Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 0 ( 1 point ) * * in Canada * * Jacqueline, age 7 2 , and Laurent, age 7 0 , are

Question point in Canada

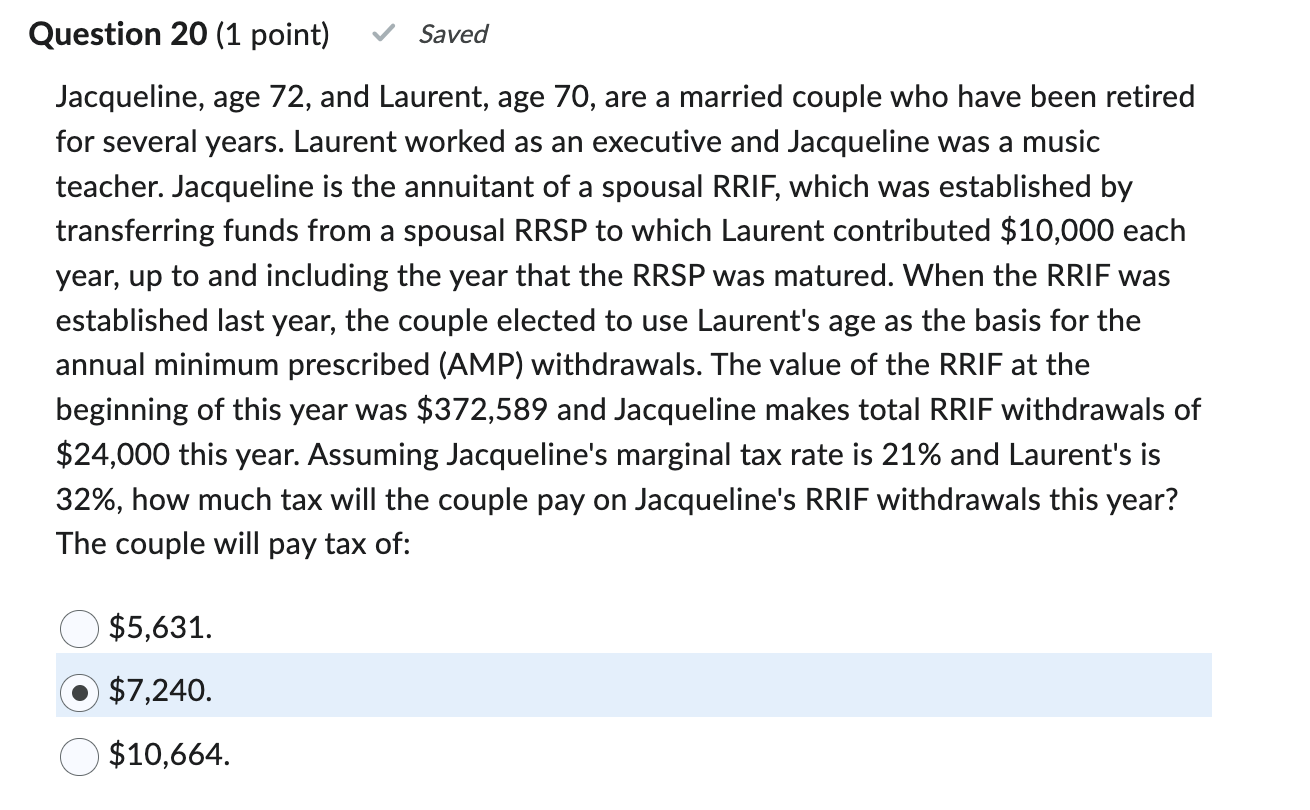

Jacqueline, age and Laurent, age are a married couple who have been retired

for several years. Laurent worked as an executive and Jacqueline was a music

teacher. Jacqueline is the annuitant of a spousal RRIF, which was established by

transferring funds from a spousal RRSP to which Laurent contributed $ each

year, up to and including the year that the RRSP was matured. When the RRIF was

established last year, the couple elected to use Laurent's age as the basis for the

annual minimum prescribed AMP withdrawals. The value of the RRIF at the

beginning of this year was $ and Jacqueline makes total RRIF withdrawals of

$ this year. Assuming Jacqueline's marginal tax rate is and Laurent's is

how much tax will the couple pay on Jacqueline's RRIF withdrawals this year?

The couple will pay tax of:

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started