Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question #17 Frank has a current income of $60,000 per year. He has completed a Retirement Needs Analysis and estimates he will need 80%

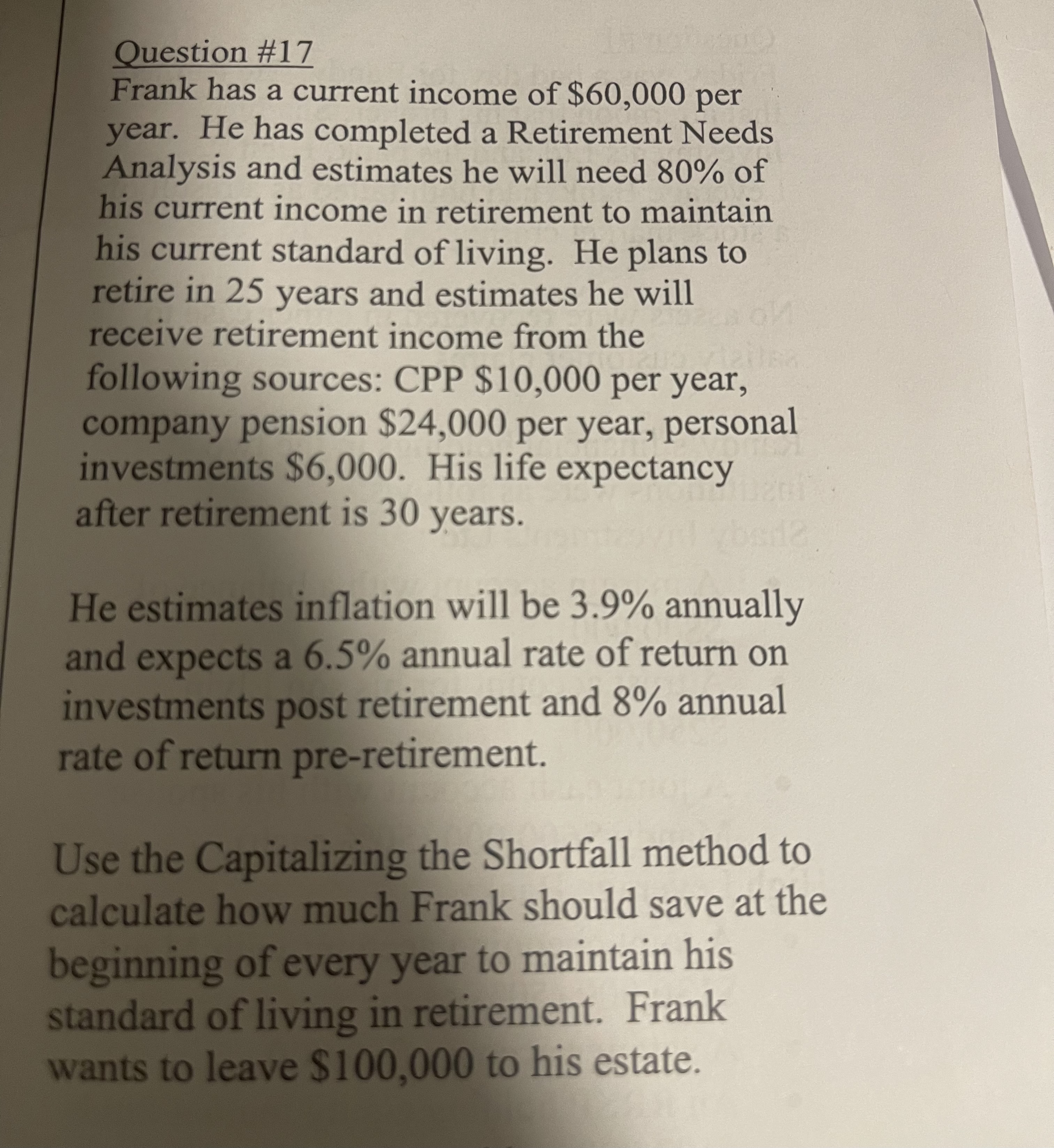

Question #17 Frank has a current income of $60,000 per year. He has completed a Retirement Needs Analysis and estimates he will need 80% of his current income in retirement to maintain his current standard of living. He plans to retire in 25 years and estimates he will receive retirement income from the following sources: CPP $10,000 per year, company pension $24,000 per year, personal investments $6,000. His life expectancy after retirement is 30 years. M beda He estimates inflation will be 3.9% annually and expects a 6.5% annual rate of return on investments post retirement and 8% annual rate of return pre-retirement. Use the Capitalizing the Shortfall method to calculate how much Frank should save at the beginning of every year to maintain his standard of living in retirement. Frank wants to leave $100,000 to his estate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started