QUESTION

1Exhibit 3 of the case shows that Porsche has a substantially higher EBIT margin and ROIC compared to other European auto manufacturers. Can we conclude that Porsche is operationally a lot more superior? Why?

2Do you think it is a good idea for Porsche to hedge 100% of its economic exposure? comment on how Porsche is currently hedging its USD economic exposure, the pros and cons of using the current method for hedging and hedging 100% of its exposure. Think of how high their hedging cost was likely to be. Is their business cyclical? Will they be badly hit by bad economic conditions? What would happen if anticipated cash flows were not forthcoming?

3In addition to using financial options, what do you think Porsche should do to manage its USD economic exposure?you should look at what other European auto manufacturers had done, brainstorm all the possible hedging strategies for Porsche. Discuss the pros and cons of each, how each would affect customers loyalty, product image, product quality or perceived quality, etc. Propose the most sensible hedging strategy (or combination of strategies) for Porsche going forward.

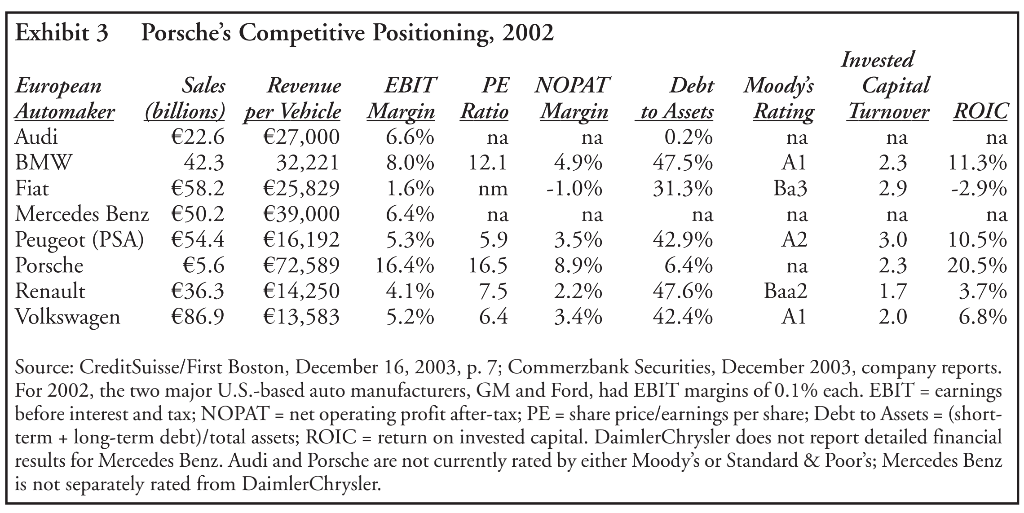

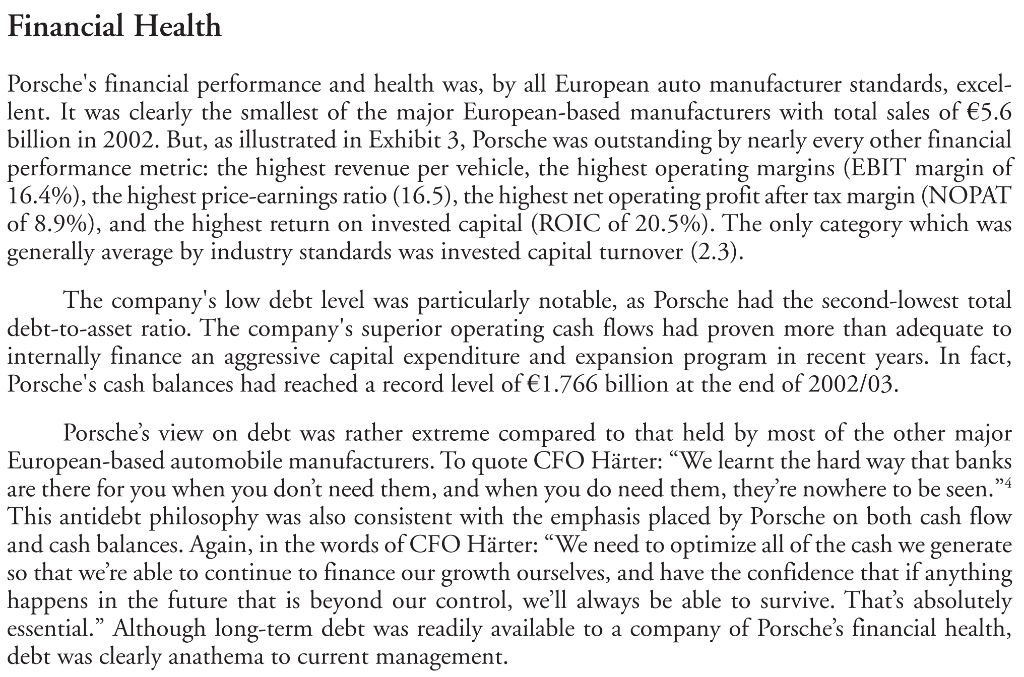

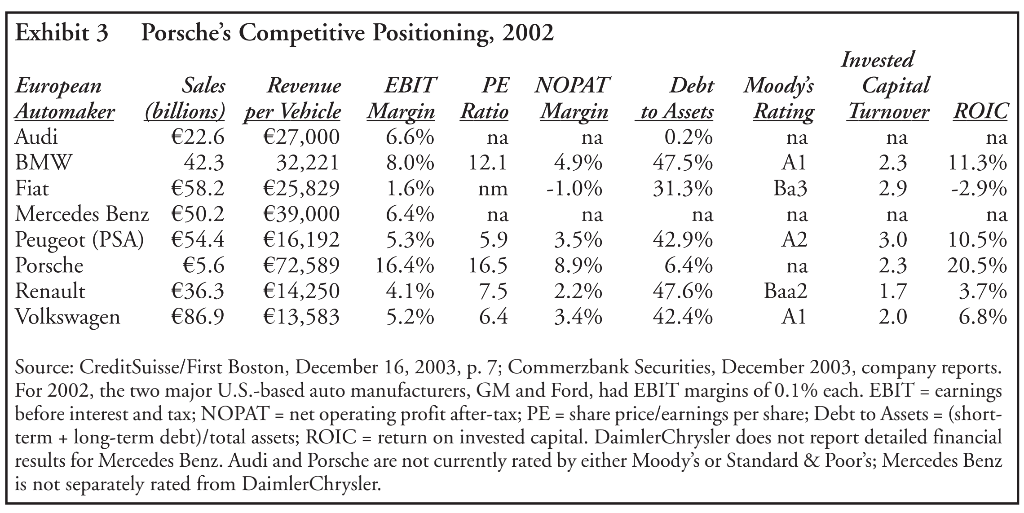

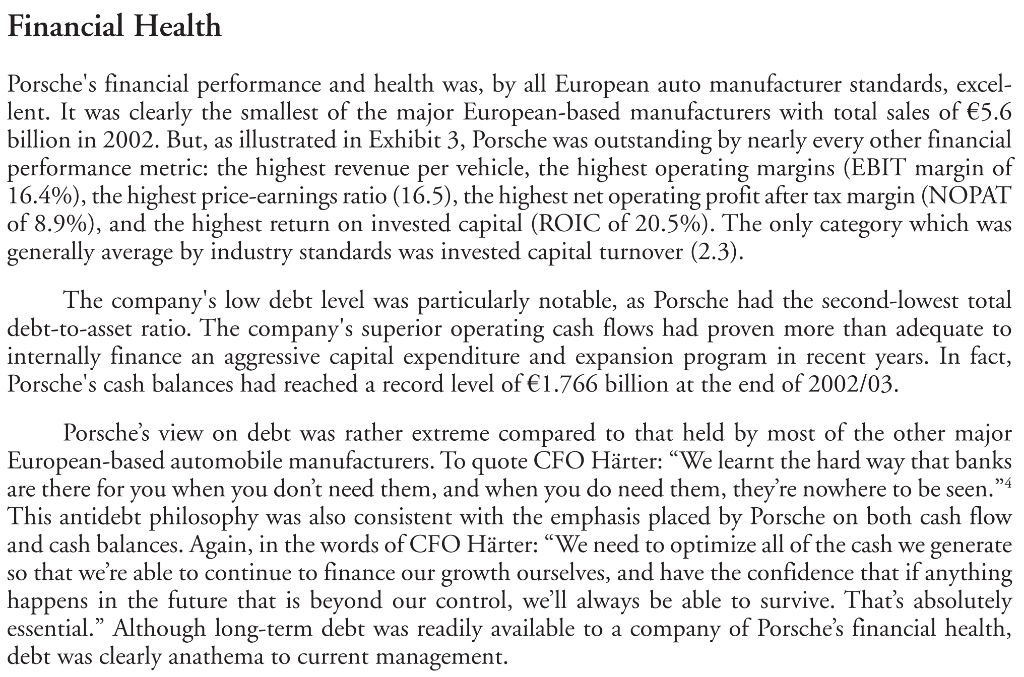

