Answered step by step

Verified Expert Solution

Question

1 Approved Answer

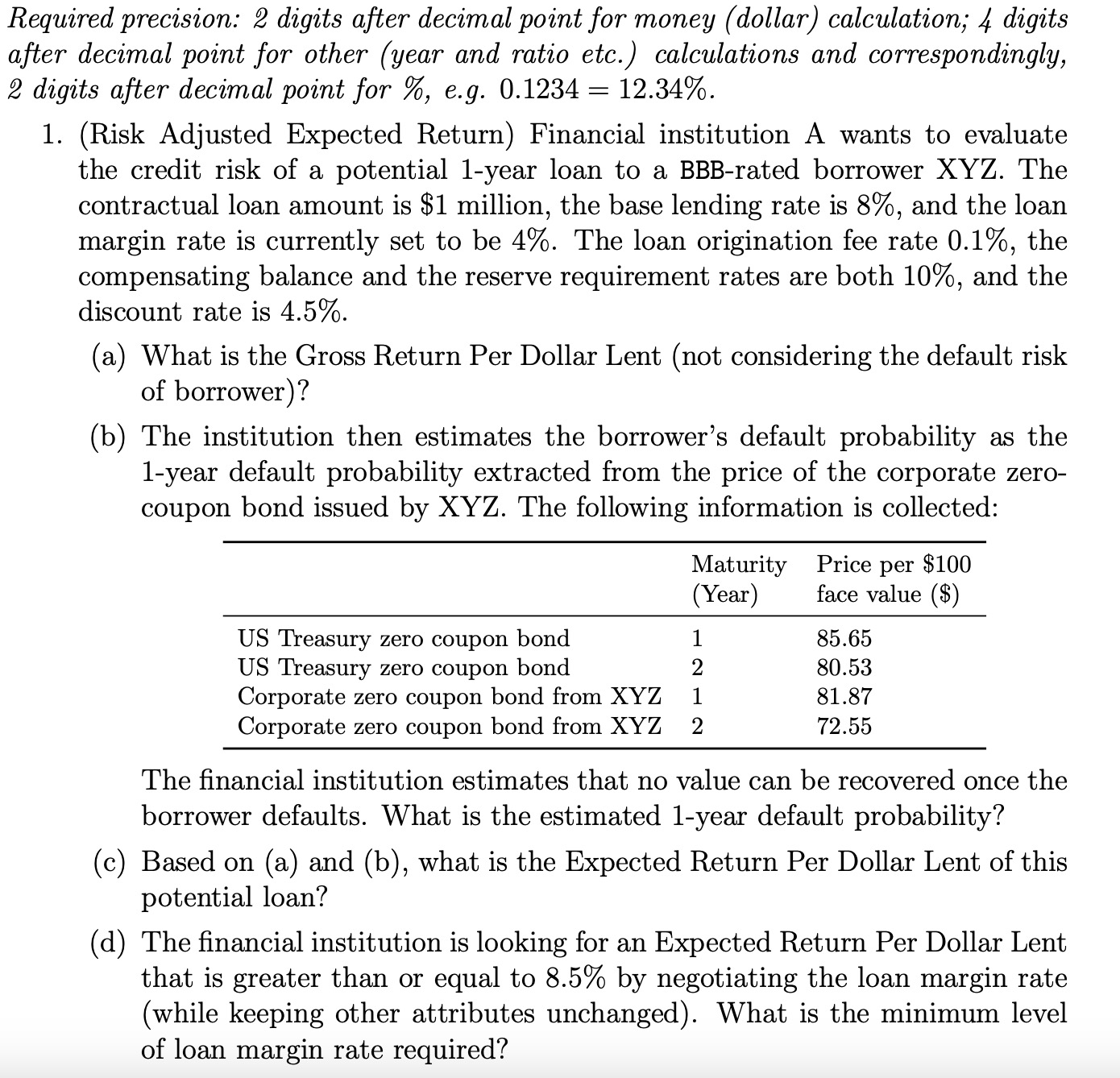

Required precision: 2 digits after decimal point for money (dollar) calculation; 4 digits after decimal point for other (year and ratio etc.) calculations and

Required precision: 2 digits after decimal point for money (dollar) calculation; 4 digits after decimal point for other (year and ratio etc.) calculations and correspondingly, 2 digits after decimal point for %, e.g. 0.1234 = 12.34%. 1. (Risk Adjusted Expected Return) Financial institution A wants to evaluate the credit risk of a potential 1-year loan to a BBB-rated borrower XYZ. The contractual loan amount is $1 million, the base lending rate is 8%, and the loan margin rate is currently set to be 4%. The loan origination fee rate 0.1%, the compensating balance and the reserve requirement rates are both 10%, and the discount rate is 4.5%. (a) What is the Gross Return Per Dollar Lent (not considering the default risk of borrower)? (b) The institution then estimates the borrower's default probability as the 1-year default probability extracted from the price of the corporate zero- coupon bond issued by XYZ. The following information is collected: Maturity (Year) Price per $100 face value ($) US Treasury zero coupon bond 1 85.65 US Treasury zero coupon bond 2 80.53 Corporate zero coupon bond from XYZ 81.87 Corporate zero coupon bond from XYZ 2 72.55 The financial institution estimates that no value can be recovered once the borrower defaults. What is the estimated 1-year default probability? (c) Based on (a) and (b), what is the Expected Return Per Dollar Lent of this potential loan? (d) The financial institution is looking for an Expected Return Per Dollar Lent that is greater than or equal to 8.5% by negotiating the loan margin rate (while keeping other attributes unchanged). What is the minimum level of loan margin rate required?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started