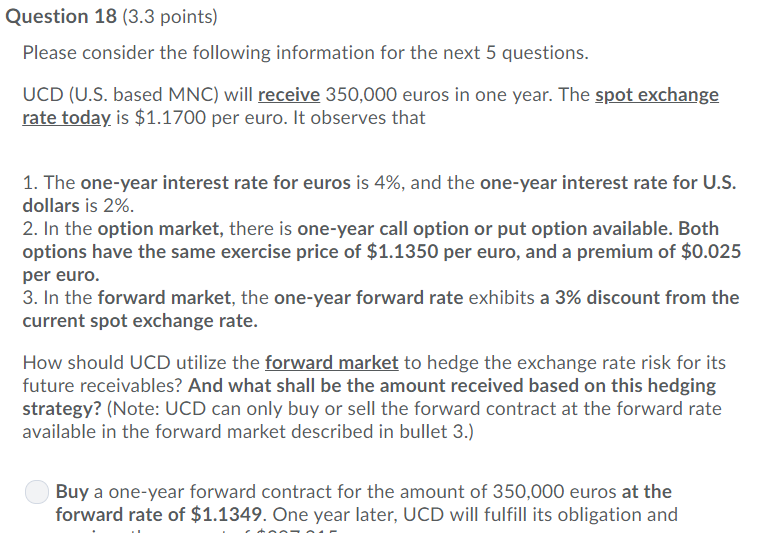

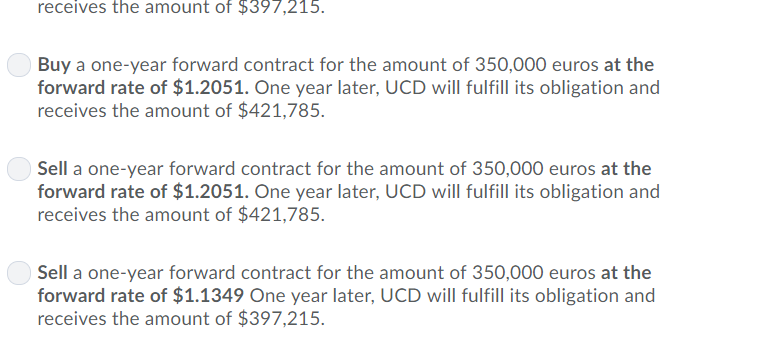

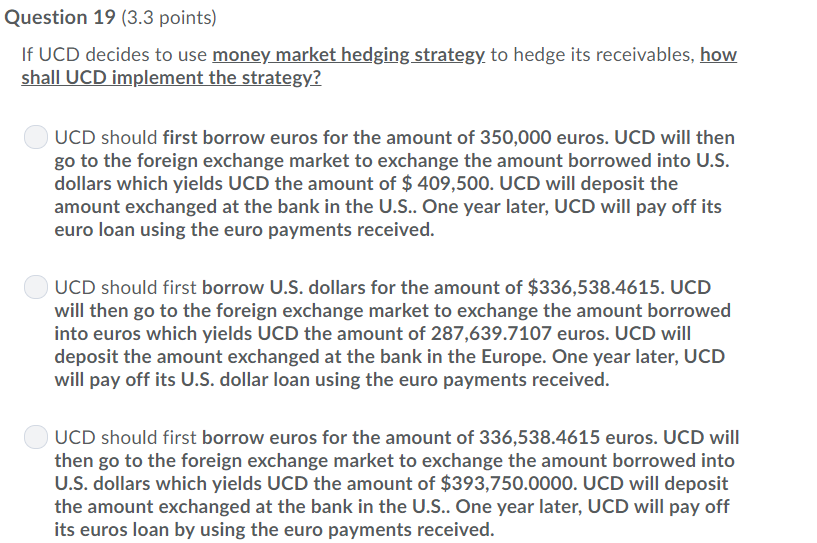

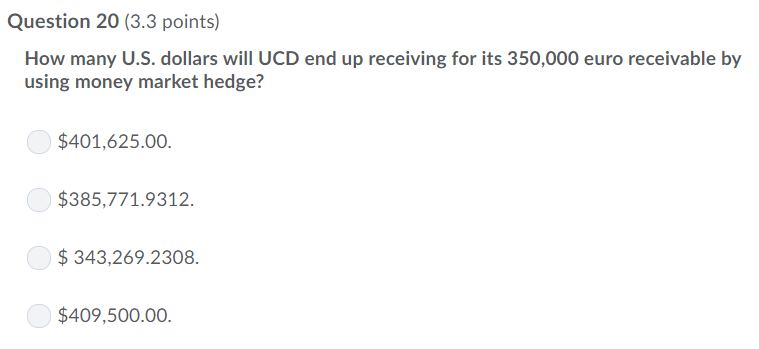

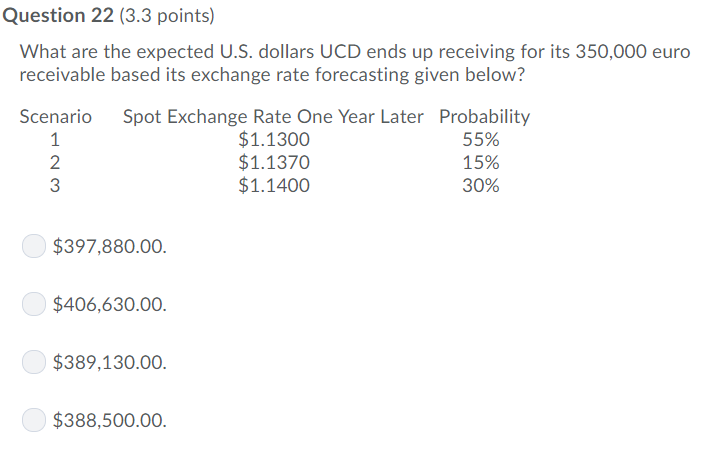

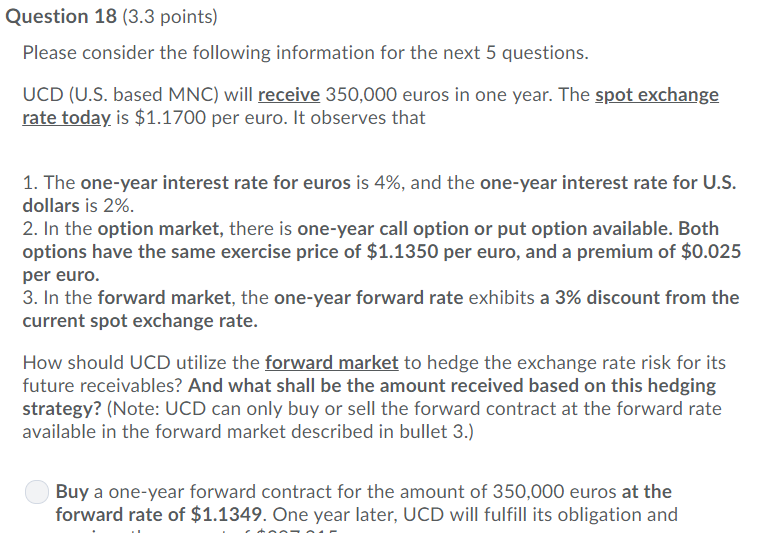

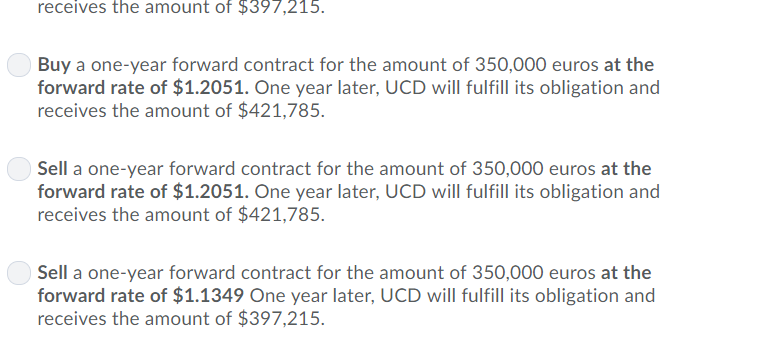

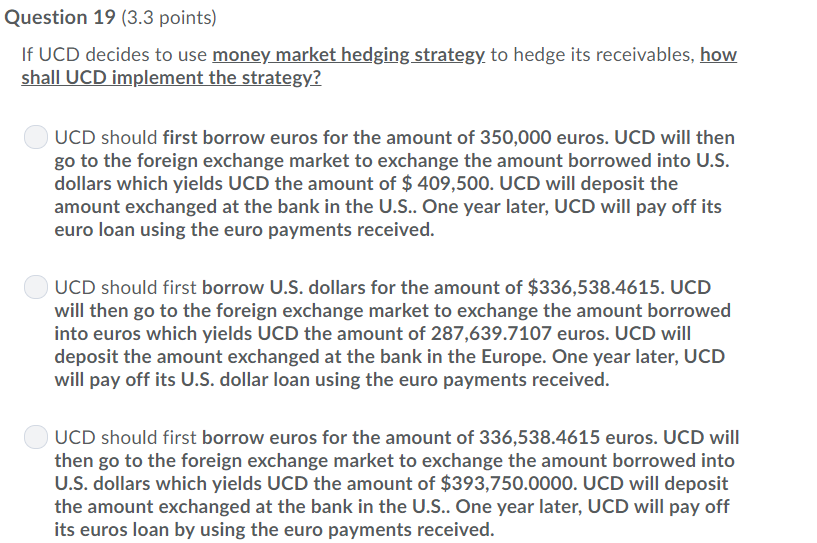

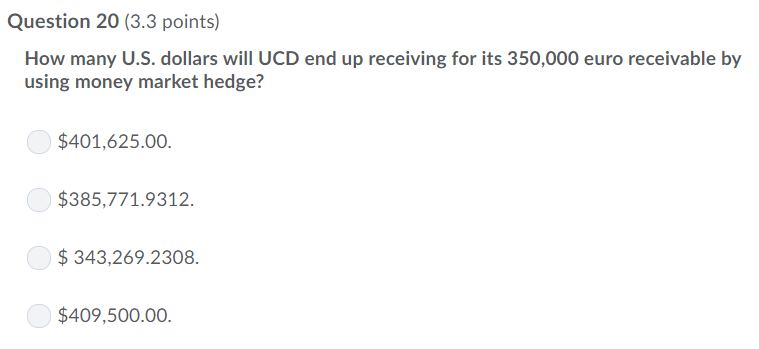

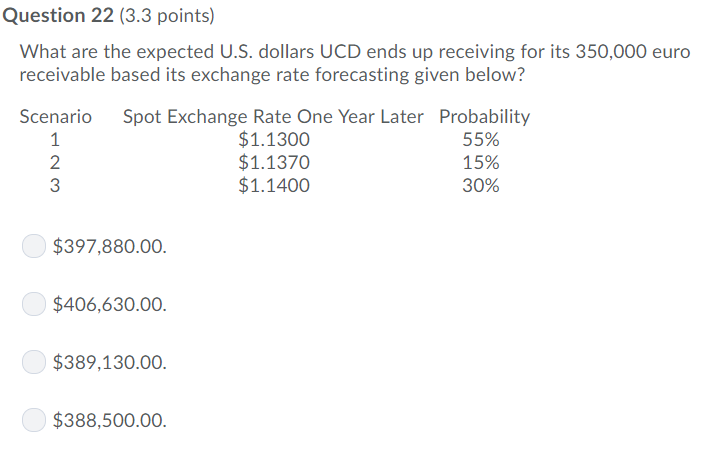

Question 18 (3.3 points) Please consider the following information for the next 5 questions. UCD (U.S. based MNC) will receive 350,000 euros in one year. The spot exchange rate today is $1.1700 per euro. It observes that I. The one-year interest rate for euros is 4%, and the one-year interest rate for us. dollars is 2%. 2. In the option market, there is one-year call option or put option available. Both options have the same exercise price of $1.1350 per euro, and a premium of $0.025 per euro. 3. In the forward market, the one-year forward rate exhibits a 3% discount from the current spot exchange rate. How should UCD utilize the forward market to hedge the exchange rate risk for its future receivables? And what shall be the amount received based on this hedging strategy? (Note: UCD can only buy or sell the forward contract