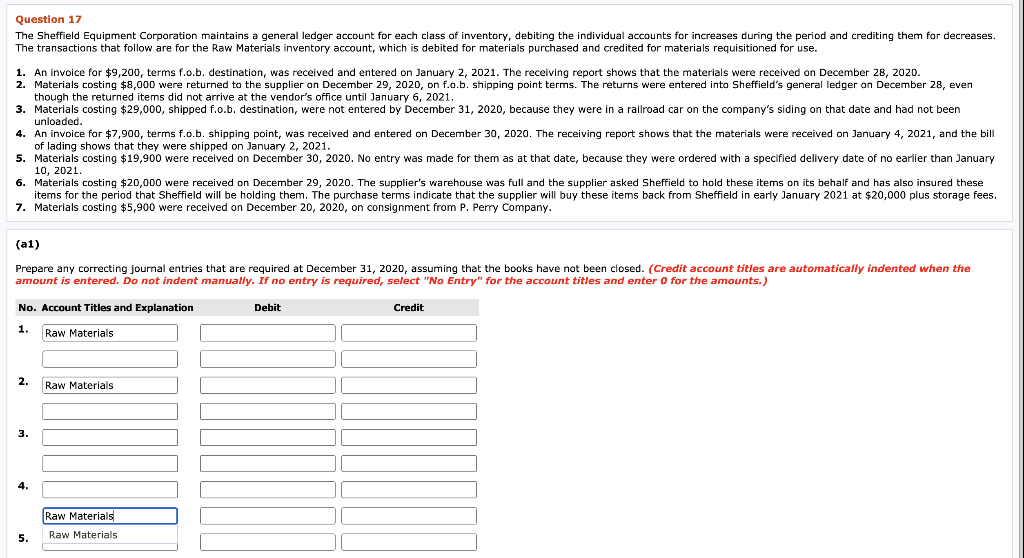

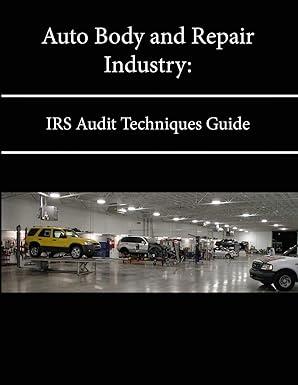

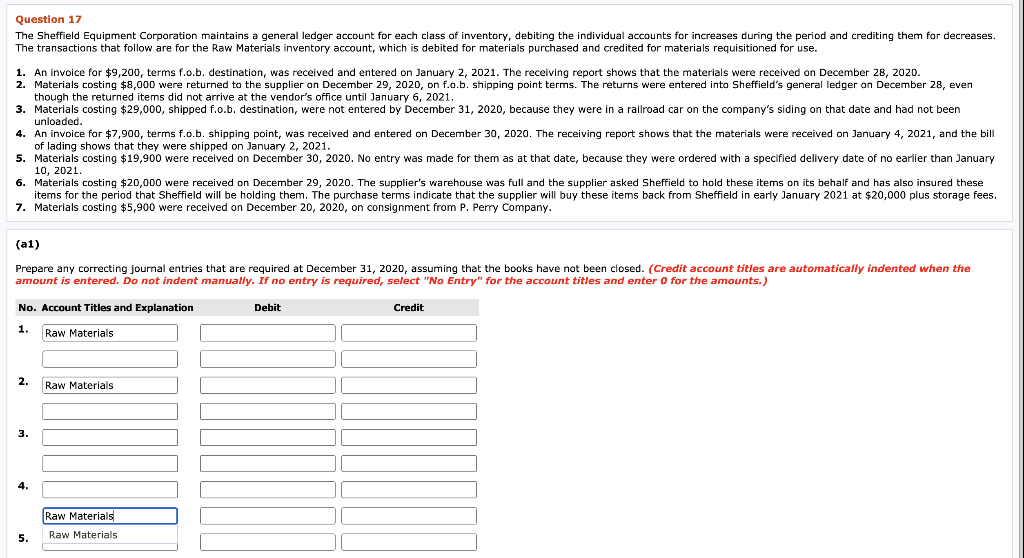

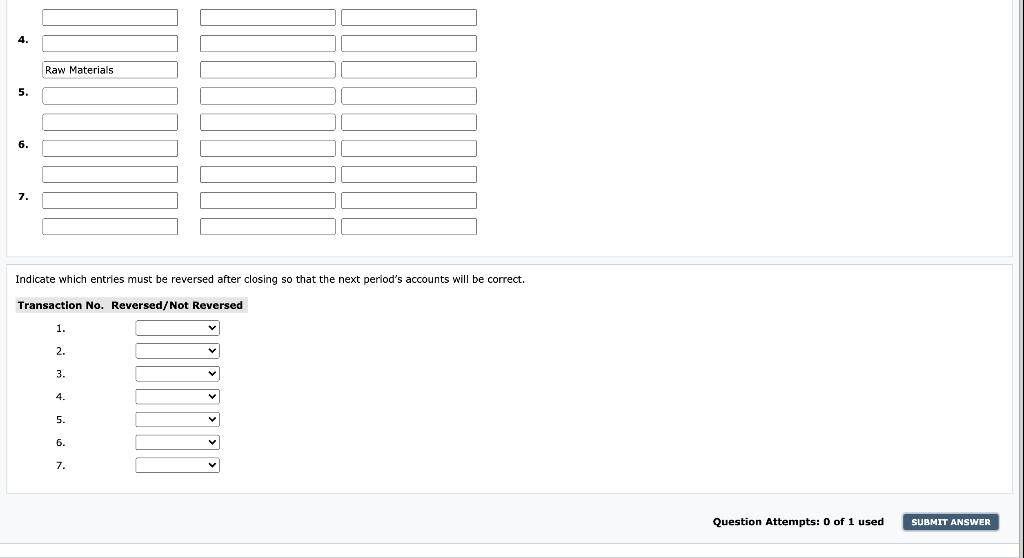

Question 17 The Sheffield Equipment Corporation maintains a general ledger account for each class of inventory, debiting the individual accounts for increases during the period and crediting them for decreases. The transactions that follow are for the Raw Materials inventory account, which is debited for materials purchased and credited for materials requisitioned for use. 1. An invoice for $9,200, terms f.o.b. destination, was received and entered on January 2, 2021. The receiving report shows that the materials were received on December 28, 2020. 2. Materials costing $8,000 were returned to the supplier on December 29, 2020, on f.o.b. shipping point terms. The returns were entered into Sheffield's general ledger on December 28, even though the returned items did not arrive at the vendor's office until January 6, 2021. 3. Materials costing $29,000, shipped f.o.b. destination, were not entered by December 31, 2020, because they were in a railroad car on the company's siding on that date and had not been unloaded. 4. An invoice for $7,900, terms f.o.b. shipping point, was received and entered on December 30, 2020. The receiving report shows that the materials were received on January 4, 2021, and the bill of lading shows that they were shipped on January 2, 2021. 5. Materials costing $19,900 were received on December 30, 2020. No entry was made for them as at that date, because they were ordered with a specified delivery date of no earlier than January 10, 2021. 6. Materials costing $20,000 were received on December 29, 2020. The supplier's warehouse was full and the supplier asked Sheffield to hold these items on its behalf and has also insured these items for the period that Sheffield will be holding them. The purchase terms indicate that the supplier will buy these items back from Sheffield in early January 2021 at $20,000 plus storage fees, 7. Materials costing $5,900 were received on December 20, 2020, on consignment from P. Perry Company. (al) Prepare any correcting journal entries that are required at December 31, 2020, assuming that the books have not been closed. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) No. Account Titles and Explanation Debit Credit 1. Raw Materials 2. Raw Materials 3. 4. Raw Materials Raw Materials 5. 4. Raw Materials 5. 6. 7. Indicate which entries must be reversed after closing so that the next period's accounts will be correct. Transaction No. Reversed/Not Reversed 1. 2 3. 4. 5. 6. 7. Question Attempts: 0 of 1 used SUBMIT