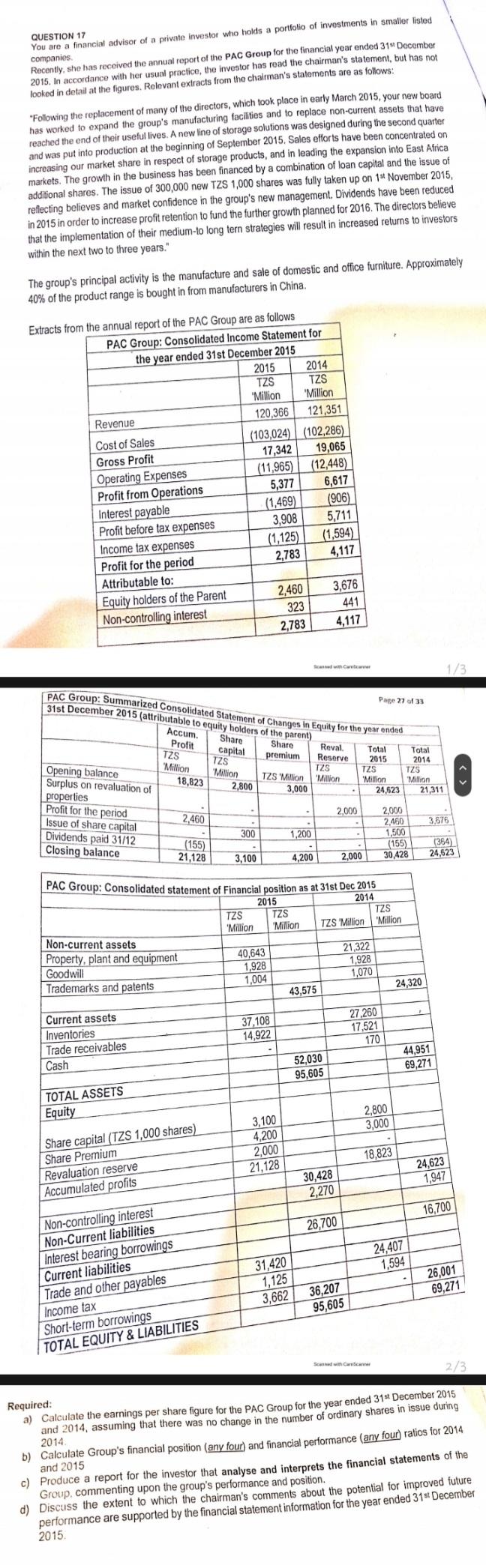

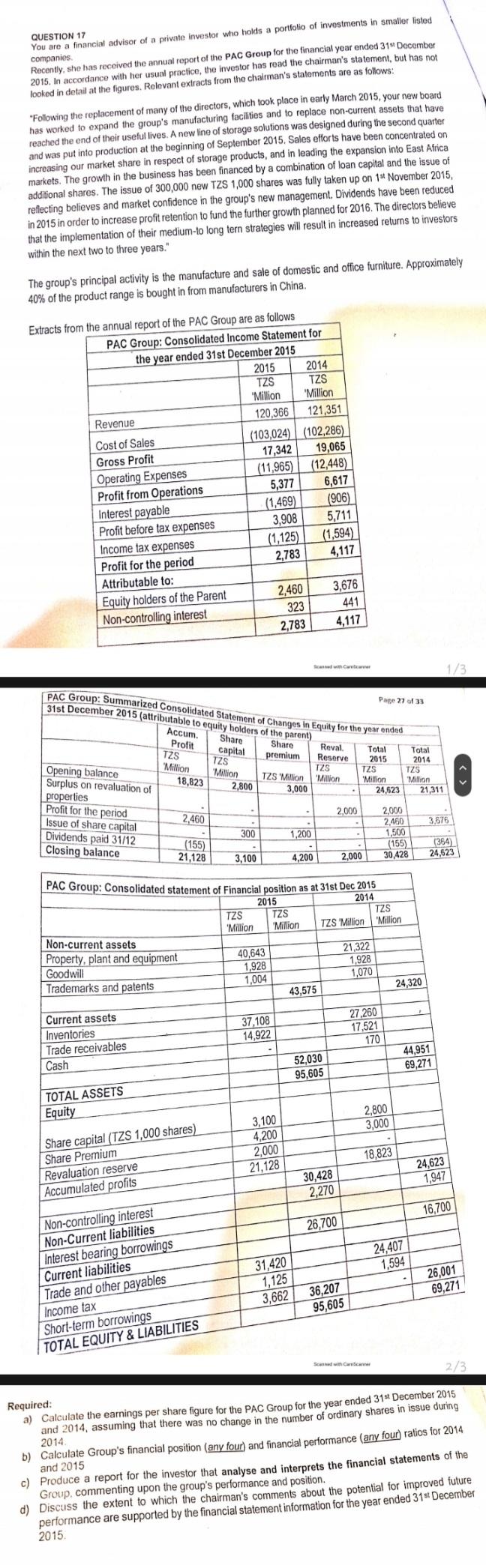

QUESTION 17 You are a financial advisor of a private investor who holds a portfolio of investments in smaller listed companies Recently, she has received the annual report of the PAC Group for the financial year ended 31 December 2015. In accordance with her usual practice, the investor has read the chairman's statement, but has not looked in detail at the figures. Relevant extracts from the chairman's statements are as follows: "Following the replacement of many of the directors, which took place in early March 2015, your new board has worked to expand the group's manufacturing facilities and to replace non-current assets that have reached the end of their useful lives. A new line of storage solutions was designed during the second quarter and was put into production at the beginning of September 2015. Sales efforts have been concentrated on increasing our market share in respect of storage products, and in leading the expansion into East Africa markets. The growth in the business has been financed by a combination of loan capital and the issue of additional shares. The issue of 300,000 new TZS 1,000 shares was fully taken up on 14 November 2015, reflecting believes and market confidence in the group's new management, Dividends have been reduced in 2015 in order to increase profit retention to fund the further growth planned for 2016. The directors believe that the implementation of their medium-to long tern strategies will result in increased returns to investors within the next two to three years." The group's principal activity is the manufacture and sale of domestic and office furniture. Approximately 40% of the product range is bought in from manufacturers in China, Extracts from the annual report of the PAC Group are as follows PAC Group: Consolidated Income Statement for the year ended 31st December 2015 2015 2014 TZS TZS "Million "Million Revenue 120,366 121,351 Cost of Sales (103,024) (102,286) Gross Profit 17,342 19,065 Operating Expenses (11,965) (12,448) Profit from Operations 5,377 6,617 Interest payable (1,469) (906) Profit before tax expenses 5,711 Income tax expenses (1,594) Profit for the period 4,117 Attributable to: Equity holders of the Parent 2,460 3,676 Non-controlling interest 323 441 2,783 4,117 3,908 (1,125) 2,783 1/3 Page 27 of 33 PAC Group: Summarized Consolidated Statement of Changes in Equity for the year ended 31st December 2015 (attributable to equity holders of the parent) Accum Share Share Profit Reserve capital TZS TZS 'Million Reval. premium "Million 2,800 Total 2015 TZS 'Million 24,623 TZS 'Million Total 2014 TZS "Million 21,311 TZS "Million 18,823 3,000 Opening balance Surplus on revaluation of properties Profit for the period Issue of share capital Dividends paid 31/12 Closing balance 2,460 3.676 300 (155) (364) 24,623 21,128 2,000 2.000 2,460 1,200 1,500 (155) 3,100 