Answered step by step

Verified Expert Solution

Question

1 Approved Answer

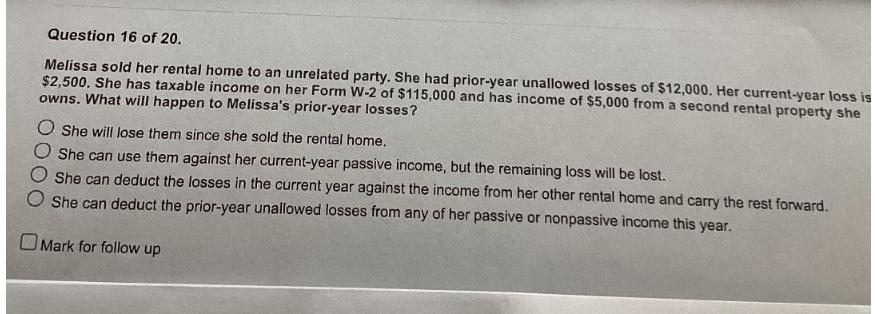

Question 16 of 20. Melissa sold her rental home to an unrelated party. She had prior-year unallowed losses of $12,000. Her current-year loss is

Question 16 of 20. Melissa sold her rental home to an unrelated party. She had prior-year unallowed losses of $12,000. Her current-year loss is $2,500. She has taxable income on her Form W-2 of $115,000 and has income of $5,000 from a second rental property she owns. What will happen to Melissa's prior-year losses? O She will lose them since she sold the rental home. She can use them against her current-year passive income, but the remaining loss will be lost. She can deduct the losses in the current year against the income from her other rental home and carry the rest forward. She can deduct the prior-year unallowed losses from any of her passive or nonpassive income this year. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The question deals with tax implications of prioryear unallowed losses on rental property when such property is sold In the United States rental activ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started