Exhibit 3 Porsche's Competitive Positioning, 2002 na nm European Sales Revenue EBIT PE Automaker (billions) per Vehicle Margin Ratio Audi 22.6 27,000 6.6% BMW 42.3 32,221 8.0% 12.1 Fiat 58.2 25,829 1.6% Mercedes Benz 50.2 39,000 6.4% Peugeot (PSA) 54.4 16,192 5.3% 5.9 Porsche 5.6 72,589 16.4% 16.5 Renault 36.3 14,250 4.1% 7.5 Volkswagen 86.9 13,583 5.2% 6.4 NOPAT Margin na 4.9% -1.0% na 3.5% 8.9% 2.2% 3.4% Debt Moody's to Assets Rating 0.2% na 47.5% A1 31.3% Ba3 na na 42.9% A2 6.4% na 47.6% Baa2 42.4% A1 Invested Capital Turnover ROIC na na 2.3 11.3% 2.9 -2.9% na na 3.0 10.5% 2.3 20.5% 1.7 3.7% 2.0 6.8% na Source: CreditSuisse/First Boston, December 16, 2003, p. 7; Commerzbank Securities, December 2003, company reports. For 2002, the two major U.S.-based auto manufacturers, GM and Ford, had EBIT margins of 0.1% each. EBIT = earnings before interest and tax; NOPAT = net operating profit after-tax; PE = share price/earnings per share; Debt to Assets = (short- term + long-term debt)/total assets; ROIC = return on invested capital. DaimlerChrysler does not report detailed financial results for Mercedes Benz. Audi and Porsche are not currently rated either Moody's or Standard & Poor's; Mercedes Benz is not separately rated from DaimlerChrysler. Financial Health Porsche's financial performance and health was, by all European auto manufacturer standards, excel- lent. It was clearly the smallest of the major European-based manufacturers with total sales of 5.6 billion in 2002. But, as illustrated in Exhibit 3, Porsche was outstanding by nearly every other financial performance metric: the highest revenue per vehicle, the highest operating margins (EBIT margin of 16.4%), the highest price-earnings ratio (16.5), the highest net operating profit after tax margin (NOPAT of 8.9%), and the highest return on invested capital (ROIC of 20.5%). The only category which was generally average by industry standards was invested capital turnover (2.3). The company's low debt level was particularly notable, as Porsche had the second-lowest total debt-to-asset ratio. The company's superior operating cash flows had proven more than adequate to internally finance an aggressive capital expenditure and expansion program in recent years. In fact, Porsche's cash balances had reached a record level of 1.766 billion at the end of 2002/03. 4 Porsche's view on debt was rather extreme compared to that held by most of the other major European-based automobile manufacturers. To quote CFO Hrter: We learnt the hard way that banks are there for you when you don't need them, and when you do need them, they're nowhere to be seen. This antidebt philosophy was also consistent with the emphasis placed by Porsche on both cash flow and cash balances. Again, in the words of CFO Hrter: We need to optimize all of the cash we generate so that we're able to continue to finance our growth ourselves, and have the confidence that if anything happens in the future that is beyond our control, we'll always be able to survive. That's absolutely essential. Although long-term debt was readily available to a company of Porsche's financial health, debt was clearly anathema to current management