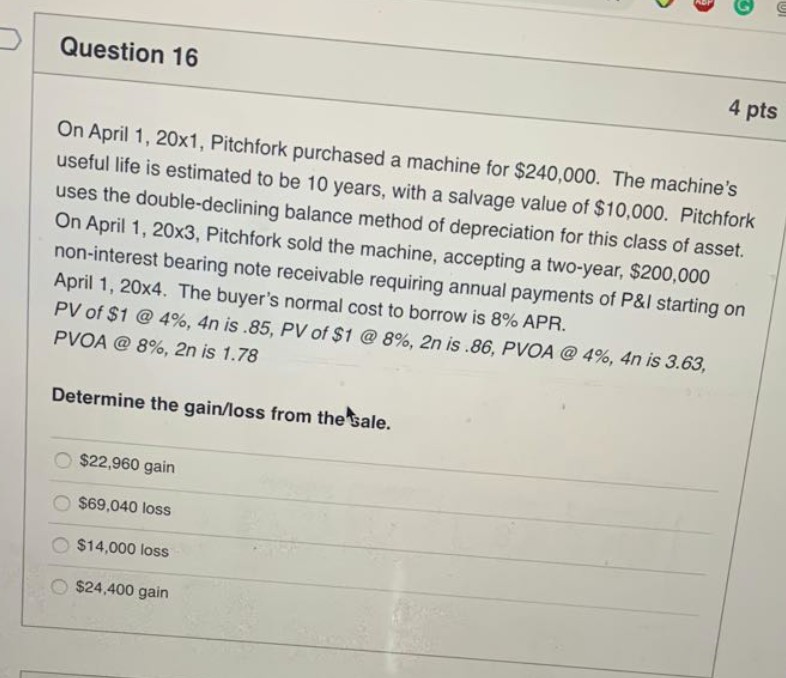

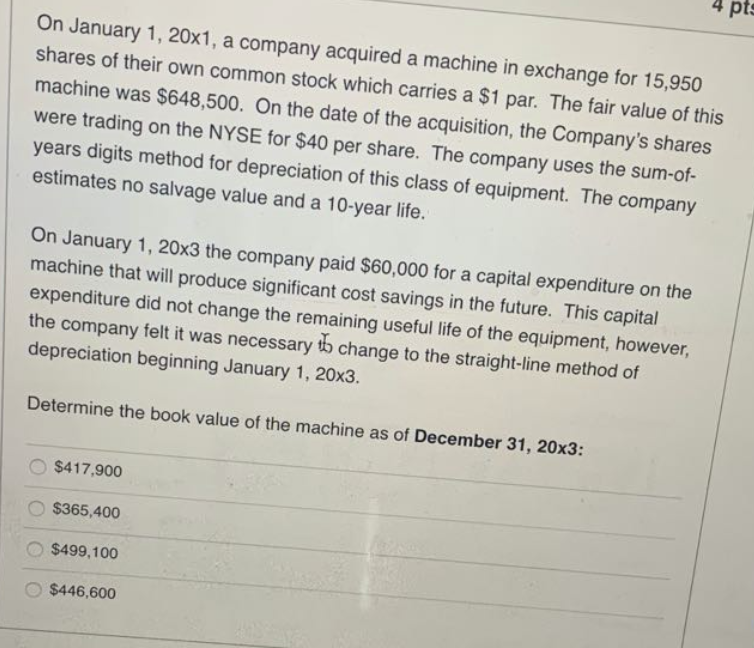

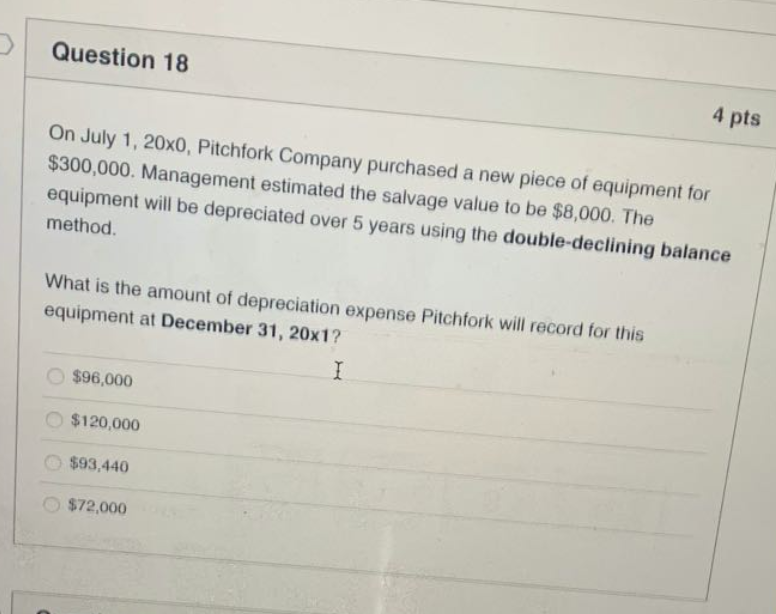

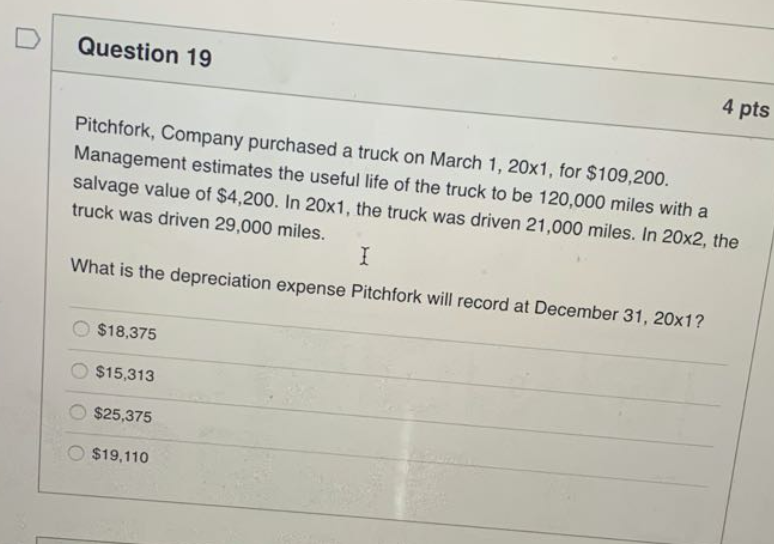

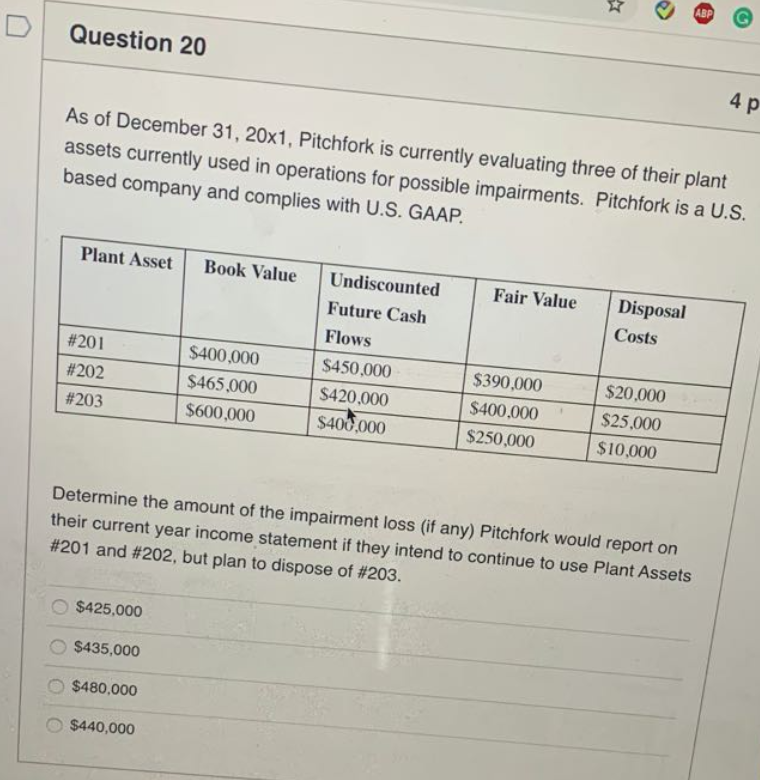

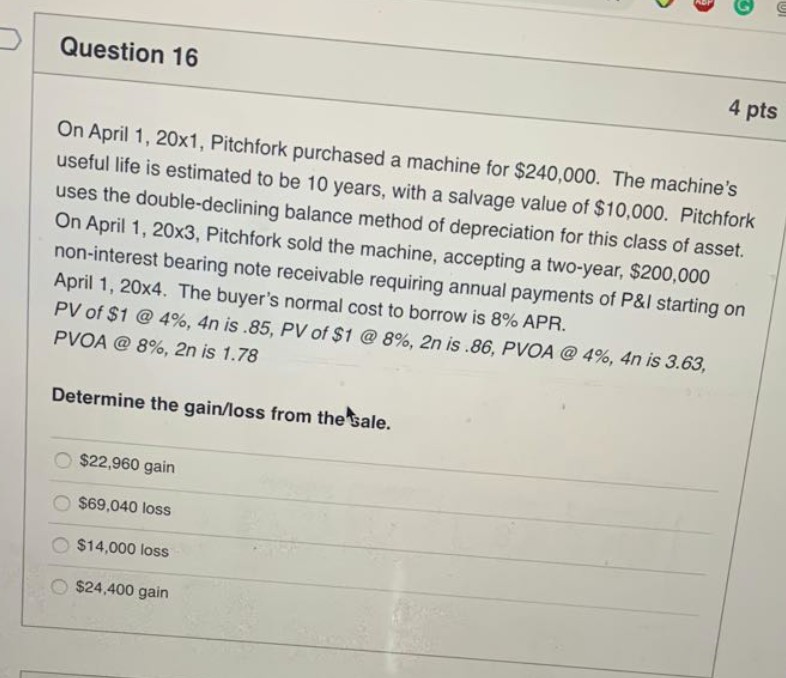

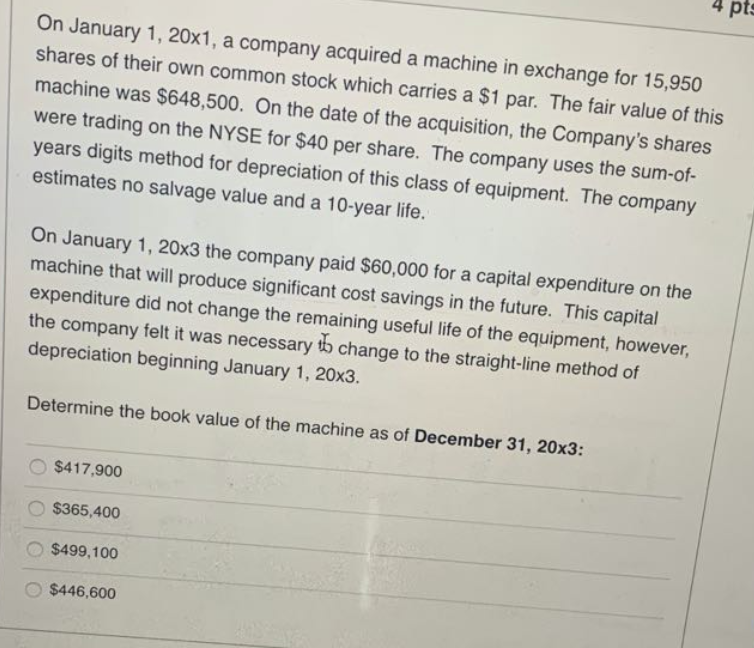

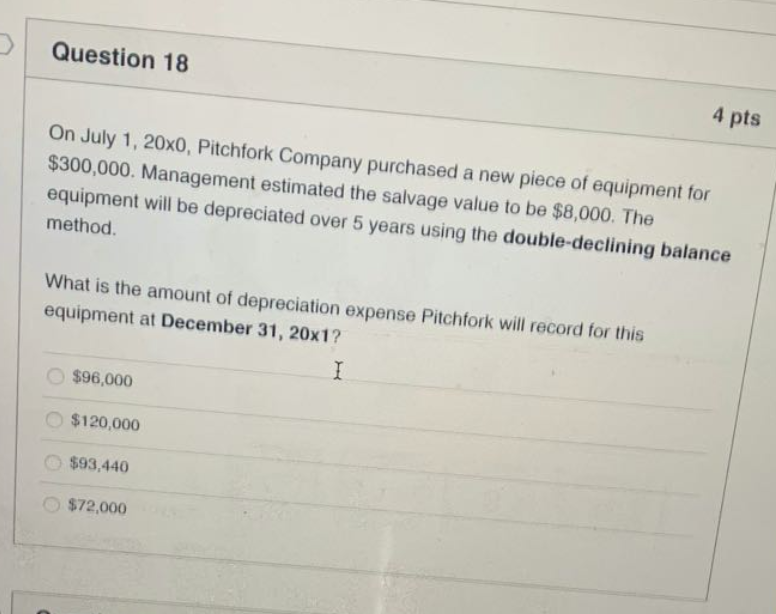

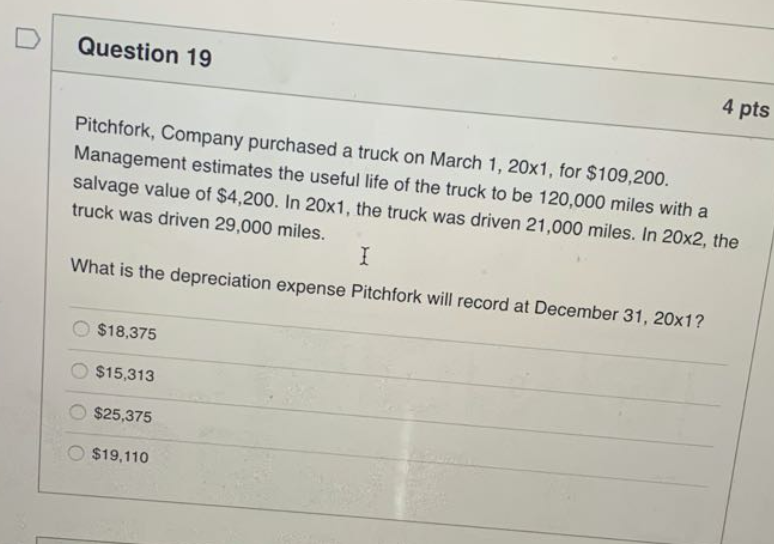

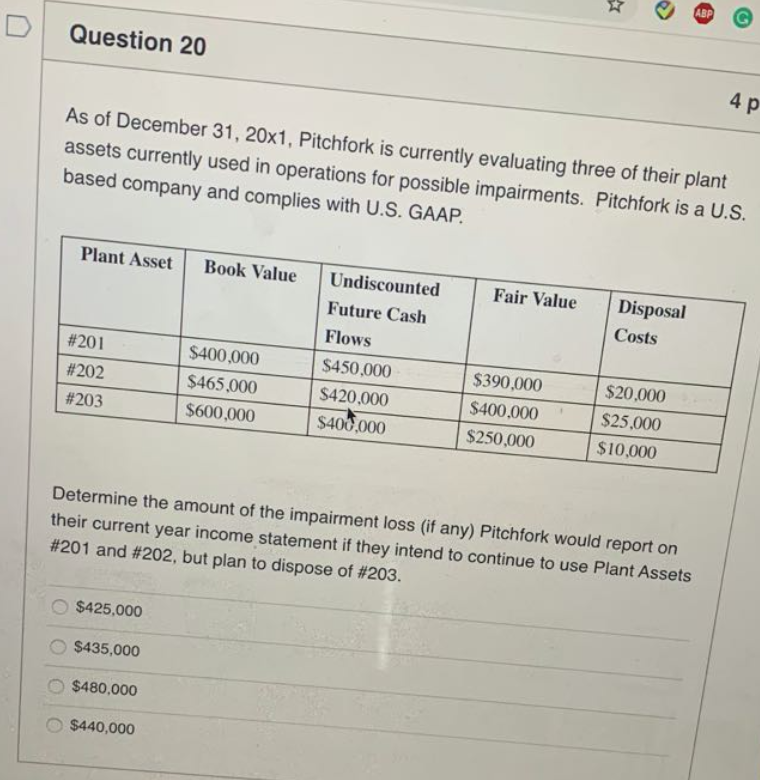

Question 16 4 pts On April 1, 20x1, Pitchfork purchased a machine for $240,000. The machine's useful life is estimated to be 10 years, with a salvage value of $10,000. Pitchfork uses the double-declining balance method of depreciation for this class of