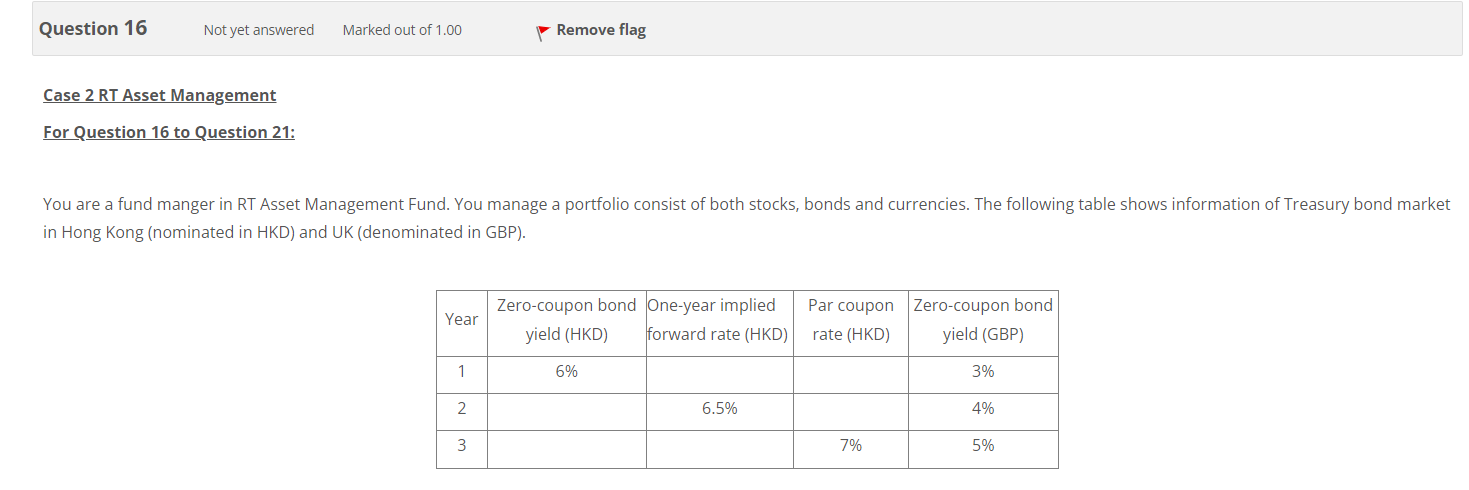

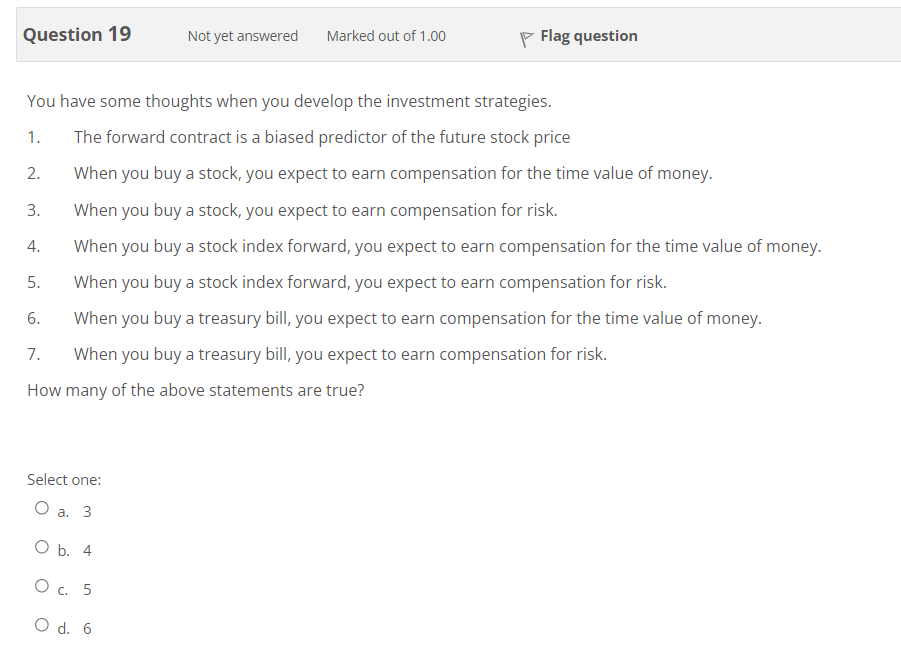

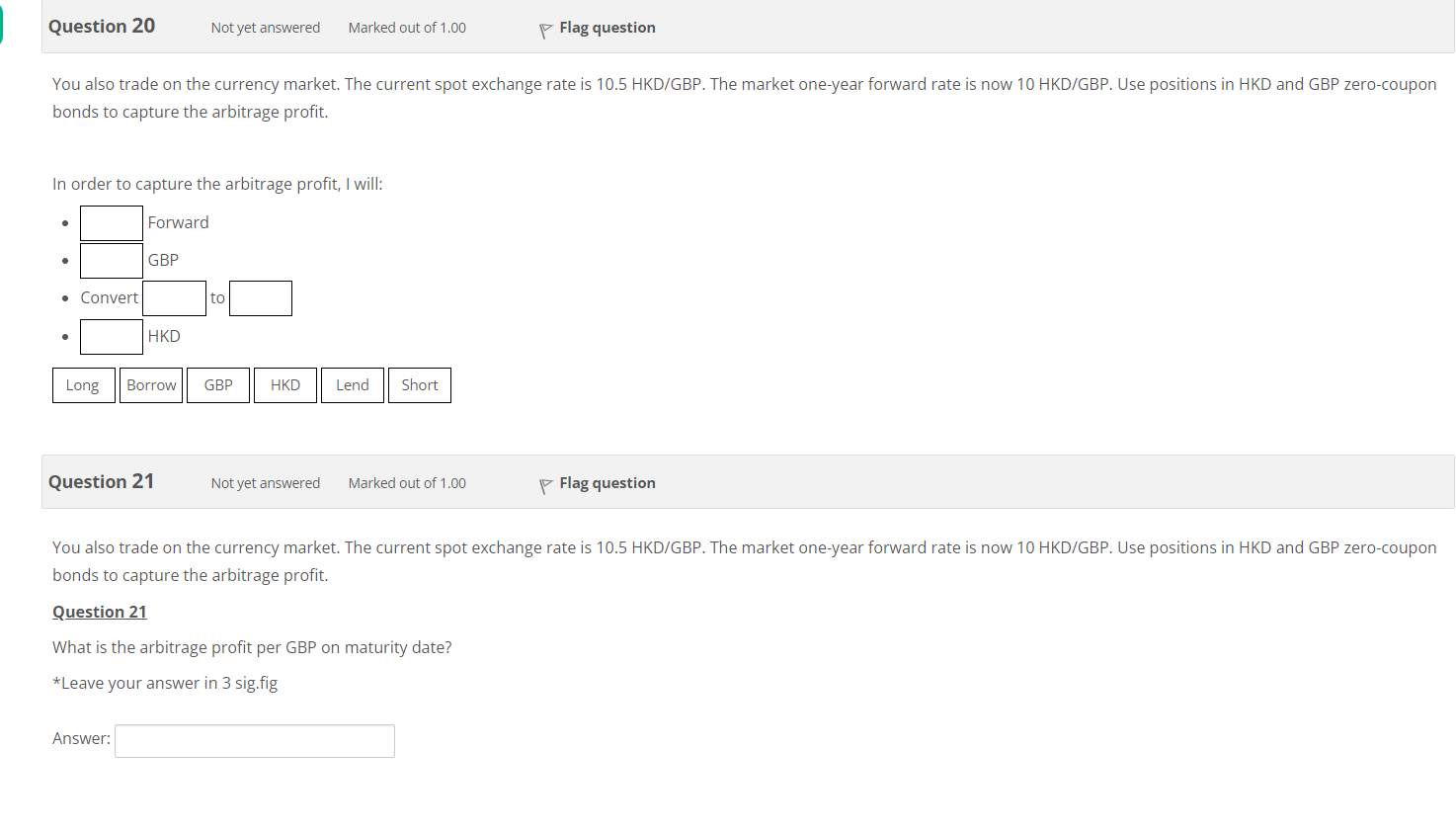

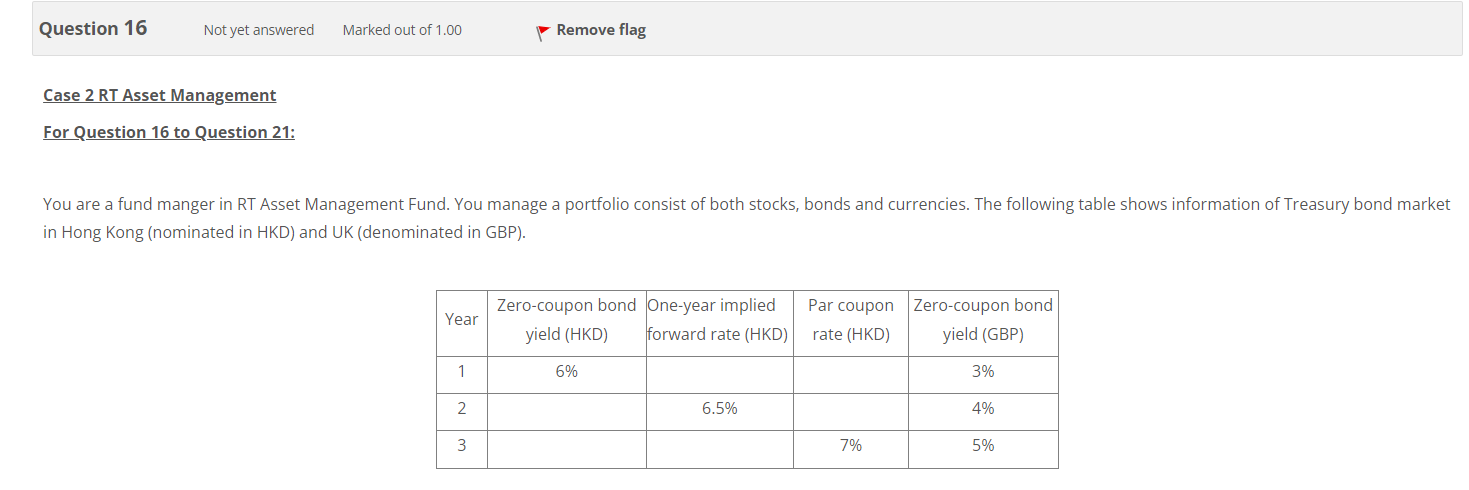

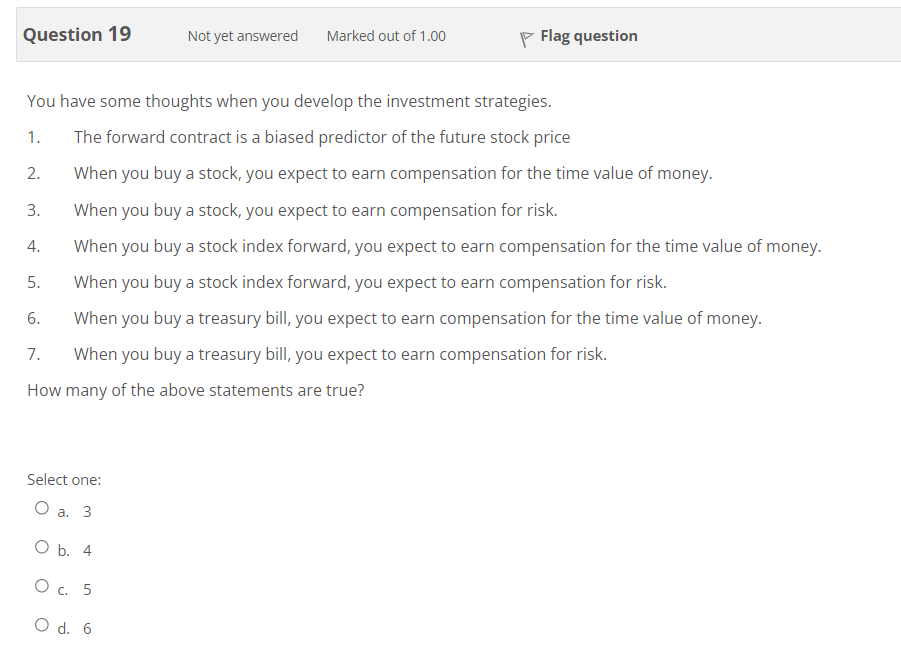

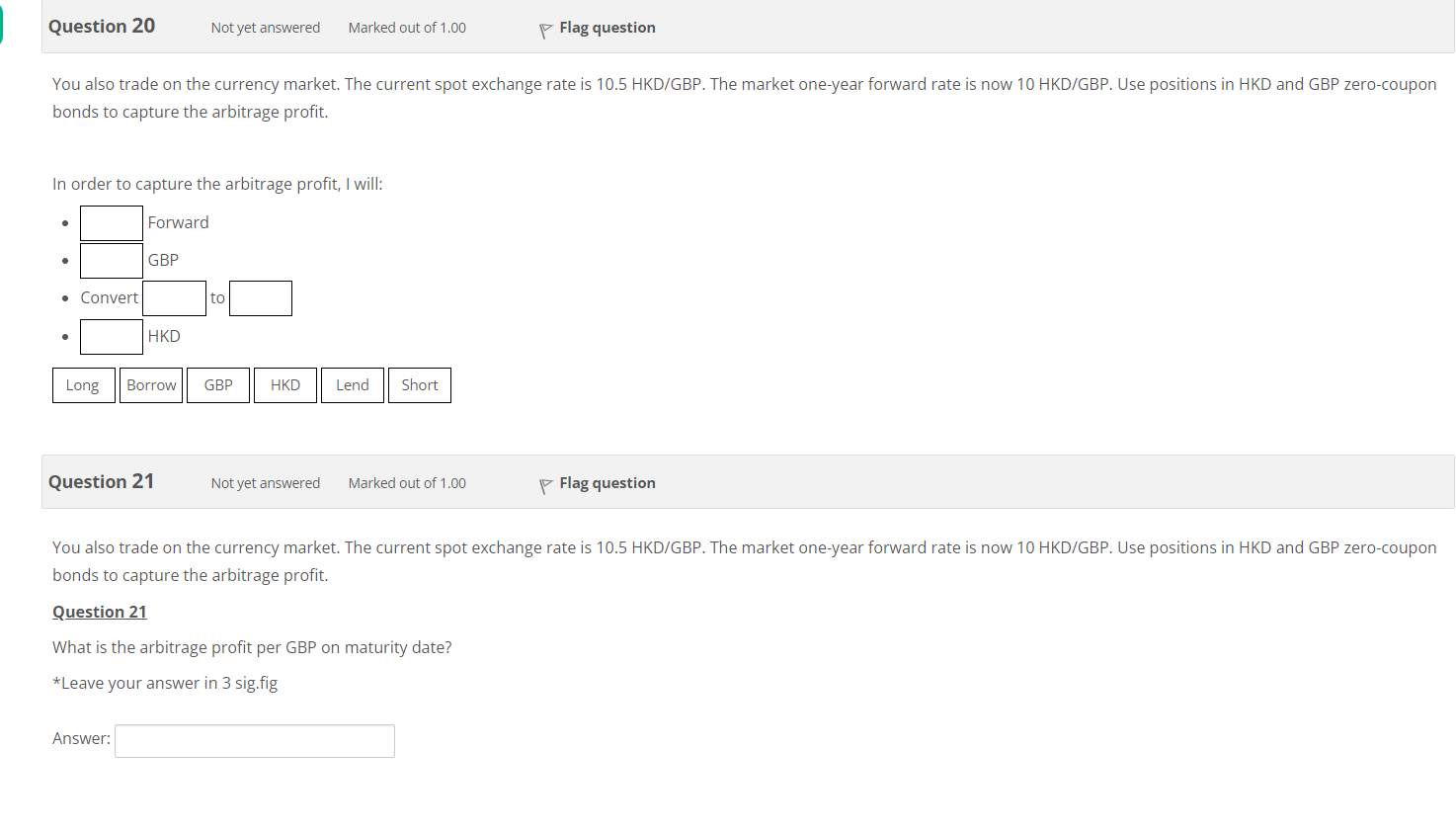

Question 16 Not yet answered Marked out of 1.00 Remove flag Case 2 RT Asset Management For Question 16 to Question 21: You are a fund manger in RT Asset Management Fund. You manage a portfolio consist of both stocks, bonds and currencies. The following table shows information of Treasury bond market in Hong Kong (nominated in HKD) and UK (denominated in GBP). Year Zero-coupon bond One-year implied yield (HKD) forward rate (HKD) Par coupon Zero-coupon bond rate (HKD) yield (GBP) 1 6% 3% 2 6.5% 4% 3 7% 5% Question 19 Not yet answered Marked out of 1.00 P Flag question You have some thoughts when you develop the investment strategies. 