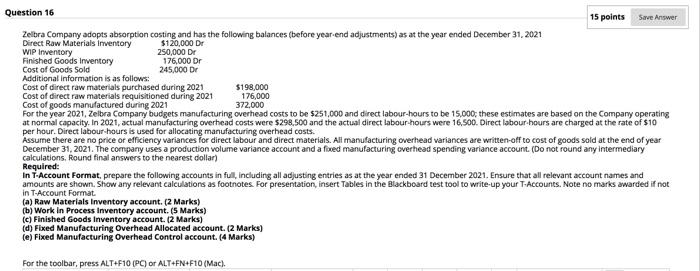

Question 16 of 17 uestion 16 15 points Zelbra Company adopts absorption casting and has the following balances (before year-end adjustments) as at the year ended December 31, 2021 Direct Raw Materials Inventory $120,000 DI WIP Inventory 250,000 Dr Finished Goods Inventory 176,000 DI Cost of Goods Sold 245,000 DI Additional information is as follows: Cost of direct raw materials purchased during 2021 $198,000 Cost of direct raw materials requisitioned during 2021 176,000 Cost of goods manufactured during 2021 372,000 For the year 2021. Zelbra Company budgets manufacturing overhead costs to be $251,000 and direct labour-hours to be 15,000, these estimates are based on the Company operating at normal capacity. In 2021 actual manufacturing overhead costs were $298,500 and the actual direct labour hours were 16.500. Direct labour hours are charged at the rate of $10 per hour. Direct labour hours is used for allocating manufacturing overhead costs Assume there are no price or efficiency variances for direct labour and direct materials. All manufacturing overhead variances are written-off to cost of goods sold at the end of year December 31, 2021. The company uses a production volume variance account and a fixed manufacturing overhead spending variance account. (Do not round any intermediary calculations. Round final answers to the nearest dollar) Required: In T-Account Format, prepare the following accounts in full, including all adjusting entries as at the year ended 31 December 2021. Ensure that all relevant account names and amounts are shown Show any relevant calculations as footnotes For presentation insert Tables in the Blackboard test tool to write-up your accounts. Note no marks awarded if not in T-Account Format. (a) Raw Materials Inventory account. (2 Marks) (b) Work in Process Inventory account. (5 Marks) (c) Finished Goods Inventory account. (2 Marks) (d) Fixed Manufacturing Overhead Allocated account. (2 Marks) (e) Fixed Manufacturing Overhead Control account. (4 Marks) T. !!! V 14px + 1992 ED For the toolbar, press ALT F10 (PC) or ALTHEN F10 (Mac) BIUS Paragraph Arial X X, 8 B T The | (:) + H HI de Zelbra Company adopts absorption costing and has the following balances (before year-end adjustments) as at the year ended December 31, 2021 Direct Raw Materials Inventory $120,000 DI WIP Inventory 250,000 DI Finished Goods Inventory 176,000 Dr Cost of Goods Sold 245.000 DE Additional information is as follows: Cost of direct raw materials purchased during 2021 $198.000 Cost of direct raw materials requisitioned during 2021 176,000 Cost of goods manufactured during 2021 372,000 For the year 2021, Zelbra Company budgets manufacturing overhead costs to be $251,000 and direct labour-hours to be 15,000 these estimates are based on the Company operating at normal Capacity in 2021, actual manufacturing overhead costs were $298,500 and the actual direct labour hours were 16.500. Direct labour-hours are charged at the rate of $10 per hour. Direct labour hours is used for allocating manufacturing overhead costs Assume there are no price or efficiency variances for direct labour and direct materials. All manufacturing overhead variances are written off to cost of goods sold at the end of year December 31 2021. The company uses a production volume variance account and a fixed manufacturing overhead spending variance account. Do not round any intermediary calculations. Round final answers to the nearest dollar Required: In Account format, prepare the following accounts in full, including all adjusting entries as at the year ended 31 December 2021. Ensure that all relevant account names and amounts are shown Show any relevant calculations as footnotes for presentation, Insert Tables in the blackboard test tool to write-up your Accounts. Note no marks awarded if not in T. Account Format (b) Work In Process Inventory account. (5 Marks) (c) Finished Goods Inventory account (2 Marks) (d) Fixed Manufacturing Overhead Allocated account. (2 Marks) () Fixed Manufacturing Overhead Control account. (4 Marks) 372.000 Question 16 15 points Save Answer Zelibra Company adopts absorption costing and has the following balances (before year-end adjustments) as at the year ended December 31, 2021 Direct Raw Materials inventory $120,000 Dr WIP Inventory 250,000 Dr Finished Goods Inventory 176,000 Dr Cost of Goods Sold 245,000 Dr Additional information is as follows: Cost of direct raw materials purchased during 2021 $198.000 Cost of direct raw materials requisitioned during 2021 176,000 Cost of goods manufactured during 2021 For the year 2021, Zelbra Company budgets manufacturing overhead costs to be $251.000 and direct labour-hours to be 15,000, these estimates are based on the Company operating at normal capacity. In 2021, actual manufacturing overhead costs were $298.500 and the actual direct labour-hours were 16.500. Direct labour-hours are charged at the rate of $10 per hour. Direct labour-hours is used for allocating manufacturing overhead costs. Assume there are no price or efficiency variances for direct labour and direct materiais. All manufacturing overhead variances are written off to cost of goods sold at the end of year December 31, 2021. The company uses a production volume variance account and a fixed manufacturing overhead spending variance account. (Do not round any intermediary calculations, Round final answers to the nearest dollar) Required: In T-Account Format, prepare the following accounts in full, including all adjusting entries as at the year ended 31 December 2021. Ensure that all relevant account names and amounts are shown. Show any relevant calculations as footnotes. For presentation, insert Tables in the Blackboard test tool to write-up your T-Accounts. Note no marks awarded if not in T-Account Format (a) Raw Materials Inventory account. (2 Marks) (b) Work in Process Inventory account. (5 Marks) (c) Finished Goods Inventory account. (2 Marks) (d) Fixed Manufacturing Overhead Allocated account. (2 Marks) (e) Fixed Manufacturing Overhead Control account. (4 Marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)