asset. On April 1, 20x3, Pitchfork sold the machine, accepting a two-year, $200,000 non-interest bearing note receivable requiring annual payments of P&I starting on April 1, 20x4. The buyer's normal cost to borrow is 8% APR. PV of $1 @ 4%, 4n is.85, PV of $1 @ 8%, 2n is.86, PVOA @ 4%, 4n is 3.63, PVOA @ 8%, 2n is 1.78 Determine the gain/loss from the sale. $22,960 gain $69,040 loss $14,000 loss $24,400 gain On January 1, 20x1, a company acquired a machine in exchange for 15,950 shares of their own common stock which carries a $1 par. The fair value of this machine was $648,500. On the date of the acquisition, the Company's shares were trading on the NYSE for $40 per share. The company uses the sum-of- years digits method for depreciation of this class of equipment. The company estimates no salvage value and a 10-year life. On January 1, 20x3 the company paid $60,000 for a capital expenditure on the machine that will produce significant cost savings in the future. This capital expenditure did not change the remaining useful life of the equipment, however, the company felt it was necessary to change to the straight-line method of depreciation beginning January 1, 20x3. Determine the book value of the machine as of December 31, 20x3: $417,900 $365,400 $499,100 $446,600 Question 18 4 pts On July 1, 20x0, Pitchfork Company purchased a new