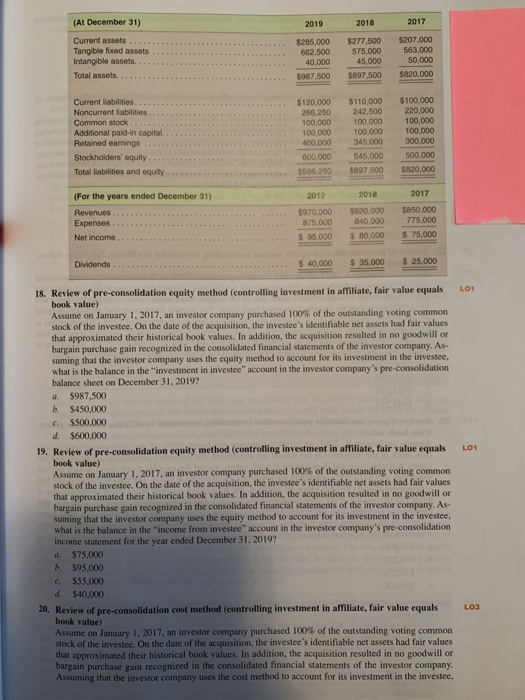

Question 18-20 are based off this sane chart

2019 2018 2017 (At December 31) Current assets Tangible fixed assets Intangible assets. Total assets.. $285,000 662,500 40.000 $987,500 $277.500 575,000 45,000 $897.500 $207.000 563.000 50,000 $320,000 Current liabilities Noncurrent liabilities Common stock Additional pald-in capital Retained earnings Stockholders' equity Total liabilities and equity $120,000 266,250 100,000 100,000 400,000 600,000 $110,000 242,500 100,000 100.000 345,000 545,000 $897500 $100,000 220,000 100,000 100,000 300,000 500,000 $820,000 $986250 2012 2018 (For the years ended December 31) Revenues Expenses Net Income $970,000 875,000 $ 95,000 $920.000 840,000 $ 80,000 2017 $850,000 775,000 $ 75,000 Dividends $ 40,000 $ 35,000 $ 25,000 LOI LO1 18. Review of pre-consolidation equity method (controlling investment in affiliate, fair value equals book value) Assume on January 1, 2017, an investor company purchased 100% of the outstanding voting common stock of the investee. On the date of the acquisition, the investee's identifiable net assets had fair values that approximated their historical book values. In addition, the acquisition resulted in no goodwill or bargain purchase gain recognized in the consolidated financial statements of the investor company. As. suming that the investor company uses the equity method to account for its investment in the investee, what is the balance in the investment in investee" account in the investor company's pre-consolidation balance sheet on December 31, 2019? $987.500 b $450,000 c. $500,000 d. $600.000 19. Review of pre-consolidation equity method (controlling investment in affiliate, fair value equals book value) Assume on January 1, 2017, an investor company purchased 100% of the outstanding voting common stock of the investee. On the date of the acquisition, the investee's identifiable net assets had fair values that approximated their historical book values. In addition, the acquisition resulted in no goodwill or bargain purchase gain recognized in the consolidated financial statements of the investor company. As- suming that the investor company uses the equity method to account for its investment in the investee, what is the balance in the "income from investee" account in the investor company's pre-consolidation income statement for the year ended December 31, 2019? $75,000 b. $95.000 $55.000 d. $40,000 20. Review of pre-consolidation cost method (controlling investment in affiliate, fair value equals book value) Assume on January 1, 2017. an investor company purchased 100% of the outstanding voting common stock of the investee. On the date of the acquisition, the investee's identifiable net assets had fair values that approximated their historical book values. In addition, the acquisition resulted in no goodwill or bargain purchase gain recognized in the consolidated financial statements of the investor company Assuming that the investor company uses the cost method to account for its investment in the investee, LO3