Question

Question: 1.Do you think the lender would have any concerns with WCC keeping the same dividend payout ratio after the acquisition? Provide an explanation. 2.Based

Question:

1.Do you think the lender would have any concerns with WCC keeping the same dividend payout ratio after the acquisition? Provide an explanation.

2.Based on 2021, explain if WCC is more or less leveraged, than the competitors.

3.Management has indicated that a multiple of 10x EBITDA is reasonable to value the invested capital of WCC. Explain if and why shareholder value has been created or

reduced from the acquisition when comparing the 2020 value per share to the 2021 value per share.

Case:

Company

Waste Control Concepts Corporation (WCC) is a regional waste management and

environmental services company serving Pennsylvania and New Jersey. Customers include

residential, commercial, industrial, and municipal accounts. WCCs market niche is small and

medium sized businesses and municipalities. Services are not directly contracted with residential

customers but rather indirectly through contracts with municipalities and private residential

communities. It manages and reduces waste at the various stages of waste collection and

disposal. WCC also recovers recyclable waste which it sells to companies that recycle such waste

into raw materials for their business raw materials. The solid waste business provides collection,

transfer, disposal, and recycling and resource recovery services. During 2020, itslargest customer

represented approximately 9% of annual revenues and WCC employed approximately 5,300

team members.

The company operates four landfill sites in the two states and manages eight transfer stations

that consolidate, compact and transport waste efficiently and economically. WCC has a patented

process that allows a higher level of waste compacting, which results in higher tonnage levels to

be transported per vehicle compared to competitors. This gives the company an advantage in

the market and provides higher margins. Company goals are targeted at better serving all

stakeholders, which includes customers, employees, the environment, the communities, and

stockholders. Customers continually want more of their waste materials recovered while at the

same time waste streams are becoming more complex, and WCCs aim is to address the current

needs, while anticipating the expanding and evolving needs of customers.

Industry

The industry has high level of competition from governmental, quasi-governmental and private

sources. WCC principally competes with large national waste management companies, counties

and municipalities that maintain their own waste collection and disposal operations and to a

lesser extent regional and local companies. In recent years, the industry has experienced

consolidation on a nation scale but there has been limited consolidation in our region. Regardless

the industry remains competitive resulting in pricing pressures.

Operating costs, disposal costs and collection fees have limited variation in the region. The prices

charged are determined locally, and typically vary by volume and weight, type of waste collected,

treatment requirements, risk of handling or disposal, frequency of collections, distance to final

disposal sites, labor costs and amount and type of equipment furnished to the customer.

Competition is intense and is based primarily on pricing and quality of service.

The industry is subject to extensive and evolving federal, state, or provincial and local

environmental, health, safety and transportation laws and regulations. These laws and

regulations are administered by the EPA and other federal, state, and local environmental,

zoning, transportation, land use, health, and safety agencies in the U.S. These agencies regularly

examine industry participants operations to monitor compliance with laws and regulations and

have the power to enforce compliance, obtain injunctions or impose civil or criminal penalties in

case of violations. Significant amounts of capital expenditures are related, either directly or

indirectly, to environmental protection measures, including compliance with federal, state, and

local rules.

The acquisition, development or expansion of a waste management or disposal facility or transfer

station requires considerable time, effort, and investment to obtain or maintain required permits

and approvals. There are no assurances that companies will be able to obtain or maintain

required governmental approvals. Once obtained, operating permits are subject to renewal,

modification, suspension, or revocation by the issuing agency. Compliance with current

regulations and future requirements could require companies to make significant capital and

operating expenditures. However, most of these expenditures are made in the normal course of

business.

Competition

WCCs competition includes the following:

Republic Services, Inc. is one of the largest hazardous solid waste companies in the United

States, providing collection, processing, recycling, and disposal services. The company owns

189 solid waste landfills, 212 transfer stations, and 79 recycling facilities. Customers include

residential, municipal, industrial, and commercial accounts. Has about 36,000 employees.

Waste Connections, Inc. provides solid waste management services including collection,

transfer, disposal, and recycling. Its customers include commercial, industrial, and residential

customers. It operates in 41 states and Canada. It owns or operates about 300 collection

facilities, 87 active landfills, and 124 transfer stations. Has about 16,000 employees.

Waste Management is North Americas largest provider of comprehensive waste

management environmental services. It serves residential, commercial, industrial, and

municipal customers. Owns or operates about 250 landfills, 100 material recovery facilities,

and about 300 transfer stations. It has approximately 45,000 employees.

Expansion

WCC has been reviewing opportunities to expand out of its current geographical region. The

corporate development department identified an opportunity, Southern Waste Corp. (SWC),

a troubled privately owned company in the Atlanta, GA and surrounding areas that has had

some operating issues and is over-leveraged. WCC has decided to move forward with an

acquisition transaction and purchase the operating assets of SWC for $200 million.

Forecast

A capital project analysis was completed which determined that WCC should move ahead with

the acquisition as it has a positive NPV and IRR above WCCs WACC. Management now wants to

understand the impact on WCCs financial statements going forward and how the acquisition will

impact the income statement, balance sheet and debt level.

