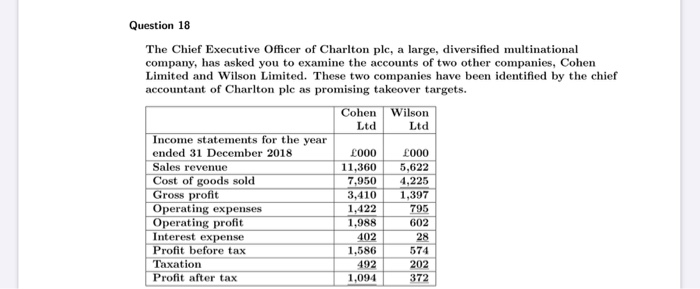

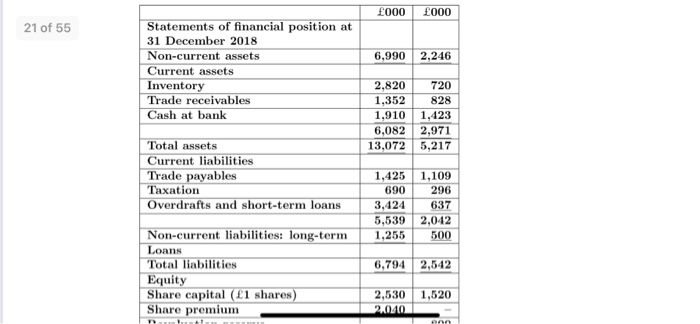

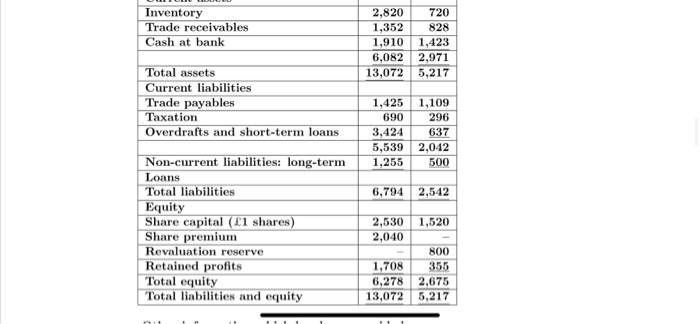

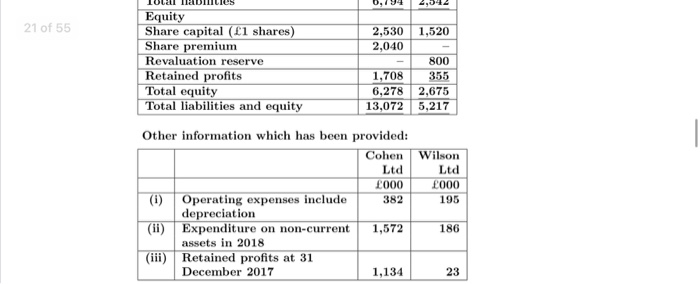

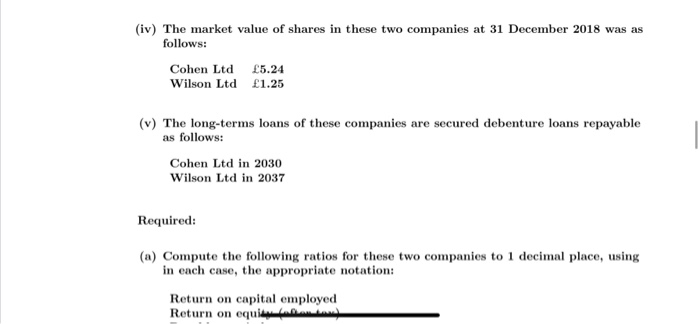

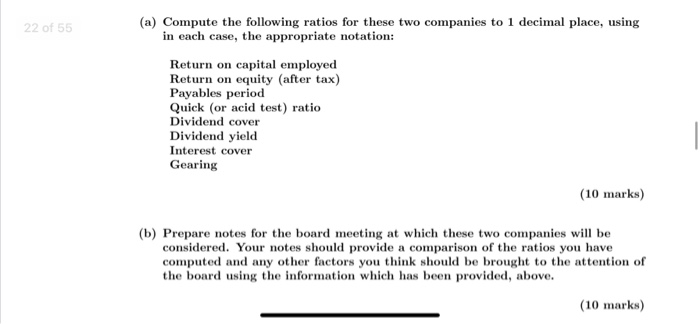

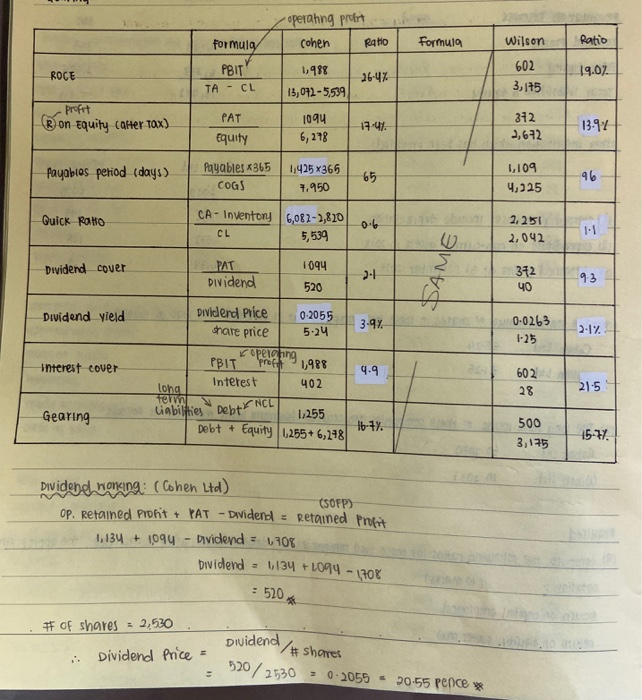

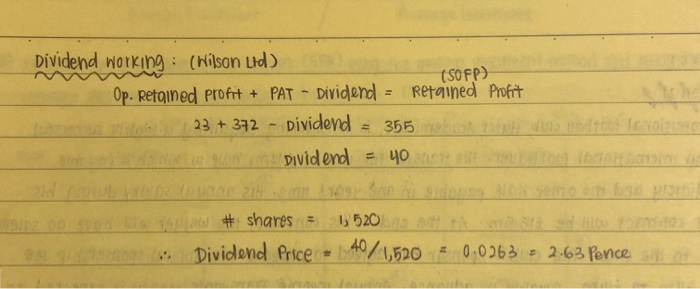

Question 18 The Chief Executive Officer of Charlton ple, a large, diversified multinational company, has asked you to examine the accounts of two other companies, Cohen Limited and Wilson Limited. These two companies have been identified by the chief accountant of Charlton ple as promising takeover targets. Cohen Wilson Ltd Ltd Income statements for the year ended 31 December 2018 L000 000 Sales revenue 11,360 5,622 Cost of goods sold 7,950 4,225 Gross profit 3,410 1,397 Operating expenses 1,422 795 Operating profit 1,988 602 Interest expense 402 Profit before tax 1,586 574 Taxation 492 202 Profit after tax 1,094 372 28 000 000 21 of 55 6,990 2,246 Statements of financial position at 31 December 2018 Non-current assets Current assets Inventory Trade receivables Cash at bank 2,820 1,352 1,910 6,082 13,072 720 828 1,423 2,971 5,217 Total assets Current liabilities Trade payables Taxation Overdrafts and short-term loans 1,425 690 3,424 5,539 1,255 1,109 296 637 2,042 500 6,794 2,542 Non-current liabilities: long-term Loans Total liabilities Equity Share capital (1 shares) Share premium 1,520 2,530 2.040 A Inventory Trade receivables Cash at bank 2,820 720 1,352 828 1,910 1,423 6,082 2,971 13,072 5,217 Total assets Current liabilities Trade payables Taxation Overdrafts and short-term loans 1,425 690 3,424 5,539 1,255 1,109 296 637 2,042 500 6,794 2,542 Non-current liabilities: long-term Loans Total liabilities Equity Share capital (L'1 shares) Share premium Revaluation reserve Retained profits Total equity Total liabilities and equity 2,530 1,520 2,040 800 1,708 355 6,278 2,675 13,072 5,217 0,99 49044 21 of 55 Equity Share capital (L'1 shares) Share premium Revaluation reserve Retained profits Total equity Total liabilities and equity 2,530 1,520 2,040 800 1,708 355 6,278 2,675 13,072 5,217 Ltd Other information which has been provided: Cohen Wilson Ltd 000 000 (0) Operating expenses include 382 195 depreciation Expenditure on non-current 1,572 186 assets in 2018 (iii) Retained