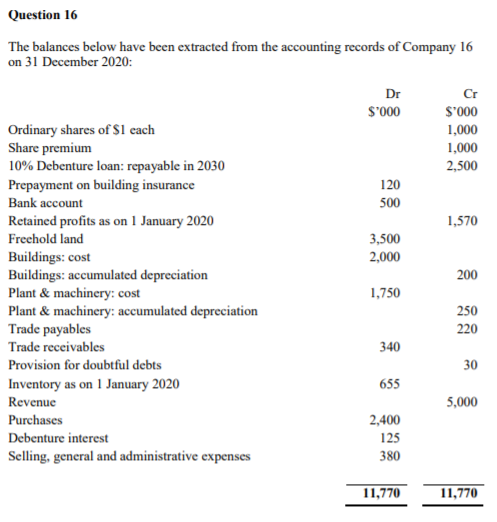

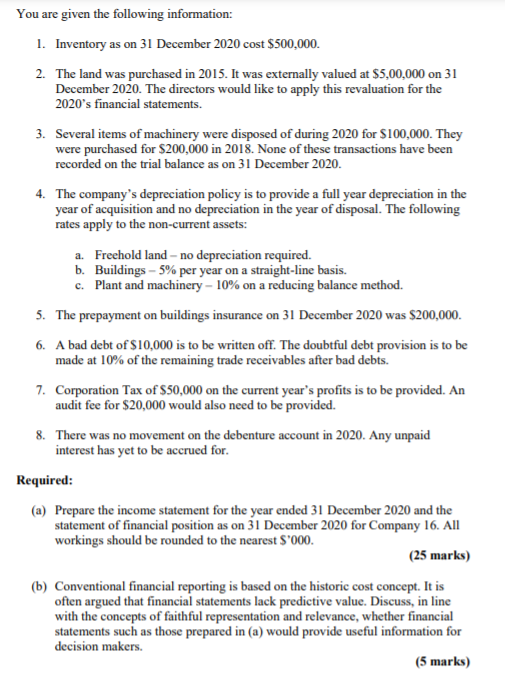

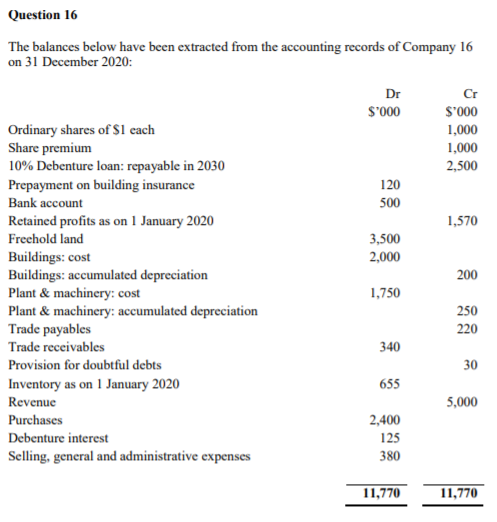

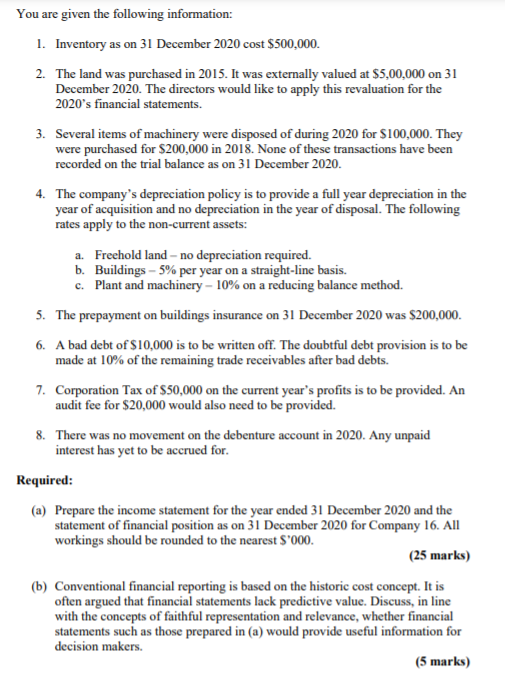

Question 16 The balances below have been extracted from the accounting records of Company 16 on 31 December 2020: Dr Cr $'000 $'000 Ordinary shares of $1 each 1,000 Share premium 1,000 10% Debenture loan: repayable in 2030 2,500 Prepayment on building insurance 120 Bank account 500 Retained profits as on 1 January 2020 1,570 Freehold land 3,500 Buildings: cost 2,000 Buildings: accumulated depreciation 200 Plant & machinery: cost 1,750 Plant & machinery: accumulated depreciation 250 Trade payables 220 Trade receivables Provision for doubtful debts 30 Inventory as on 1 January 2020 655 Revenue 5,000 Purchases 2,400 Debenture interest 125 Selling, general and administrative expenses 380 340 11,770 11,770 You are given the following information: 1. Inventory as on 31 December 2020 cost $500,000 2. The land was purchased in 2015. It was externally valued at $5,00,000 on 31 December 2020. The directors would like to apply this revaluation for the 2020's financial statements. 3. Several items of machinery were disposed of during 2020 for $100,000. They were purchased for $200,000 in 2018. None of these transactions have been recorded on the trial balance as on 31 December 2020. 4. The company's depreciation policy is to provide a full year depreciation in the year of acquisition and no depreciation in the year of disposal. The following rates apply to the non-current assets: a. Freehold land no depreciation required. b. Buildings - 5% per year on a straight-line basis. c. Plant and machinery - 10% on a reducing balance method. 5. The prepayment on buildings insurance on 31 December 2020 was $200,000. 6. A bad debt of $10,000 is to be written off. The doubtful debt provision is to be made at 10% of the remaining trade receivables after bad debts. 7. Corporation Tax of $50,000 on the current year's profits is to be provided. An audit fee for $20,000 would also need to be provided. 8. There was no movement on the debenture account in 2020. Any unpaid interest has yet to be accrued for. Required: (a) Prepare the income statement for the year ended 31 December 2020 and the statement of financial position as on 31 December 2020 for Company 16. All workings should be rounded to the nearest $'000. (25 marks) (6) Conventional financial reporting is based on the historic cost concept. It is often argued that financial statements lack predictive value. Discuss, in line with the concepts of faithful representation and relevance, whether financial statements such as those prepared in (a) would provide useful information for decision makers