Answered step by step

Verified Expert Solution

Question

1 Approved Answer

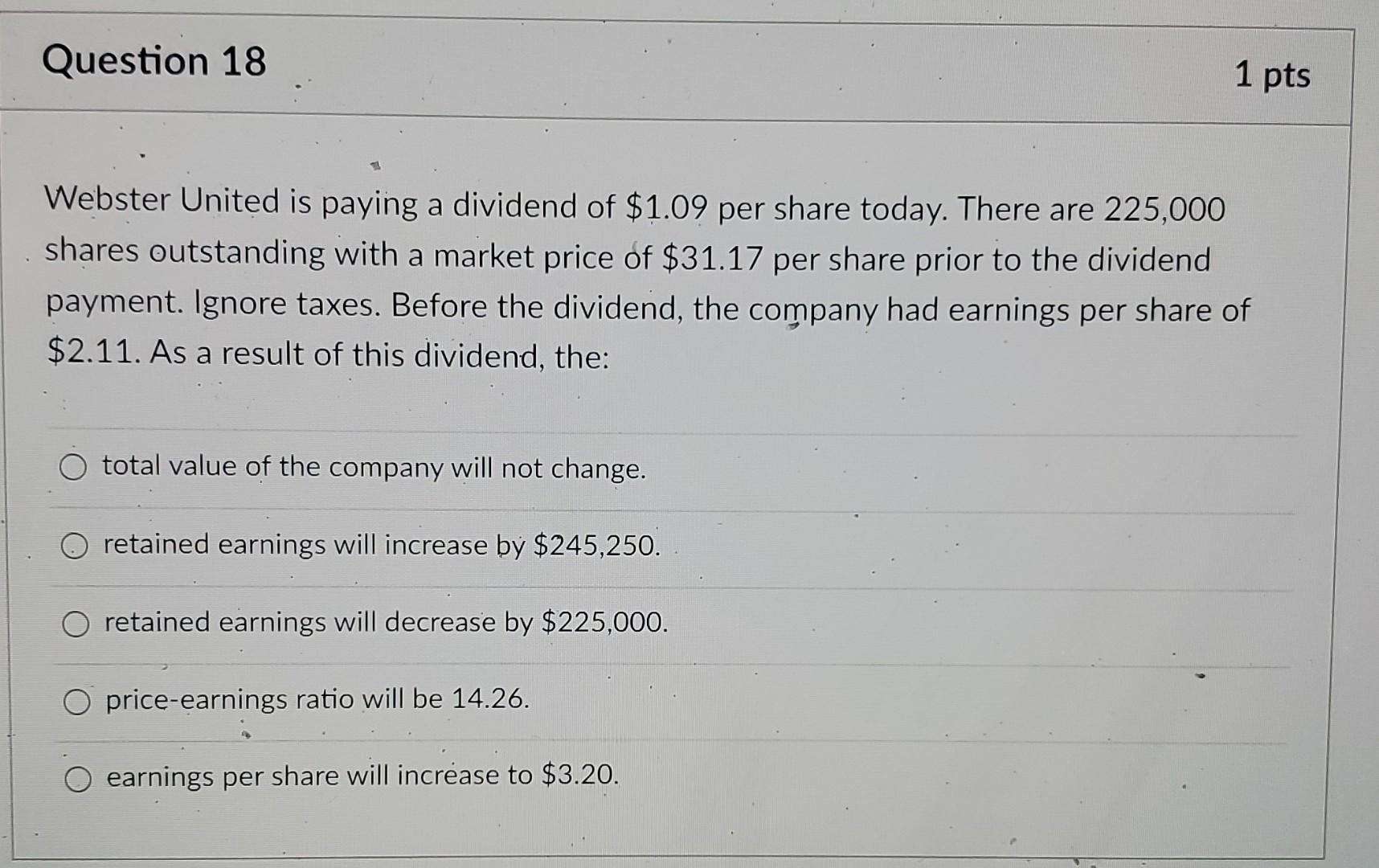

Question 18 1 pts a Webster United is paying a dividend of $1.09 per share today. There are 225,000 shares outstanding with a market price

