Answered step by step

Verified Expert Solution

Question

1 Approved Answer

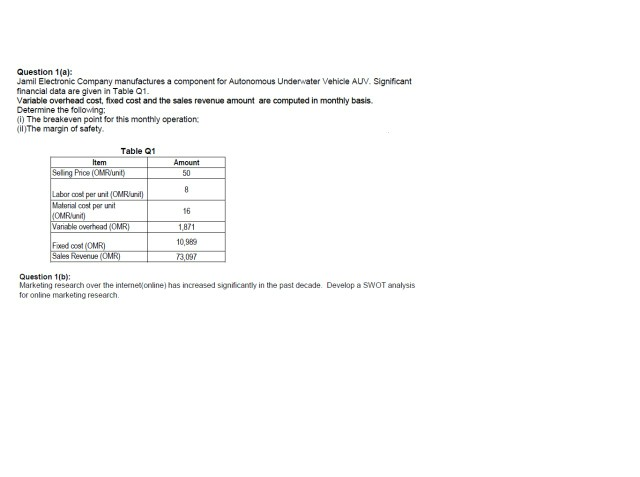

Question 1(a): Jamil Electronic Company manufactures a component for Autonomous Underwater Vehicle AUV. Significant Variable overhead cost, fixed cost and the sales revenue amount are

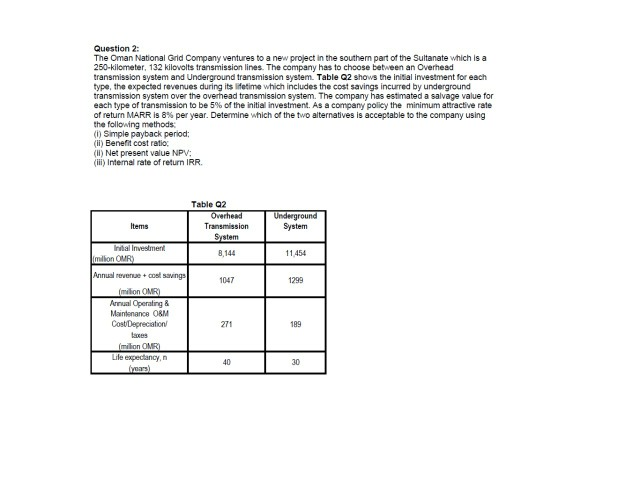

Question 1(a): Jamil Electronic Company manufactures a component for Autonomous Underwater Vehicle AUV. Significant Variable overhead cost, fixed cost and the sales revenue amount are computed in monthly basis. Determine the following: The breakeven point for this monthly operation (ii) The margin of safety. Table Q1 Item Seling Price (OMR) Amount 50 8 Labor cost per unit (OMR) Material cost per unit (OMR unit) Variable overhead (OMR) 16 1871 Fored (OMR) Sales Revenue (OMR) 10,989 73,097 Question 1b): Marketing research over the internetrine) has increased significantly in the past decade. Develop a SWOT analysis for online marketing research. Question 2: The Oman National Grid Company ventures to a new project in the southern part of the Sultanate which is a 250-kilometer, 132 kilovolts transmission lines. The company has to choose between an Overhead transmission system and Underground transmission system. Table Q2 shows the initial investment for each type, the expected revenues during its lifetime which includes the cost savings incurred by underground transmission system over the overhead transmission system. The company has estimated a salvage value for each type of transmission to be 5% of the initial investment. As a company policy the minimum attractive rate of return MARR is 8% per year. Determine which of the two alternatives is acceptable to the company using the following methods (1) Simple payback period; (ii) Benefit cost ratio: (II) Net present value NPV: (iii) Internal rate of return IRR. Table 92 Overhead Transmission System Underground System Items Initial Investment milion OMR) 8,144 11454 1047 1299 Annual revenue cost savings (milion OMR) Annual Operating & Maintenance ORM Cost Depreciation 271 189 milion OMR Life expectancy, years) 40 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started