at the forward rate available in the forward market described in bullet 3.) Buy a one-year forward contract for the amount of 350,000 euros at the forward rate of $1.1349. One year later, UCD will fulfill its obligation and receives the amount of $397,215. Buy a one-year forward contract for the amount of 350,000 euros at the forward rate of $1.2051. One year later, UCD will fulfill its obligation and receives the amount of $421,785. Sell a one-year forward contract for the amount of 350,000 euros at the forward rate of $1.2051. One year later, UCD will fulfill its obligation and receives the amount of $421,785. Sell a one-year forward contract for the amount of 350,000 euros at the forward rate of $1.1349 One year later, UCD will fulfill its obligation and receives the amount of $397,215. Question 19 (3.3 points) If UCD decides to use money market hedging strategy to hedge its receivables, how shall UCD implement the strategy? UCD should first borrow euros for the amount of 350,000 euros. UCD will then go to the foreign exchange market to exchange the amount borrowed into U.S. dollars which yields UCD the amount of $ 409,500. UCD will deposit the amount exchanged at the bank in the U.S.. One year later, UCD will pay off its euro loan using the euro payments received UCD should first borrow U.S.dollars for the amount of $336,538.4615. UCD will then go to the foreign exchange market to exchange the amount borrowed into euros which yields UCD the amount of 287,639.7107 euros. UCD will deposit the amount exchanged at the bank in the Europe. One year later, UCD will pay off its U.S. dollar loan using the euro payments received UCD should first borrow euros for the amount of 336,538.4615 euros. UCD will then go to the foreign exchange market to exchange the amount borrowed into U.S. dollars which yields UCD the amount of $393,750.0000. UCD will deposit the amount exchanged at the bank in the U.S.. One year later, UCD will pay off its euros loan by using the euro payments received. Question 20 (3.3 points) How many U.S. dollars will UCD end up receiving for its 350,000 euro receivable by using money market hedge? $401,625.00 $385,771.9312 $343,269.2308. $409,500.00. Question 22 (3.3 points) What are the expected U.S. dollars UCD ends up receiving for its 350,000 euro receivable based its exchange rate forecasting given below? Scenario Spot Exchange Rate One Year Later Probability $1.1300 $1.1370 $1.1400 55% 15% 30% 2 3 $397,880.00 $406,630.00 $389,130.00. $388,500.00