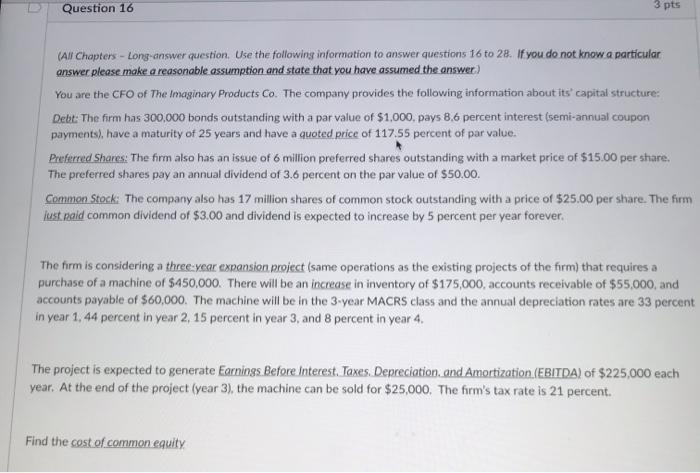

Question 16 3 pts (All Chapters - Long-answer question. Use the following information to answer questions 16 to 28. If you do not know a particular answer please make a reasonable assumption and state that you have assumed the answer You are the CFO of The Imaginary Products Co. The company provides the following information about its capital structure: Debt: The firm has 300,000 bonds outstanding with a par value of $1,000, pays 8.6 percent interest (semi-annual coupon payments), have a maturity of 25 years and have a quoted price of 117.55 percent of par value. Preferred Shares: The firm also has an issue of 6 million preferred shares outstanding with a market price of $15.00 per share. The preferred shares pay an annual dividend of 3.6 percent on the par value of $50.00 Common Stock: The company also has 17 million shares of common stock outstanding with a price of $25.00 per share. The firm lust paid common dividend of $3.00 and dividend is expected to increase by 5 percent per year forever. The firm is considering a three-year expansion project (same operations as the existing projects of the firm) that requires a purchase of a machine of $450,000. There will be an increase in inventory of $175,000, accounts receivable of $55,000, and accounts payable of $60,000. The machine will be in the 3-year MACRS class and the annual depreciation rates are 33 percent in year 1, 44 percent in year 2, 15 percent in year 3, and 8 percent in year 4. The project is expected to generate Earnings Before Interest. Taxes. Depreciation, and Amortization (EBITDA) of $225,000 each year. At the end of the project (year 3), the machine can be sold for $25,000. The firm's tax rate is 21 percent. Find the cost of common equity Solve for the cost of preferred stock. Edit View Format Table 12 Para pranv B T P 2 Solve for the before-tax and after-tax cost of debt. Calculate the weights of equity, debt, and preferred stock. What is the firm's weighted average cost of capital? What is the initial investment at time 0? What is the annual depreciation in years 1, 2, and 3? What is the annual cash flow from operations in years 1, 2, and 3