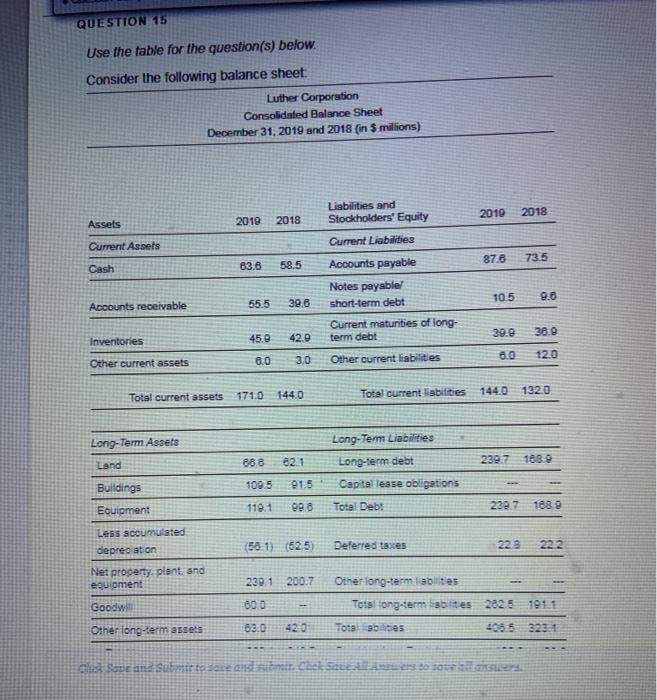

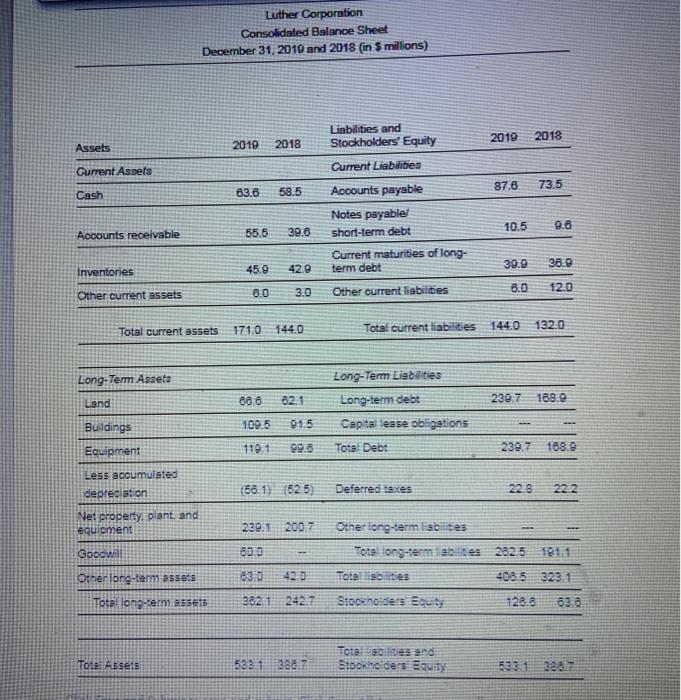

QUESTION 15 Use the table for the question(s) below. Consider the following balance sheet Luther Corporation Consolidated Balance Sheet December 31, 2019 and 2018 (in 5 millions) Liabilities and Stockholders' Equity 2019 2018 Assets 2019 2018 Current Assets Current Liabilities 735 87.6 Cash 83.6 58.5 Accounts payable Notes payable short-term debt Current matunities of long- term debt 9.6 55.5 105 Accounts receivable 39.6 39.9 Inventories 45.9 36.9 42.0 3.0 2.0 12.0 Other current assets Other current liabilities 171.0 Total current assets 1440 144.0 1320 Total current abilities Long-Term Assets Land 68.8 821 239.7 1089 Long-Term Liabilities Long-term debt Capitellesse obligations Total Deb: 909.5 91.5 Bulidings Equipment 110.1 99.6 239.7 1889 Less accumulated deprecation (56.1) (525) Deferred taxes 228 222 Net property, plent, and eQuoment 239.1 200.7 Other long-term labites Goodw 000 Total long-term abilities 2825 1011 Other long-term assets 03.0 42.0 Tota abdities 408.53231 O Sana subito it. Chek Sobe SURSES Luther Corporation Consolidated Balance Sheet December 31, 2010 and 2018 (in S millions) Liabilities and Stockholders' Equity 2019 2018 Assets 2019 2018 Current Assets Current Liabilities 87.6 73.5 Cash 63.8 58.5 10.5 9.6 Accounts receivable Accounts payable Notes payable short-term debt Current maturities of long- term debt 55.5 39.6 39.9 36.9 Inventories 45.0 42.9 3.0 8.0 Other current assets Other current fiabilities 12.0 171.0 Total current assets 144.0 Total current liabilities 144.0 132.0 Long-Term Assets Land 80.6 62.1 239.7 168.9 Long-Term Liabilities Long-term debt Capital lesse obligations Total Debt Buildings 109.5 015 Equipment 1181 99.8 239.7 168.0 Less socumulated depreciation (58.1) (525) Deferred taxes 22.8 222 Net property, plant, and equipment 239.1 200,7 Goodwill 60.0 Other long-term liabilities Tots long-term abite 2825 Tota lisbilities 403.5 323.1 Stockholders Bouity 128.8 63.0 Other long-term assets 830 42.0 Total long-term assets 38212427 Total Rese18 5831 Total sites and Stockho ders Equity 5331 Luther's current ratio for 2019 is closest to: O 0.84 O 0.92 01.09 01.19