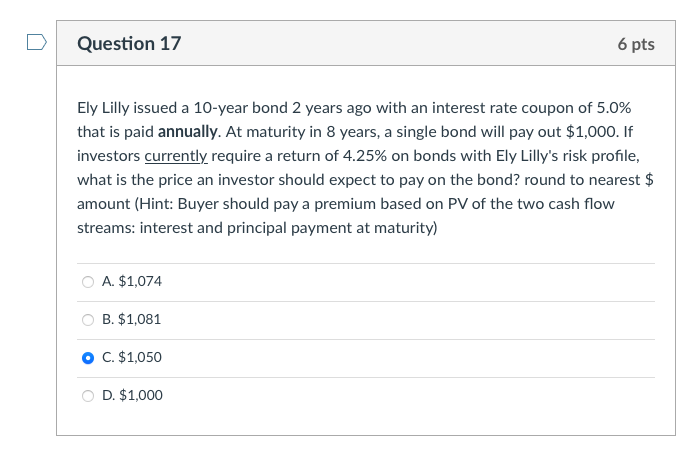

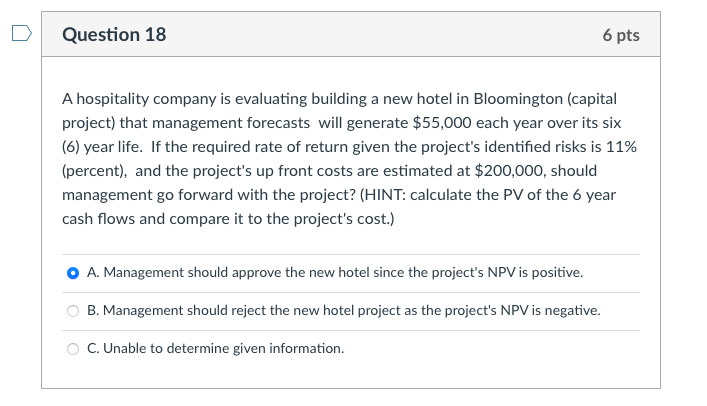

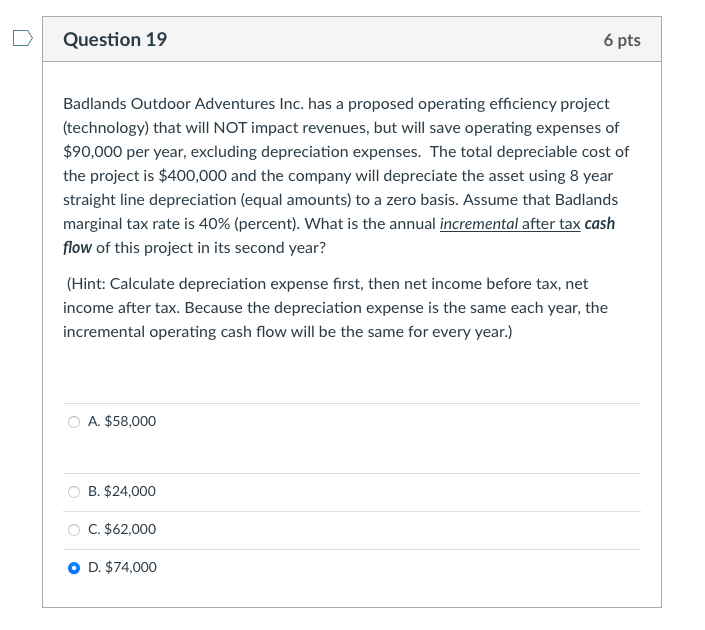

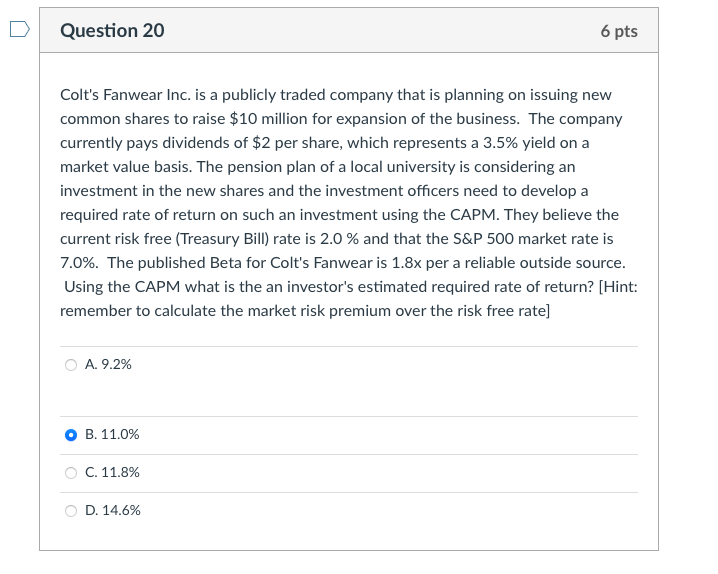

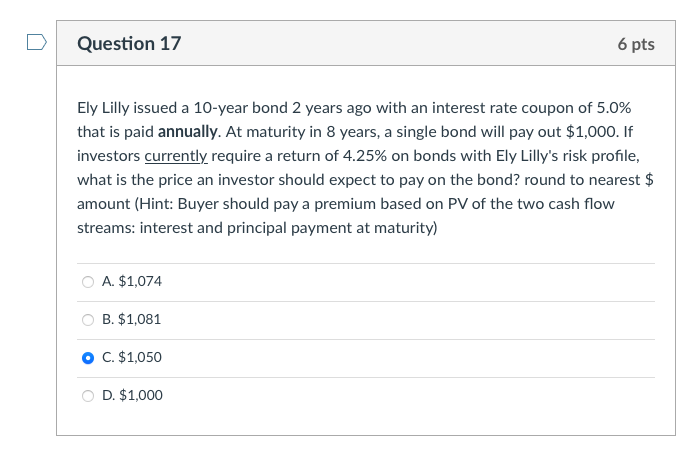

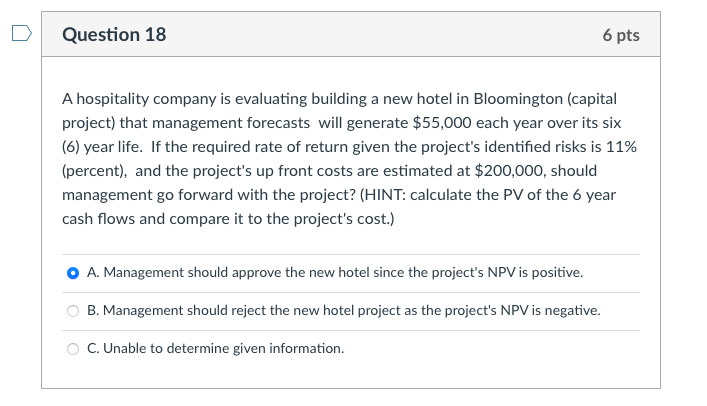

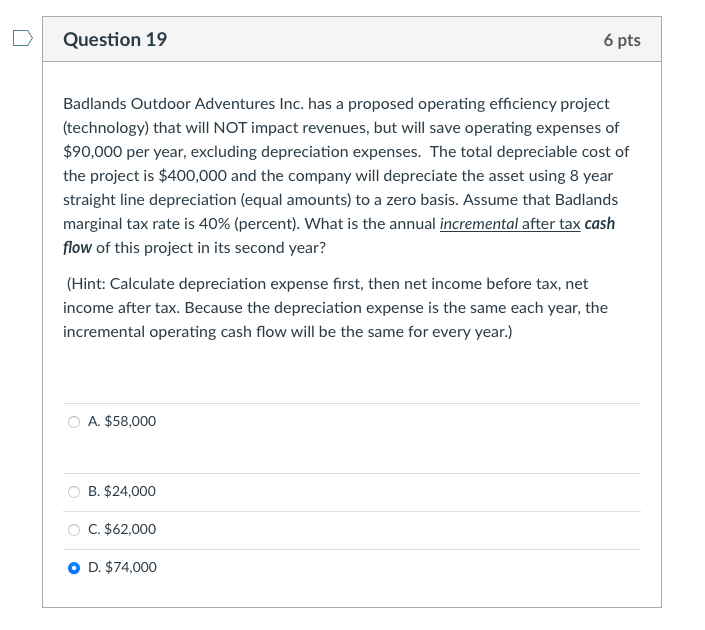

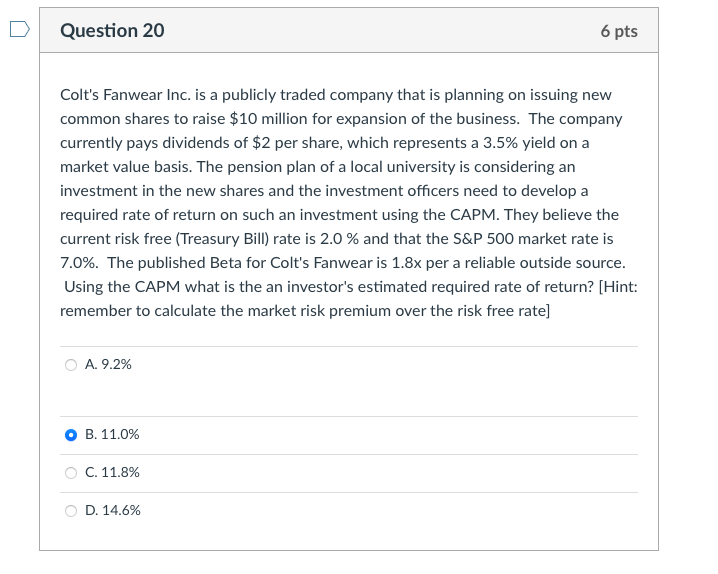

Question 17 6 pts Ely Lilly issued a 10-year bond 2 years ago with an interest rate coupon of 5.0% that is paid annually. At maturity in 8 years, a single bond will pay out $1,000. If investors currently require a return of 4.25% on bonds with Ely Lilly's risk profile, what is the price an investor should expect to pay on the bond? round to nearest $ amount (Hint: Buyer should pay a premium based on PV of the two cash flow streams: interest and principal payment at maturity) O A. $1,074 B. $1,081 O C. $1,050 O D. $1,000 Question 18 6 pts A hospitality company is evaluating building a new hotel in Bloomington (capital project) that management forecasts will generate $55,000 each year over its six (6) year life. If the required