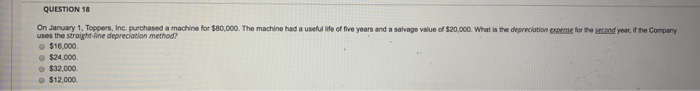

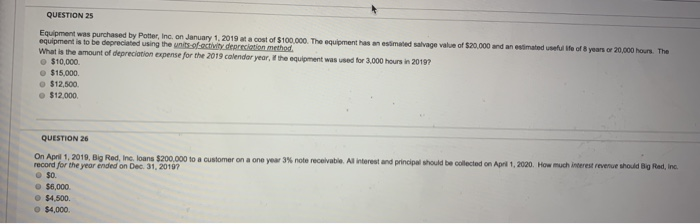

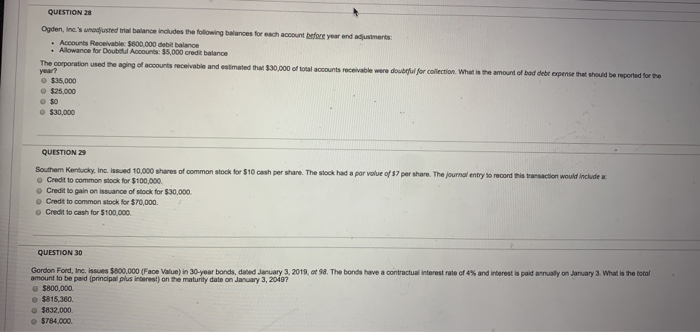

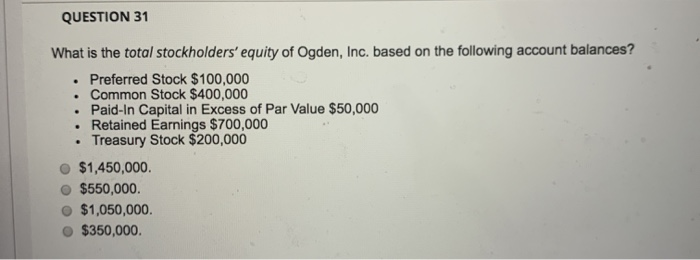

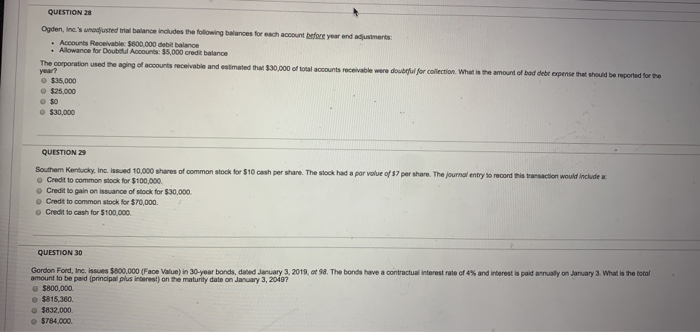

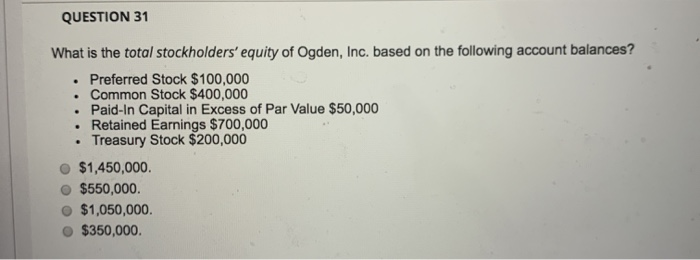

QUESTION 18 e of five years and a salvage value of $20,000. What is the depreciation rent for the second year, if the Company On January 1, Toppers, Inc. purchased a machine for $80,000. The machine had a us uses the straight-line depreciation method? $16.000 $24.000 $32.000 $12,000 QUESTION 25 Equipment was purchased by Potter, Inc. on January 1, 2019 at a cost of $100.000. The equipment has an estimated salvage value of $20,000 and an estimated useful ife of 8 years or 20,000 hours. The equipment is to be depreciated using the wifecy depreciation method What is the amount of depreciation expense for the 2019 calendar year, the equipment was used for 3.000 hours in 2019? $10,000 $15.000 $12.500 $12.000 QUESTION 26 not receivable. Al interest and principal should be collected on April 1, 2020 How much interest revenue should B Radic On April 1, 2019. Big Red, Inc. loan $200.000 to a customer on a one year record for the year ended on Dec 31, 20187 $0. $6,000 54,500 $4,000 QUESTION 28 Ogden, in justed trial balance includes the following balances for each account before year and adjustments: Accounts Receivable: $600.000 debit balance Allowance for Douth Account: $5,000 credit balance The corporation used the aging of accounts receive and estimated that $30.000 of ou r doubforo What is the mount of bad debe expense that would be record for the 30 $25.000 SO $30,000 QUESTION 29 entry to record is transaction would include a Southern Kentucky Inc issued 10,000 shares of common stock for $10 cash per share. The stock hada por volue of 17 per share. The r Credit to common stock for $100,000 Credit to gain on issuance of stock for $30.000 Credit to common stock for $70.000 Credit to cash for $100.000 QUESTION 30 9. The bonds have a contractual interest rate of anderest is paid annually on January 3. What is the total Gordon Ford, inc e s $800,000 Face Value in your bonds, and January 3, 2019. amount to be paid (principal plus interest) on the maturity date on January 3, 20497 $800.000 $815360 $832 000 ST4000 QUESTION 31 What is the total stockholders' equity of Ogden, Inc. based on the following account balances? . Preferred Stock $100,000 Common Stock $400,000 Paid-In Capital in Excess of Par Value $50,000 Retained Earnings $700,000 Treasury Stock $200,000 $1,450,000 $550,000. $1,050,000. $350,000