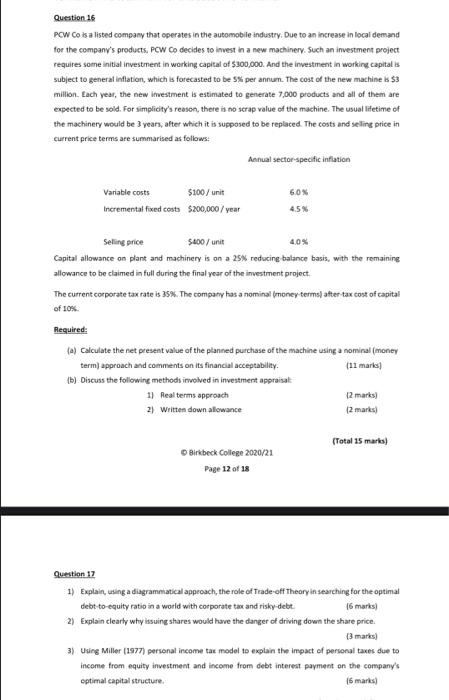

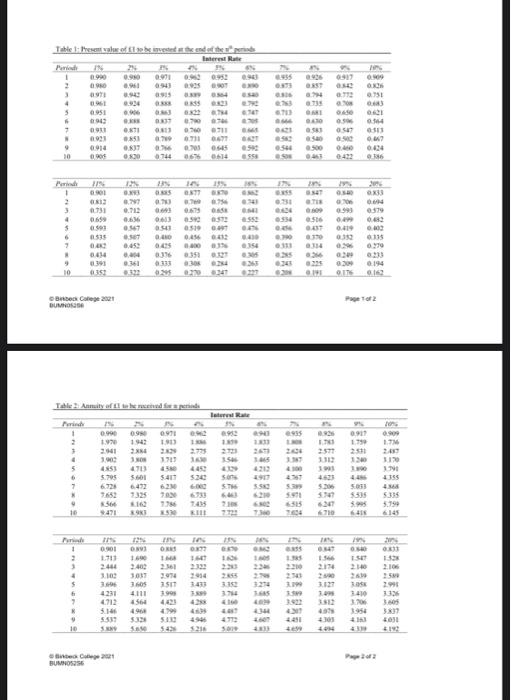

Question 16 PCW Co is a listed company that operates in the automobile industry. Due to an increase in local demand for the company's products, PCW Co decides to invest in a new machinery. Such an investment project requires sone initial investment in working capital of $300,000. And the investment in working capital is subject to general inflation, which is forecasted to be 5% per annum. The cost of the new machine is $3 milion. Each year, the new investment is estimated to generate 7,000 products and all of them are expected to be sold. For simplicity's reason, there is no scrap value of the machine. The usual lifetime of the machinery would be 3 years after which it is supposed to be replaced. The costs and selling price in current price terms are summarised as follows: Annual sector specific inflation Variable costs $100/unit Incremental fixed costs $200,000/year 60% 4.5% 40% Seling price $400/unit Capital allowance on plant and machinery is on a 25% reducing balance basis, with the remaining allowance to be claimed in full during the final year of the investment project. The current corporate tax rate is 35%. The company has a nominal money terms) after tax cost of capital of 10%. Required: (a) Calculate the net present value of the planned purchase of the machine using a nominal (money term) approach and comments on its financial acceptability 111 mark) (D) Discuss the following methods involved in investment appraisal 1) Real terms approach 2) Written down allowance [2 marks) (Total 15 marks) Birkbeck College 2020/21 Page 12 of 18 Question 12 1) Explain, using a diagrammatical approach, the role of Trade-off Theory in searching for the optimal debt-to-equity ratio in a world with corporate tax and risky debt 16marks) 2) Explain clearly why issuing shares would have the danger of driving down the share price [3 marks 3) Using Miller (1977) personal income tax model to explain the impact of personal taxes due to income from equity investment and income from debt interest payment on the company's optimal capital structure 16 marks) 1 of 4 Formulae Sheet Portfolio Theory and Capital Asset Pricing Model Mean and standard deviation E(R) - FR = x +R,+ +R,) where is the expectation operator: R is the rate of retur; T is the sample size sa. IR - E(R)F - UR, - Exe)f + [R. - ExR)F + - + [R, - EXRF) where s.d. stands for the standard deviation PX Correlation coefficient and covariance COR, R) where p is the correlation coefficient Cove) is the covariance between the two stock returns CovR) IR - EUR, SIR, - EUR,)- R-EUR, DIR,, - E(R, 1+[R... - ER, HIRECR, 13+ +[Rex-ER, SIR,,- EUR, ) 7 Portfolio return and standard deviation EXR,) = E(R) + WE(R) where P stands for portfolio: w is the proportion of wealth invested in the individuai stock Minimum variance portfolio w s.d-Psd,sd, sd + xd; -25d5d, Market portfolio [E(R) -r