4,200 2.000 30,428 PAC Group: Consolidated statement of Financial position as at 31st Dec 2015 2015 2014 TZS TZS TZS 'Million "Million Non-current assets TZS "Million Million Property, plant and equipment 40,643 21,322 Goodwill 1,928 1,928 Trademarks and patents 1,004 1,070 43,575 24,320 Current assets Inventories 37,108 27,260 Trade receivables 14,922 17,521 Cash 52,030 44,951 95,605 69,271 TOTAL ASSETS Equity 3,100 2,800 Share capital (TZS 1,000 shares) 4.200 3.000 Share Premium 2,000 Revaluation reserve 18.823 21,128 Accumulated profits 30,428 2,270 170 24,623 1,947 16,700 26,700 24,407 1,594 Non-controlling interest Non-Current liabilities Interest bearing borrowings Current liabilities Trade and other payables Income tax Short-term borrowings TOTAL EQUITY & LIABILITIES 31,420 1,125 3,662 26,001 69,271 36,207 95,605 Scandic 2/3 Required: a) Calculate the earnings per share figure for the PAC Group for the year ended 31 December 2015 and 2014, assuming that there was no change in the number of ordinary shares in issue during 2014. b) Calculate Group's financial position (any four and financial performance (any four ratios for 2014 and 2015 c) Produce a report for the investor that analyse and interprets the financial statements of the Group, commenting upon the group's performance and position. d) Discuss the extent to which the chairman's comments about the potential for improved future performance are supported by the financial statement information for the year ended 31st December 2015 QUESTION 17 You are a financial advisor of a private investor who holds a portfolio of investments in smaller listed companies Recently, she has received the annual report of the PAC Group for the financial year ended 31 December 2015. In accordance with her usual practice, the investor has read the chairman's statement, but has not looked in detail at the figures. Relevant extracts from the chairman's statements are as follows: "Following the replacement of many of the directors, which took place in early March 2015, your new board has worked to expand the group's manufacturing facilities and to replace non-current assets that have reached the end of their useful lives. A new line of storage solutions was designed during the second quarter and was put into production at the beginning of September 2015. Sales efforts have been concentrated on increasing our market share in respect of storage products, and in leading the expansion into East Africa markets. The growth in the business has been financed by a combination of loan capital and the issue of additional shares. The issue of 300,000 new TZS 1,000 shares was fully taken up on 14 November 2015, reflecting believes and market confidence in the group's new management, Dividends have been reduced in 2015 in order to increase profit retention to fund the further growth planned for 2016. The directors believe that the implementation of their medium-to long