piece of equipment for $300,000. Management estimated the salvage value to be $8,000. The equipment will be depreciated over 5 years using the double-declining balance method. What is the amount of depreciation expense Pitchfork will record for this equipment at December 31, 20x1? $96,000 $120,000 $93,440 $72,000 Question 19 4 pts Pitchfork, Company purchased a truck on March 1, 20x1, for $109,200. Management estimates the useful life of the truck to be 120,000 miles with a salvage value of $4,200. In 20x1, the truck was driven 21,000 miles. In 20x2, the truck was driven 29,000 miles. What is the depreciation expense Pitchfork will record at December 31, 20x1? $18,375 $15,313 $25,375 $19,110 Question 20 As of December 31, 20x1, Pitchfork is currently evaluating three of their plant assets currently used in operations for possible impairments. Pitchfork is a U.S. based company and complies with U.S. GAAP. Plant AssetBook Value Fair Value Disposal Costs Undiscounted Future Cash Flows $450,000 $420,000 $400,000 #201 #202 #203 $400,000 $465.000 $600,000 $390,000 $400.000 $250,000 $20,000 $25.000 $10,000 Determine the amount of the impairment loss (if any) Pitchfork would report on their current year income statement if they intend to continue to use Plant Assets #201 and #202, but plan to dispose of #203. $425,000 $435,000 $480,000 $440,000