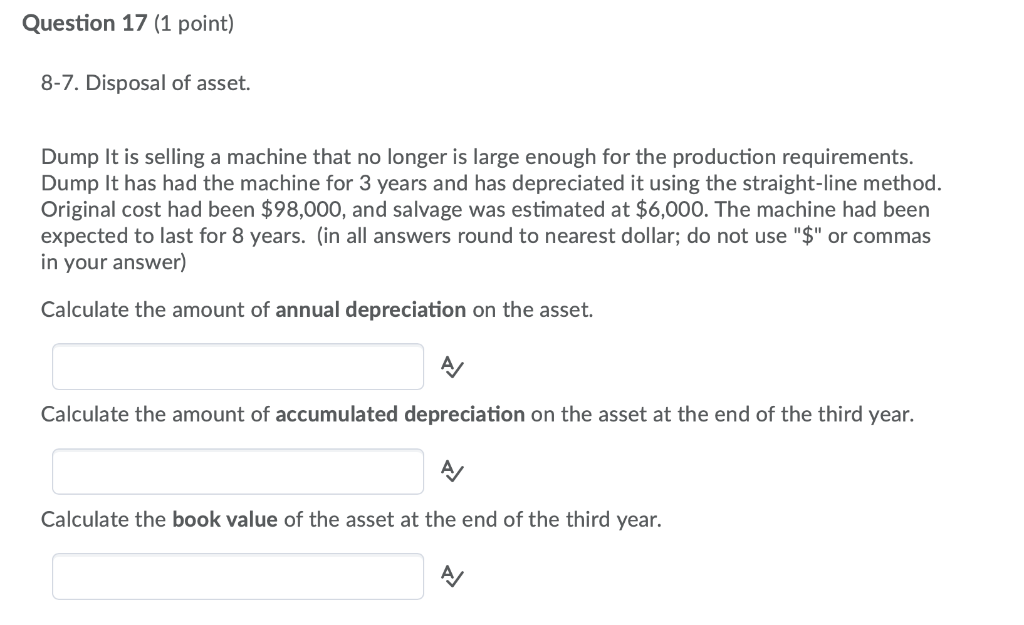

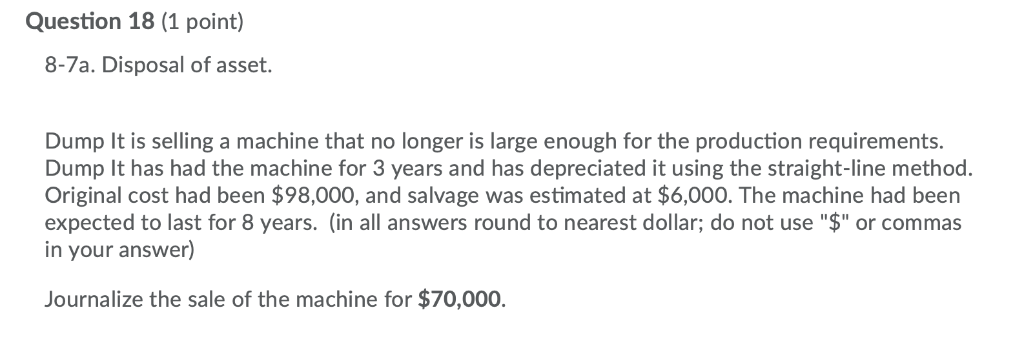

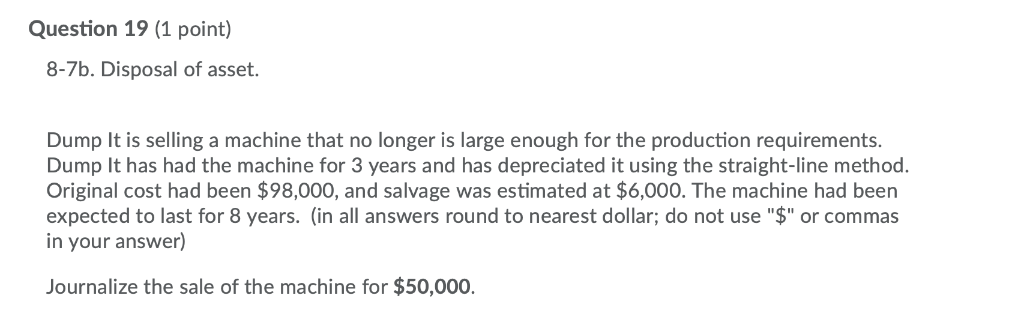

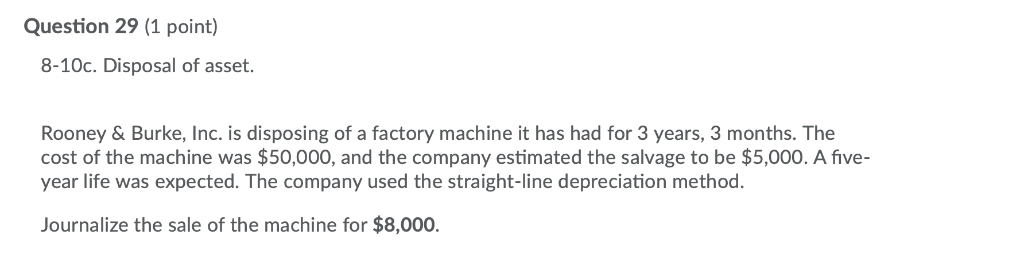

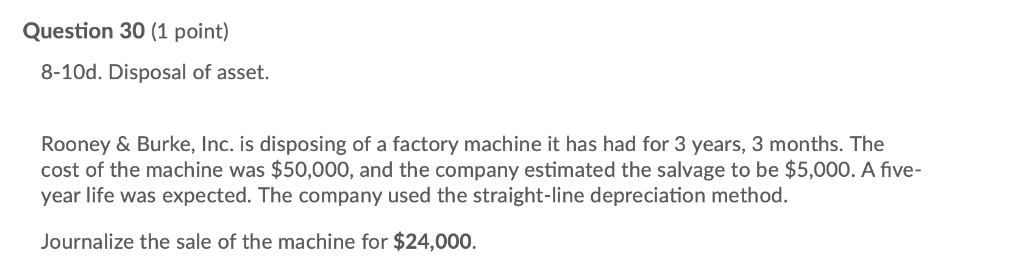

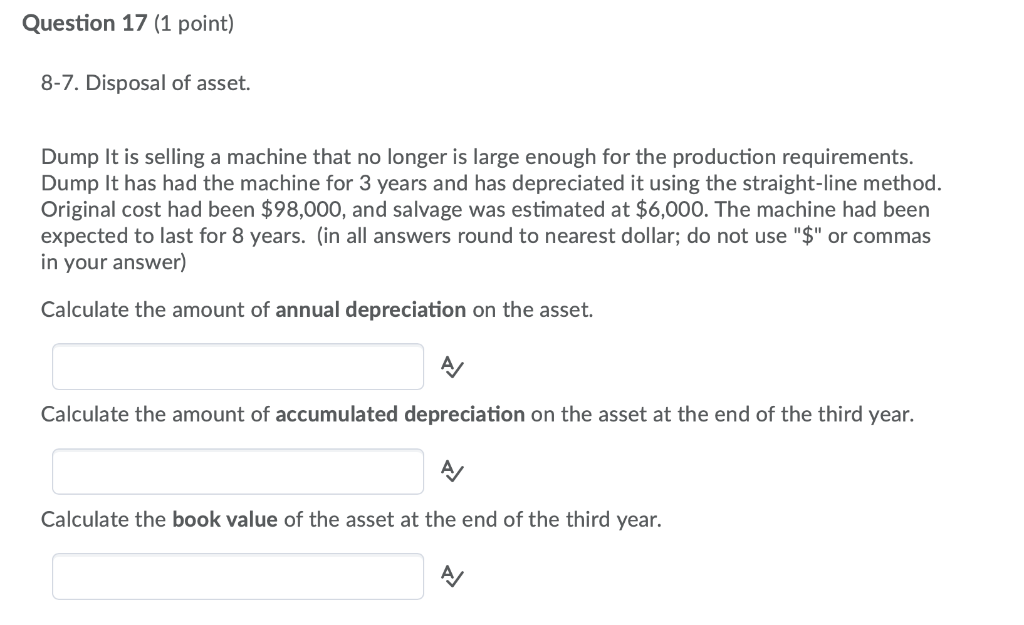

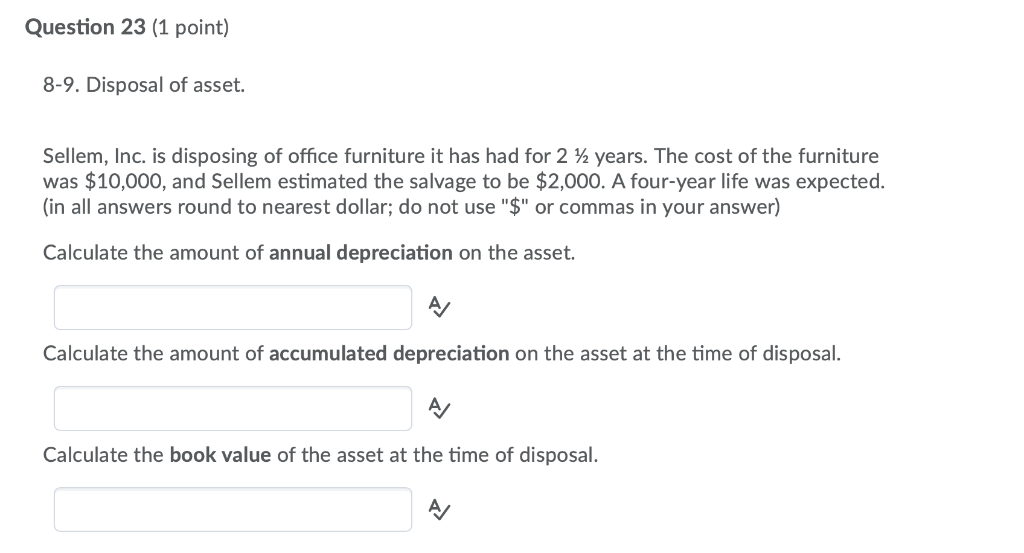

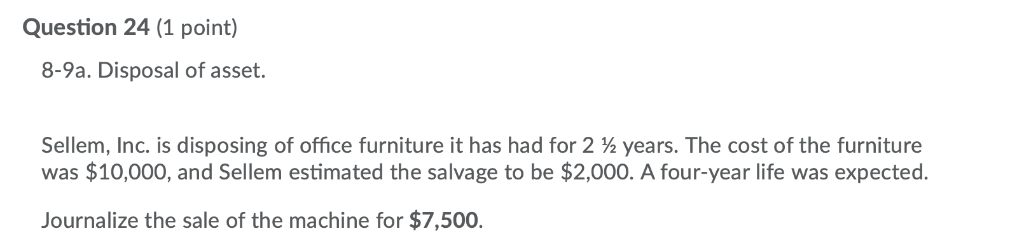

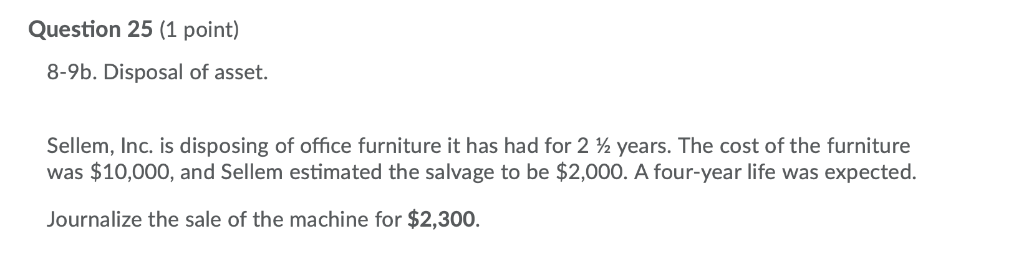

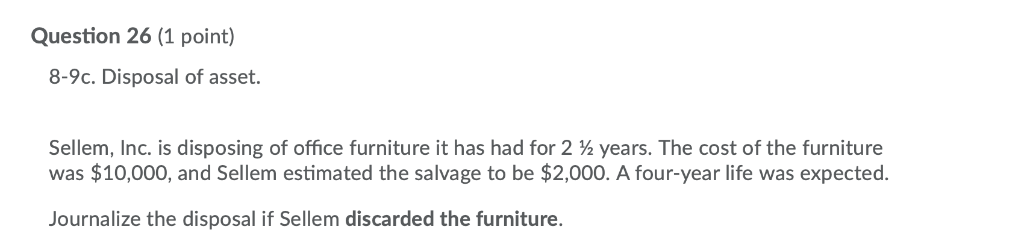

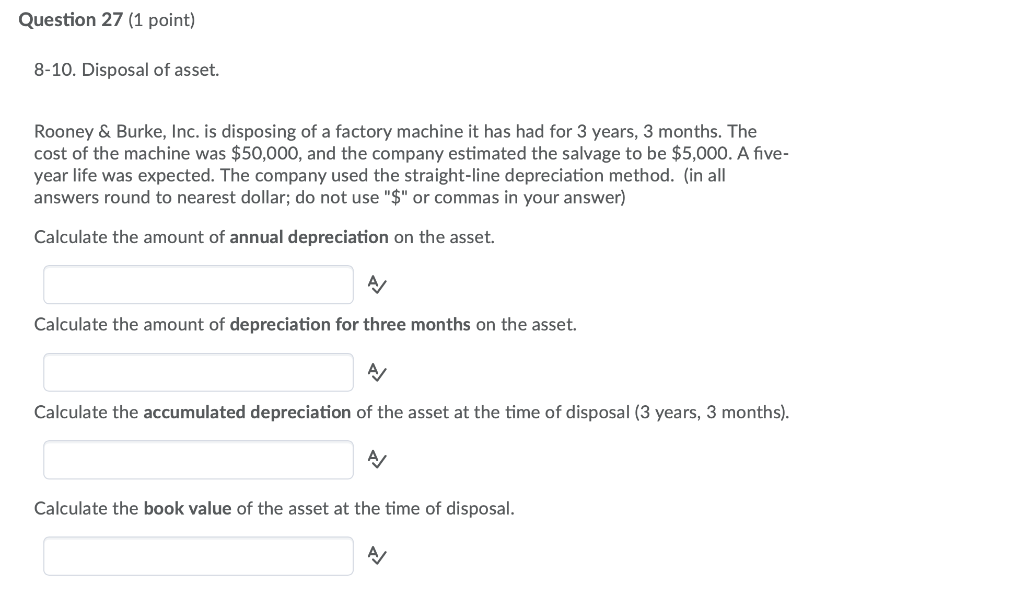

Question 17 (1 point) 8-7. Disposal of asset. Dump It is selling a machine that no longer is large enough for the production requirements Dump It has had the machine for 3 years and has depreciated it using the straight-line method. Original cost had been $98,000, and salvage was estimated at $6,000. The machine had been expected to last for 8 years. (in all answers round to nearest dollar; do not use "$" or commas in