Question

Question 16 On January 1, 2019, Illusion Company purchased a new machine for 2,100,000. The new equipment has an estimated useful life of nine years

Question 16

On January 1, 2019, Illusion Company purchased a new machine for 2,100,000. The new equipment has an estimated useful life of nine years and the residual value was estimated to be 85,000. Depreciation was computed on the sum-of-the-years'-digits method. What amount should be shown in Illusion's Statement of Financial Position at December 31, 2021, net of accumulated depreciation, for this machine? (Rounded to nearest )

A. 1,695,000 B. 1,335,000 C. 1,025,334 D. 1,244,250

Question 17

Technical Products Ltd purchased a computer for 13,000 on July 1, 2020. The company intends to depreciate it over 5 years using the double-declining balance method. Residual value is 1,000. Depreciation for 2020 is

A. 6,500 B. 3,250 C. 4,875 D. 2,600

Question 18

CBA Ltd has a year end of 31 December and operates a factory which makes component for smart phones. It purchased a machine on 1 July 2017 for $80,000 which had a useful life of ten years and is depreciated on the straight-line basis, time apportioned in the years of acquisition and disposal. The machine was revalued to $81,000 on 1 July 2018. There was no change to its useful life at that date.

A fire at the factory on 1 October 2020 damaged the machine leaving it with a lower operating capacity. The accountant considers that the company has to recognize an impairment loss in relation to this damage. The accountant has ascertained the following information at 1 October 2020:

(1) The carrying amount of the machine is $60,750. (2) An equivalent new machine would cost $120,000. (3) The machine could be sold in its current condition for a gross amount of $53,000, dismantling costs would amount to $1,200. (4) In its current condition, the machine could operate for three more years which gives it a value in use figure of $42,615.

What is the total impairment loss associated with CBA Ltds machine at 1 October 2020?

A $nil B $17,750

C $8,950

D $15,750

Question 19

On January 2, 2019, UV Ltd. purchased a machinery with a cost of HK$10,440,000, a useful life of 10 years and no salvage value. The Company uses straight-line depreciation. At December 31, 2019 and December 31, 2020, the company determines that impairment indicators are present. The following information is available for impairment testing at each year end:

12/31/2019 Fair value less cost to sell HK$9,315,000 Value-in-use HK$9,350,000

12/31/2020 HK$8,356,000 HK$8,315,000

There is no change in the assets useful life or salvage value. The 2020 Statement of profit or loss will report

a.Recovery of Impairment Loss of HK$44,889.

b.Impairment Loss of HK$10,000.

c.Recovery of Impairment Loss of HK$38,889.

d. Impairment Loss of HK$1,000,000.

Question 20

Galaxy Ltd purchased a depreciable asset for 420,000 on January 1, 2018. The estimated residual value is 42,000, and the estimated total useful life is 9 years. The straight-line method is used for depreciation. In 2021, it changed its estimates to a total useful life of 6 years with a residual value of 60,000. What is 2021 depreciation expense?

A. 42,000 B. 78,000 C. 112,000 D. 126,000

Question 21

According to HKAS 38, which of the following should not be treated as intangible asset?

1.Mastheads

2.Publishing titles

3.Trademark

4.Customer list

a.IandII

b.IandIV

c. I,IIandIV

d. I, II, III and IV

Question 22

Limited-life intangibles are reported at their

A.replacement cost. B.disposal value C.carrying amount unless impaired. D.acquisition cost.

Question 23

All of the following are true regarding recovery of impairments for intangible assets EXCEPT

A. No recovery of impairment is allowed for Goodwill. B. After a recovery of impairment has been recognized, the carrying value of the asset reported on the statement of financial position will be the higher of the fair value less cost to sell or the value-in-use. C. The amount of the recovery is limited to the carrying value of the asset that would have been reported had no impairment occurred. D. A recovery of impairment will be reported in the "Other income" section of the Statement of profit or loss and other comprehensive income.

Question 24

Which of the following is TRUE about Purchased goodwill

A. It should be written off as soon as possible against retained earnings. B. It is not allowed to be reinstated when there is improvement of operating environment. C. It should be written back as soon as possible as other income. D. It should be written off by systematic charges as a regular operating expense over the period benefited.

Question 25

which of the following costs should be EXCLUDED from research and development

a.Modification of the design of a product b.Acquisition of R & D equipment for use on a current project only

c.Engineering activity required to advance the design of a product to the manufacturing stage d. Cost of marketing research for a new product

Question 26

Which of the following is considered research and development costs?

a.Application of research findings or other knowledge to a plan or design for a new product or process.

b.Laboratory research aimed at discovery of new knowledge.

c.Conceptual formulation and design of possible product or process alternatives.

d. All of the above.

Question 27

Larry Corporation purchased a patent for 640,000 on October 1, 2019. It had a useful life of 10 years. On January 1, 2021, Larry spent 36,000 to successfully defend the patent in a lawsuit. Larry feels that as of that date, the remaining useful life is 8 years. What amount should be reported for patent amortization expense for 2021?

A. 74,500. B. 93,600. C. 120,000. D. 123,600

Question 28

Lopez Corp. incurred 600,000 of research costs to develop a product and subsequently patent was granted on January 2, 2016. Legal fees and other costs associated with registration of the patent totaled 50,000. On March 31, 2021, Lopez paid 200,000 for legal fees in a successful defense of the patent. The total amount capitalized for the patent through March 31, 2021 should be

A. 210,000. B. 250,000. C. 500,000. D. 650,000.

Question 29

On January 2, 2018, Koll, Inc. purchased a patent for a new consumer product for 450,000. At the time of purchase, the patent was valid for 12 years; however, the patents useful life was estimated to be only 8 years due to the competitive nature of the product. On December 31, 2021, the product was permanently withdrawn from the market under governmental order because of a potential health hazard in the product. What amount should Koll charge against income during 2021, assuming amortization is recorded at the end of each year?

A. 37,500 B. 56,250 C. 225,000 D. 270,000

Question 30

A. 0. B. 450,000.

C. 540,000.

D. 750,000.

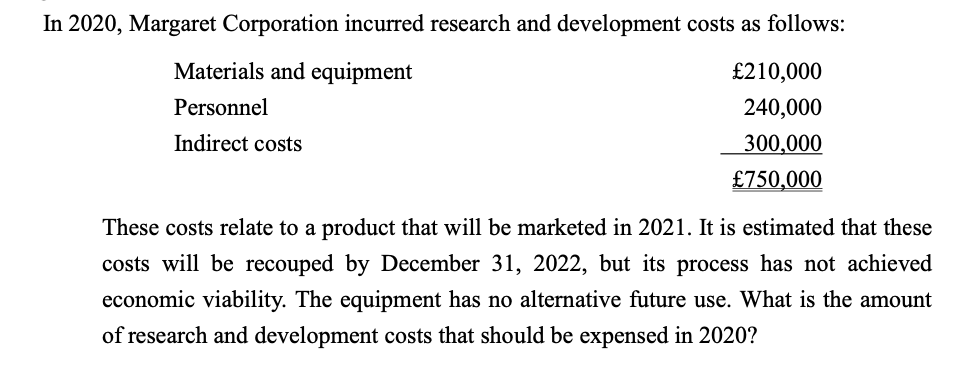

In 2020, Margaret Corporation incurred research and development costs as follows: Materials and equipment 210,000 Personnel 240,000 Indirect costs 300,000 750,000 These costs relate to a product that will be marketed in 2021. It is estimated that these costs will be recouped by December 31, 2022, but its process has not achieved economic viability. The equipment has no alternative future use. What is the amount of research and development costs that should be expensed in 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started