question (1)-(5)is a true false question,the others are normal answer question

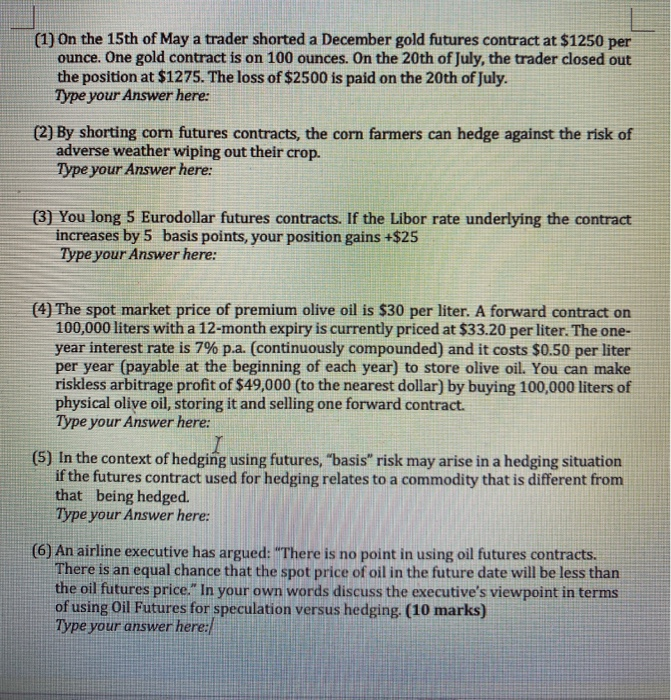

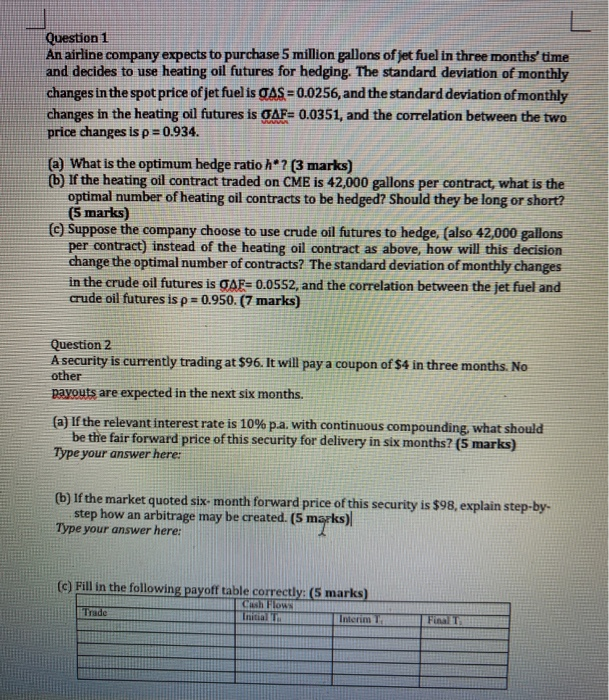

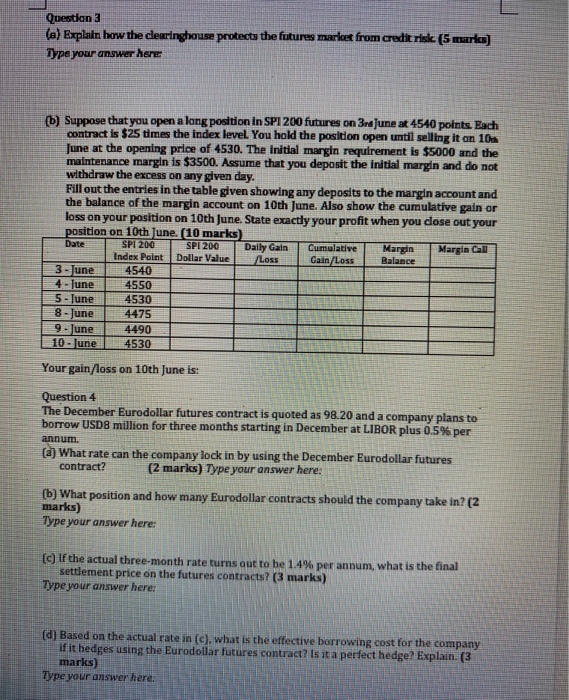

(1) On the 15th of May a trader shorted a December gold futures contract at $1250 per ounce. One gold contract is on 100 ounces. On the 20th of July, the trader closed out the position at $1275. The loss of $2500 is paid on the 20th of July. Type your Answer here: (2) By shorting corn futures contracts, the corn farmers can hedge against the risk of adverse weather wiping out their crop. Type your Answer here: (3) You long 5 Eurodollar futures contracts. If the Libor rate underlying the contract increases by 5 basis points, your position gains +$25 Type your Answer here: (4) The spot market price of premium olive oil is $30 per liter. A forward contract on 100,000 liters with a 12-month expiry is currently priced at $33.20 per liter. The one- year interest rate is 7% p.a. continuously compounded) and it costs $0.50 per liter per year (payable at the beginning of each year) to store olive oil. You can make riskless arbitrage profit of $49,000 (to the nearest dollar) by buying 100,000 liters of physical olive oil, storing it and selling one forward contract Type your Answer here: (5) In the context of hedging using futures, "basis" risk may arise in a hedging situation if the futures contract used for hedging relates to a commodity that is different from that being hedged. Type your Answer here: (6) An airline executive has argued: "There is no point in using oil futures contracts. There is an equal chance that the spot price of oil in the future date will be less than the oil futures price." In your own words discuss the executive's viewpoint in terms of using Oil Futures for speculation versus hedging (10 marks) Type your answer here: Question 1 An airline company expects to purchase 5 million gallons of jet fuel in three months' time and decides to use heating oil futures for hedging. The standard deviation of monthly changes in the spot price of jet fuel is CAS = 0.0256, and the standard deviation of monthly changes in the heating oil futures is GAF= 0.0351, and the correlation between the two price changes is p = 0.934. (a) What is the optimum hedge ratio h*? (3 marks) b) If the heating oil contract traded on CME is 42,000 gallons per contract, what is the optimal number of heating oil contracts to be hedged? Should they be long or short? (5 marks) (C) Suppose the company choose to use crude oil futures to hedge, (also 