your answer) Calculate the amount of annual depreciation on the asset. Calculate the amount of accumulated depreciation on the asset at the end of the third year. Calculate the book value of the asset at the end of the third year Question 18 (1 point) 8-7a. Disposal of asset. Dump It is selling a machine that no longer is large enough for the production requirements. Dump It has had the machine for 3 years and has depreciated it using the straight-line method. Original cost had been $98,000, and salvage was estimated at $6,000. The machine had been expected to last for 8 years. (in all answers round to nearest dollar; do not use "$" or commas in your answer) Journalize the sale of the machine for $70,000. Question 19 (1 point) 8-7b. Disposal of asset. Dump It is selling a machine that no longer is large enough for the production requirements. Dump It has had the machine for 3 years and has depreciated it using the straight-line method. Original cost had been $98,000, and salvage was estimated at $6,000. The machine had been expected to last for 8 years. (in all answers round to nearest dollar; do not use "$" or commas in your answer) Journalize the sale of the machine for $50,000. Question 20 (1 point) 8-8a. Disposal of asset. Gone & Gone have a Patent that has a value on the books of $22,000 Journalize the sale of the patent for $27,000. Question 21 (1 point) 8-8b. Disposal of asset. Gone & Gone have a Patent that has a value on the books of $22,000 Journalize the sale of the patent for $19,000 Question 22 (1 point) 8-8c. Disposal of asset. Gone & Gone have a Patent that has a value on the books of $22,000 Journalize the effect of the loss of a lawsuit that cost $15,000. Question 25 (1 point) 8-9b. Disposal of asset. Sellem, Inc. is disposing of office furniture it has had for 2 years. The cost of the furniture was $10,000, and Sellem estimated the salvage to be $2,000. A four-year life was expected Journalize the sale of the machine for $2,300 Question 27 (1 point) 8-10. Disposal of asset. Rooney& Burke, Inc. is disposing of a factory machine it has had for 3 years, 3 months. The cost of the machine was $50,000, and the company estimated the salvage to be $5,000. A five- year life was expected. The company used the straight-line depreciation method. (in all answers round to nearest dollar; do not use "$" or commas in your answer) Calculate the amount of annual depreciation on the asset. Calculate the amount of depreciation for three months on the asset. Calculate the accumulated depreciation of the asset at the time of disposal (3 years, 3 months) Calculate the book value of the asset at the time of disposal