Answered step by step

Verified Expert Solution

Question

1 Approved Answer

research the answers and guess do not have appendix D or A please answer all questions 2.27 points Exodus Limousine Company has $1,000 par value

research the answers and guess do not have appendix D or A

please answer all questions

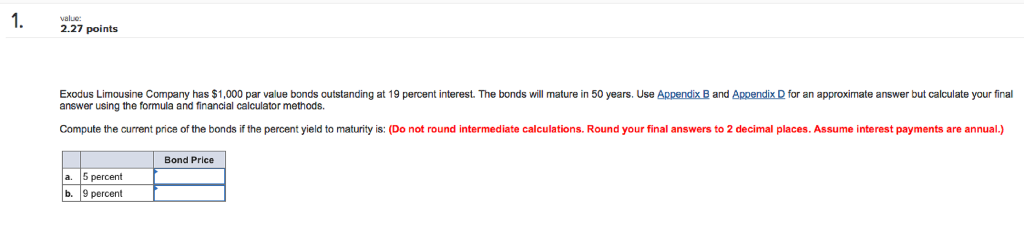

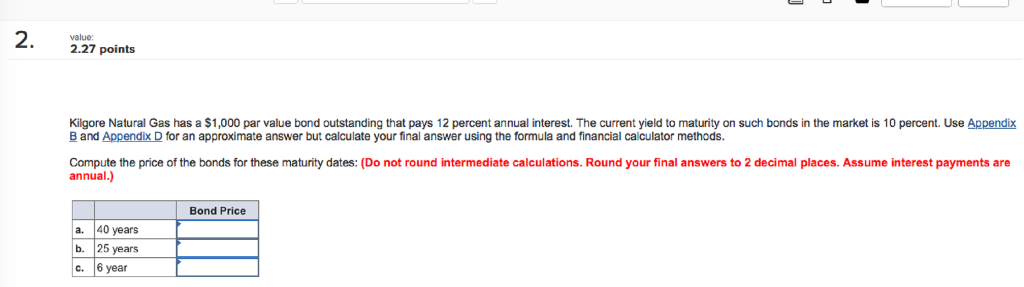

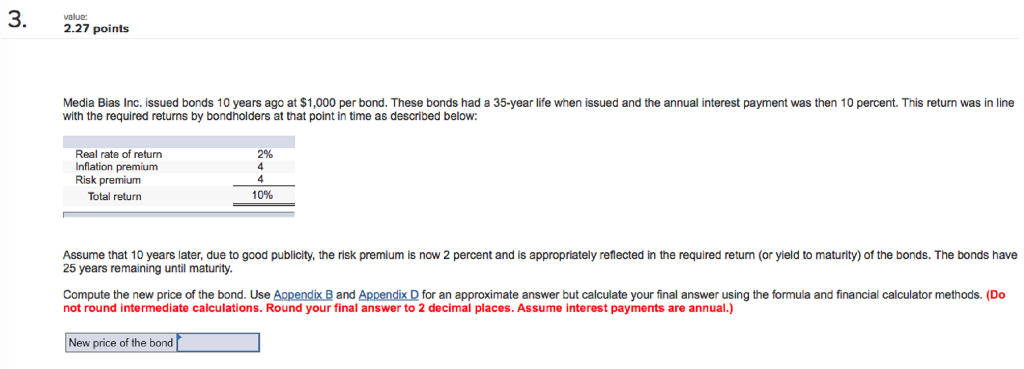

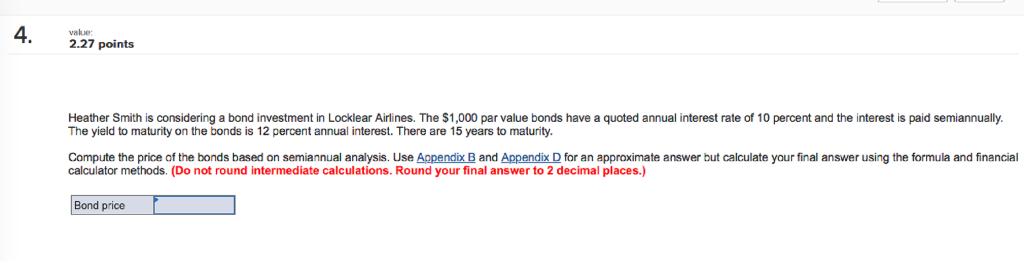

2.27 points Exodus Limousine Company has $1,000 par value bonds outstanding at 19 percent interest. The bonds will mature in 50 years. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Compute the current price of the bonds if the percent yield to maturity is: (Do not round intermediate calculations. Round your final answers to 2 decimal places. Assume interest payments are annual.) Bond Price a. 5 percent b. 9 percent 2.27 points Kilgore Natural Gas has a $1,000 par value bond outstanding that pays 12 percent annual interest. The current yield to maturity on such bonds in the market is 10 percent. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Compute the price of the bonds for these maturity dates: (Do not round intermediate calculations. Round your final answers to 2 decimal places. Assume interest payments are annual.) Bond Price a. 40 years b. 25 years c. 6 year 3. 227 points Media Bias Inc. issued bonds 10 years ago at $1,000 per bond. These bonds had a 35-year life when issued and the annual interest payment was then 10 percent. This return was in line with the required returns by bondholders at that point in time as described below: Real rate of return Inflation premium 2% Total return 1096 Assume that 10 years later, due to good publicity, the risk premium is now 2 percent and is appropriately reflected in the required return (or yield to maturity) of the bonds. The bonds have Compute the new price of the bond. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places. Assume interest payments are annual.) New price of the bond value: 2.27 points Heather Smith is considering a bond investment in Locklear Airlines. The $1,000 par value bonds have a quoted annual interest rate of 10 percent and the interest is paid semiannually The yield to maturity on the bonds is 12 percent annual interest. There are 15 years to maturity. Compute the price of the bonds based on semiannual analysis. Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Bond priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started