Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 1-6 with detailed solution please The Titan is evaluating a project under the internal codename of 'The Snap! You are given the following information

question 1-6 with detailed solution please

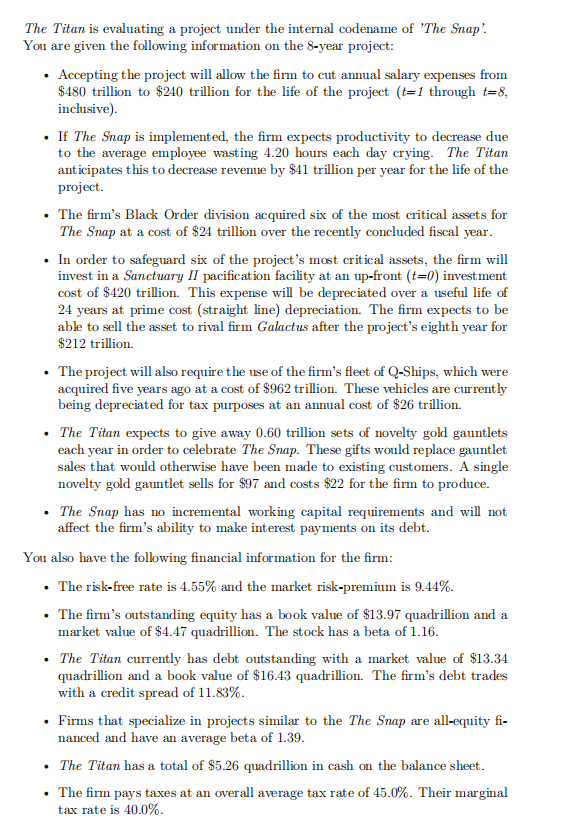

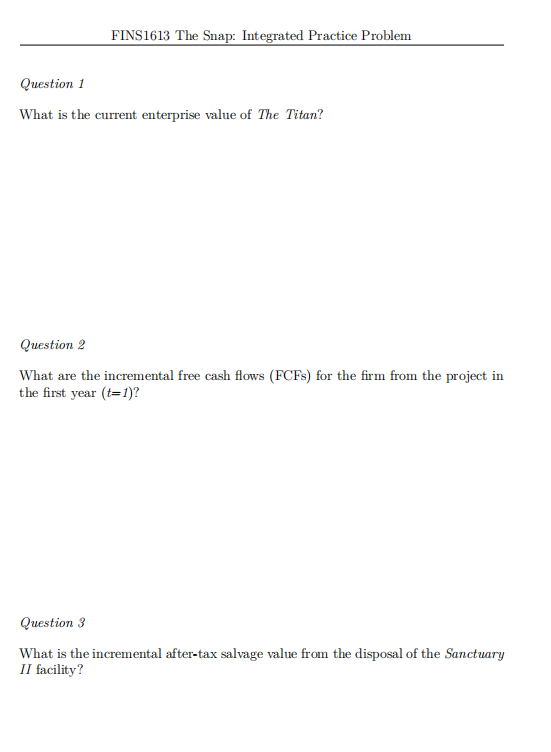

The Titan is evaluating a project under the internal codename of 'The Snap! You are given the following information on the 8-year project: Accepting the project will allow the firm to cut annual salary expenses from $480 trillion to $240 trillion for the life of the project (t=1 through t=8, inclusive) If The Snap is implemented, the firm expects productivity to decrease due to the average employee wasting 4.20 hours each day crying. The Titan anticipates this to decrease revenue by $41 trillion per year for the life of the project. The firm's Black Order division acquired six of the most critical assets for The Snap at a cost of $24 trillion over the recently concluded fiscal year. In order to safeguard six of the project's most critical assets, the firm will invest in a Sanctuary Il pacification facility at an up-front (t=0) investment cost of $420 trillion. This expense will be depreciated over a useful life of 24 years at prime cost (straight line) depreciation. The firm expects to be able to sell the asset to rival firm Galactus after the project's eighth year for $212 trillion. The project will also require the use of the firm's fleet of Q-Ships, which were acquired five years ago at a cost of $962 trillion. These vehicles are currently being depreciated for tax purposes at an annual cost of $26 trillion. The Titan expects to give away 0.60 trillion sets of novelty gold gauntlets each year in order to celebrate The Snap. These gifts would replace gauntlet sales that would otherwise have been made to existing customers. A single novelty gold gauntlet sells for $97 and costs $22 for the firm to produce. The Snap has no incremental working capital requirements and will not affect the firm's ability to make interest payments on its debt. You also have the following financial information for the firm: The risk-free rate is 4.55% and the market risk-premium is 9.44%. The firm's outstanding equity has a book value of $13.97 quadrillion and a market value of $4.47 quadrillion. The stock has a beta of 1.16. The Titan currently has debt outstanding with a market value of $13.34 quadrillion and a book value of $16.43 quadrillion. The firm's debt trades with a credit spread of 11.83%. Firms that specialize in projects similar to the The Snap are all-equity fi- nanced and have an average beta of 1.39. The Titan has a total of $5.26 quadrillion in cash on the balance sheet. The firm pays taxes at an overall average tax rate of 45.0%. Their marginal tax rate is 40.0% FINS1613 The Snap: Integrated Practice Problem Question 1 What is the current enterprise value of The Titan? Question 2 What are the incremental free cash flows (FCFS) for the firm from the project in the first year (t=1)? Question 3 What is the incremental after-tax salvage value from the disposal of the Sanctuary II facility? FINS1613 The Snap: Integrated Practice Problem Question 4 What is the after-tax cost of debt for the project? Question 5 If The Titan expects to finance the project at its current capital structure, what is the appropriate cost of equity to use for this project? (assume that, for the purposes of this calculation, the firm's