Isd; -LE(R)-5, COR.R) (E(R)-1, Jsd; +[EXR,)-5, bst - [EXR, ) + EUR, )-2r, CoR) Capital Asset Pricing Model E(R) = Ry+B[E(R.) - RJ Cow(RR) V(R) Equity Valuation Dividend yield - D/P D dividend per share P.share price Payout ratio=D/E D: dividend per share E: Earings per share Plowback ratio = 1-payout ratio 8= return on equity x plowback ratio The Dividend Growth Model Diy P- The Coast Dividend Model Present Value of Growth Cyperties + PVGO ar Capitalismul Appraisal The Weighted Average Cod orahal wacC = (1 +Texfm+ Inimale of Rom IRR-R NPVN R-R) The Fisher formal Black-Scholes" Option Pricing Formula Cl- Nidat - InSX) -- Capital Structure Theory Modiglianid Miller Proposition (noty, Proposition with a TD Miller O-TU-T Table 1. These value the end of the Interest Rate 0.990 0.90 0.9710920952 6,961 0543.925 0907 0:15 OST 0917 006 0.2 0.75 5 wo 109000 09 33700 TO 0.11 OS 711 WS 031 0.914 050-31 6529067 0600424 6 0.70 0714 BTT SEXO 1 2 07 0.31 731 ve he 0510 20 $ 6 7 0:57 . 0.419 0.00 033200335 SESU . . 23 0.414 361 0336 03512 333 3052 0309 0233 0.0090.194 16016 10 153 BB Colege 2021 GUMINOSA Page 2 Table 2 Annuity of Illie het die late ess 0911 TE NE TI Pih 1 2 1 4 5 6 7 1.7 24 11 ONE 0.990.9 0.9710009 1. 1943 1903 11 20 2733 1902 SH 470 5.705 . 50 6.499 ST 765 7325 70 3577 11 10 13 11 4100 HE ST S 50 5335 WT SIS 59 35 10 471 6418 IN 2 0001 1.711 2444 16 4 ON 16 1 2402 3019 360 2511 4111 190 4561 442 43 40 332 5 25 2.1 TETE ESIE 13 2.100 2 26.95 140 3. 37 SW E SEE 7 4231 4712 OSE 5.530 1.30 2014 4031 2021 BUMINOS256 Question 16 PCW Co is a listed company that operates in the automobile industry. Due to an increase in local demand for the company's products, PCW Co decides to invest in a new machinery. Such an investment project requires sone initial investment in working capital of $300,000. And the investment in working capital is subject to general inflation, which is forecasted to be 5% per annum. The cost of the new machine is $3 milion. Each year, the new investment is estimated to generate 7,000 products and all of them are expected to be sold. For simplicity's reason, there is no scrap value of the machine. The usual lifetime of the machinery would be 3 years after which it is supposed to be replaced. The costs and selling price in current price terms are summarised as follows: Annual sector specific inflation Variable costs $100/unit Incremental fixed costs $200,000/year 60% 4.5% 40% Seling price $400/unit Capital allowance on plant and machinery is on a 25% reducing balance basis, with the remaining allowance to be claimed in full during the final year of the investment project. The current corporate tax rate is 35%. The company has a nominal money terms) after tax cost of capital of 10%. Required: (a) Calculate the net present value of the planned purchase of the machine using a nominal (money term) approach and comments on its financial acceptability 111 mark) (D) Discuss the following methods involved in investment