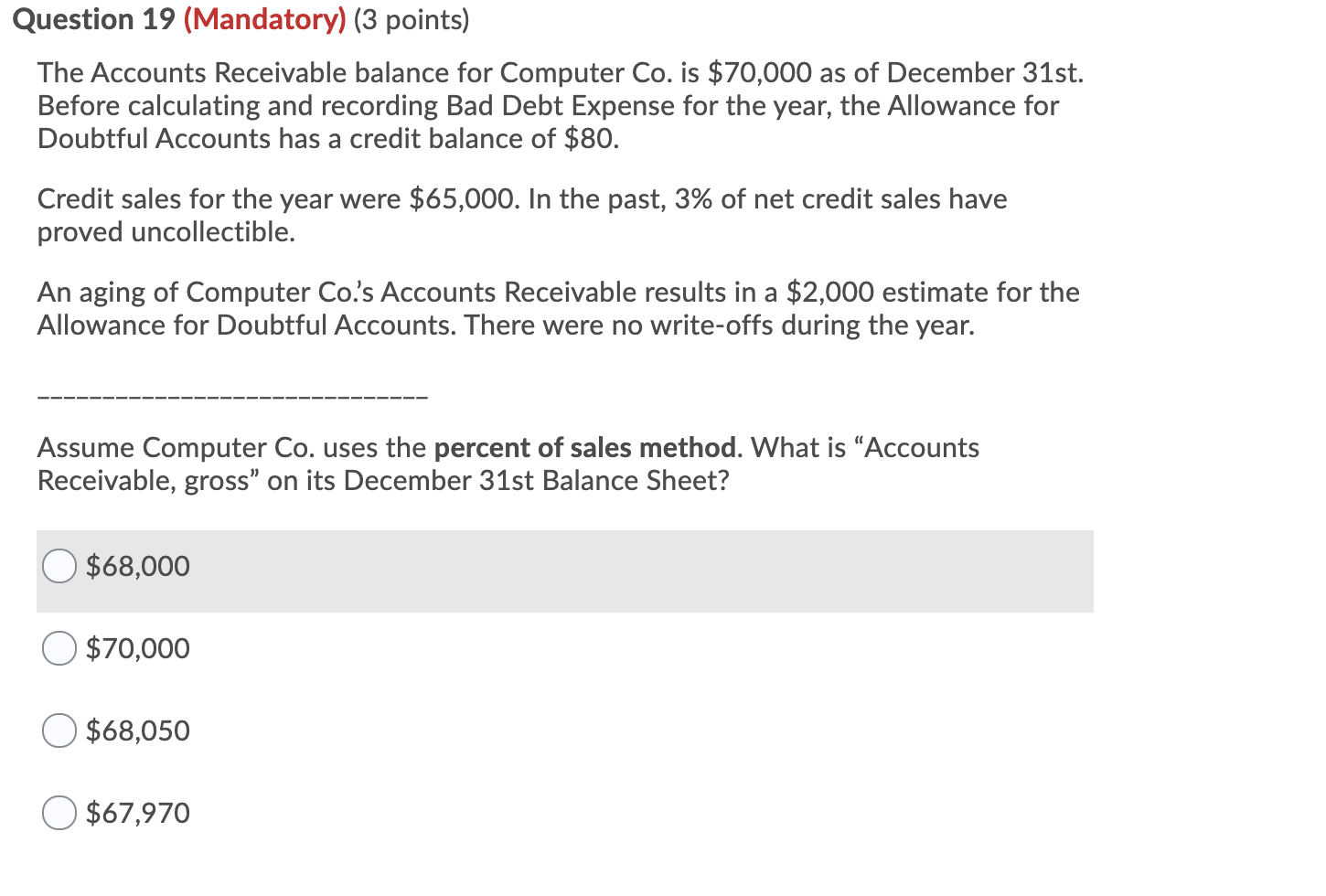

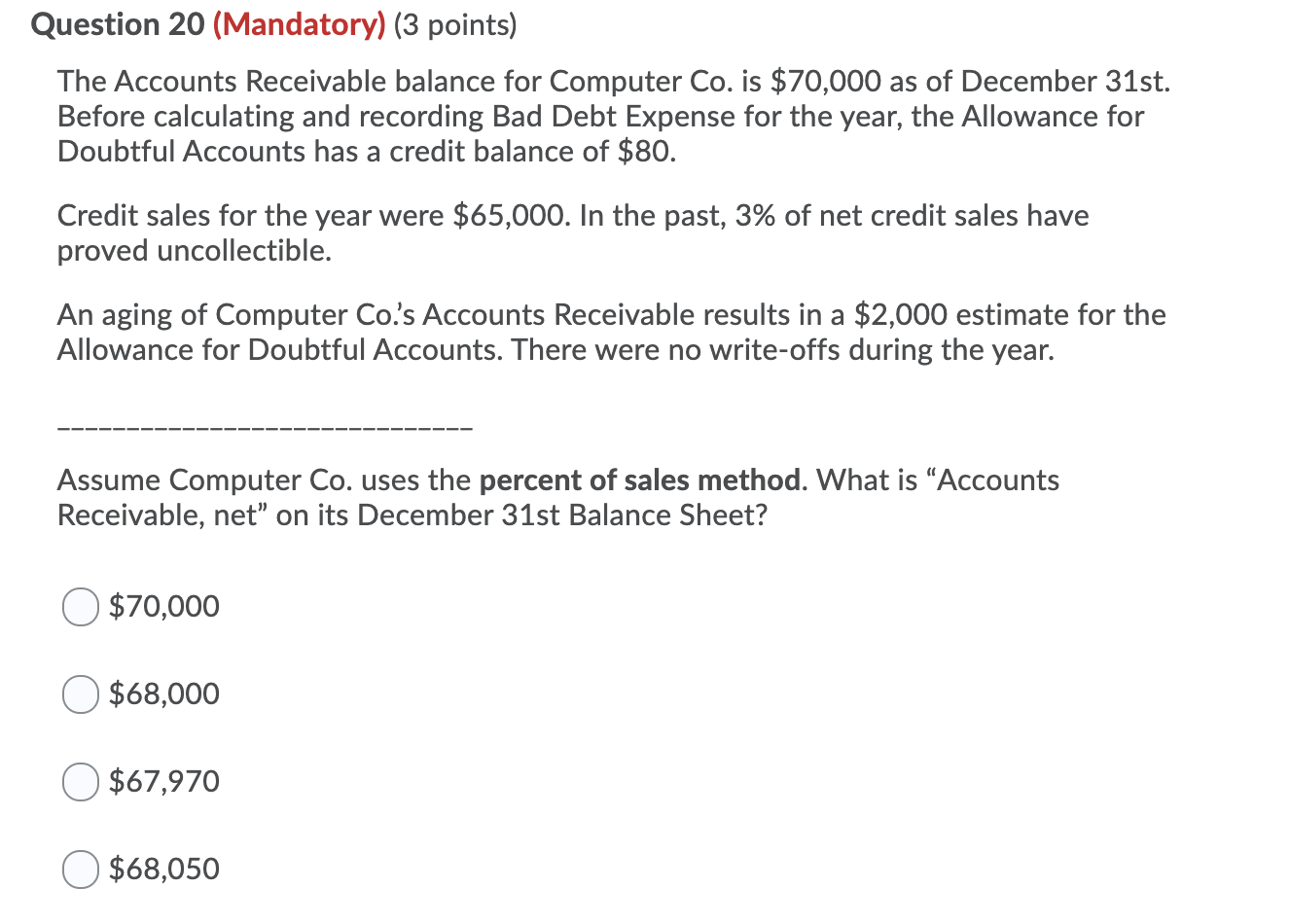

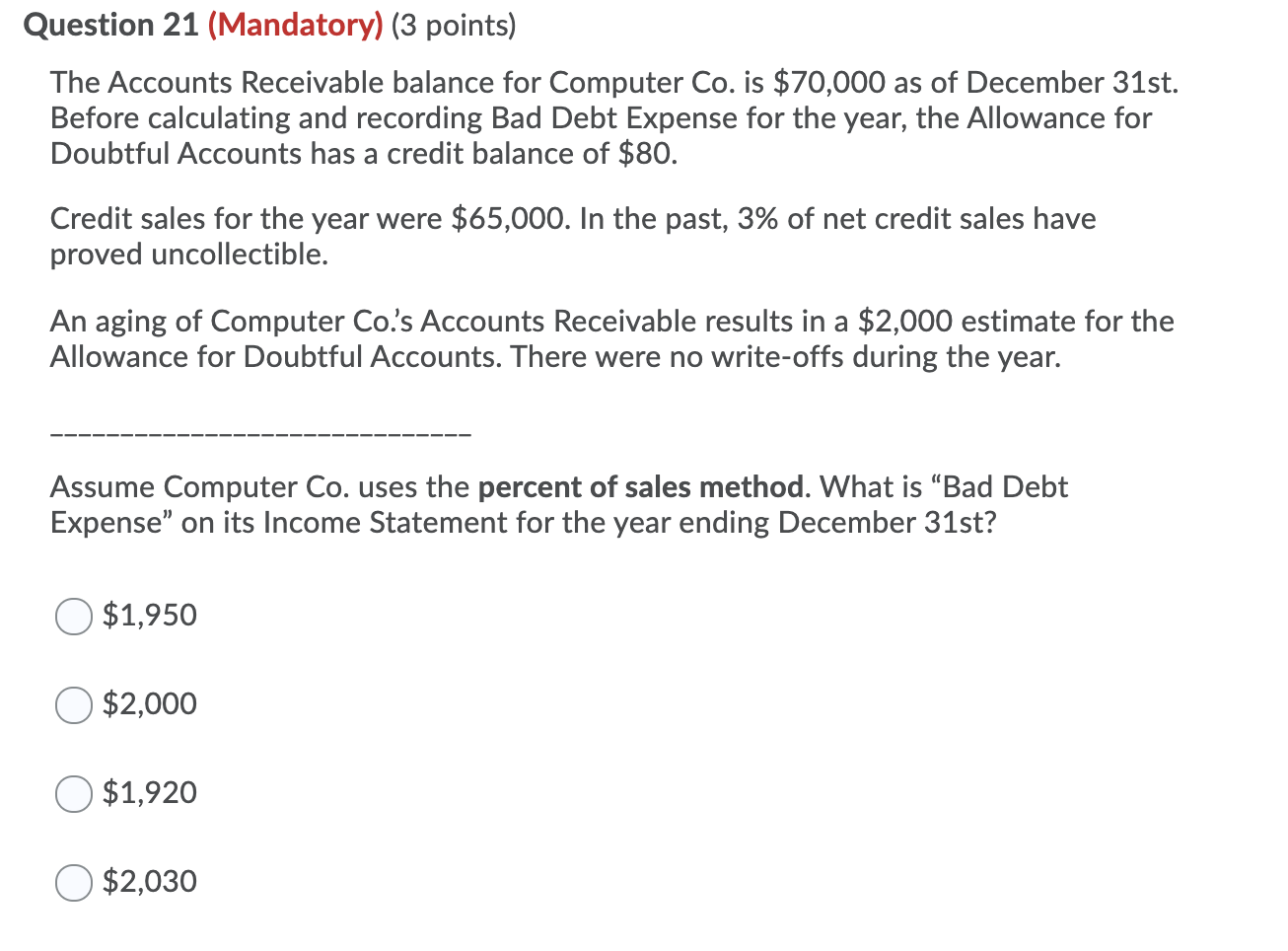

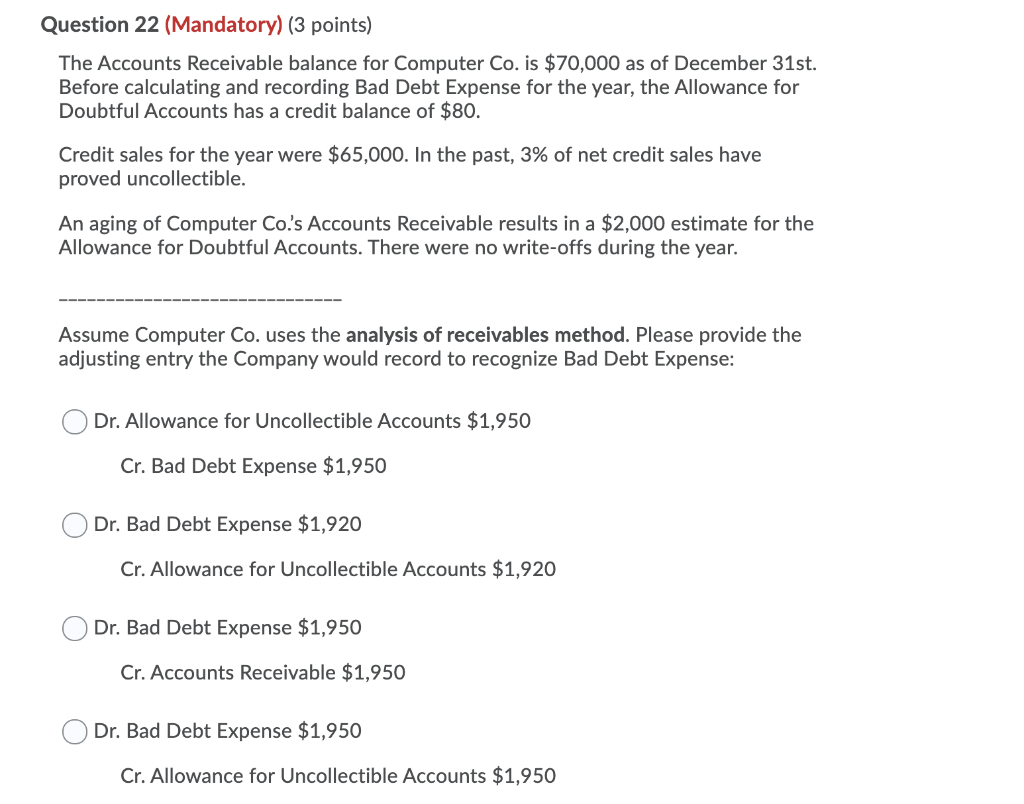

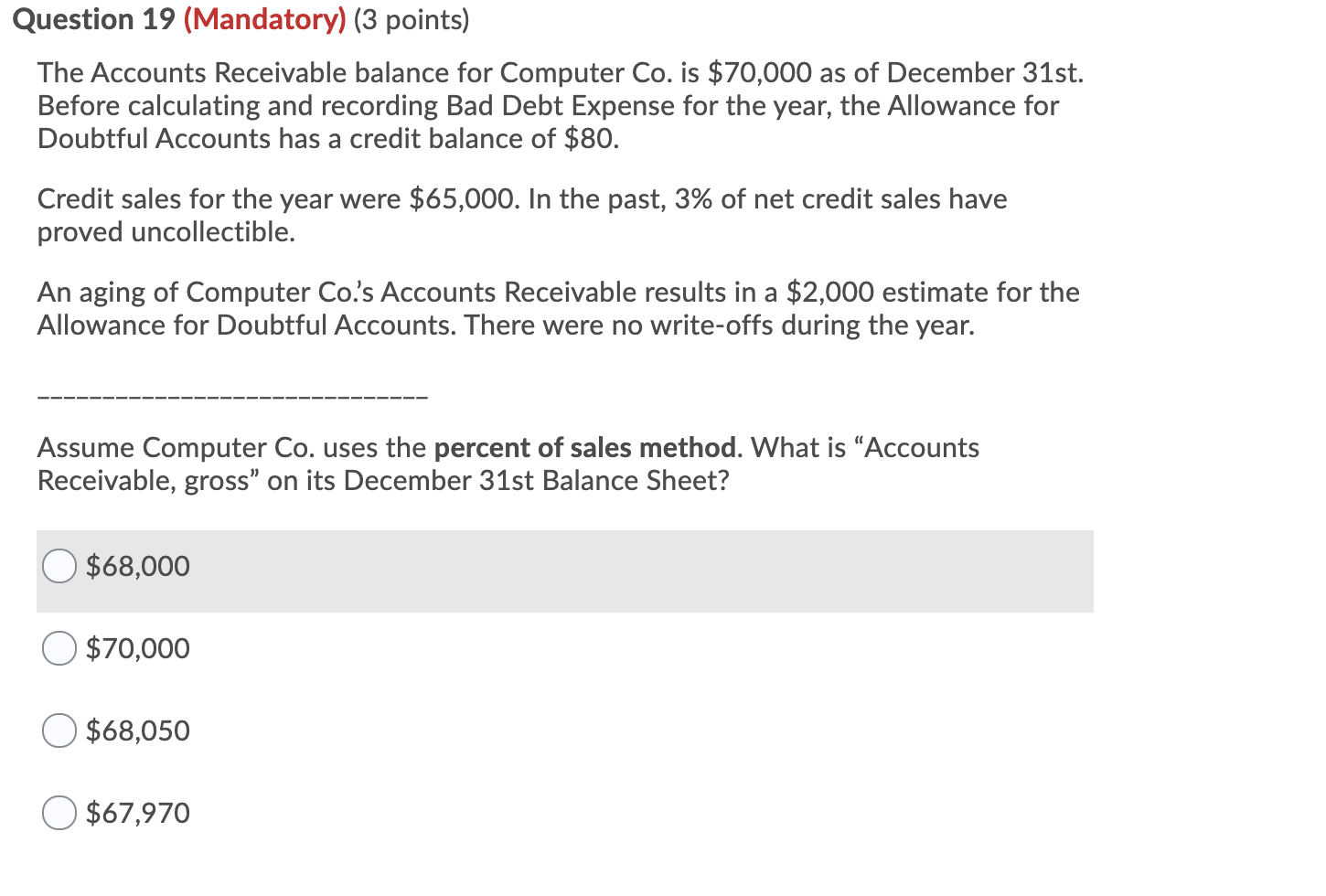

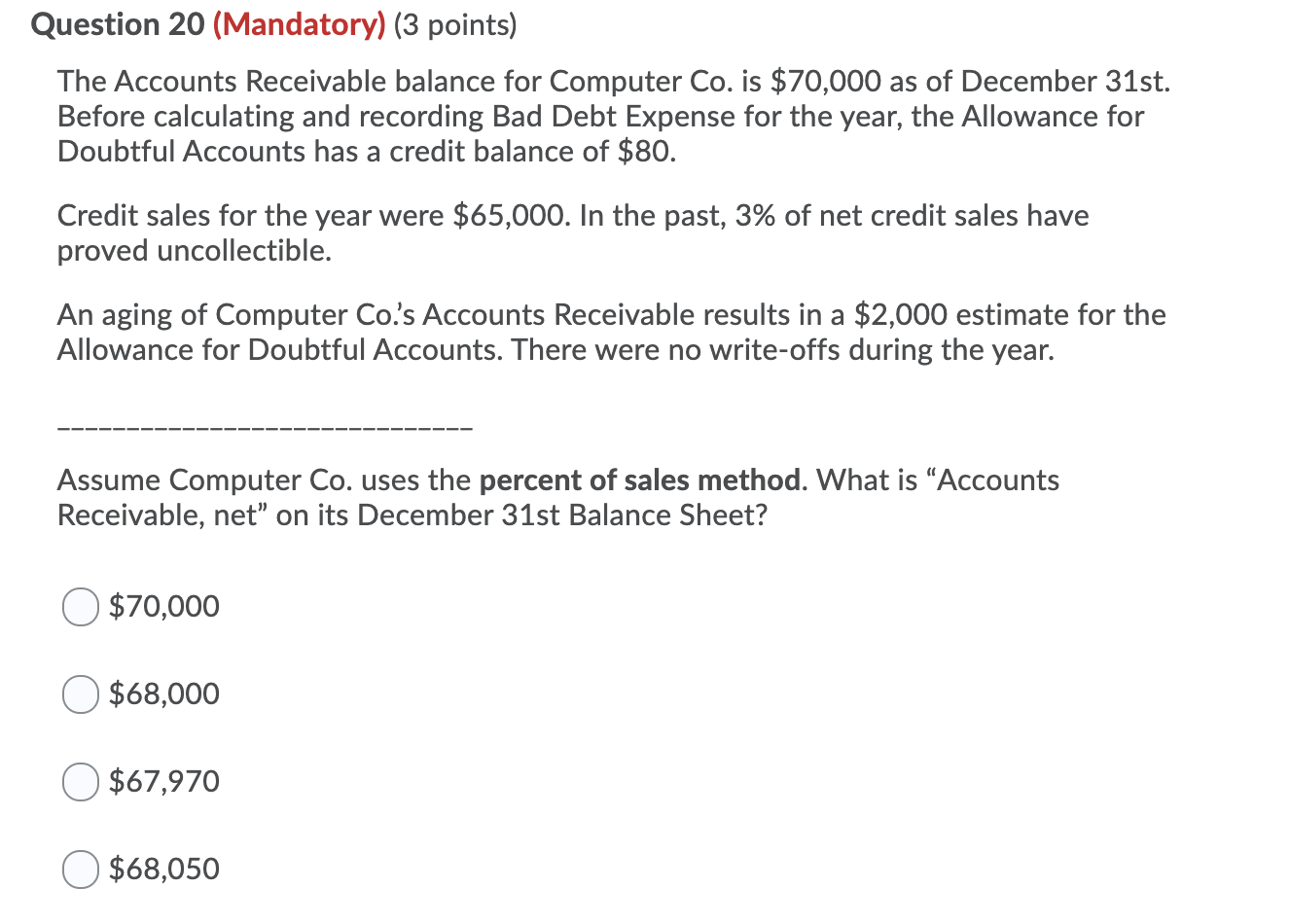

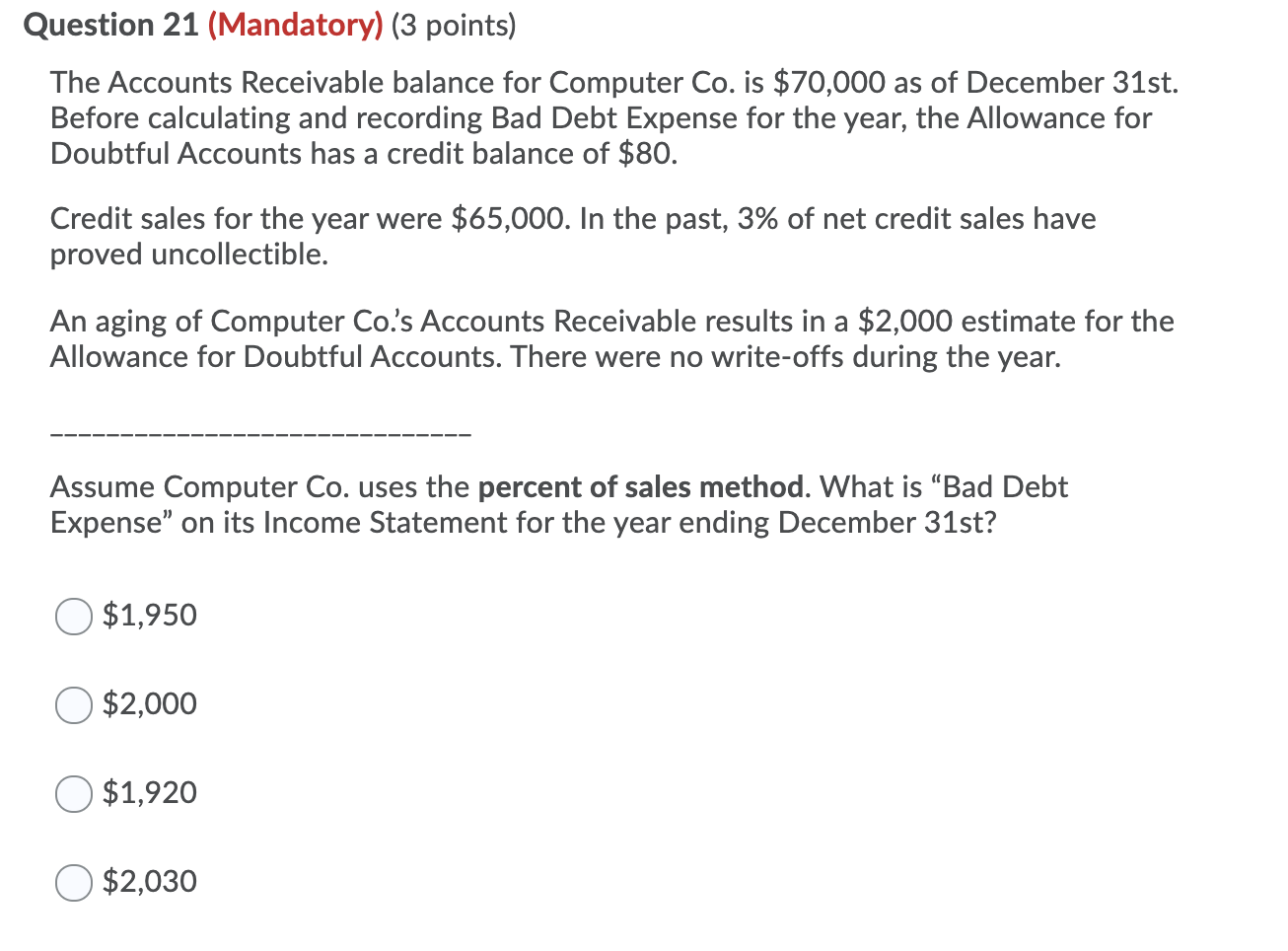

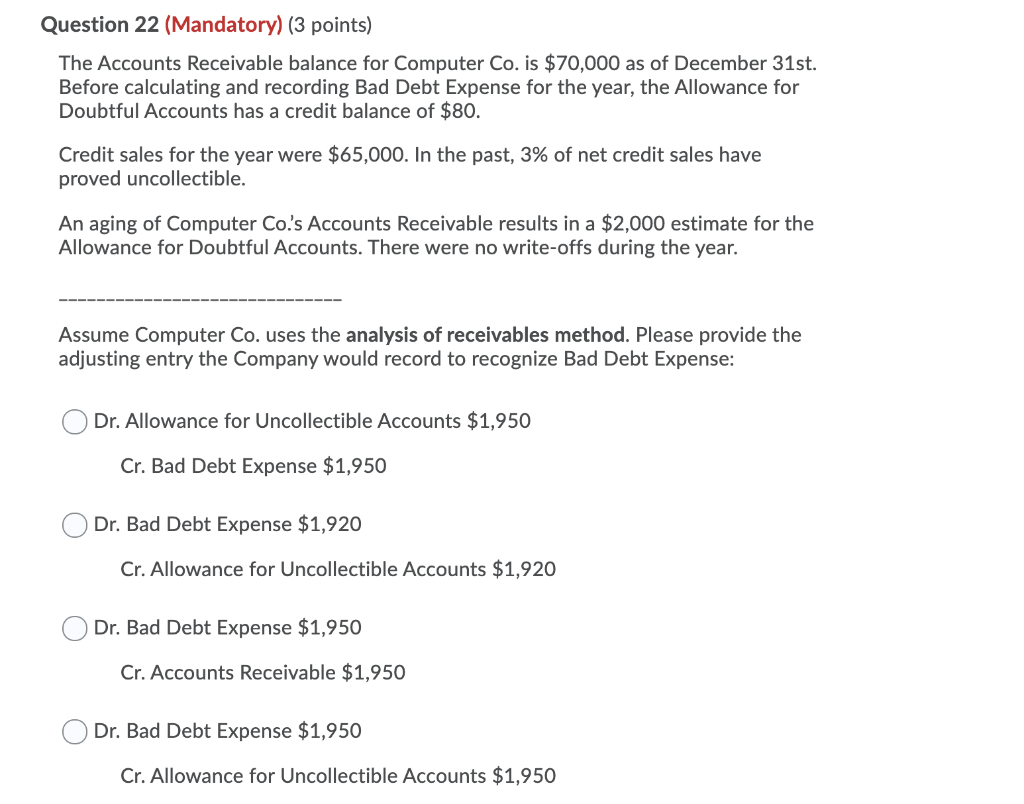

Question 19 (Mandatory) (3 points) The Accounts Receivable balance for