1. The forward contract is a biased predictor of the future stock price 2. When you buy a stock, you expect to earn compensation for the time value of money. 3. When you buy a stock, you expect to earn compensation for risk. 4. When you buy a stock index forward, you expect to earn compensation for the time value of money. 5. When you buy a stock index forward, you expect to earn compensation for risk. 6. When you buy a treasury bill, you expect to earn compensation for the time value of money. 7. When you buy a treasury bill, you expect to earn compensation for risk. How many of the above statements are true? Select one: O a. 3 a. O b. 4 O c. 5 O d. 6 Question 20 Not yet answered Marked out of 1.00 Flag question You also trade on the currency market. The current spot exchange rate is 10.5 HKD/GBP. The market one-year forward rate is now 10 HKD/GBP. Use positions in HKD and GBP zero-coupon bonds to capture the arbitrage profit. In order to capture the arbitrage profit, I will: Forward GBP . Convert to . HKD Long Borrow GBP HKD Lend Short Question 21 Not yet answered Marked out of 1.00 P Flag question You also trade on the currency market. The current spot exchange rate is 10.5 HKD/GBP. The market one-year forward rate is now 10 HKD/GBP. Use positions in HKD and GBP zero-coupon bonds to capture the arbitrage profit. Question 21 What is the arbitrage profit per GBP on maturity date? *Leave your answer in 3 sig.fig Answer: Question 16 Not yet answered Marked out of 1.00 Remove flag Case 2 RT Asset Management For Question 16 to Question 21: You are a fund manger in RT Asset Management Fund. You manage a portfolio consist of both stocks, bonds and currencies. The following table shows information of Treasury bond market in Hong