appraisal 1) Real terms approach 2) Written down allowance [2 marks) (Total 15 marks) Birkbeck College 2020/21 Page 12 of 18 Question 12 1) Explain, using a diagrammatical approach, the role of Trade-off Theory in searching for the optimal debt-to-equity ratio in a world with corporate tax and risky debt 16marks) 2) Explain clearly why issuing shares would have the danger of driving down the share price [3 marks 3) Using Miller (1977) personal income tax model to explain the impact of personal taxes due to income from equity investment and income from debt interest payment on the company's optimal capital structure 16 marks) 1 of 4 Formulae Sheet Portfolio Theory and Capital Asset Pricing Model Mean and standard deviation E(R) - FR = x +R,+ +R,) where is the expectation operator: R is the rate of retur; T is the sample size sa. IR - E(R)F - UR, - Exe)f + [R. - ExR)F + - + [R, - EXRF) where s.d. stands for the standard deviation PX Correlation coefficient and covariance COR, R) where p is the correlation coefficient Cove) is the covariance between the two stock returns CovR) IR - EUR, SIR, - EUR,)- R-EUR, DIR,, - E(R, 1+[R... - ER, HIRECR, 13+ +[Rex-ER, SIR,,- EUR, ) 7 Portfolio return and standard deviation EXR,) = E(R) + WE(R) where P stands for portfolio: w is the proportion of wealth invested in the individuai stock Minimum variance portfolio w s.d-Psd,sd, sd + xd; -25d5d, Market portfolio [E(R) -r Isd; -LE(R)-5, COR.R) (E(R)-1, Jsd; +[EXR,)-5, bst - [EXR, ) + EUR, )-2r, CoR) Capital Asset Pricing Model E(R) = Ry+B[E(R.) - RJ Cow(RR) V(R) Equity Valuation Dividend yield - D/P D dividend per share P.share price Payout ratio=D/E D: dividend per share E: Earings per share Plowback ratio = 1-payout ratio 8= return on equity x plowback ratio The Dividend Growth Model Diy P- The Coast Dividend Model Present Value of Growth Cyperties + PVGO ar Capitalismul Appraisal The Weighted Average Cod orahal wacC = (1 +Texfm+ Inimale of Rom IRR-R NPVN R-R) The Fisher formal Black-Scholes" Option Pricing Formula Cl- Nidat - InSX) -- Capital Structure Theory Modiglianid Miller Proposition (noty, Proposition with a TD Miller O-TU-T Table 1. These value the end of the Interest Rate 0.990 0.90 0.9710920952 6,961 0543.925 0907 0:15 OST 0917 006 0.2 0.75 5 wo 109000 09 33700 TO 0.11 OS 711 WS 031 0.914 050-31 6529067 0600424 6 0.70 0714 BTT SEXO 1 2 07 0.31 731 ve he 0510 20 $ 6 7 0:57 . 0.419 0.00 033200335 SESU . . 23 0.414 361 0336 03512 333 3052 0309 0233 0.0090.194 16016 10 153 BB Colege 2021 GUMINOSA Page 2 Table 2 Annuity of Illie het die late ess 0911 TE NE TI Pih 1 2 1 4 5 6 7 1.7 24 11 ONE 0.990.9 0.9710009 1. 1943 1903 11 20 2733 1902 SH 470 5.705 . 50 6.499 ST 765 7325 70 3577 11 10 13 11 4100 HE ST S 50 5335 WT SIS 59 35 10 471 6418 IN 2 0001 1.711 2444 16 4 ON 16 1 2402 3019 360 2511 4111 190 4561 442 43 40 332 5 25 2.1 TETE ESIE 13 2.100 2 26.95 140 3. 37 SW E SEE 7 4231 4712 OSE 5.530 1.30 2014 4031 2021 BUMINOS256