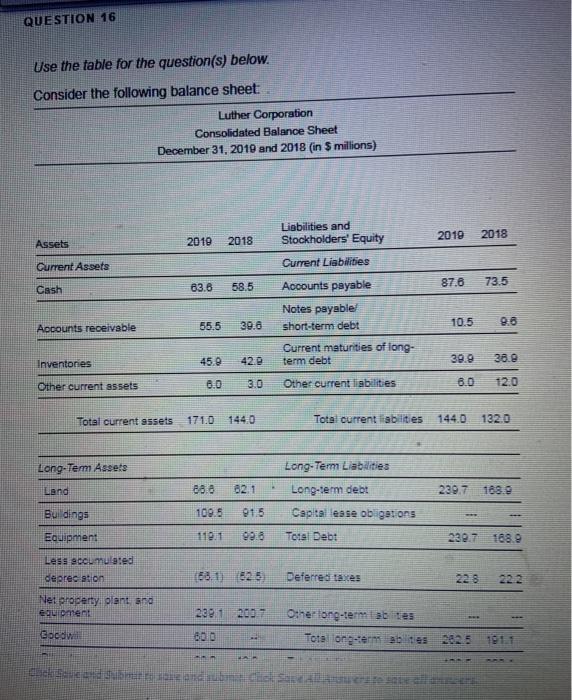

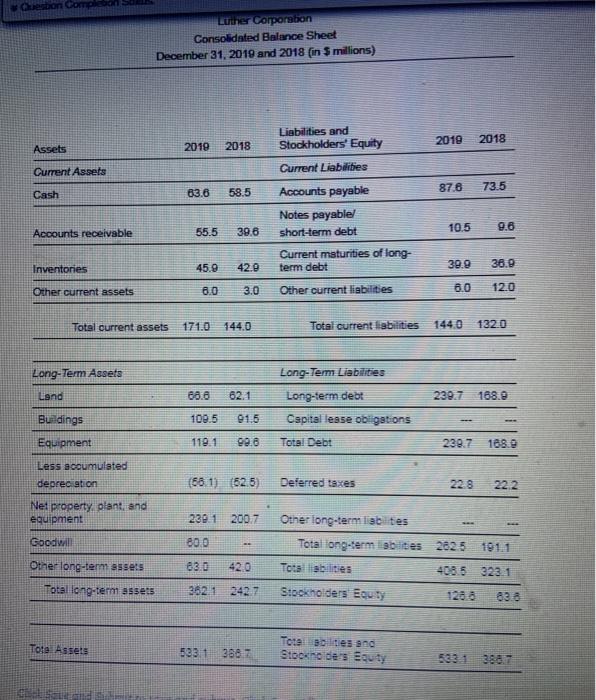

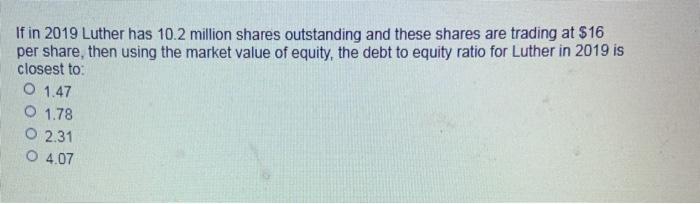

QUESTION 16 Use the table for the question(s) below. Consider the following balance sheet: Luther Corporation Consolidated Balance Sheet December 31, 2019 and 2018 (in 9 millions) Liabilities and Stockholders' Equity 2010 2018 Assets 2019 2018 Current Assets Current Liabilities Cash 83.6 58.5 87.6 73.5 55.5 39.6 Accounts receivable Accounts payable Notes payable short-term debt Current maturities of long- term debt 9.6 10.5 Inventones 45.9 422 38.2 Other current assets 3.0 Other current liabilities 6.0 12.0 Total current assets 171.0 Total current abilities 1320 Long-Term Assets Land 88 02.1 239.7 Long-Term Liabilities Long-term debt Capital lesse obligations Total Debt Buildings 109.5 Equipment 1191 998 239.7 188.9 Less so mulered deprecation 1861 625) Deferred tates 228 Net property plant and Elment 2001 2002 Other long-terma tes Total long-term bites Boca 800 hebrer 102 and be Quebon Comp Luther Corporation Consolidated Balance Sheet December 31, 2019 and 2018 (in S millions) 2018 Assets 2010 2010 2018 Liabilities and Stockholders' Equity Current Liabilities Current Assets 73.5 Cash 63.6 87.6 58.5 10.5 9.6 Accounts receivable Accounts payable Notes payable! short-term debt Current maturities of long- term debt 65.5 39.6 Inventories 45.9 42.9 39.9 36.9 Other current assets 3.0 Other current liabilities 0.0 120 Total current assets 171.0 144.0 Total current liabilities 144.0 1320 Long-Term Assets Long-Term Liabilities Long-term debt Land 62.1 239.7 168.9 108.5 01:5 Capital lease obligations Buildings Equipment 119.1 99.6 Total Debt 239.7 1889 Less accumulated depreciation (66.1) (62.5) Deferred taxes 228 22.2. Net property, plant and equipment 2301 2007 Goodwill 80.0 Other long-term liabites Total long-term sities Total abilities 282,5 Other long-term assets 63.0 42.0 403.5 323.1 Total long-term assets 36241 242.7 Stockholders Equity 838 Total Assets 533.1 3887 Tote bildes and Stockholders Buy If in 2019 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then using the market value of equity, the debt to equity ratio for Luther in 2019 is closest to O 1.47 O 1.78 O 2.31 O 4.07