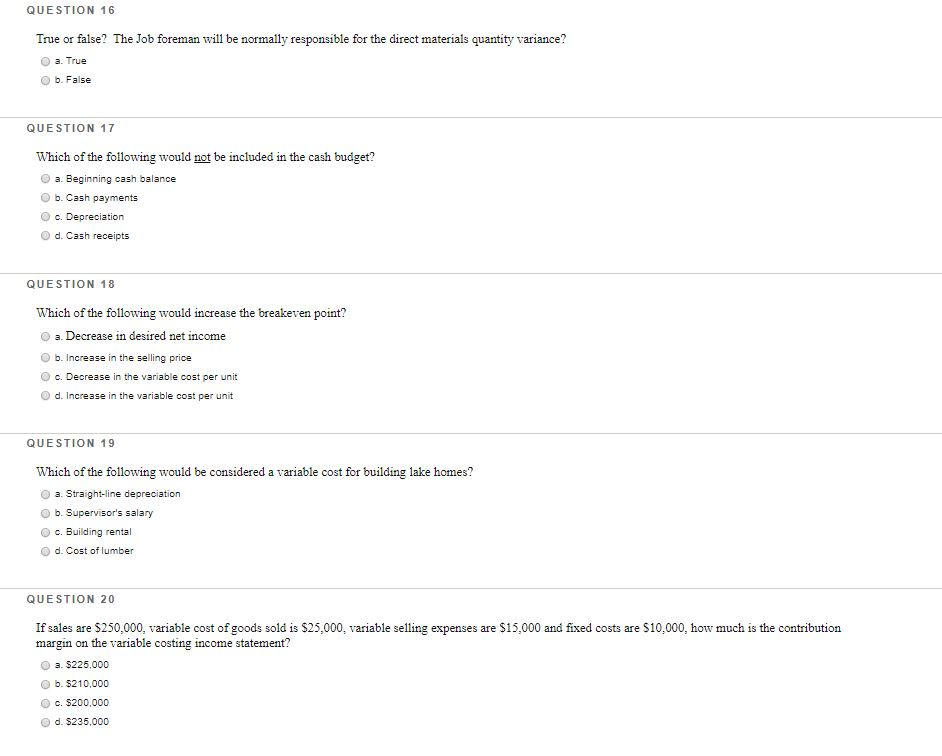

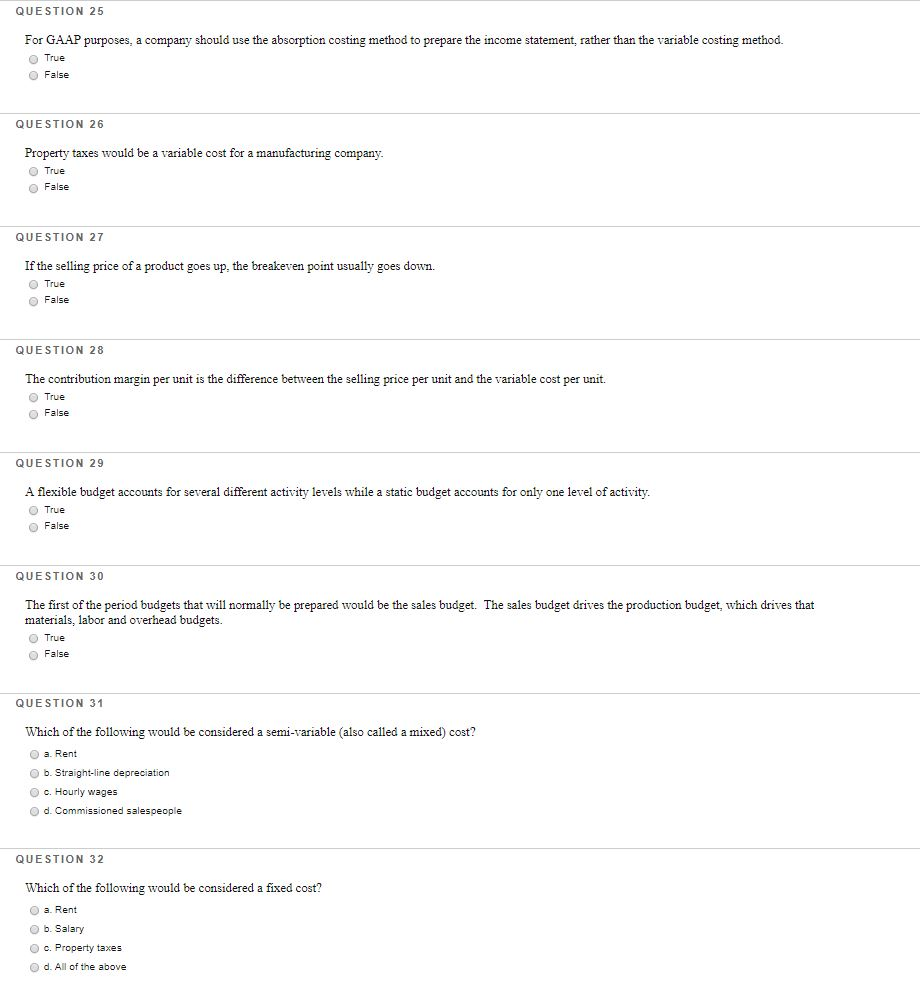

QUESTION 16 True or false? The Job foreman will be normally responsible for the direct materials quantity variance? a. True b. False QUESTION 17 Which of the following would not be included in the cash budget? a. Beginning cash balance b. Cash payments c. Depreciation d. Cash receipts QUESTION 18 Which of the following would increase the breakeven point? a. Decrease in desired net income b. Increase in the selling price c. Decrease in the variable cost per unit d. Increase in the variable cost per unit QUESTION 19 Which of the following would be considered a variable cost for building lake homes? a. Straight-line depreciation b. Supervisor's salary c. Building rental d. Cost of lumber QUESTION 20 If sales are $250,000, variable cost of goods sold is $25,000. variable selling expenses are $15,000 and fixed costs are $10,000, how much is the contribution margin on the variable costing income statement? a $225,000 b. $210,000 c. $200,000 d. 5235,000 QUESTION 25 For GAAP purposes, a company should use the absorption costing method to prepare the income statement, rather than the variable costing method. True False QUESTION 26 Property taxes would be a variable cost for a manufacturing company. True False QUESTION 27 If the selling price of a product goes up the breakeven point usually goes down. True False QUESTION 28 The contribution margin per unit is the difference between the selling price per unit and the variable cost per unit. True False QUESTION 29 A flexible budget accounts for several different activity levels while a static budget accounts for only one level of activity. True False QUESTION 30 The first of the period budgets that will normally be prepared would be the sales budget. The sales budget drives the production budget, which drives that materials, labor and overhead budgets. True False QUESTION 31 Which of the following would be considered a semi-variable (also called a mixed) cost? a. Rent b. Straight-line depreciation c. Hourly wages d. Commissioned salespeople QUESTION 32 Which of the following would be considered a fixed cost? a. Rent b. Salary c. Property taxes d. All of the above