Question 1(5,6, and question 2

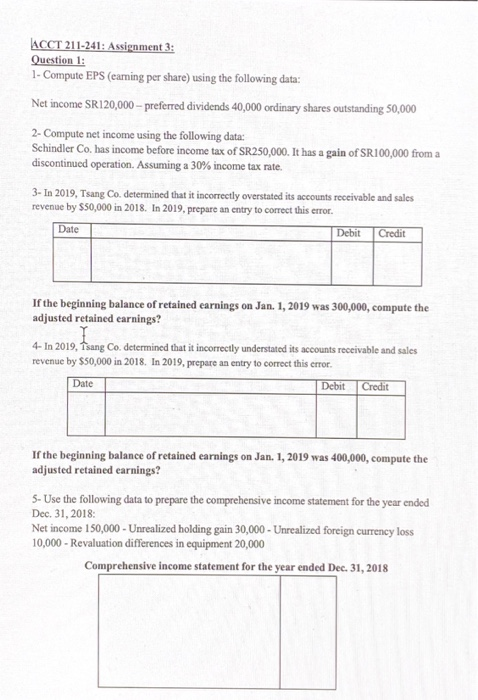

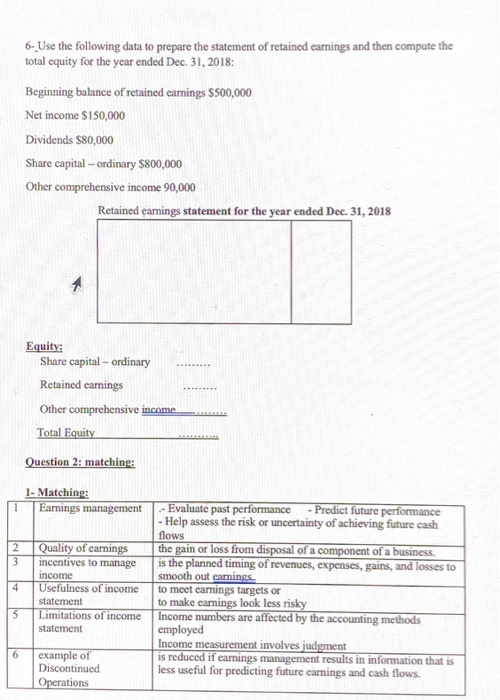

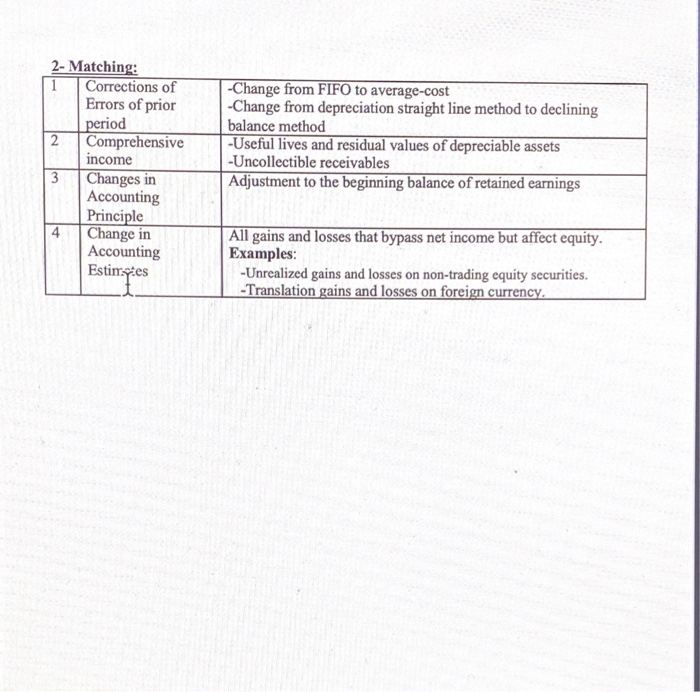

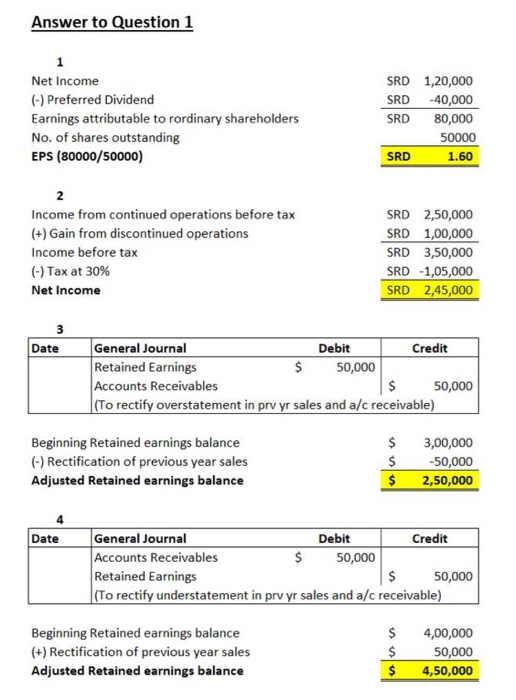

ACCT 211-241: Assignment 3: Question 1: 1- Compute EPS (earning per share) using the following data: Net income SR120,000 - preferred dividends 40,000 ordinary shares outstanding 50,000 2- Compute net income using the following data: Schindler Co. has income before income tax of SR250,000. It has a gain of SR100,000 from a discontinued operation. Assuming a 30% income tax rate. 3- In 2019, Tsang Co. determined that it incorrectly overstated its accounts receivable and sales revenue by $50,000 in 2018. In 2019, prepare an entry to correct this error. Date Debit Credit If the beginning balance of retained earnings on Jan. 1, 2019 was 300,000, compute the adjusted retained earnings? 4- In 2019, Tsang Co. determined that it incorrectly understated its accounts receivable and sales revenue by $50,000 in 2018. In 2019, prepare an entry to correct this crror. Date Debit Credit If the beginning balance of retained earnings on Jan. 1, 2019 was 400,000, compute the adjusted retained earnings? 5- Use the following data to prepare the comprehensive income statement for the year ended Dec 31, 2018 Net income 150,000 - Unrealized holding gain 30,000 - Unrealized foreign currency loss 10,000 - Revaluation differences in equipment 20,000 Comprehensive income statement for the year ended Dec 31, 2018 6- Use the following data to prepare the statement of retained carings and then compute the total equity for the year ended Dec 31, 2018: Beginning balance of retained earnings $500,000 Net income $150,000 Dividends $80,000 Share capital - ordinary $800,000 Other comprehensive income 90,000 Retained earnings statement for the year ended Dec. 31, 2018 Equity: Share capital - ordinary Retained earings Other comprehensive income Total Equity Question 2: matching: 1- Matching: Earnings management Quality of carings incentives to manage income Usefulness of income statement Limitations of income statement -Evaluate past