Computer Co. is $70,000 as of December 31st. Before calculating and recording Bad Debt Expense for the year, the Allowance for Doubtful Accounts has a credit balance of $80. Credit sales for the year were $65,000. In the past, 3% of net credit sales have proved uncollectible. An aging of Computer Co.'s Accounts Receivable results in a $2,000 estimate for the Allowance for Doubtful Accounts. There were no write-offs during the year. Assume Computer Co. uses the percent of sales method. What is Accounts Receivable, gross" on its December 31st Balance Sheet? $68,000 $70,000 $68,050 $67,970 Question 20 (Mandatory) (3 points) The Accounts Receivable balance for Computer Co. is $70,000 as of December 31st. Before calculating and recording Bad Debt Expense for the year, the Allowance for Doubtful Accounts has a credit balance of $80. Credit sales for the year were $65,000. In the past, 3% of net credit sales have proved uncollectible. An aging of Computer Co.'s Accounts Receivable results in a $2,000 estimate for the Allowance for Doubtful Accounts. There were no write-offs during the year. Assume Computer Co. uses the percent of sales method. What is Accounts Receivable, net" on its December 31st Balance Sheet? $70,000 $68,000 $67,970 $68,050 Question 21 (Mandatory) (3 points) The Accounts Receivable balance for Computer Co. is $70,000 as of December 31st. Before calculating and recording Bad Debt Expense for the year, the Allowance for Doubtful Accounts has a credit balance of $80. Credit sales for the year were $65,000. In the past, 3% of net credit sales have proved uncollectible. An aging of Computer Co.'s Accounts