rate of return given the project's identified risks is 11% (percent), and the project's up front costs are estimated at $200,000, should management go forward with the project? (HINT: calculate the PV of the 6 year cash flows and compare it to the project's cost.) A. Management should approve the new hotel since the project's NPV is positive. B. Management should reject the new hotel project as the project's NPV is negative. O C. Unable to determine given information. Question 19 6 pts Badlands Outdoor Adventures Inc. has a proposed operating efficiency project (technology) that will NOT impact revenues, but will save operating expenses of $90,000 per year, excluding depreciation expenses. The total depreciable cost of the project is $400,000 and the company will depreciate the asset using 8 year straight line depreciation (equal amounts) to a zero basis. Assume that Badlands marginal tax rate is 40% (percent). What is the annual incremental after tax cash flow of this project in its second year? (Hint: Calculate depreciation expense first, then net income before tax, net income after tax. Because the depreciation expense is the same each year, the incremental operating cash flow will be the same for every year.) O A. $58,000 O B. $24,000 O C. $62,000 O D. $74,000 Question 20 6 pts Colt's Fanwear Inc. is a publicly traded company that is planning on issuing new common shares to raise $10 million for expansion of the business. The company currently pays dividends of $2 per share, which represents a 3.5% yield on a market value basis. The pension plan of a local university is considering an investment in the new shares and the investment officers need to develop a required rate of return on such an investment using the CAPM. They believe the current risk free (Treasury Bill) rate is 2.0% and that the S&P 500 market rate is 7.0%. The published Beta for Colt's Fanwear is 1.8x per a reliable outside source. Using the CAPM what is the an investor's estimated required rate of return? [Hint: remember to calculate the market risk premium over the risk free rate] O A. 9.2% O B. 11.0% O C. 11.8% O D. 14.6%