tern strategies will result in increased returns to investors within the next two to three years." The group's principal activity is the manufacture and sale of domestic and office furniture. Approximately 40% of the product range is bought in from manufacturers in China, Extracts from the annual report of the PAC Group are as follows PAC Group: Consolidated Income Statement for the year ended 31st December 2015 2015 2014 TZS TZS "Million "Million Revenue 120,366 121,351 Cost of Sales (103,024) (102,286) Gross Profit 17,342 19,065 Operating Expenses (11,965) (12,448) Profit from Operations 5,377 6,617 Interest payable (1,469) (906) Profit before tax expenses 5,711 Income tax expenses (1,594) Profit for the period 4,117 Attributable to: Equity holders of the Parent 2,460 3,676 Non-controlling interest 323 441 2,783 4,117 3,908 (1,125) 2,783 1/3 Page 27 of 33 PAC Group: Summarized Consolidated Statement of Changes in Equity for the year ended 31st December 2015 (attributable to equity holders of the parent) Accum Share Share Profit Reserve capital TZS TZS 'Million Reval. premium "Million 2,800 Total 2015 TZS 'Million 24,623 TZS 'Million Total 2014 TZS "Million 21,311 TZS "Million 18,823 3,000 Opening balance Surplus on revaluation of properties Profit for the period Issue of share capital Dividends paid 31/12 Closing balance 2,460 3.676 300 (155) (364) 24,623 21,128 2,000 2.000 2,460 1,200 1,500 (155) 3,100 4,200 2.000 30,428 PAC Group: Consolidated statement of Financial position as at 31st Dec 2015 2015 2014 TZS TZS TZS 'Million "Million Non-current assets TZS "Million Million Property, plant and equipment 40,643 21,322 Goodwill 1,928 1,928 Trademarks and patents 1,004 1,070 43,575 24,320 Current assets Inventories 37,108 27,260 Trade receivables 14,922 17,521 Cash 52,030 44,951 95,605 69,271 TOTAL ASSETS Equity 3,100 2,800 Share capital (TZS 1,000 shares) 4.200 3.000 Share Premium 2,000 Revaluation reserve 18.823 21,128 Accumulated profits 30,428 2,270 170 24,623 1,947 16,700 26,700 24,407 1,594 Non-controlling interest Non-Current liabilities Interest bearing borrowings Current liabilities Trade and other payables Income tax Short-term borrowings TOTAL EQUITY & LIABILITIES 31,420 1,125 3,662 26,001 69,271 36,207 95,605 Scandic 2/3 Required: a) Calculate the earnings per share figure for the PAC Group for the year ended 31 December 2015 and 2014, assuming that there was no change in the number of ordinary shares in issue during 2014. b) Calculate Group's financial position (any four and financial performance (any four ratios for 2014 and 2015 c) Produce a report for the investor that analyse and interprets the financial statements of the Group, commenting upon the group's performance and position. d) Discuss the extent to which the chairman's comments about the potential for improved future performance are supported by the financial statement information for the year ended 31st December 2015