Receivable results in a $2,000 estimate for the Allowance for Doubtful Accounts. There were no write-offs during the year. Assume Computer Co. uses the percent of sales method. What is Bad Debt Expense" on its Income Statement for the year ending December 31st? O $1,950 $2,000 $1,920 $2,030 Question 22 (Mandatory) (3 points) The Accounts Receivable balance for Computer Co. is $70,000 as of December 31st. Before calculating and recording Bad Debt Expense for the year, the Allowance for Doubtful Accounts has a credit balance of $80. Credit sales for the year were $65,000. In the past, 3% of net credit sales have proved uncollectible. An aging of Computer Co.'s Accounts Receivable results in a $2,000 estimate for the Allowance for Doubtful Accounts. There were no write-offs during the year. Assume Computer Co. uses the analysis of receivables method. Please provide the adjusting entry the Company would record to recognize Bad Debt Expense: Dr. Allowance for Uncollectible Accounts $1,950 Cr. Bad Debt Expense $1,950 Dr. Bad Debt Expense $1,920 Cr. Allowance for Uncollectible Accounts $1,920 Dr. Bad Debt Expense $1,950 Cr. Accounts Receivable $1,950 Dr. Bad Debt Expense $1,950 Cr. Allowance for Uncollectible Accounts $1,950