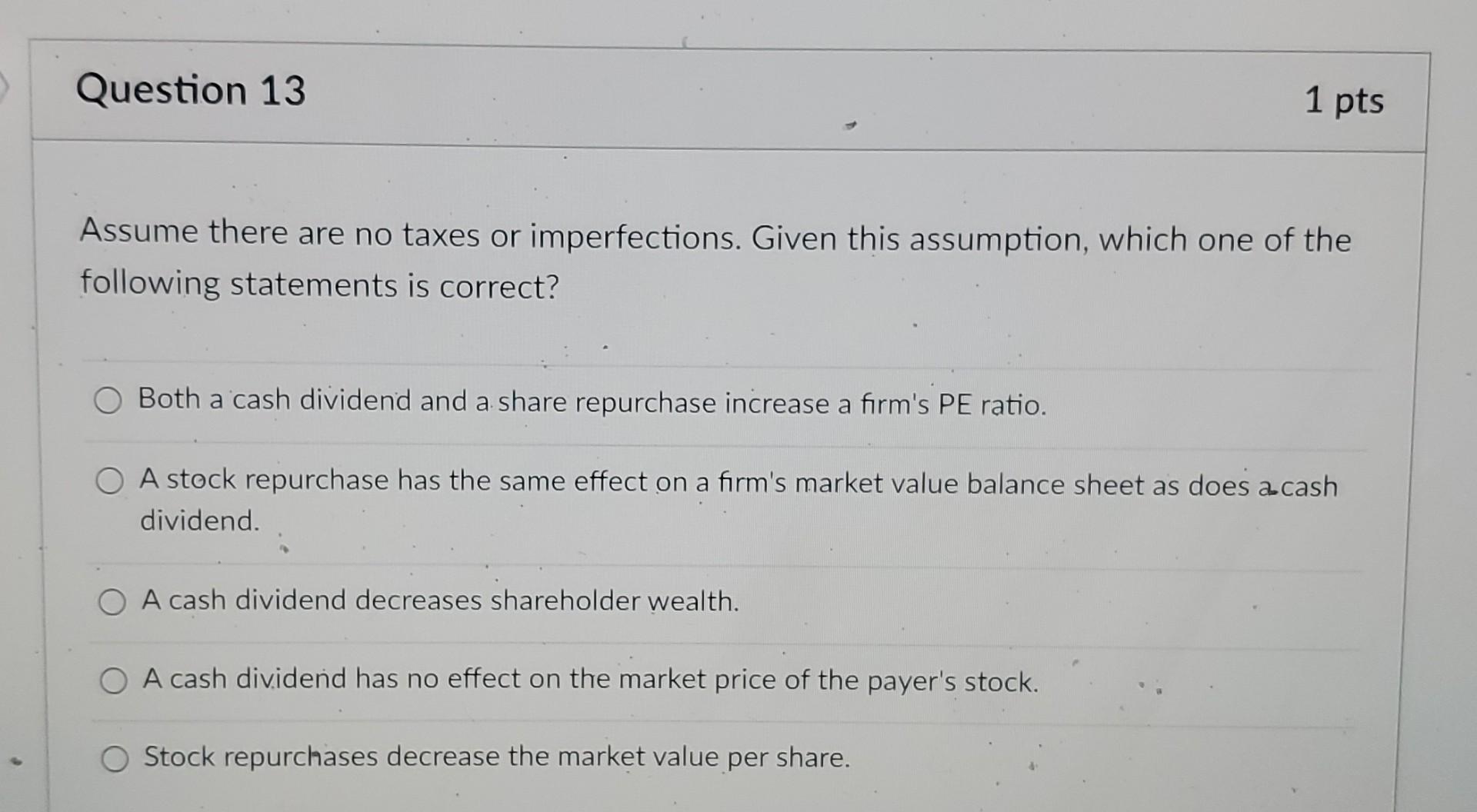

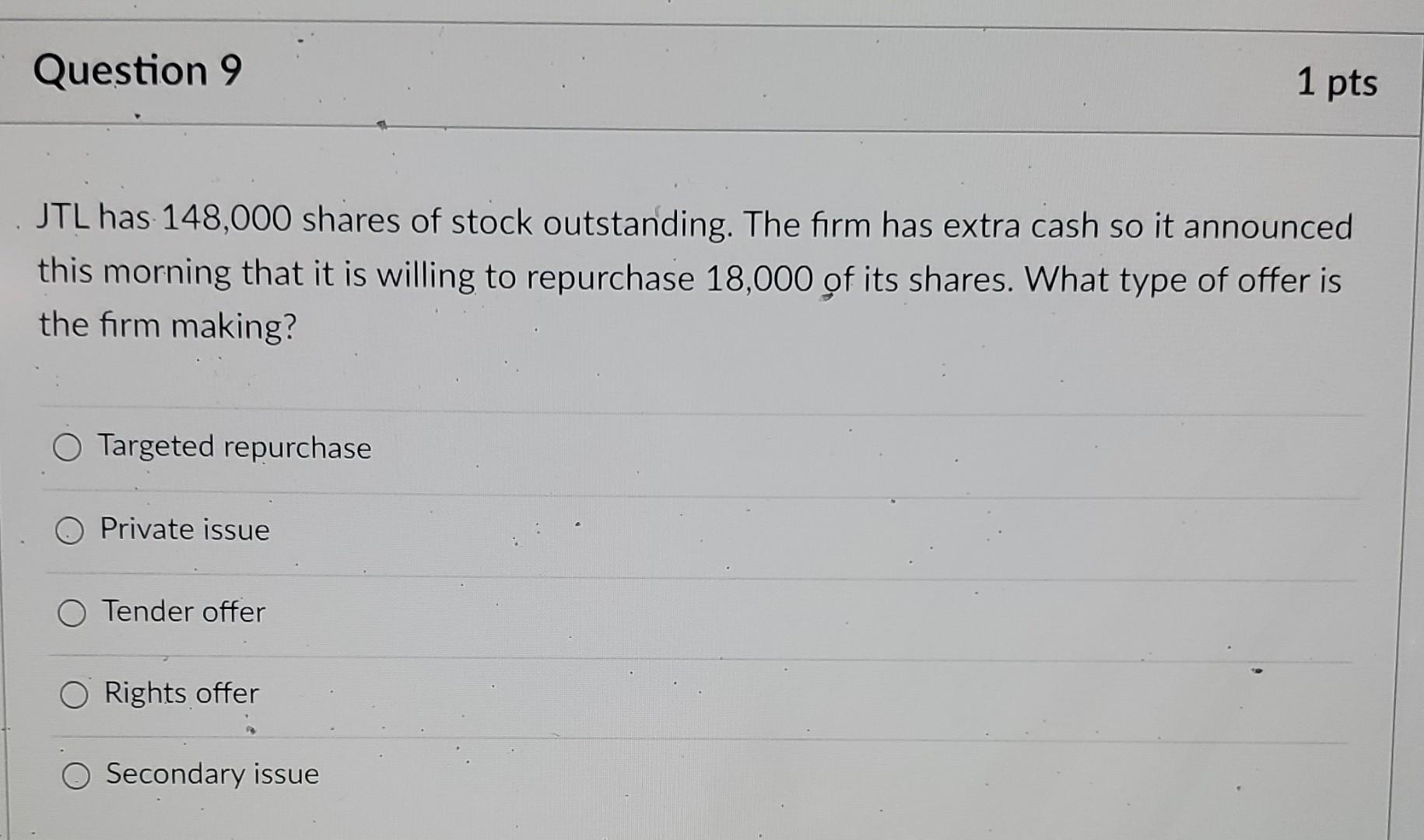

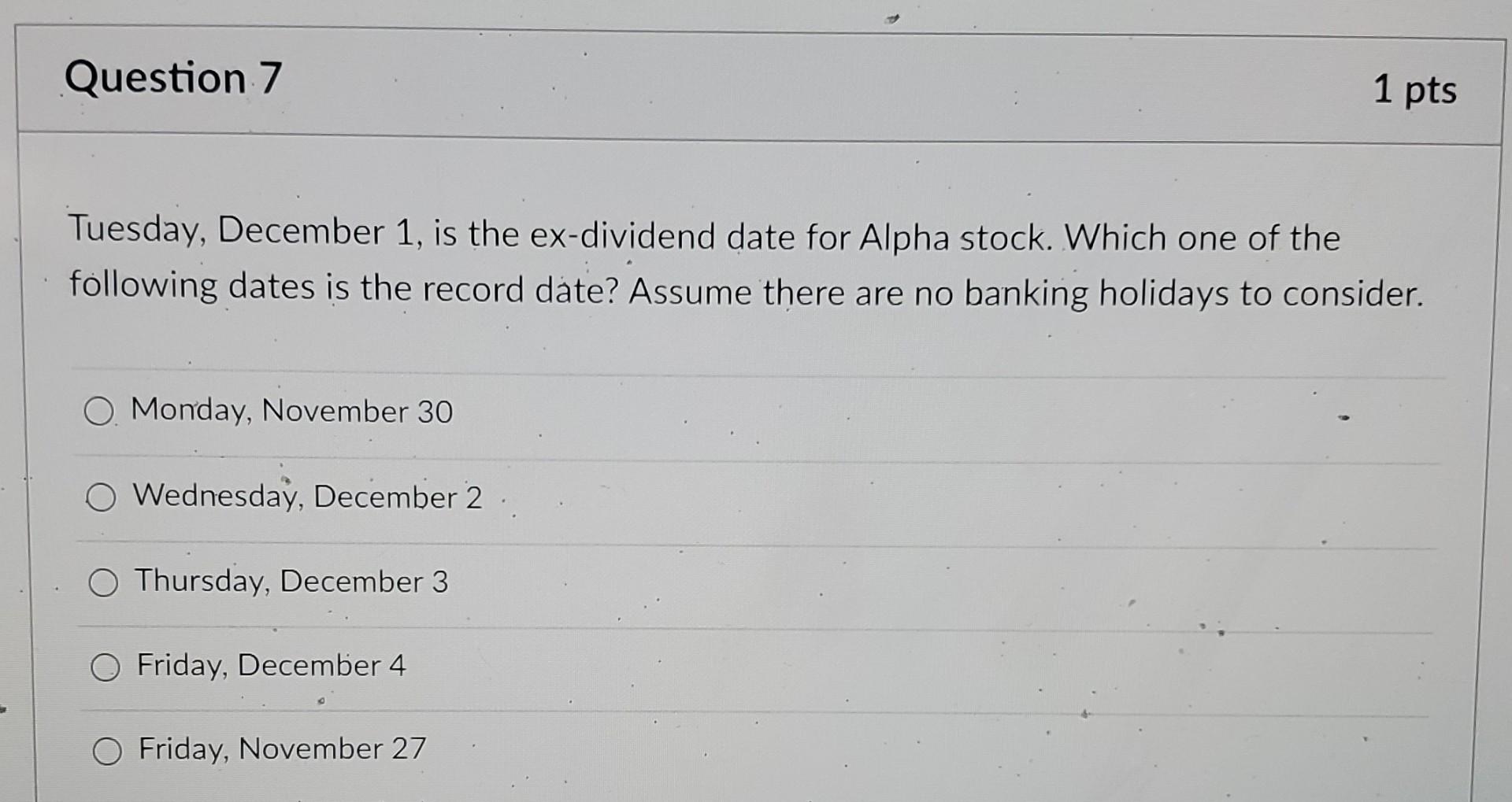

Question 18 1 pts a Webster United is paying a dividend of $1.09 per share today. There are 225,000 shares outstanding with a market price of $31.17 per share prior to the dividend payment. Ignore taxes. Before the dividend, the company had earnings per share of $2.11. As a result of this dividend, the: total value of the company will not change. O retained earnings will increase by $245,250. retained earnings will decrease by $225,000. price-earnings ratio will be 14.26. earnings per share will increase to $3.20. Question 13 1 pts Assume there are no taxes or imperfections. Given this assumption, which one of the following statements is correct? O Both a cash dividend and a share repurchase increase a firm's PE ratio. O A stock repurchase has the same effect on a firm's market value balance sheet as does a cash dividend. O A cash dividend decreases shareholder wealth. O A cash dividend has no effect on the market price of the payer's stock. Stock repurchases decrease the market value per share. Question 9 1 pts JTL has 148,000 shares of stock outstanding. The firm has extra cash so it announced this morning that it is willing to repurchase 18,000 of its shares. What type of offer is the firm making? O Targeted repurchase Private issue Tender offer O Rights offer Secondary issue Question 7 1 pts Tuesday, December 1, is the ex-dividend date for Alpha stock. Which one of the following dates is the record dte? Assume there are no banking holidays to consider. O Monday, November 30 O Wednesday, December 2 Thursday, December 3 O Friday, December 4 Friday, November 27

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started