WCCs finance, corporate development and operations departments have developed the

following five-year forecast assumptions for WCC which considers both its current operations

and the addition of the Southern Waste Corp. operations.

Income Statement

2020 current revenue levels will increase at an annual rate of 4.0%

The acquisition of SWC will add $80.0 million of incremental revenue in 2021 and it will

increase at an annual rate of 4.5% thereafter

Cost of services will be 63.5% of revenue

SG&A expense will be 9.5% of revenue in 2021 and 2022 and then decrease to 9.0%

thereafter

Depreciation expense will be 7.5% of revenue

Interest expense for 2021 will be based on the 2021 debt balance, in the following years

it will be based on the average debt balance of the prior year and current year. The

interest rate over the projection period will be 9.0%

Tax rate of 25.0%

Balance Sheet

Constant operating cash level of $10.0 million

Accounts receivable DSO of 34 days

Inventory turnover of 32x (inventory consists of recyclable materials resold)

Other long-term assets at 1.2% of revenue

Accounts payable days cost of sales (COS) of 45 days

Accrued expense 2.0% of COS

Other long-term liabilities 2.0% of COS

Dividend payout ratio to be maintained at 70%

Maintenance capital expenditures of 8.5% of revenue

Expansion capital expenditures are the cost of the acquisition in 2021, no expansion capx

beyond 2021

WCC has 8 million shares outstanding

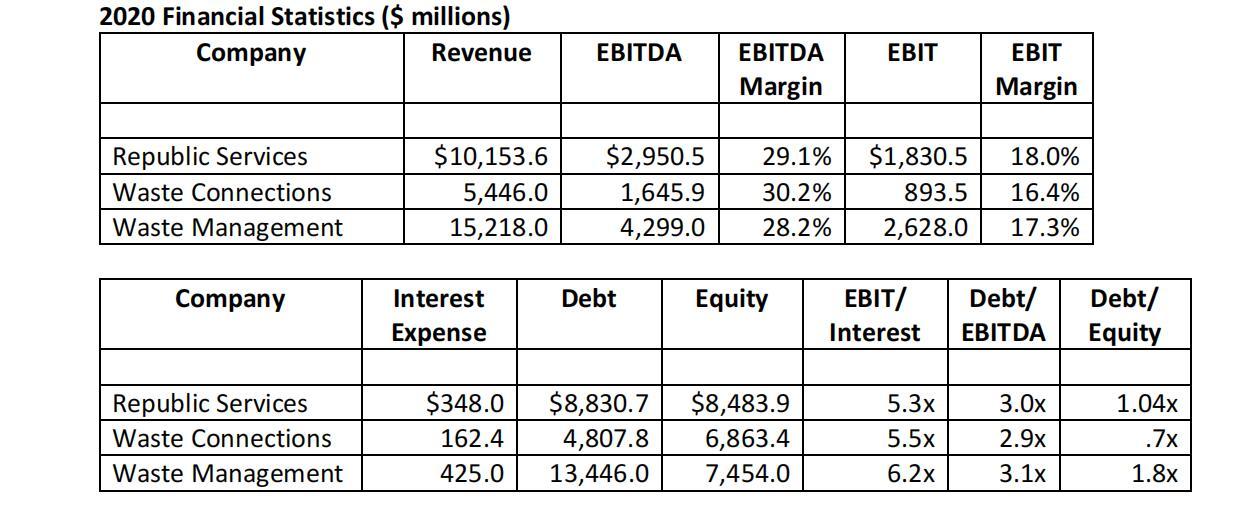

2020 Financial Statistics ($ millions) Company Revenue EBITDA EBIT EBITDA Margin EBIT Margin Republic Services Waste Connections Waste Management $10,153.6 5,446.0 15,218.0 $2,950.5 1,645.9 4,299.0 29.1% 30.2% 28.2% $1,830.5 893.5 2,628.0 18.0% 16.4% 17.3% Company Debt Equity Interest Expense EBIT/ Interest Debt/ EBITDA Debt/ Equity Republic Services Waste Connections Waste Management $348.0 162.4 425.0 $8,830.7 4,807.8 13,446.0 $8,483.9 6,863.4 7,454.0 5.3x 5.5x 3.Ox 2.9x 3.1x 1.04x .7x 1.8x 6.2x 2020 Financial Statistics ($ millions) Company Revenue EBITDA EBIT EBITDA Margin EBIT Margin Republic Services Waste Connections Waste Management $10,153.6 5,446.0 15,218.0 $2,950.5 1,645.9 4,299.0 29.1% 30.2% 28.2% $1,830.5 893.5 2,628.0 18.0% 16.4% 17.3% Company Debt Equity Interest Expense EBIT/ Interest Debt/ EBITDA Debt/ Equity Republic Services Waste Connections Waste Management $348.0 162.4 425.0 $8,830.7 4,807.8 13,446.0 $8,483.9 6,863.4 7,454.0 5.3x 5.5x 3.Ox 2.9x 3.1x 1.04x .7x 1.8x 6.2xStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started