42,000 gallons per contract) instead of the heating oil contract as above, how will this decision change the optimal number of contracts? The standard deviation of monthly changes in the crude oil futures is AF=0.0552, and the correlation between the jet fuel and crude oil futures is p = 0.950. (7 marks) Question 2 A security is currently trading at $96. It will pay a coupon of $4 in three months. No other payouts are expected in the next six months. (a) If the relevant interest rate is 10% p.a, with continuous compounding, what should be the fair forward price of this security for delivery in six months? (5 marks) Type your answer here: (b) If the market quoted six-month forward price of this security is $98, explain step-by- step how an arbitrage may be created. (5 marks) Type your answer here: (c) Fill in the following payoff table correctly: (5 marks) Ch Flow LENT Interim Thunde (1) On the 15th of May a trader shorted a December gold futures contract at $1250 per ounce. One gold contract is on 100 ounces. On the 20th of July, the trader closed out the position at $1275. The loss of $2500 is paid on the 20th of July. Type your Answer here: (2) By shorting corn futures contracts, the corn farmers can hedge against the risk of adverse weather wiping out their crop. Type your Answer here: (3) You long 5 Eurodollar futures contracts. If the Libor rate underlying the contract increases by 5 basis points, your position gains +$25 Type your Answer here: (4) The spot market price of premium olive oil is $30 per liter. A forward contract on 100,000 liters with a 12-month expiry is currently priced at $33.20 per liter. The one- year interest rate is 7% p.a. continuously compounded) and it costs $0.50 per liter per year (payable at the beginning of each year) to store olive oil. You can make riskless arbitrage profit of $49,000 (to the nearest dollar) by buying 100,000 liters of physical olive oil, storing it and selling one forward contract. Type your Answer here: (5) In the context of hedging using futures, "basis" risk may arise in a hedging situation if the futures contract used for hedging relates to a commodity that is different from that being hedged. Type your Answer here: (6) An airline executive has argued: "There is no point in using oil futures contracts. There is an equal chance that the spot price of oil in the future date will be less than the oil futures price." In your own words discuss the executive's viewpoint in terms of using Oil Futures for speculation versus hedging (10 marks) Type your answer here