debt carries no systematic risk.) Question 6 What is appropriate cost of capital for The Titan to use as a discount rate for the The Snap? The Titan is evaluating a project under the internal codename of 'The Snap! You are given the following information on the 8-year project: Accepting the project will allow the firm to cut annual salary expenses from $480 trillion to $240 trillion for the life of the project (t=1 through t=8, inclusive) If The Snap is implemented, the firm expects productivity to decrease due to the average employee wasting 4.20 hours each day crying. The Titan anticipates this to decrease revenue by $41 trillion per year for the life of the project. The firm's Black Order division acquired six of the most critical assets for The Snap at a cost of $24 trillion over the recently concluded fiscal year. In order to safeguard six of the project's most critical assets, the firm will invest in a Sanctuary Il pacification facility at an up-front (t=0) investment cost of $420 trillion. This expense will be depreciated over a useful life of 24 years at prime cost (straight line) depreciation. The firm expects to be able to sell the asset to rival firm Galactus after the project's eighth year for $212 trillion. The project will also require the use of the firm's fleet of Q-Ships, which were acquired five years ago at a cost of $962 trillion. These vehicles are currently being depreciated for tax purposes at an annual cost of $26 trillion. The Titan expects to give away 0.60 trillion sets of novelty gold gauntlets each year in order to celebrate The Snap. These gifts would replace gauntlet sales that would otherwise have been made to existing customers. A single novelty gold gauntlet sells for $97 and costs $22 for the firm to produce. The Snap has no incremental working capital requirements and will not affect the firm's ability to make interest payments on its debt. You also have the following financial information for the firm: The risk-free rate is 4.55% and the market risk-premium is 9.44%. The firm's outstanding equity has a book value of $13.97 quadrillion and a market value of $4.47 quadrillion. The stock has a beta of 1.16. The Titan currently has debt outstanding with a market value of $13.34 quadrillion and a book value of $16.43 quadrillion. The firm's debt trades with a credit spread of 11.83%. Firms that specialize in projects similar to the The Snap are all-equity fi- nanced and have an average beta of 1.39. The Titan has a total of $5.26 quadrillion in cash on the balance sheet. The firm pays taxes at an overall average tax rate of 45.0%. Their marginal tax rate is 40.0% FINS1613 The Snap: Integrated Practice Problem Question 1 What is the current enterprise value of The Titan? Question 2 What are the incremental free cash flows (FCFS) for the firm from the project in the first year (t=1)? Question 3 What is the incremental after-tax salvage value from the disposal of the Sanctuary II facility? FINS1613 The Snap: Integrated Practice Problem Question 4 What is the after-tax cost of debt for the project? Question 5 If The Titan expects to finance the project at its current capital structure, what is the appropriate cost of equity to use for this project? (assume that, for the purposes of this calculation, the firm's debt carries no systematic risk.) Question 6 What is appropriate cost of capital for The Titan to use as a discount rate for the The SnapStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started