Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 17 All of the following are advantages of debt financing EXCEPT: Interest expense is tax deductible. O Debt can be eliminated Interest is a

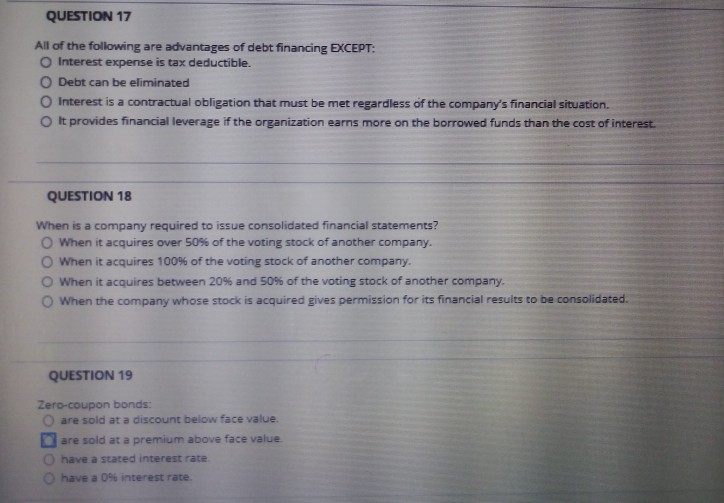

QUESTION 17 All of the following are advantages of debt financing EXCEPT: Interest expense is tax deductible. O Debt can be eliminated Interest is a contractual obligation that must be met regardless of the company's financial situation. It provides financial leverage if the organization earns more on the borrowed funds than the cost of interest. QUESTION 18 When is a company required to issue consolidated financial statements? When it acquires over 50% of the voting stock of another company. When it acquires 100% of the voting stock of another company. When it acquires between 20% and 50% of the voting stock of another company. When the company whose stock is acquired gives permission for its financial results to be consolidated. QUESTION 19 Zero-coupon bonds: are sold at a discount below face value. are sold at a premium above face value have a stated interest rate have a 0% interest rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started