Answered step by step

Verified Expert Solution

Question

1 Approved Answer

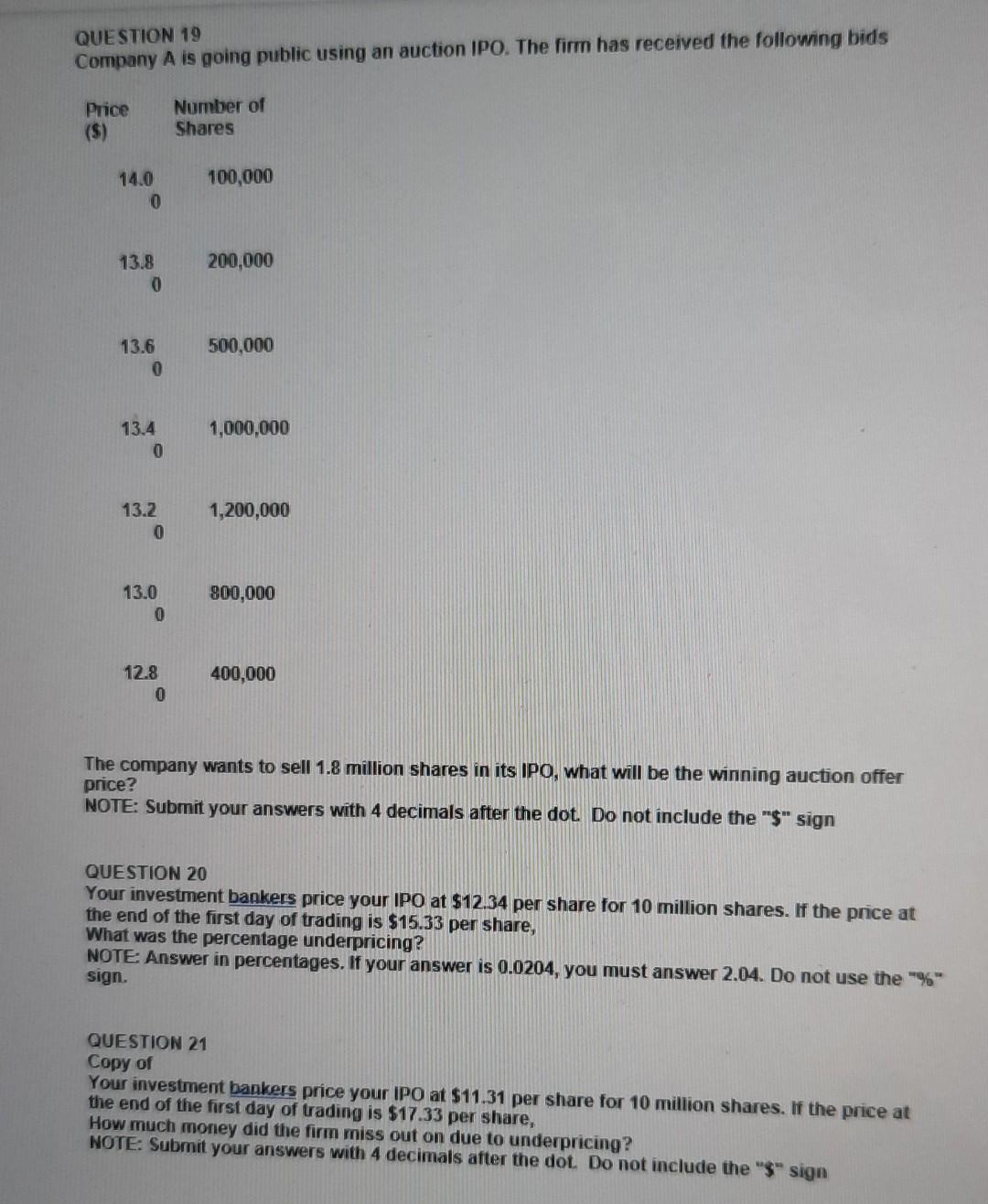

QUESTION 19 Company A is going public using an auction IPO. The firm has received the following bids The company wants to sell 1.8 million

QUESTION 19 Company A is going public using an auction IPO. The firm has received the following bids The company wants to sell 1.8 million shares in its IPO, what will be the winning auction offer price? NOTE: Submit your answers with 4 decimals after the dot. Do not include the " \( \$ " \)quot; sign QUESTION 20 Your investment bankers price your IPO at $12.34 per share for 10 million shares. If the price at the end of the first day of trading is $15.33 per share, What was the percentage underpricing? NOTE: Answer in percentages. If your answer is 0.0204, you must answer 2.04. Do not use the "\%" sign. QUESTION 21 Copy of Your investment bankers price your IPO at \$11.31 per share for 10 million shares. If the price at the end of the first day of trading is $17.33 per share, How much money did the firm miss out on due to underpricing? NOTE: Submit your answers with 4 decimals after the dot. Do not include the " $ " sign

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started