Answered step by step

Verified Expert Solution

Question

1 Approved Answer

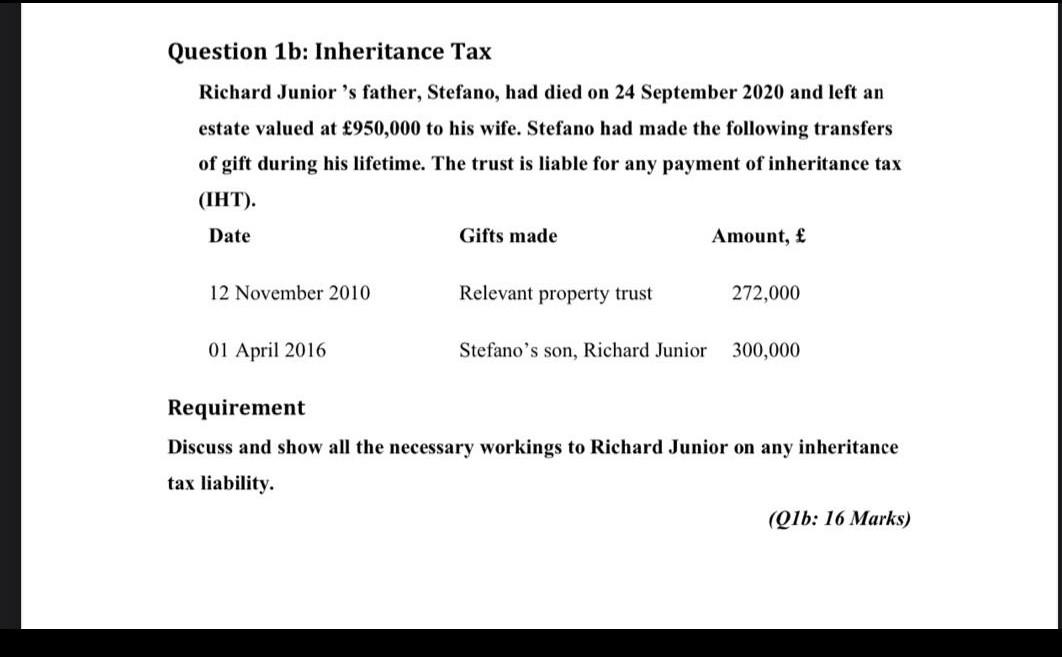

Question 1b: Inheritance Tax Richard Junior's father, Stefano, had died on 24 September 2020 and left an estate valued at 950,000 to his wife. Stefano

Question 1b: Inheritance Tax Richard Junior's father, Stefano, had died on 24 September 2020 and left an estate valued at 950,000 to his wife. Stefano had made the following transfers of gift during his lifetime. The trust is liable for any payment of inheritance tax (IHT). Date Gifts made Amount, 12 November 2010 Relevant property trust 272,000 01 April 2016 Stefano's son, Richard Junior 300,000 Requirement Discuss and show all the necessary workings to Richard Junior on any inheritance tax liability. (Q1b: 16 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started