Kong (nominated in HKD) and UK (denominated in GBP). Year Zero-coupon bond One-year implied yield (HKD) forward rate (HKD) Par coupon Zero-coupon bond rate (HKD) yield (GBP) 1 6% 3% 2 6.5% 4% 3 7% 5% Question 19 Not yet answered Marked out of 1.00 P Flag question You have some thoughts when you develop the investment strategies. 1. The forward contract is a biased predictor of the future stock price 2. When you buy a stock, you expect to earn compensation for the time value of money. 3. When you buy a stock, you expect to earn compensation for risk. 4. When you buy a stock index forward, you expect to earn compensation for the time value of money. 5. When you buy a stock index forward, you expect to earn compensation for risk. 6. When you buy a treasury bill, you expect to earn compensation for the time value of money. 7. When you buy a treasury bill, you expect to earn compensation for risk. How many of the above statements are true? Select one: O a. 3 a. O b. 4 O c. 5 O d. 6 Question 20 Not yet answered Marked out of 1.00 Flag question You also trade on the currency market. The current spot exchange rate is 10.5 HKD/GBP. The market one-year forward rate is now 10 HKD/GBP. Use positions in HKD and GBP zero-coupon bonds to capture the arbitrage profit. In order to capture the arbitrage profit, I will: Forward GBP . Convert to . HKD Long Borrow GBP HKD Lend Short Question 21 Not yet answered Marked out of 1.00 P Flag question You also trade on the currency market. The current spot exchange rate is 10.5 HKD/GBP. The market one-year forward rate is now 10 HKD/GBP. Use positions in HKD and GBP zero-coupon bonds to capture the arbitrage profit. Question 21 What is the arbitrage profit per GBP on maturity date? *Leave your answer in 3 sig.fig