Answered step by step

Verified Expert Solution

Question

1 Approved Answer

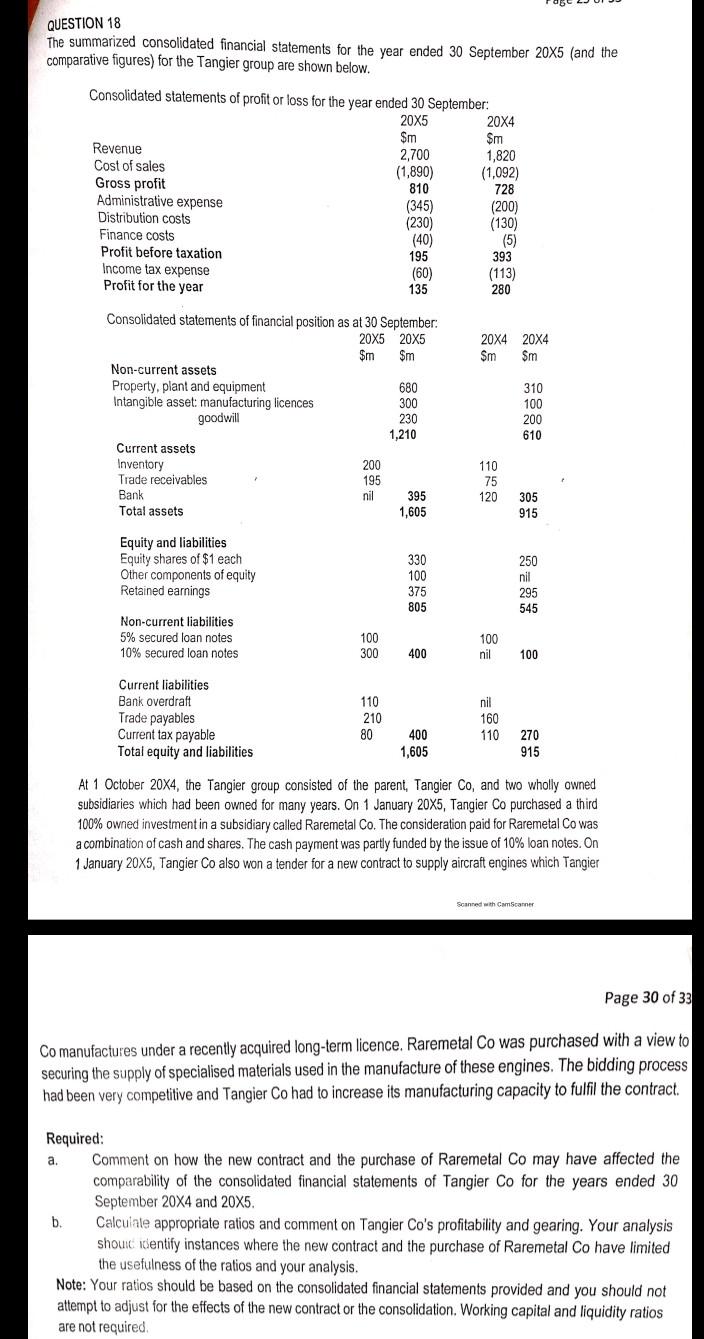

QUESTION 18 The summarized consolidated financial statements for the year ended 30 September 20X5 (and the comparative figures) for the Tangier group are shown below.

QUESTION 18 The summarized consolidated financial statements for the year ended 30 September 20X5 (and the comparative figures) for the Tangier group are shown below. Consolidated statements of profit or loss for the year ended 30 September: 20X5 20X4 $m $m Revenue 2,700 1,820 Cost of sales (1,890) (1,092) Gross profit 810 728 Administrative expense (345) (200) Distribution costs (230) (130) Finance costs (40) (5) Profit before taxation 195 393 Income tax expense (60) (113) Profit for the year 135 280 20X4 20X4 Sm $m Consolidated statements of financial position as at 30 September 20x5 20x5 $m $m Non-current assets Property, plant and equipment 680 Intangible asset manufacturing licences 300 goodwill 230 1,210 Current assets Inventory 200 Trade receivables 195 Bank nil 395 Total assets 1,605 310 100 200 610 110 75 120 305 915 Equity and liabilities Equity shares of $1 each Other components of equity Retained earnings 330 100 375 805 250 nil 295 545 Non-current liabilities 5% secured loan notes 10% secured loan notes 100 300 100 nil 400 100 Current liabilities Bank overdraft Trade payables Current tax payable Total equity and liabilities 110 210 80 nil 160 110 400 1,605 270 915 At 1 October 20X4, the Tangier group consisted of the parent, Tangier Co, and two wholly owned subsidiaries which had been owned for many years. On 1 January 20X5, Tangier Co purchased a third 100% owned investment in a subsidiary called Raremetal Co. The consideration paid for Raremetal Co was a combination of cash and shares. The cash payment was partly funded by the issue of 10% loan notes. On 1 January 20X5, Tangier Co also won a tender for a new contract to supply aircraft engines which Tangier Scanned with ComScanner Page 30 of 33 Co manufactures under a recently acquired long-term licence. Raremetal Co was purchased with a view to securing the supply of specialised materials used in the manufacture of these engines. The bidding process had been very competitive and Tangier Co had to increase its manufacturing capacity to fulfil the contract Required: a. Comment on how the new contract and the purchase of Raremetal Co may have affected the comparability of the consolidated financial statements of Tangier Co for the years ended 30 September 20X4 and 20X5. b. Calculate appropriate ratios and comment on Tangier Co's profitability and gearing. Your analysis should identify instances where the new contract and the purchase of Raremetal Co have limited the usefulness of the ratios and your analysis. Note: Your ratios should be based on the consolidated financial statements provided and you should not attempt to adjust for the effects of the new contract or the consolidation. Working capital and liquidity ratios are not required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started