profits at 31 December 2017 1,134 23 (iv) The market value of shares in these two companies at 31 December 2018 was as follows: Cohen Ltd 5.24 Wilson Ltd 1.25 (v) The long-terms loans of these companies are secured debenture loans repayable as follows: Cohen Ltd in 2030 Wilson Ltd in 2037 Required: (a) Compute the following ratios for these two companies to 1 decimal place, using in each case, the appropriate notation: Return on capital employed Return on equiem 22 of 55 (a) Compute the following ratios for these two companies to 1 decimal place, using in each case, the appropriate notation: Return on capital employed Return on equity (after tax) Payables period Quick (or acid test) ratio Dividend cover Dividend yield Interest cover Gearing (10 marks) (b) Prepare notes for the board meeting at which these two companies will be considered. Your notes should provide a comparison of the ratios you have computed and any other factors you think should be brought to the attention of the board using the information which has been provided, above. (10 marks) operahng print cohen Ratio Formula Ratio Formula PBIT TA CL Wilson 602 3,175 ROCE 1,988 13,072-5539 26-4% 19.07. profit on Equity coher tox) PAT 1094 6, 278 17.47 372 2,672 13.94 Equity Payabias period (days) Payables X365 COGS 1,425 X365 1,950 65 1,109 4,325 96 Quick Rako CA-Inventony 6,082-2,810 CL 0.6 2.251 2,042 1.1 5,539 Dividend cover PAT Dividend 1094 520 2.1 SAME 372 40 9.3 Dividend yield Dividend price share price 0-2055 5.24 3.9%. 0.0263 1-25 2-1%. Koperting Interest cover PBIT Interest long Termi NCL Liabilities Debt 1,988 402 4.9 602 28 21:5 Gearing 1,255 Debt + Equity 1,255+6,278 16-18 500 3,175 15-77 (SOFP) Dividere woning: (Cohen Ltd) Op. retained profit + VAT - Dividend 1,134 + 1094 - Dividend = 1108 Dividend Retained Profit 1,134 +1094 - 1706 : 520 # of shares = 2,530 Dividend Dividend price 520/2530 4 /# shares - 0.2055 - 20:55 pence Dividend working : (Wilson Lid) (SOFP) Op. Retained profit + PAT - Dividend = Retained Profit 23 + 372 - Dividend = 355 Dividend = 40 i # shares = 15209 . Dividend Price = 40/1,520 = 0.0063 -2.63 Pence on SOTA I have completed on 18 ca but in I need help to on 18(b). I do not khow how to compare and analyze 97 the ratios. I would need answers from to an 18 (b) with explanation ! Thank you for the help