performance - Predict future performance - Help assess the risk or uncertainty of achieving future cash flows the gain or loss from disposal of a component of a business is the planned timing of revenues, expenses, gains, and losses to smooth out eamings to meet earnings targets or to make earnings look less risky Income numbers are affected by the accounting methods employed Income measurement involves judgment is reduced if camings management results in information that is less useful for predicting future carnings and cash flows. example of Discontinued Operations 2- Matching: Corrections of Errors of prior period Comprehensive income Changes in Accounting Principle Change in Accounting Estinctes -Change from FIFO to average-cost -Change from depreciation straight line method to declining balance method -Useful lives and residual values of depreciable assets -Uncollectible receivables Adjustment to the beginning balance of retained earnings All gains and losses that bypass net income but affect equity. Examples: -Unrealized gains and losses on non-trading equity securities. - Translation gains and losses on foreign currency. Answer to Question 1 Net Income (-) Preferred Dividend Earnings attributable to rordinary shareholders No. of shares outstanding EPS (80000/50000) SRD SRD SRD 1,20,000 -40,000 80,000 50000 1.60 SRD Income from continued operations before tax (+) Gain from discontinued operations Income before tax (-) Tax at 30% Net Income SRD 2,50,000 SRD 1,00,000 SRD 3,50,000 SRD -1,05,000 SRD 2,45,000 Date General Journal Debit Credit Retained Earnings $ 50,000 Accounts Receivables $ 50,000 (To rectify overstatement in prv yr sales and a/c receivable) Beginning Retained earnings balance (-) Rectification of previous year sales Adjusted Retained earnings balance $ $ $ 3,00,000 -50,000 2,50,000 Date General Journal Debit Credit Accounts Receivables $ 50,000 Retained Earnings $ 50,000 (To rectify understatement in prv yr sales and a/c receivable) Beginning Retained earnings balance (+) Rectification of previous year sales Adjusted Retained earnings balance $ $ $ 4,00,000 50,000 4,50,000