All UST yields are quoted semi-annual. USTs are considered risk free" and are not priced with a credit spread. Risky bonds (i.e. everything that is not a UST) will price to the UST with the same maturity plus the appropriate credit spread for their rating and maturity. Formatting: All bond prices to two decimal places All bond values to the nearest dollar (i.e. no decimals needed) All bond yields to three decimals (i.e. 5.245% is input as 5.245, not 0.053) Section One: Easy (10 points each) 1 What is the price of UST 2% Syr UST? See Market Data: 5yr UST yield is 2.77%... 2 What is the price of UST 3% 10yr UST? See Market Data: 10yr UST yield is 2.97%... 3 What is the price of Apple (AA Rated) AAPL 3/4 10yr? See Market Data: we know it is priced to 10yr UST yield (2.97%) plus credit spread (30 bps) for a total YTM of 3.27%... What is the price of JP Morgan (AA Rated) JPM 2% 3yr? See Market Data: we know it is priced to 3yr UST yield (2.55%) plus credit spread (15 bps) for a total YTM of 2.70%... 4 5 What is the price of a zero-coupon UST, maturing 10 years from today? See Market Data: it is priced to the 10yr UST yield of 2.97%... Section Two: Intermediate (7 points each) 6 You own $1 mil Par Amount of the UST 3% 30yr bond. What is the dollar value of this holding? 7 If UST yields fall 25 bp... What is the new dollar value of the $1 mil Par Amount of UST 34 30yr bond? 8 You own $1 mil Notional Amount of Amazon (BBB Rated) AMZN 3% 7yr. What is the dollar value of this holding? 9 If BBB credit spreads rise by 15 bps... What is the new dollar value of the $1 mil Par Amount of AMZN 3% 7yr bond? You buy a municipal bond with a tax-free YTM of 2.50%. If your effective tax rate is 35%, what is the taxable-equivalent YTM on this municipal bond (i.e. what taxable yield would give you the same after-tax economics)? 10 Section Three: Harder (3 points each) 11 Three years ago, in 2016, you bought $100,000 Face Value of Boeing Aerospace (A Rated) 310yr bonds at a YTM of 3.25%. What was the amount of your initial investment amount (i.e. what is their value; that's what you pay)? 12 Three years pass, it's now 2019 (today), and the market is as outlined in Market Data. What is the value of your BA holdings today? 13 News is released: Boeing 737 Max aircraft has serious safety flaws. Credit spreads on all Boeing bonds widen (rise) by 100 bps. You sell your BA bonds, what cash amount do you receive for them (i.e. what is their value; that's what you receive)? What's the dollar gain or loss you experienced between initial purchase (question 11) and the final valuation at sale (question 13)? If you made a gain, input as positive number. If you made a loss, input as negative number. 14 If back in 2016 the Boeing Bonds actually traded at a price of 99.00, what would have been their YTM? 15 Appendix: Market Data UST Yield Curve 3.000% 2.800% Credit Spreads In Bps, for Rating & Maturity 3yr 5yr 7yr 10yr 30yr 5 10 15 20 25 35 55 65 70 75 80 85 15 20 25 AAA AA A BBB 30 2.600% 35 40 45 50 2.400% 2.200% Credit Spreads are quoted in bps Remember: a bps is 1/100th of 1% For example, 25 bps = 0.25% 8 9 10 30 2.000% 2 3 4 5 6 7 YTM 2.250 2.410 2.550 2.670 2.770 2.850 2.910 2.950 2.970 2.970 2.970 Maturity (Years)

Question 1-5

Question 1-5